Ethereum: Why 298,000 ETH tokens were bought in just 24 hours

- Ethereum experiences its second-largest shopping for day, with long-term holders accumulating considerably.

- Market indicators present blended indicators, with decreases in open curiosity and change reserves hitting an eight-year low.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has not too long ago exhibited some attention-grabbing market actions.

Regardless of an 8% decline over the previous week, Ethereum noticed a slight uptick of 0.3% within the final 24 hours, bringing its present buying and selling worth to $3,519.

This minor enhance comes throughout a interval of total market uncertainty, notably following the approval of spot Ethereum ETFs by the U.S. Securities and Trade Fee in Might.

Lengthy-term holders capitalize on market dips

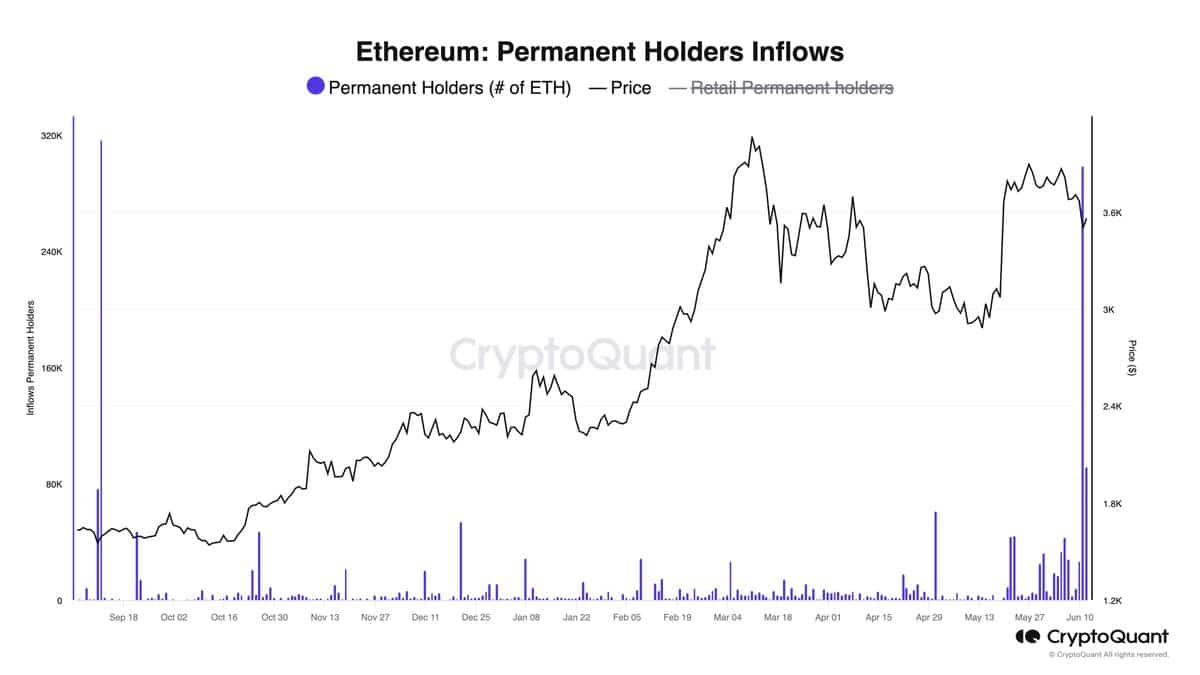

Amid these worth changes, Ethereum has experienced a big surge in long-term holder accumulation. In accordance with Julio Moreno, CryptoQuant’s head of analysis, Ethereum simply witnessed its second-largest shopping for day by long-term holders.

On June 12, about 298,000 Ethereum tokens, valued at roughly $1.34 billion, had been bought by these steadfast buyers, capitalizing on a slight 2% worth dip throughout the identical 24-hour interval.

Supply: CryptoQuant

This noteworthy accumulation was not far off from the file set on eleventh September, 2023, when 317,000 Ether tokens had been acquired as costs dipped under $1,600.

This sample of strategic shopping for throughout worth drops highlights the arrogance long-term buyers have in Ethereum’s worth.

