Ethereum, which is trending steadily, rose 3.8% from the previous week, while Solana, which suffered a major failure for the first time in a year, temporarily fell sharply

Macroeconomics and monetary markets

On the sixth, within the US New York inventory market, the Dow Jones Industrial Common closed 141.2 factors (0.37%) larger than the day prior to this, and the Nasdaq Index closed 11.3 factors (0.07%) larger.

U.S. shares associated to crypto belongings (digital foreign money), which have been on a steep rise and fall for the reason that starting of the yr, confirmed a rebound, with Coinbase up 2.1% and Riot up 4.3%.

CoinPost app (warmth map operate)

connection:Rating of beneficial securities accounts for the inventory market that can be utilized at a worthwhile worth

connection:Why Sumitomo Mitsui Card Platinum Most popular is quickly gaining recognition as a brand new NISA financial savings funding

Digital foreign money market circumstances

Within the crypto asset (digital foreign money) market, the Bitcoin worth rose 0.31% from the day prior to this to 1 BTC = $42,953.

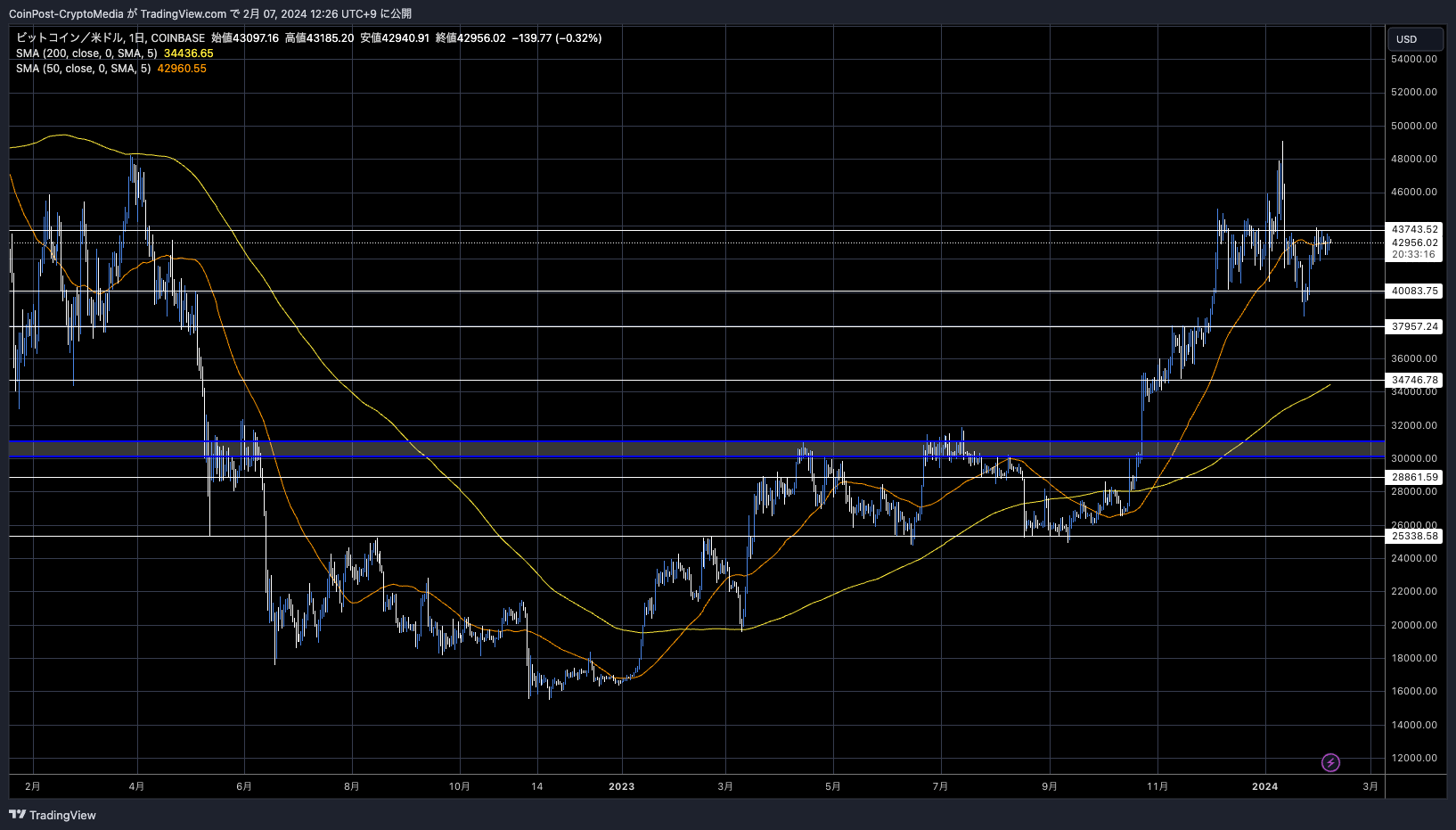

BTC/USD day by day

It has been revealed that MicroStrategy, which holds a considerable amount of Bitcoin (BTC), continued to buy 850 BTC (equal to $37 million) in January of this yr, reaching 190,000 BTC.

In January, @MicroStrategy acquired an extra 850 BTC for $37.2 million and now holds 190,000 BTC. Please be part of us at 5pm ET as we talk about our This autumn 2023 monetary outcomes and reply questions on our #bitcoin technique and enterprise outlook. $MSTR https://t.co/j5SbcELsue

— Michael Saylor⚡️ (@saylor) February 6, 2024

connection:MicroStrategy buys extra Bitcoin in January, leading to unrealized positive factors of over 300 billion yen

Ethereum (ETH) is trending comparatively steadily, rising 2.2% from the day prior to this.

