Ethereum: Will liquidations make $2000 a pipe dream

- Ethereum’s lengthy positions face record-high liquidations, surpassing $58 million in Might.

- Regardless of a slight value improve, Ethereum stays in a bearish development across the $1,830 value vary.

Ethereum’s [ETH] value has been trapped inside the $1,800 value vary for fairly a while, however these days, we’ve witnessed a glimmer of hope with a modest surge. Sadly, even this slight upward motion hasn’t confirmed ample to safeguard sure merchants’ positions from being forcefully liquidated.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Ethereum lengthy liquidations hit month-to-month excessive

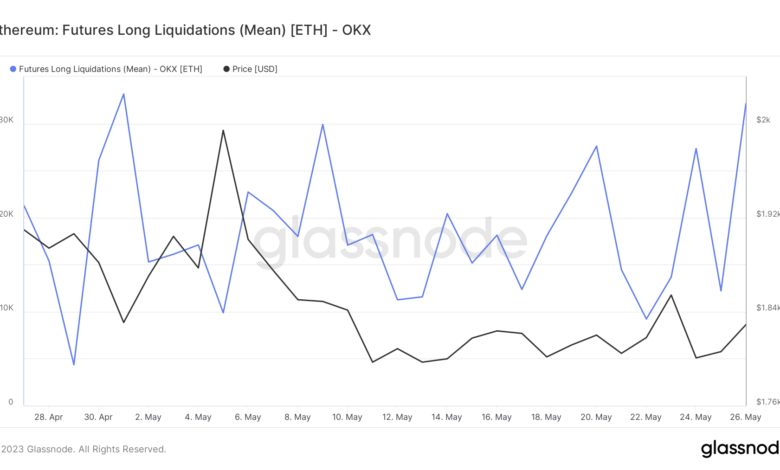

Glassnode Alerts reported that the Imply Liquidated Quantity in Ethereum Futures Contracts’ Lengthy Positions peaked on 27 Might. In response to the noticed chart, the typical quantity of Ethereum Futures Lengthy Liquidations exceeded 32,000 ETH, equal to over $58 million on the press time valuation. This made it one of many highest ETH Futures Liquidations in Might.

Supply: Glassnode

In futures contracts, the imply liquidated quantity signifies the typical variety of contracts forcefully closed or liquidated as a consequence of merchants’ incapacity to satisfy margin necessities. When participating in lengthy positions for Ethereum futures contracts, merchants are speculating on the worth of ETH growing.

Nonetheless, if ETH falls under a particular threshold, merchants’ accounts could lack ample funds to cowl the losses, ensuing within the unlucky occasion of liquidation.

Ethereum’s 24-hour liquidation map

Analyzing the Ethereum liquidation inside a 24-hour timeframe revealed a notable quantity of liquidation exercise. In response to CoinGlass, ETH skilled liquidations totaling $8.42 million prior to now 24 hours.

Additional evaluation indicated that lengthy positions witnessed liquidations amounting to $2.48 million, whereas quick positions confronted liquidations totaling $5.94 million.

Supply: CoinGlass

As of this writing, lengthy positions accounted for over $600,000 in liquidations, whereas quick positions stood at over $500,000. Taking a broader perspective by inspecting the ETH liquidation chart, it turns into evident that lengthy positions skilled extra liquidations in Might when in comparison with quick positions.

How a lot are 1,10,100 ETHs value right now?

Observing value swings in a every day timeframe

Analyzing Ethereum’s every day timeframe chart revealed a 1.26% improve in worth on the shut of commerce on Might 26. As of this writing, Ethereum was buying and selling round $1,830, exhibiting a minor upward development of lower than 1%. Though ETH remained inside a bearish development, it was displaying indicators of weakening because of the latest modest development it has skilled.

Notably, the Relative Energy Index (RSI) line indicated that ETH was approaching the brink of transitioning to a bullish development.

Supply: TradingView