Ethereum: Why this weekend could set the stage for a $3K breakthrough

- Ethereum has all the suitable causes to push for a $3K gamble this weekend

- However first, a couple of velocity bumps have to be addressed

Amid post-election liquidity, altcoins are pushing to new highs. Ethereum [ETH] has surged over 15%, breaking previous $2.9K for the primary time in 90 days. In the meantime, Bitcoin’s historic drop in reserves is fueling FOMO, setting the stage for alts to observe go well with.

Nevertheless, ETH faces headwinds: a dormant whale holding $1.14 billion in ETH has reactivated, sparking fears of a sell-off. Regardless of sturdy inflows, ETH nonetheless trails Solana, which is closing in on $200.

With Bitcoin concentrating on $78K, ETH’s path to reclaiming dominance is likely to be a tricky climb.

The upcoming weekend will probably be essential for Ethereum

Bitcoin dominance slipped from practically 61% after hitting its ATH to round 58% at press time. In the meantime, Ethereum’s market share has climbed throughout the identical interval, now approaching 14%, signaling a capital shift into altcoins.

As anticipated, the mid-November cycle is essential for the altcoin market. With the election buzz settling and the market getting into a part of utmost euphoria, altcoins are poised for a possible surge.

Nevertheless, this situation might solely play out if Bitcoin holds its floor within the $74K – $78K vary. A BTC consolidation would create the perfect circumstances for buyers to give attention to high-cap alts, aligning with the present market temper.

The FOMC fee lower additional helps short-term holders to carry onto their BTC. Whereas some dumping might happen over the weekend, a significant downward spiral is unlikely.

Ethereum bulls are poised to reap the benefits of this example. As weaker palms shake out, concern may drive buyers into Ethereum, doubtlessly setting the stage for a push towards $3K.

Nonetheless, loads of hurdles forward

After a shaky begin to November, Ethereum’s resurgence is noteworthy. In October, ETH struggled, dealing with three rejections and failing to interrupt above $2.7K, with pullbacks that hindered its momentum within the bull market.

In the meantime, Solana has emerged as the highest altcoin, breaking by way of the $160 ceiling with minimal setbacks. In actual fact, SOL just lately flipped BNB to safe the 4th spot and is now approaching a $100 billion market cap.

So, it’s not exhausting to think about Solana stealing the highlight once more. On high of that, the 8-year-old whale cashing in on positive factors may stir adverse sentiment, doubtlessly holding Ethereum again from testing $3K.

