Ethereum’s 3% bluff: Will ETH remain above $2.5K or fall to $2.3K?

- Ethereum skilled a notable worth surge, testing the essential $2,500 resistance degree.

- Will the bulls keep momentum, or will the bears reclaim management?

Ethereum [ETH] skilled a big pullback at the beginning of the final week of August, wiping out many of the positive factors it had achieved throughout the first week of the month, when the altcoin examined the $2,700 ceiling.

Nonetheless, the bearish tone that kicked off September shifted as ETH surged over 3% up to now 24 hours, buying and selling at $2,521 at press time.

Apparently, regardless of the worth surge, the altcoin season index fell, suggesting weak investor confidence within the ongoing bullish development.

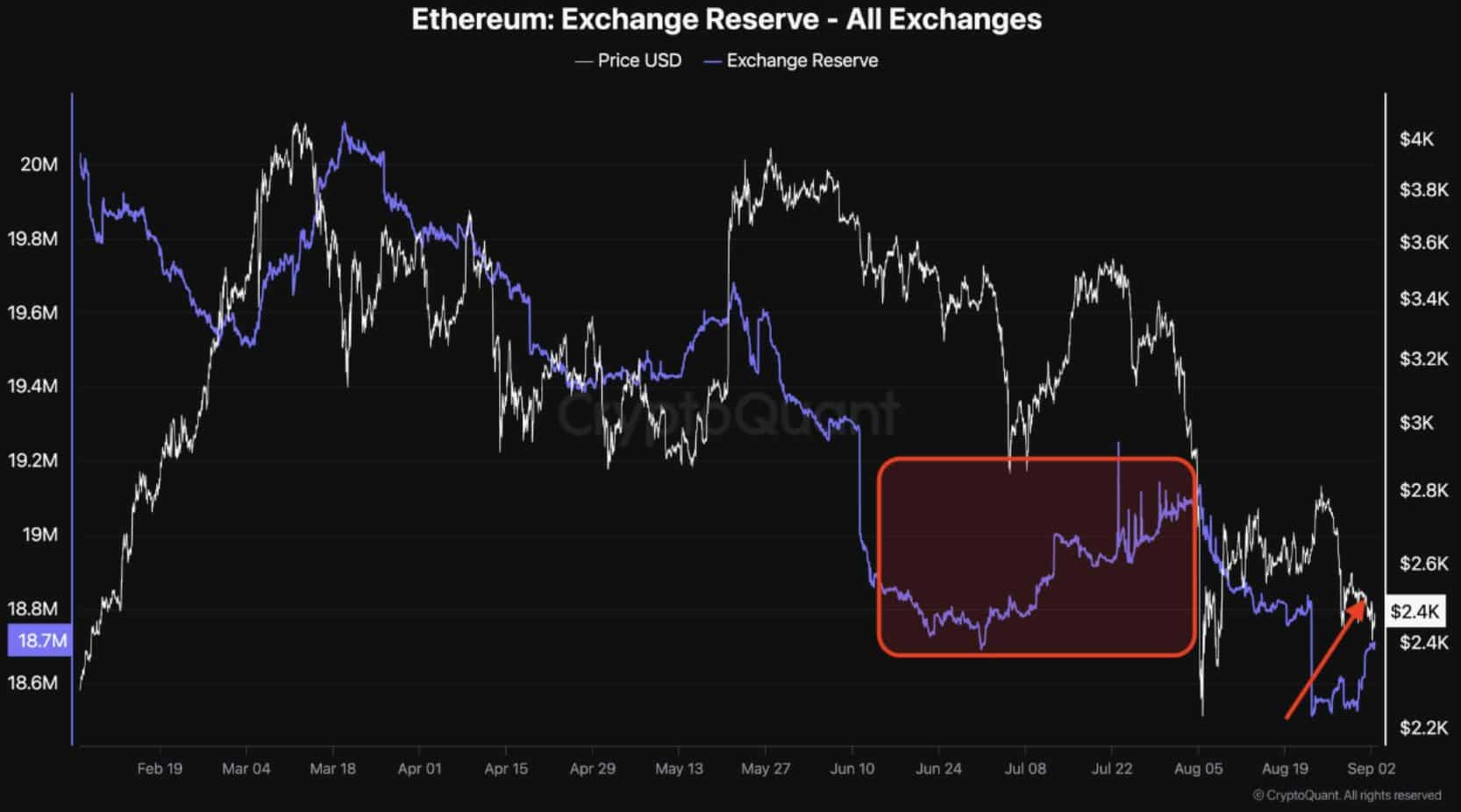

Underpinned by rising ETH trade reserves

In a post, a outstanding crypto analyst highlighted a big improvement, suggesting the beginning of a distribution part.

Merely put, the notable spike in ETH trade reserves indicated that extra merchants are capitalizing on the current surge by shifting their earnings to exchanges earlier than the hype fades.

Supply: CryptoQuant

Based on AMBCrypto’s evaluation of the chart above, every time ETH has closed close to its resistance degree, it has been accompanied by a rise in ETH trade reserves.

As an example, when ETH examined the $4,050 resistance earlier in March, the trade reserves spiked from $19.5 million to $20.8 million.

Equally, when ETH’s worth broke above the $2,800 ceiling final month, rising trade reserves led to robust resistance, stopping bulls from pushing the worth increased.

Consequently, the worth retraced to the $2,390 assist degree.

Nonetheless, since then, bulls have been eagerly awaiting a worth correction. So, is the current 3% surge the important thing to a rally?

No assurance for a bullish upsurge

Unsurprisingly, the chart above confirmed a notable spike in trade reserves from $18.5 million to $18.7 million the day after ETH skilled a big surge on the 2nd of September.

This confirmed the standard day buying and selling technique of locking in earnings as quickly as the worth confirmed a slight upward development.

Nonetheless, to counter this algorithmic conduct, new merchants should enter the market whereas long-term holders keep away from promoting.

