Ethereum’s $50M liquidations – Here’s what traders should know

- Each longs and shorts skilled a turbulent time after ETH’s value went up and down

- Realized Earnings elevated, indicating that the worth might fall under $3,400

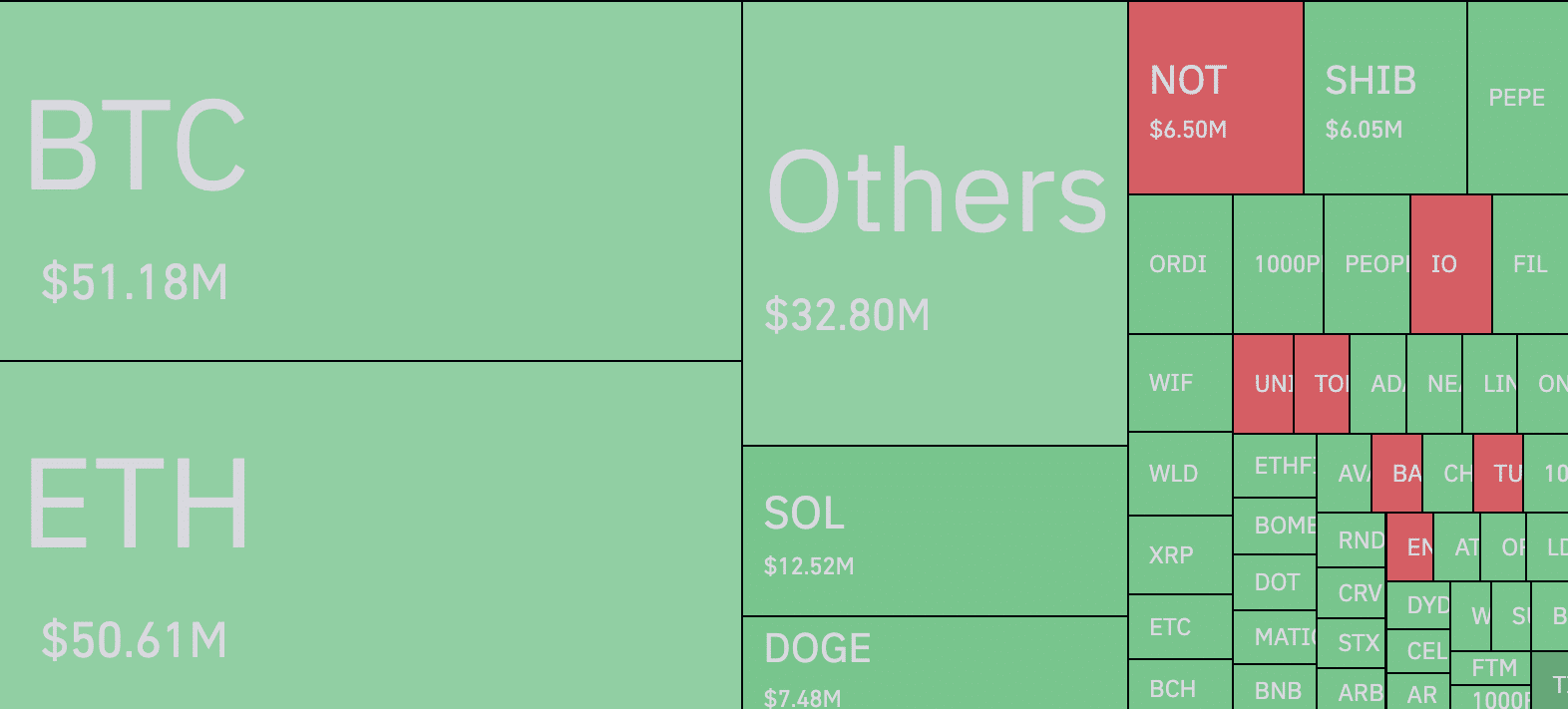

The excessive volatility out there induced liquidations out there to hit $215 million. Out of this, Ethereum [ETH] contracts accounted for $50.61 million, based on information from Coinglass.

Liquidations happen when a dealer doesn’t have a enough margin stability to maintain a place open. The forceful closure is critical to keep away from additional losses.

Stormy season for the market

For ETH, the excessive liquidations may very well be linked to the cryptocurrency’s value. A have a look at the worth motion revealed that it dropped to $3,368 in some unspecified time in the future on 14 June. Afterward, the worth rose to $3,512, earlier than settling above $3,500 at press time.

Because of these value swings, each longs and shorts weren’t spared. Longs confer with merchants betting on the worth of an asset to hike. Shorts, then again, are merchants with stakes on a value decline.

Supply: Coinglass

Nonetheless, merchants appeared to count on the depreciation in value. This, due to the Put/Name ratio earlier than Friday’s choices of expiry. Based on Deribit, the derivatives change, Ethereum’s Put/Name Ratio was 0.37.

