Ethereum’s $35 million shake-up: How ETH’s 7% hike triggered a 2-month high

- ETH’s worth appreciated by over 5% on 3 Could

- This contributed to a hike within the variety of brief positions liquidated

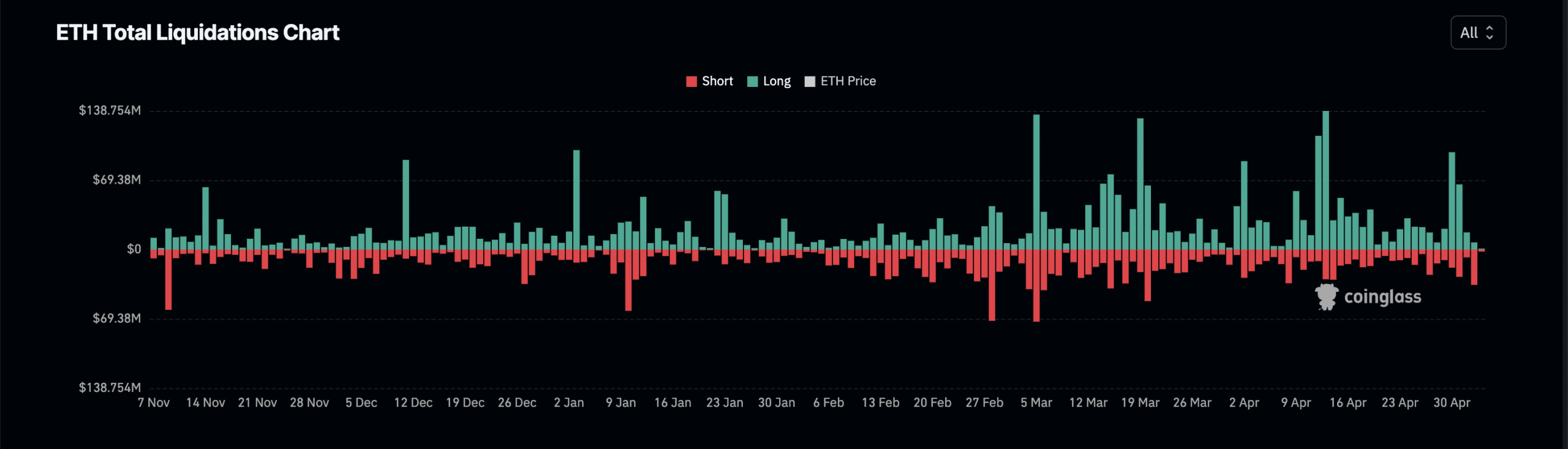

Ethereum’s [ETH] 7% worth rally throughout the intraday buying and selling session on 3 Could brought on brief liquidations on its derivatives market to rally to a two-month excessive, in line with Coinglass.

The truth is, the on-chain information supplier went on to disclose that on that day, $35 million price of ETH’s brief positions have been liquidated. Compared, lengthy liquidations totalled simply $7.16 million.

Supply: Coinglass

Liquidations occur in an asset’s derivatives market when a dealer’s place is forcefully closed as a result of inadequate funds to take care of it. Brief liquidations happen when the worth of an asset instantly rises, and merchants who’ve open positions in favor of a worth decline are compelled to exit their positions.

In keeping with Santiment’s information, the altcoin closed on 3 Could above $3000 after buying and selling beneath that worth degree for the reason that starting of the month.

Derivatives market merchants keep their palms

Nonetheless extending its positive factors at press time, ETH’s worth was up by over 5% within the final 24 hours. On the time of writing, the market-leading altcoin was valued at $3,104.

Right here, it’s price noting that Coinglass information additionally steered that the worth rally has not instigated any vital exercise in ETH’s derivatives market. The truth is, buying and selling quantity in that market grew by simply 2%.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Equally, the coin’s Futures open curiosity recorded a minor 3% hike over the identical interval. ETH’s Futures open curiosity was $10.68 billion at press time. Moreover, ETH’s Choices quantity cratered by over 50% throughout the interval underneath evaluate.

Choices buying and selling grants contributors the best to purchase or promote an asset at a specified date. Typically, when ETH sees a decline in its Choices quantity, it means that there’s much less hypothesis on its future worth actions as market contributors wait to see the place the coin’s market is perhaps heading subsequent.

A mixed studying of the minor hike in ETH’s Futures buying and selling quantity and its declining Choices quantity means that the coin’s derivatives market contributors have adopted a “wait and see” strategy. Merely put, they aren’t putting vital bets on the place its worth would possibly head subsequent.