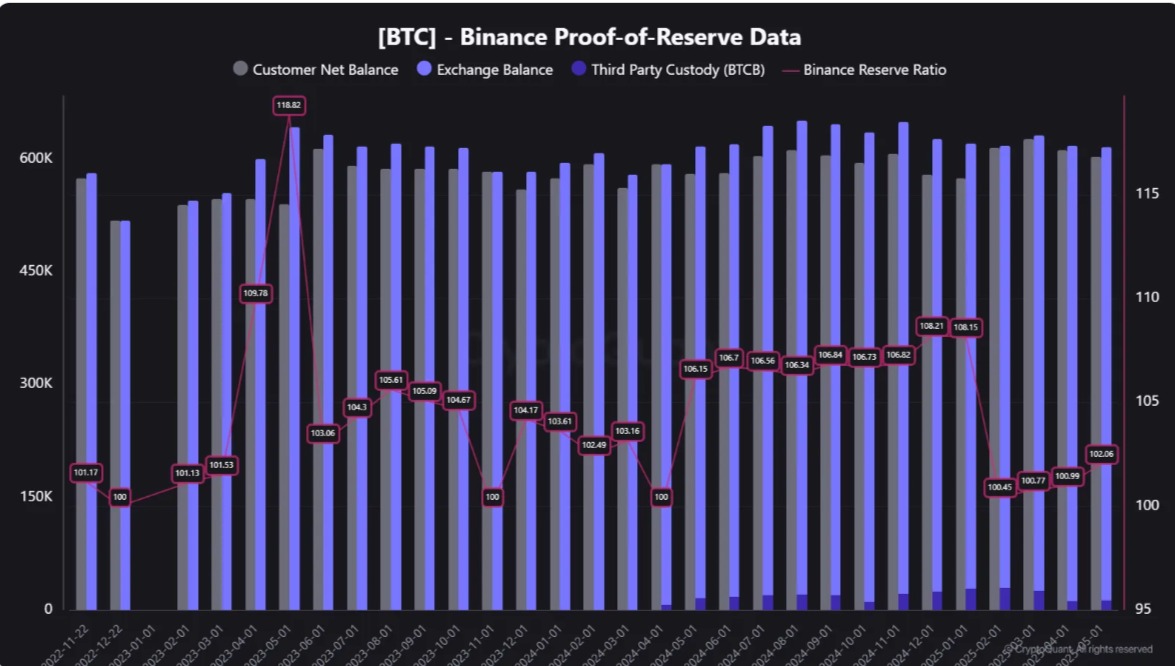

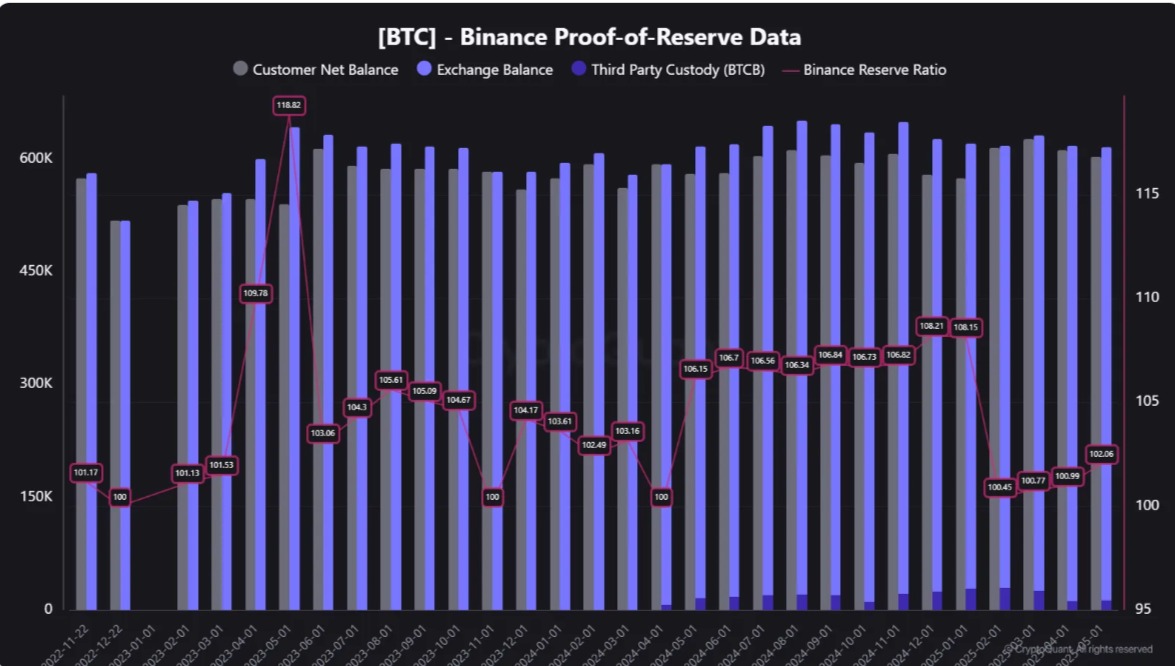

Binance holds 102% BTC reserves for 30 straight months – Snapshot reveals

- Binance holds 616,886 BTC in opposition to 604,410 BTC in buyer liabilities, sustaining a 102% BTC Reserve Ratio.

