Ethereum: Will high network activity lead to a price hike

- ETH was down by greater than 2% within the final 24 hours.

- Shopping for strain on Ethereum was excessive, and whale exercise elevated.

Ethereum [ETH] as soon as once more proved that it’s the king of altcoins, because it outshone the remainder. If the newest information is to be thought-about, ETH was the chief in latest volatility and common intraday worth adjustments amongst top-tier capital property. Does this trace at a worth uptick quickly?

Ethereum sits on the prime

As per IntoTheBlock’s information, the Ethereum ecosystem remained extremely lively on the worth font and different associated points, outperforming the remainder. This might presumably point out a worth rise within the coming days.

In keeping with CoinMarketCap, ETH’s worth rose by over 12% within the final 30 days.

#Ethereum is main in latest volatility and common intraday worth adjustments amongst prime tier capital property.@intotheblock information is simplified and signifies that the #eth ecosytem is strongly lively. A worth run wouldn’t be a shock.#crypto #bitcoin #Market #currency #BBB24 pic.twitter.com/O1pLDxgiNw

—

ℤ𝕐ℝ𝔼 (@lord_zyre) January 19, 2024

Whereas ETH’s exercise on the worth entrance remained excessive, AMBCrypto deliberate to test its community exercise.

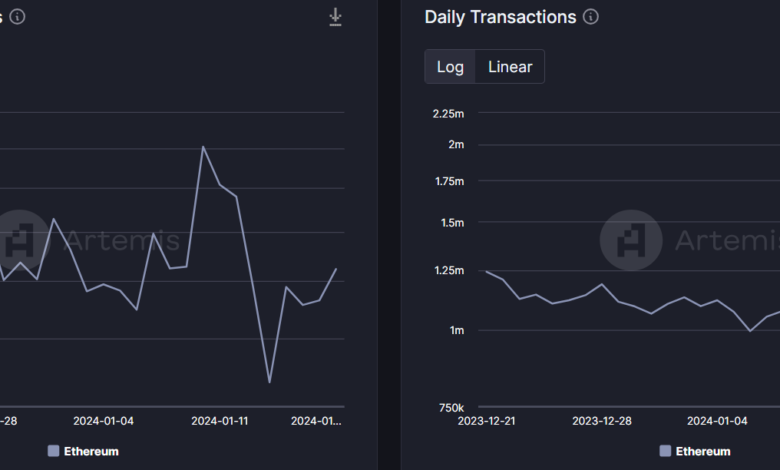

An evaluation of Artemis’ data clearly revealed that each Ethereum’s day by day lively addresses and day by day variety of transactions remained comparatively excessive all through the final 30 days.

Not solely that, however issues on the captured worth entrance additionally seemed promising. This gave the impression to be the case as ETH’s charges gained upward momentum.

Along with the uptick, the blockchain’s income additionally adopted the same rising pattern. Nevertheless, a detrimental flag was the drop in its TVL.

Will ETH’s worth transfer up additional?

Although ETH’s worth surged in double digits final month and community exercise remained excessive, its day by day chart turned purple. The king of altcoins was down by greater than 2% within the final 24 hours.

At press time, ETH was trading at $2,477.74 with a market capitalization of over $297 billion.

To see how buyers have been reacting to this, we checked Santiment’s information. Our evaluation revealed that buyers have been exerting shopping for strain on the token. This was evident from the truth that Ethereum’s provide on exchanges dipped whereas its provide outdoors of exchanges went up.

Moreover, whales have been additionally assured in ETH as its provide held by prime addresses elevated final week.

Learn Ethereum’s [ETH] Value Prediction 2024-25

Contemplating the excessive ecosystem exercise and shopping for strain, the opportunity of a worth uptick within the coming days can’t be dominated out. Subsequently, AMBCrypto then took a have a look at ETH’s liquidation heatmap to see the upcoming resistance ranges.

Our evaluation revealed that ETH would face sturdy resistance close to the $2,600 mark. If it managed to climb above that degree, it will once more face resistance between $2,770 and $2,800.