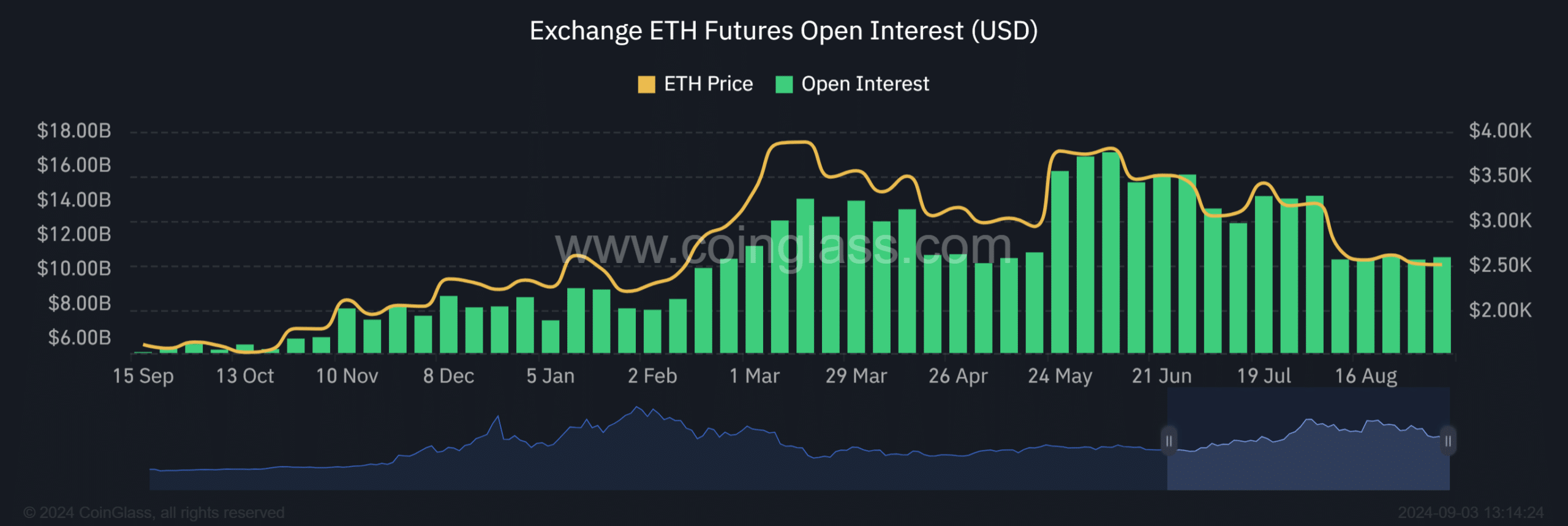

Supply: Coinglass

To the bulls’ reduction, AMBCrypto famous a rise in Open Curiosity amongst Futures merchants.

Based on the chart above, the OI surged to $10.72 billion, marking a 0.37% improve from yesterday’s $10.68 billion.

Regardless of this uptick, a a lot stronger improve in Open Curiosity can be wanted to ensure a sustained bullish swing.