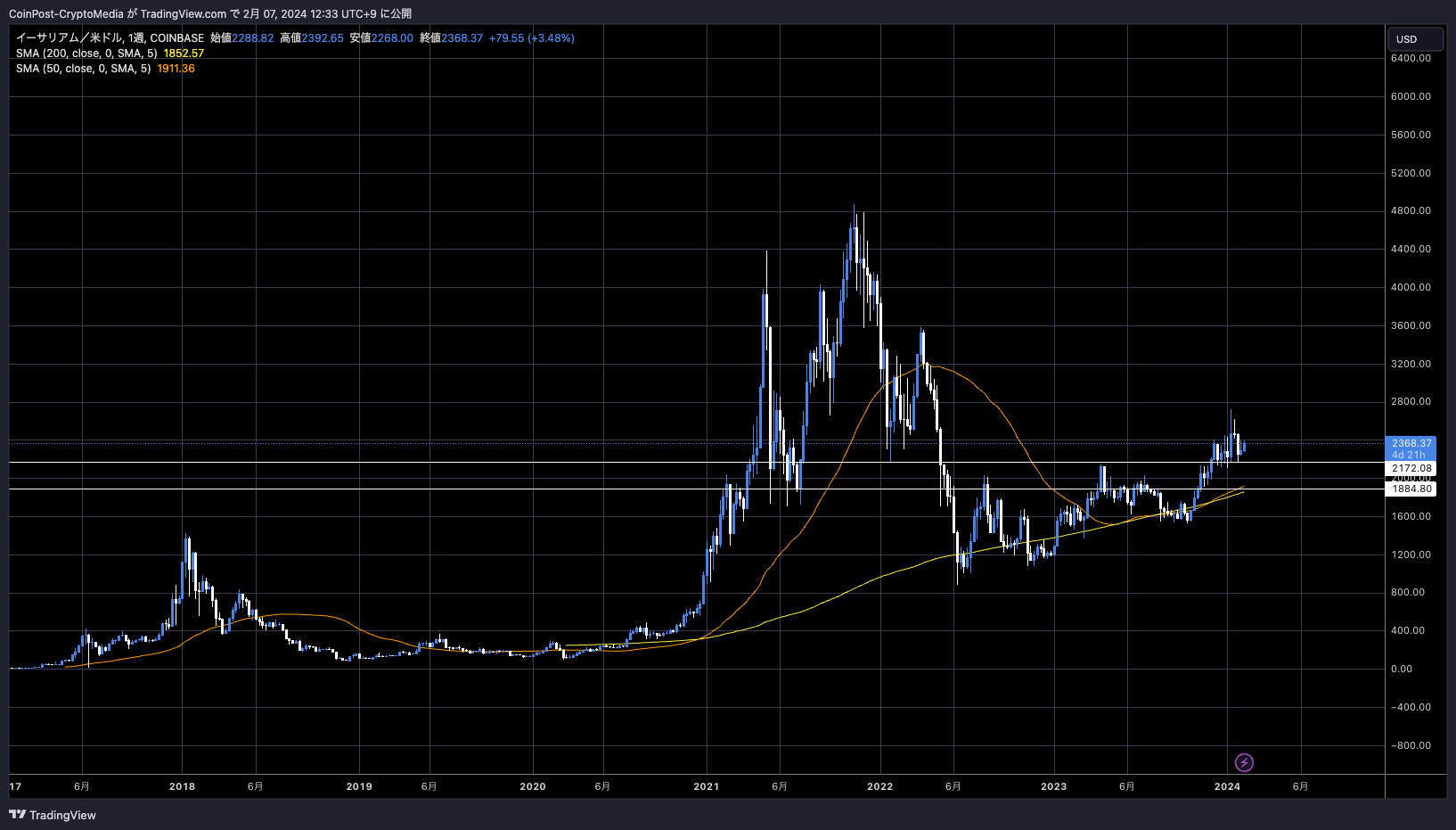

ETH/USD weekly

Rekt Capital stated that the worth motion of ETH exhibits optimistic indicators technically.

$ETH already exhibiting indicators of worth stability at this ~$2274 Vary Low assist

Nonetheless technically positioning itself for a repeat of final month’s transfer#ETH #Crypto #Ethereum https://t.co/3ljv7fTkm4 pic.twitter.com/zerO7PfOlJ

— Rekt Capital (@rektcapital) February 6, 2024

As the ultimate testnet launch of the Dencun improve nears, and as soon as the deployment is efficiently accomplished, there are plans to resolve on the Dencun mainnet launch date, in addition to expectations for approval of the Ethereum spot ETF (trade traded fund). It’s seen as.

connection:Ethereum Dencun improve second check profitable, closing check on February seventh

Rekt Capital additionally talked about the market capitalization of the altcoin market. If it breaks out of the milestone line, a hype cycle will start within the first quarter.

From the angle of encouraging capital inflows into crypto belongings (digital currencies), the US Federal Reserve’s intentions to chop rates of interest early are receding as a result of sturdy financial indicators within the US. Chairman Powell, whereas utilizing cautious language, successfully dominated out the opportunity of a charge minimize in March.

There’s a rising view that capital inflows into threat belongings might be restricted till the center of this yr, doubtlessly exposing them to promoting strain, and the affect of the macro financial system may have a robust affect available on the market worth after the Bitcoin halving. Dew.

Amid rising considerations about China’s financial recession, some are pointing to capital inflows from China primarily based on the withdrawal of cash from the sluggish inventory market. That is believed to be because of the 8% plunge within the CSI 1000 index, which covers many Chinese language shares.