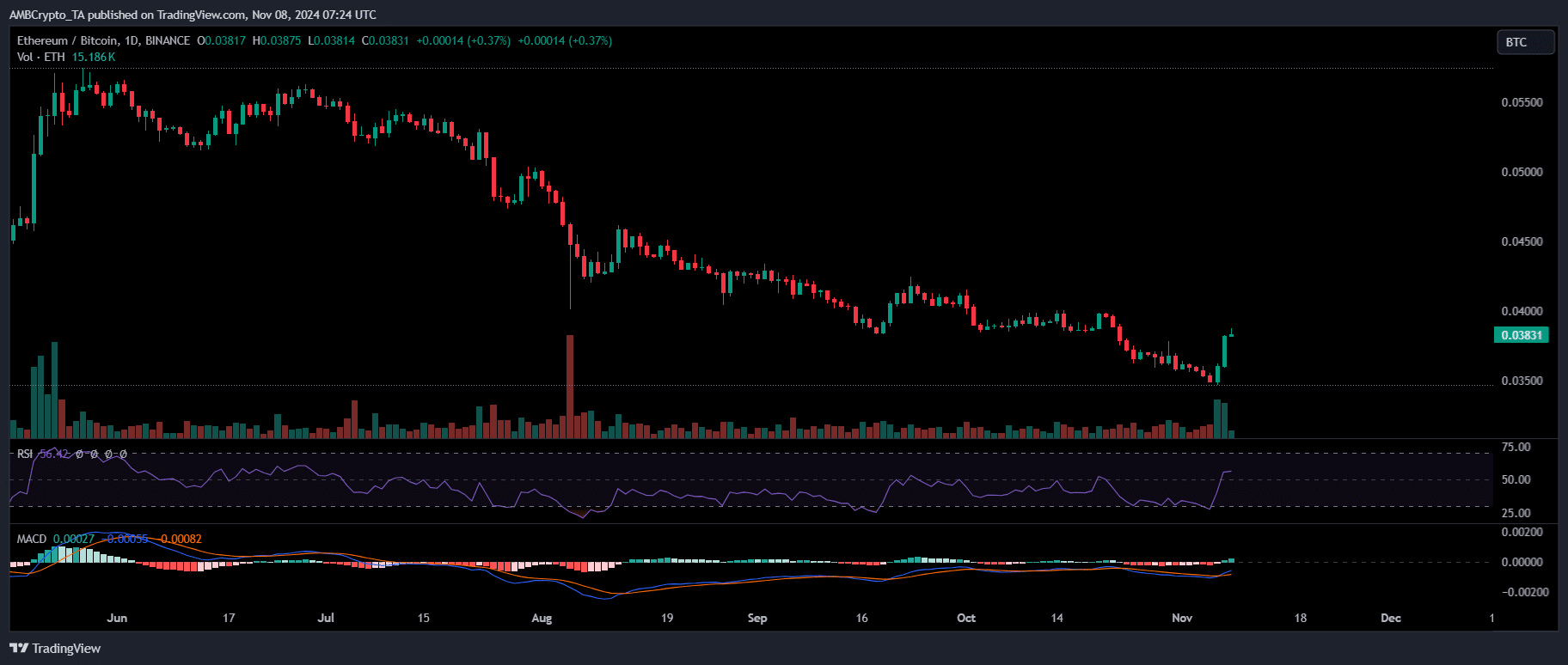

Supply : TradingView

Regardless of these challenges, Ethereum’s rising dominance over Bitcoin has caught the eye of AMBCrypto. After greater than 5 months, ETH has lastly outperformed BTC.

In consequence, the 80% revenue cohorts are more likely to maintain on to their ETH, making a weekend pullback much less doubtless. That is supported by a number of components: BTC holding regular within the $74K-$78K vary, ETH attracting liquidity, and short-term holders staying put.

Nevertheless, the affect of whales and long-term holders can’t be neglected. If dormant whales begin to reawaken, it may put ETH in a troublesome place. A powerful catalyst could also be wanted to assist Ethereum navigate these potential challenges.

The catalyst ETH wants is right here

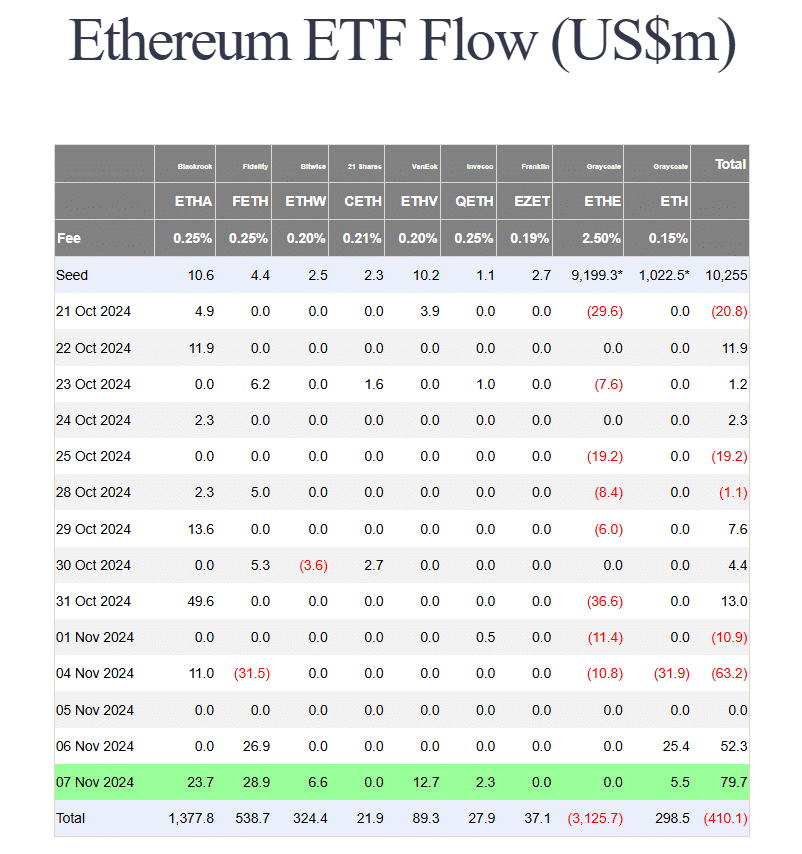

During the last two weeks, cumulative flows have been -$75M, largely because of components that stalled ETH’s rally in October. But, the important thing components that held ETH again this yr – poor efficiency from the ETH ETF and low seasonality – are actually doubtless reversing.

Even modest, regular flows may assist elevate ETH, particularly as Ethereum stays the one altcoin, apart from Bitcoin, with a visual and accessible ETF product.

Supply : Farside Traders

In brief, Ethereum’s rising publicity to the institutional panorama may act as a key catalyst, serving to to mitigate any sideways stress that might push ETH decrease.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Regardless of issues over ETH failing to draw liquidity from its ETFs, a reversal on this pattern would spark the suitable momentum, enabling Ethereum to remain within the lengthy sport and doubtlessly reclaim its dominance.

With spot ETFs seeing the best inflows of near $80 million, breaking a two-month stoop, there’s a sturdy chance of ETH hitting $3K by the tip of this month.