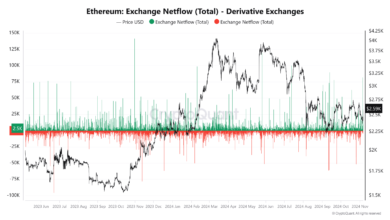

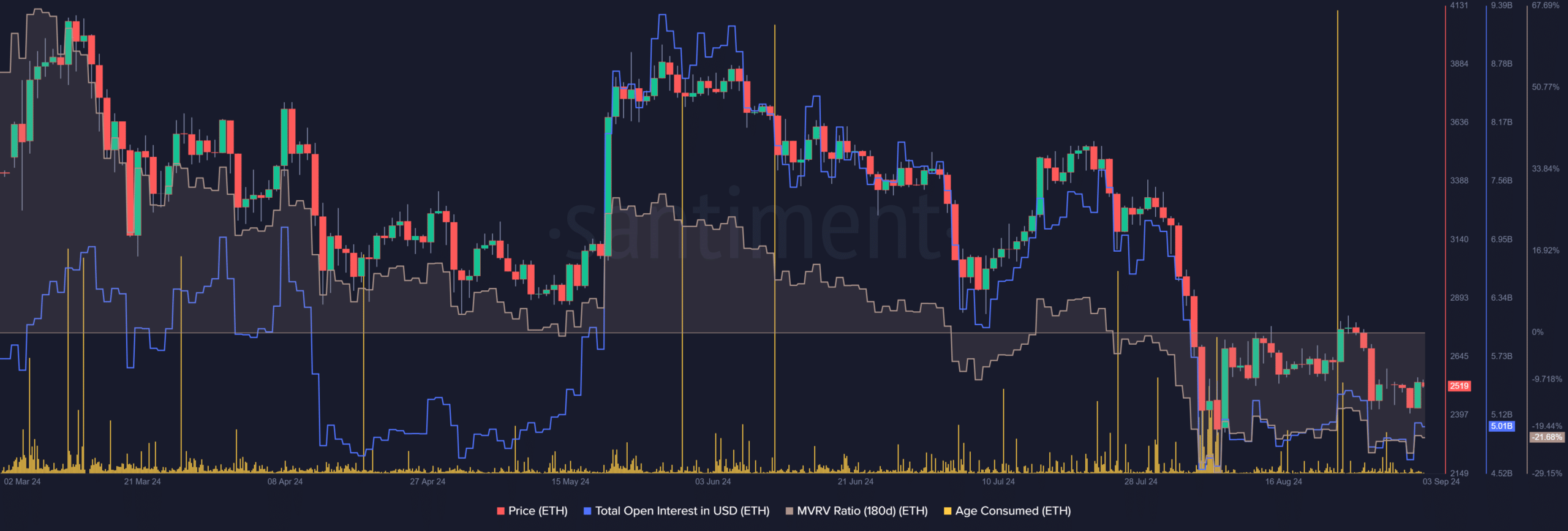

Supply: Santiment

Whereas Futures merchants present restricted optimism for a assured ETH worth surge, long-term holders have been routinely promoting a portion of their aged cash, signaling a bearish development.