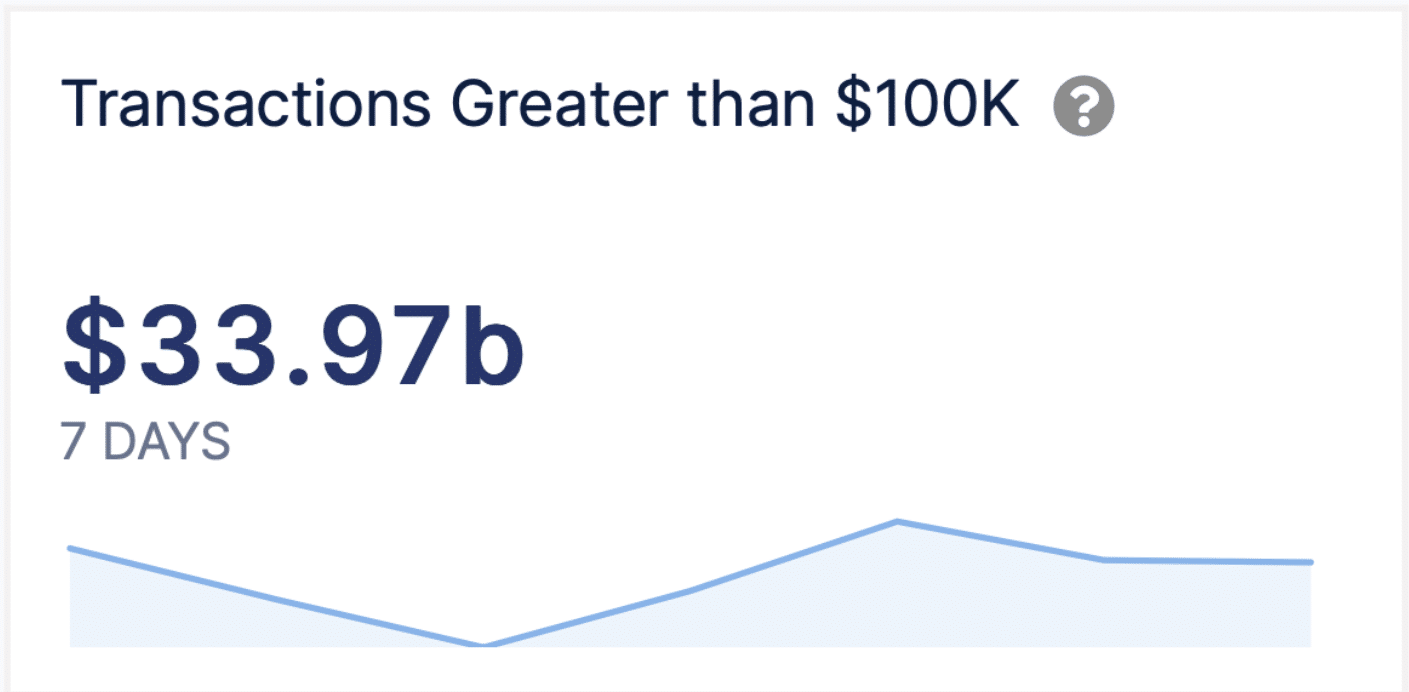

Moreover, this pattern corresponds with a rise in massive transactions over $100,000, as proven in IntoTheBlock data, the place such transactions rose from under 4,000 earlier within the week to over 6,000

This means lively accumulation by whales whatever the prevailing market circumstances.

Supply: IntoTheBlock

Market warning and technical outlook

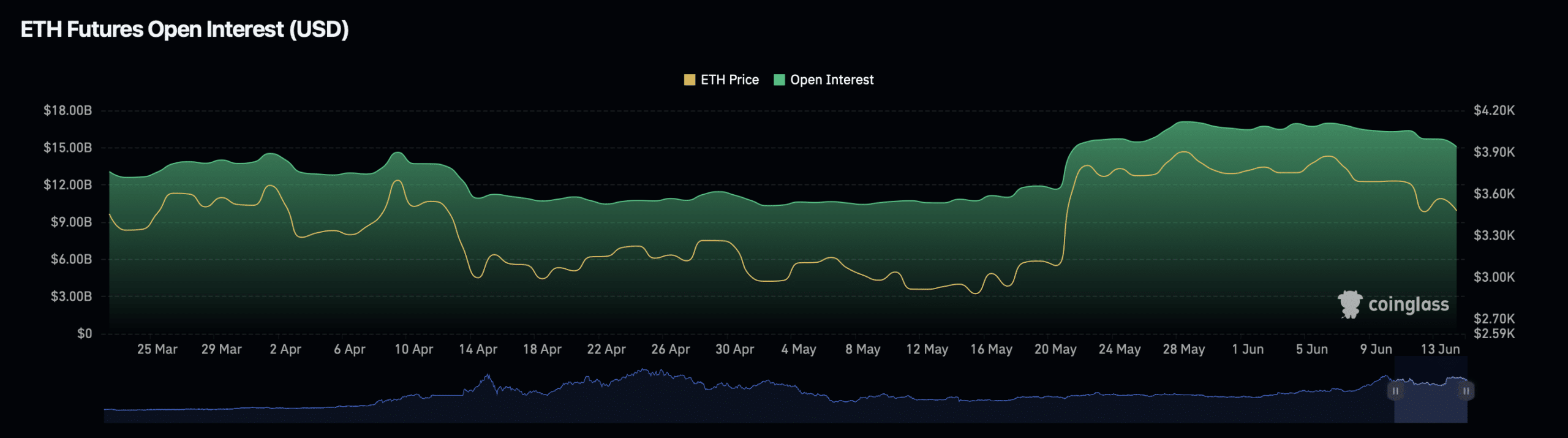

Nonetheless, contrasting this bullish accumulation exercise, Ethereum’s market metrics corresponding to open curiosity and buying and selling quantity current a extra subdued outlook.