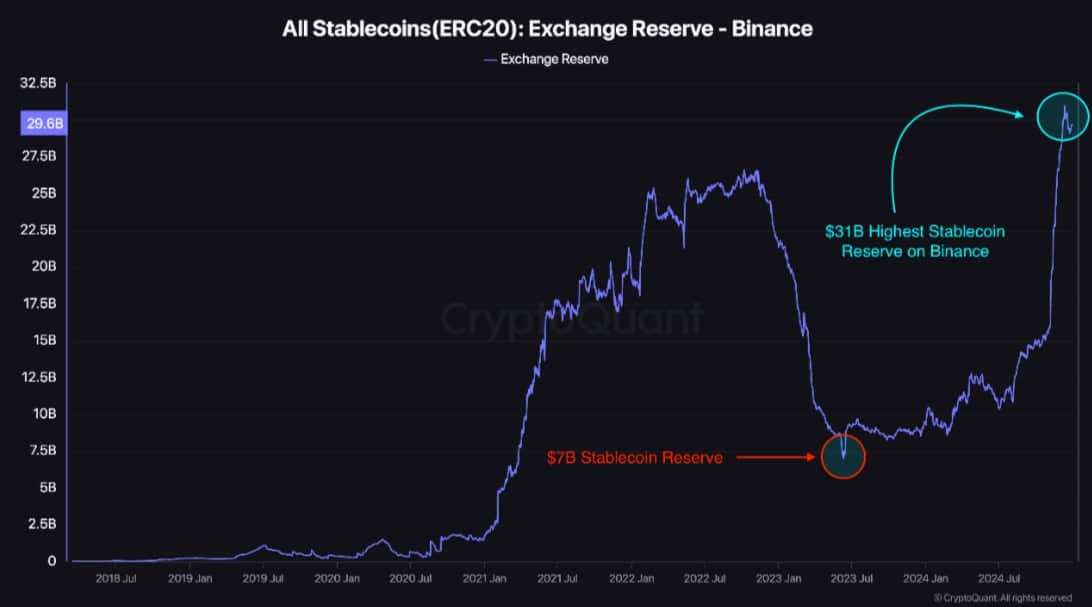

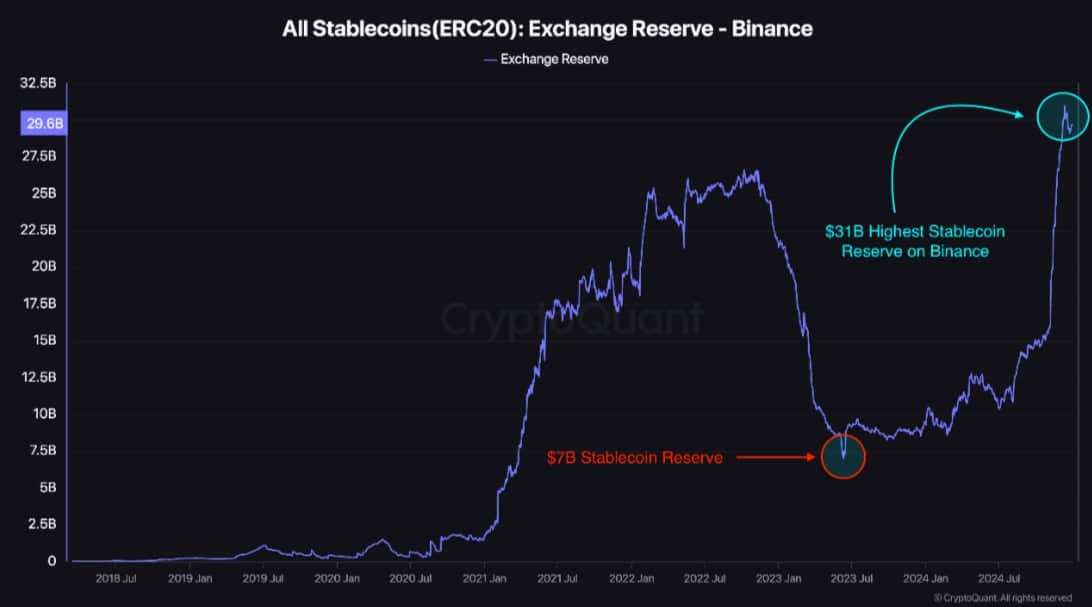

- Stablecoin reserves additionally climbed to $31 billion by January 2025, strengthening general liquidity.

For the reason that collapse of FTX, on-chain transparency has change into a benchmark for change credibility.

In keeping with transparency measures, Binance has revealed its proof of reserve information each month since 2022.

In accordance with the most recent report, Binance, the biggest crypto change, has maintained a Bitcoin Reserve Ratio above 100% for 30 consecutive months.

In accordance with CryptoQuant, Binance presently holds 616,886 BTC in opposition to buyer web balances of 604,410 BTC, bringing its BTC Reserve Ratio to 102%.

This contains 603,374 BTC on Binance’s change wallets and 13,512 BTC held by third-party custodians.

Supply: CryptoQuant

Vital asset holdings are essential as a result of they absolutely again all buyer funds and supply assurance.

After buyers misplaced their cash within the FTX and Mt. Gox incidents, there was an rising demand for crypto exchanges to reveal their holdings, with on-chain trackers regularly validating this information.

Binance has taken the lead in making this data publicly accessible, which helps to construct confidence amongst prospects and customers.

The rising reserves point out sturdy asset backing and a dedication to transparency. Consequently, prospects, buyers, and holders on Binance can really feel safe in opposition to potential market uncertainties sooner or later.

Supply: CryptoQuant

The truth is, over the previous 12 months, Binance’s reserves have skilled exponential development as the corporate continues to safe prospects’ investments by means of BTC and stablecoin reserves.

As of March 2025, Binance has recorded 29 consecutive months operating holding above 100%.

Furthermore, Binance’s stablecoin reserves have continued rising. As of January 2025, reserves climbed to $31 billion, strengthening the platform’s liquidity place.

This twin reserve development in each BTC and stablecoins helps safe investor capital and cushions the change in opposition to excessive market volatility.

Why this issues for crypto as an entire

Undoubtedly, a optimistic and rising BTC reserve for Binance, the biggest crypto platform on buying and selling quantity, performs a significant position in constructing extra belief and confidence.

Thus, buyers could have extra confidence within the crypto change and the entire crypto market.

Considerably, alerts the expansion in the entire market the place buyers can not lose their funds over fraudulent exchanges.

Extra importantly, this places stress on different exchanges to undertake comparable practices, shifting the market towards extra accountability.