On the twenty third of August, the age-consumed soared to an astounding $629 million, which subsequently led to a worth plunge.

Moreover, a detrimental MVRV ratio indicated that the present market worth of ETH is beneath its realized worth, indicating that the asset could also be undervalued. It could sign a possible shopping for alternative.

Nonetheless, the shortage of a big Open Curiosity surge may point out that the true worth of ETH has not but been realized.

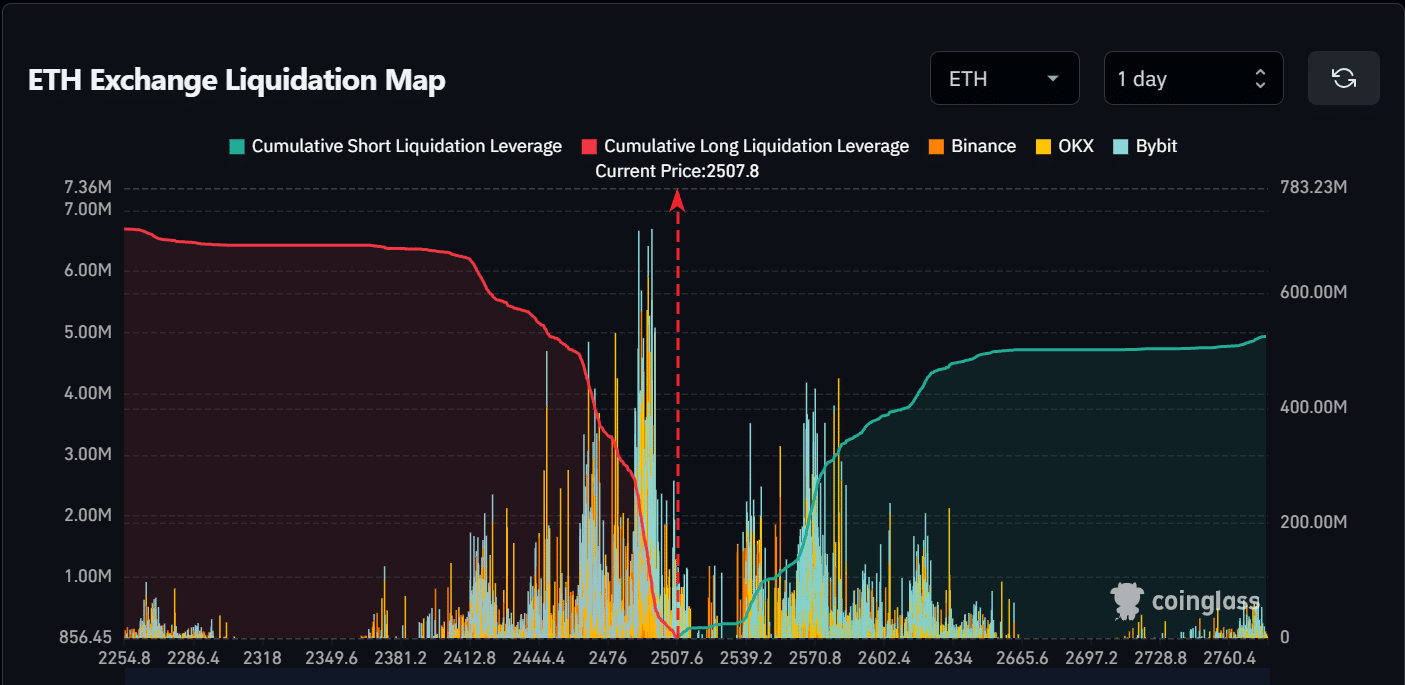

Supply: Coinglass

Furthermore, AMBCrypto famous that the current 3% surge might need been a bluff, resulting in $34 million in brief liquidations and pushing ETH to check the essential $2,500 degree.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Nonetheless, as analyzed by AMBCrypto, resulting from lack of robust shopping for exercise, the possibilities of a breakout had diminished.

In brief, if shopping for exercise doesn’t improve, ETH may face round $40 million in lengthy liquidations if it falls beneath the $2,500 assist, retracing its worth again to $2,300.