The CSI index fell -21.6% in 2021, 21.8% in 2022, and 11% in 2023, suggesting that international traders have retreated from the Chinese language inventory market. Chinese language authorities are tightening rules on brief promoting.

Reuters reported on the twenty fifth of final month that some Chinese language traders are beginning to transfer their funds into crypto belongings (digital currencies). Based on Bloomberg, mainland China and Hong Kong inventory markets have misplaced $6 trillion (900 trillion yen) in market capitalization since their earlier peaks.

connection:Numerous Chinese language traders are shifting their focus to digital currencies following the extreme droop in Chinese language shares = report

altcoin market

The Solana (SOL) blockchain has skilled its first main failure since February 2023.

connection:Solana Chain halts operations for five hours as a result of failure

Though SOL costs plummeted by greater than 4% at one level, the affect remained slight, dropping 0.2% from the day prior to this as the worth recovered.

Based on a weekly report from asset administration agency CoinShares, Solana obtained $13 million in inflows into trade traded merchandise (ETPs) final week, far exceeding Ethereum’s $6 million.

We have now launched the “Warmth Map” operate to the CoinPost app for traders!

Along with vital information about digital currencies, you can even see at a look trade data such because the greenback yen and worth actions of crypto asset-related shares within the inventory market similar to Coinbase.■Click on right here to obtain the iOS and Android variations

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU— CoinPost (digital foreign money media) (@coin_post) December 21, 2023

Bitcoin ETF particular characteristic

Click on right here for an inventory of previous market reviews