Ethereum Whales Take Over, ETH Stuck Below $3,500: What’s Going On?

Ethereum costs are secure at spot charges, transferring horizontally even after america Securities and Alternate Fee (SEC) accepted the listing and buying and selling of spot Ethereum ETFs on July 23.

Ethereum is trending under the essential resistances at $3,500 and $3,700 at press time. Nonetheless, consumers have saved costs above $3,300 as worth motion strikes horizontally.

Although there are expectations of volatility, studying from choices knowledge, now that spot Ethereum ETFs can be found for buying and selling, one analyst picked out a important improvement that may have an effect on the BTC-ETH dynamic.

Ethereum Whales Taking, ETH Outperforms BTC

In a submit on X, Santiment knowledge reveals an uptick in whale exercise forward of the spot Ethereum ETF in america. The analytics platform stated a number of high-value ETH transfers have outpaced these ordinarily seen on Bitcoin and USDT since July 17.

The bizarre enhance in this sort of switch may present rising confidence in Ethereum and ETH’s long-term prospects. This has even been accelerated with one other crypto by-product product, offering an alternative choice to Bitcoin.

Trying on the ETHBTC worth chart, it’s evident that ETH bulls have the higher hand. After the drop in late June, the coin continues outperforming Bitcoin, sharply rising on July 23. Evident within the each day chart, there’s a double-bar bullish formation signaling the presence of ETH consumers eager on funneling capital and increasing positive factors.

ETH is discovering help on the 50% Fibonacci retracement stage of the Could 2024 commerce vary, confirming the uptrend. Even so, for Could consumers to take cost, bulls should clear 0.057 BTC, setting the bottom for additional positive factors towards 0.08 BTC recorded in 2022.

Over $1 Billion Value Of Spot ETF Shares Traded

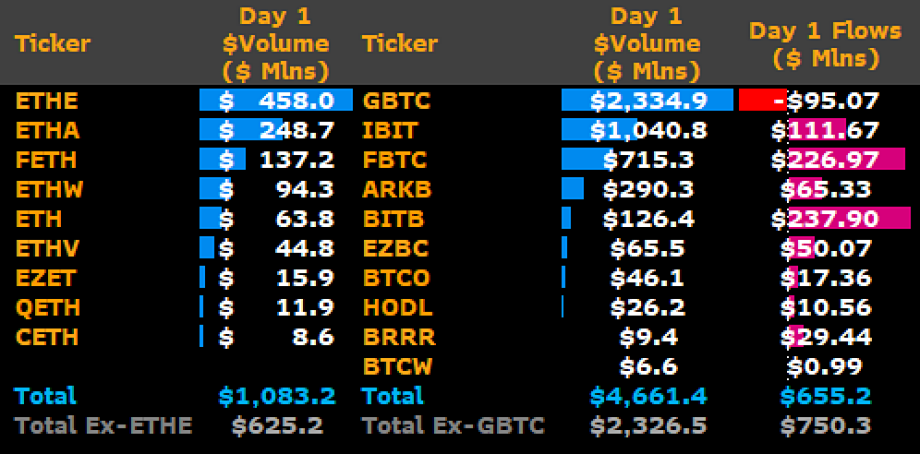

Inflows into spot ETFs will gasoline the bull run. As seen in Bitcoin, worth efficiency will largely rely on curiosity from institutional gamers. Barely 24 hours after the product launched in america, varied issuers purchased $1.1 billion of ETH.

Inflows will possible rise when ETH costs break above the instant resistance stage, ideally final week’s excessive and $3,700. As costs stall for now, the launch of this product, a Bitwise analyst said, cements Ethereum’s position as a foundational know-how in web3.

As seen from the speedy development of the digital financial system, Ethereum, the Bitwise analyst added, will see the sensible contracts platform catalyze improvement.