Open interest in Ethereum has decreased by practically 2% to $15.41 billion, whereas buying and selling quantity noticed a big decline of 25.77%, now standing at $24.19 billion. These metrics recommend a cautious stance amongst some market members, probably anticipating additional worth changes.

Supply: Coinglass

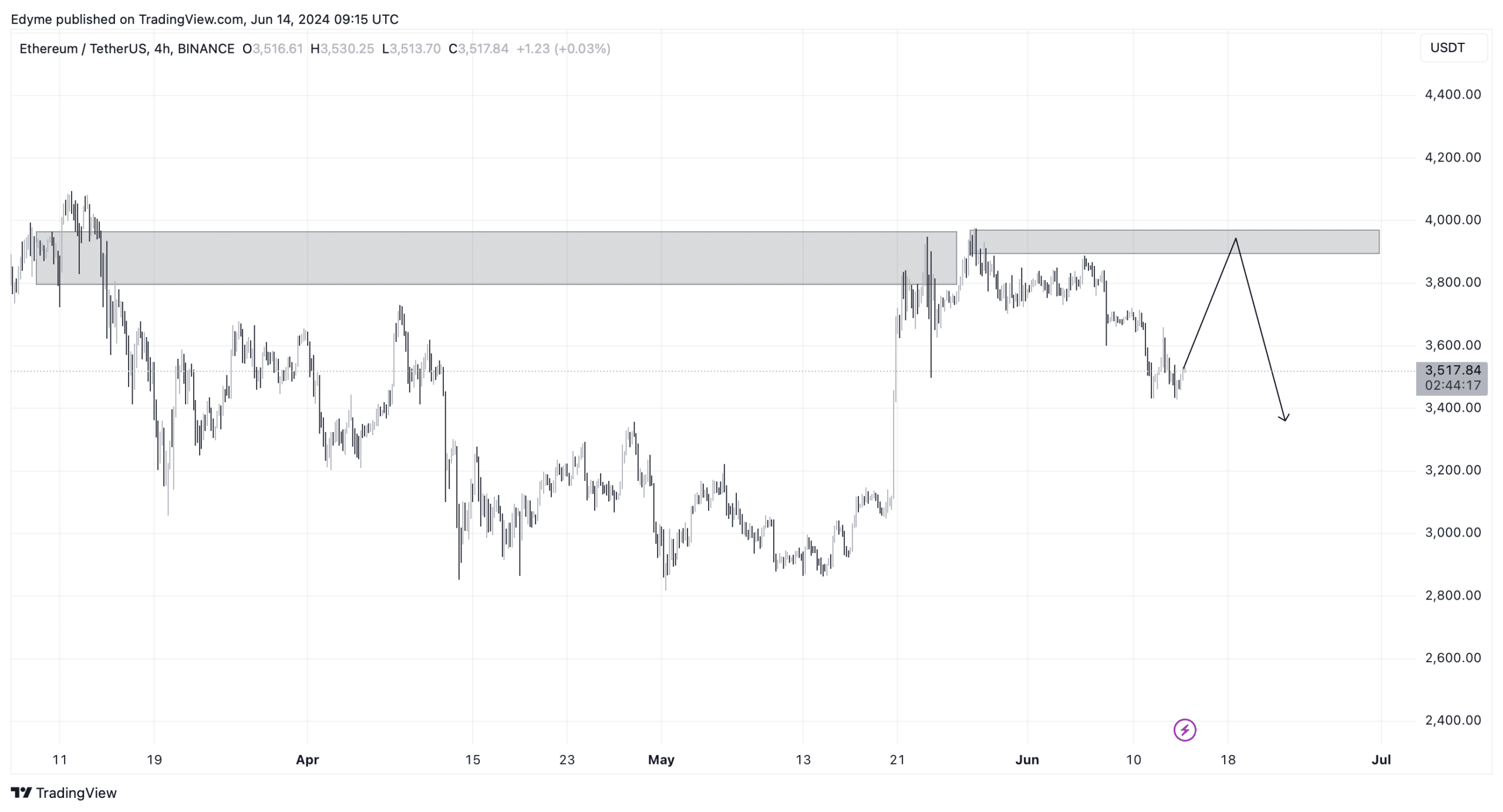

On the technical entrance, Ethereum’s lack of ability to surpass its March highs has activated a promote setup on its every day chart, hinting at doable continued downward strain.

Nonetheless, a shorter-term perspective from the 4-hour chart suggests there could be a brief rise to round $3,800, probably offering liquidity for an ongoing downtrend.

Supply: TradingView

Learn Ethereum’s [ETH] Value Prediction 2024-25

In one other very important side of market dynamics, the quantity of Ethereum held on exchanges has hit an eight-year low, as famous by AMBCrypto.

This discount in exchange-held Ethereum, coupled with the launch of spot ETFs, might result in a big provide shock, which may, in flip, set off a pointy worth enhance.