Ethereum Whales Quietly Accumulate As Stablecoin Usage Skyrockets 400%

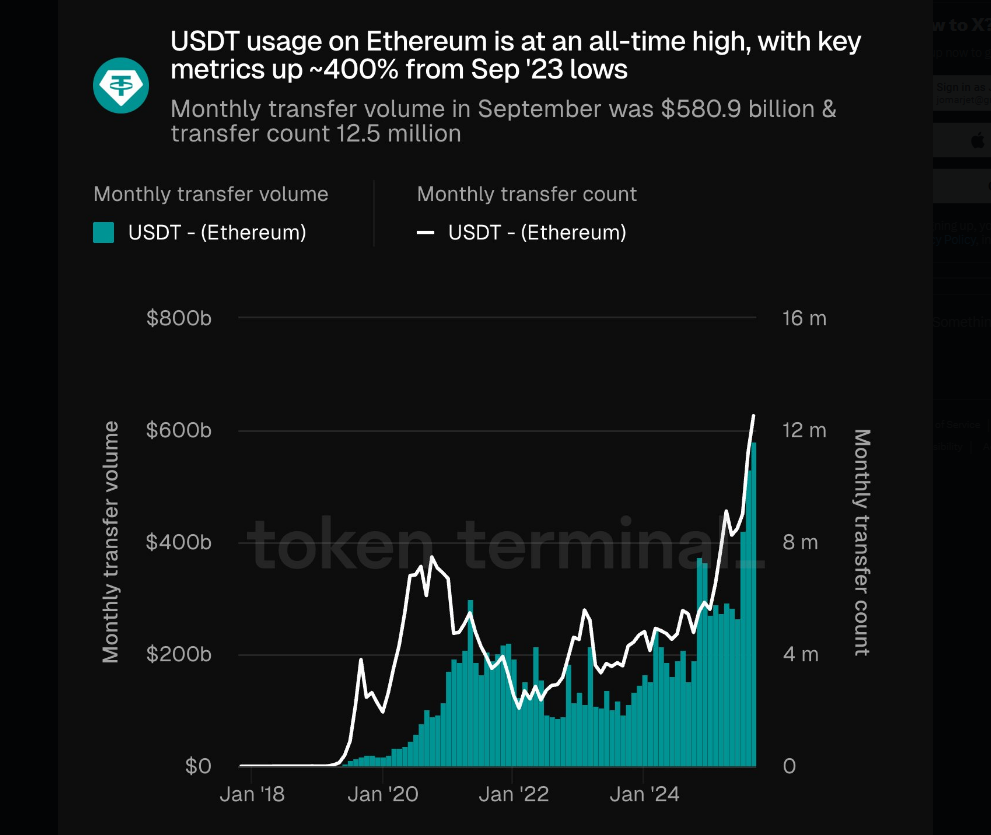

Stories have disclosed a 400% rise in stablecoin transfers on Ethereum over the past 30 days, pushing whole switch quantity to $581 billion and greater than 12.5 million transfers, in accordance with Token Terminal.

Associated Studying

The stablecoin market cap on Ethereum now tops $163 billion. On the identical time, Ethereum has fallen about 4.50% up to now week, and briefly examined assist close to $3,738, which some merchants known as a shopping for alternative.

Whales Step In With Giant Buys

On-chain trackers present heavy shopping for from massive holders. A newly created pockets, 0x86Ed, spent $32 million to select up 8,491 ETH in roughly three hours, primarily based on Arkham Intelligence information.

One other high-profile account monitored by LookOnChain moved 284K USDC into Hyperliquid after current liquidations, apparently to keep up lengthy publicity to ETH.

Stories say October’s stablecoin transaction quantity on Ethereum handed $1.91 trillion for the second time on file, an indication that large flows are nonetheless transferring via the community.

USDT utilization on Ethereum is at an all-time excessive, with key metrics up ~400% from Sep ’23 lows.

Month-to-month switch quantity in September was $580.9 billion & switch depend 12.5 million.

