Will Bitcoin dip towards $105K? – THESE datasets reveal…

Key Takeaways

What has occurred after the liquidations on Monday?

After a $1.7 billion liquidation throughout crypto on the twenty second of September, the Open Curiosity dropped, and spot BTC ETFs and Binance stablecoins famous outflows.

What had been the clues that the promoting was not capitulation, however measured?

The long-term holder promoting was regular in current weeks and never simply pushed by this week’s drop, displaying a market correction moderately than capitulation.

On the twenty fourth of September, Binance recorded its first main outflow of stablecoins in three months. In a single day, $913 million flowed out, noticed analyst Amr Taha in a publish on CryptoQuant Insights.

BTC spot exchange-traded funds (ETF) flows had been unfavorable, with a $253 million outflow on the twenty fifth of September. What’s the general impact on Bitcoin [BTC] and the remainder of the market?

This decreased the spot-buying liquidity on the platform and likewise signaled weakened shopping for energy on Binance. The development had been constructive for stablecoin flows in current weeks, so a break on this development pointed to massive gamers shifting their positions.

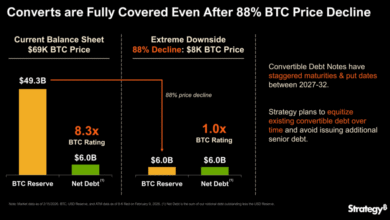

The Binance web taker quantity elevated to +$364 million. This signaled an increase in retail participation. Nevertheless, the Open Curiosity (OI) on the change fell by practically $500 million.

CoinGlass data confirmed a $3.35 billion drop in OI throughout exchanges on Friday, the twenty sixth of September.

Are Bitcoin holders in panic now?

But, surprisingly, the estimated leverage ratio for Bitcoin hardly noticed a dent. This meant that the drop in OI was pushed primarily by liquidations and was not a market-wide de-risking occasion.

It was the primary clue that Bitcoin holders weren’t capitulating.

The long-term holder (LTH) Spent Output Revenue Ratio (SOPR) has slowly been declining for the reason that first week of July. Crucially, the ratio was nonetheless at 1.57, nicely above the 1 worth that indicators holders in revenue.

The sustained dip was accelerated by the current worth drop, displaying traders had been promoting.

Nevertheless, it has not made new lows in comparison with current months, displaying the market was doubtless not in capitulation mode.

Moreover, the Coinbase Premium remained inexperienced, although it noticed a dip in current days. This was one other signal that, although ETF flows had been unfavorable to mirror bearish investor sentiment, sell-offs from U.S.-based traders weren’t excessive.

For the reason that twenty second of September, Bitcoin has declined by 5.16%, persevering with its downward development. A deeper correction towards the $105,000–$107,000 vary now seems doubtless.

The drop in OI displays a decreased urge for food for danger amongst speculators, reinforcing the present bearish sentiment. Nevertheless, the broader market development stays bullish, and such corrections are a pure a part of wholesome worth motion.

Merchants and traders should not lose sight of the forest for the timber.