At a ~$500 billion valuation, @Tether_to is probably the most beneficial enterprise constructing on @ethereum. pic.twitter.com/Z83e68NO8C

— Token Terminal 📊 (@tokenterminal) October 13, 2025

Establishments Are Rising Publicity

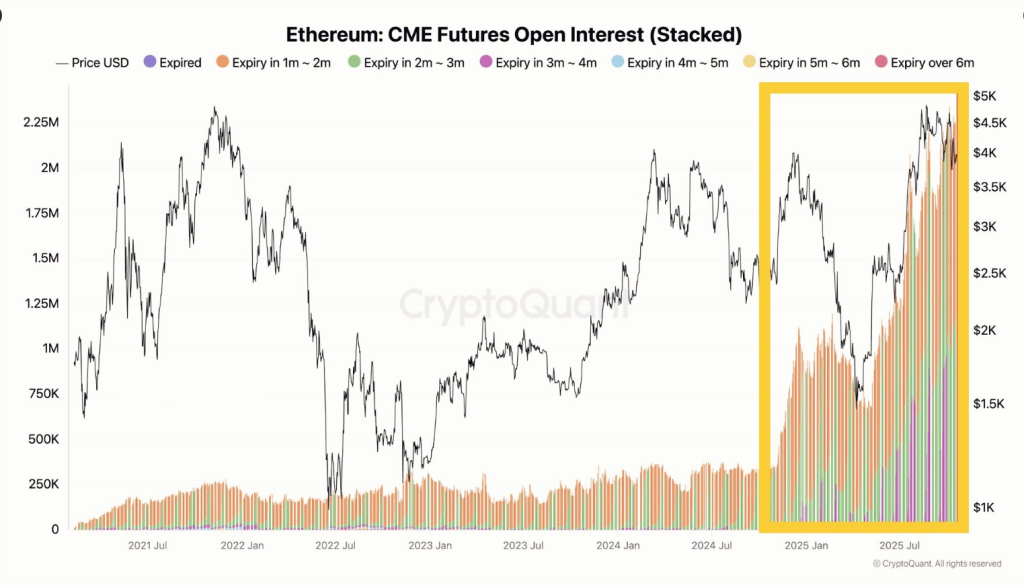

CryptoQuant and alternate knowledge level to an increase in institutional curiosity. CME futures open curiosity for ETH has climbed, suggesting bigger gamers are setting positions forward of a possible worth transfer.

Fundstrat’s Tom Lee was cited saying ETH might head towards $5,000 if the ETH/BTC ratio clears the 0.087 resistance. Matt Sheffield, CIO at Sharplink Gaming, advised analysts that previous liquidations didn’t cease actual use and that the size of funds on legacy programs — SWIFT processes about $150T a 12 months — exhibits how a lot room exists for stablecoins to develop on Ethereum.

Large cash is flowing into #Ethereum institutional curiosity is clearly rising quick….

The surge in CME futures open curiosity indicators that sensible cash is gearing up for a serious $ETH transfer forward… pic.twitter.com/8oUfApDeoP

— BitGuru 🔶 (@bitgu_ru) October 23, 2025

Technical Setups Present Clear Ranges To Watch

Technical evaluation specialists have famous a confluence of indicators close to at this time’s costs. At present, ETH is buying and selling close to $3887, simply above the numerous Fibonacci retracement of 0.618 at $3781.

The 0.786 retracement is close to $3,640 with the extent of formal invalidation set at $3443. Some technicians have pointed to a triple backside buying and selling sample round $3600, in addition to the potential for a brand new accumulation studying from a Wycoff re-accumulation sample which might result in greater targets (notably $5125 on the 1.618 extension.

Associated Studying

Steadiness Between Circulate And Threat

In sum, with heavy stablecoin movement, whale shopping for, and growing curiosity in futures, this has created a foundation for bullish calls into the $5000 vary.

That mentioned, chart patterns fail, on-chain actions might not result in adjustments in worth, and merchants who stay cognizant of the ETH/BTC ratio, the invalidation line at $3443, and whether or not massive transactions are transferring or getting used for longer-term custody, might get extra readability within the coming classes.

Featured picture from Movement Island, chart from TradingView