Because the ratio was under 0.50, it meant that expectations have been bearish. Nonetheless, it didn’t appear the contributors anticipated the excessive stage of volatility.

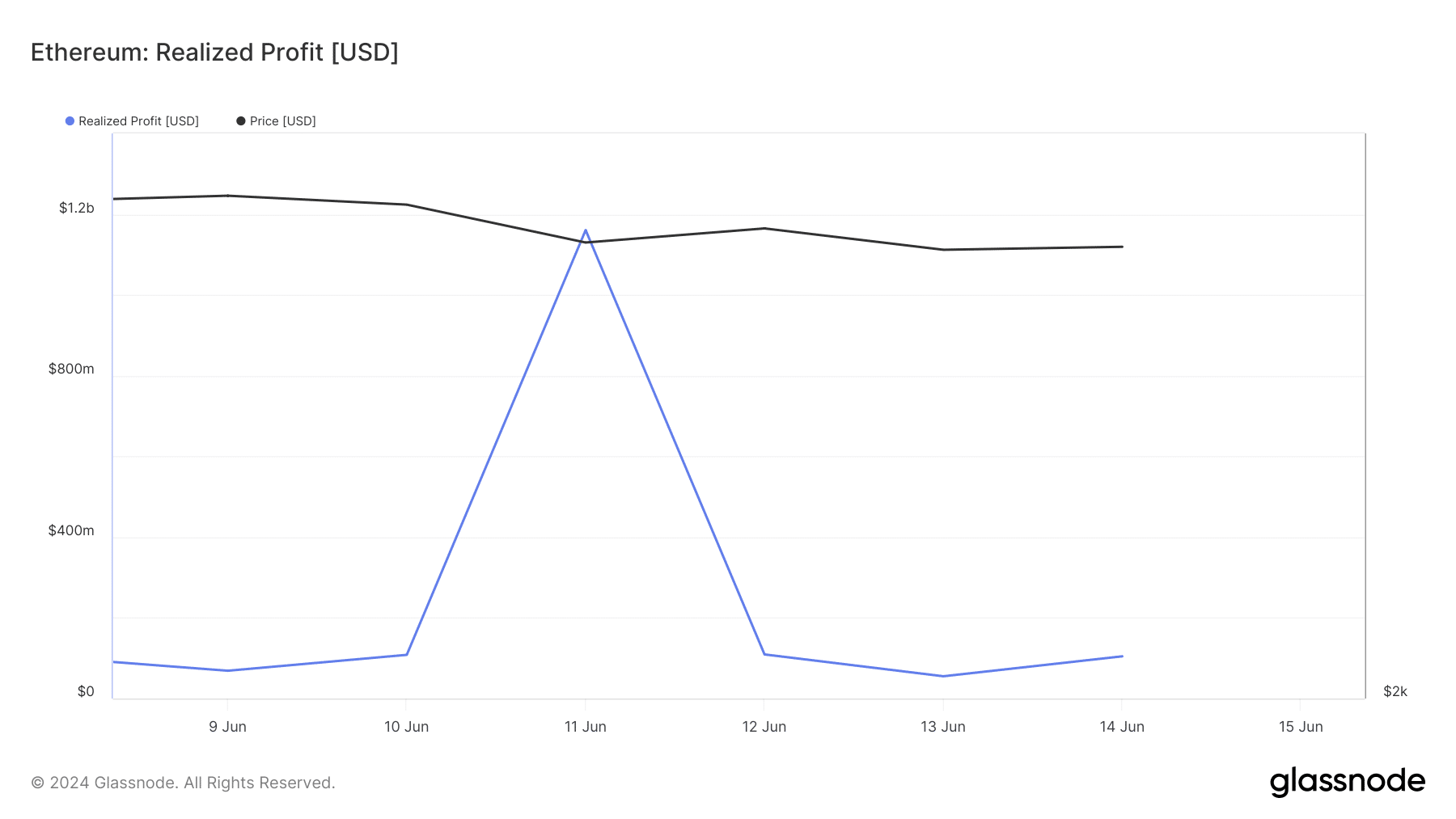

When it comes to the worth, AMBCrypto regarded on the Realized Revenue too. Because the identify implies, this denotes the full of all moved cash whose final value was decrease than its press time worth.

ETH plans to swing between $3,400 and $3,600

On 12 June, ETH’s Realized Profit was $55.18 million. By 14 June, the worth had risen to $104. 58 million. A rise on this metric implies that holders are reserving earnings, and this might result in a value fall on the charts.

Nonetheless, if the metric stabilizes itself, promoting stress reduces throughout the market. For Ethereum, Realized Revenue appears to have settled across the aforementioned worth. Subsequently, it is likely to be possible for the altcoins to commerce between $3, 400 and $3,600 over the following few days.

Supply: Glassnode

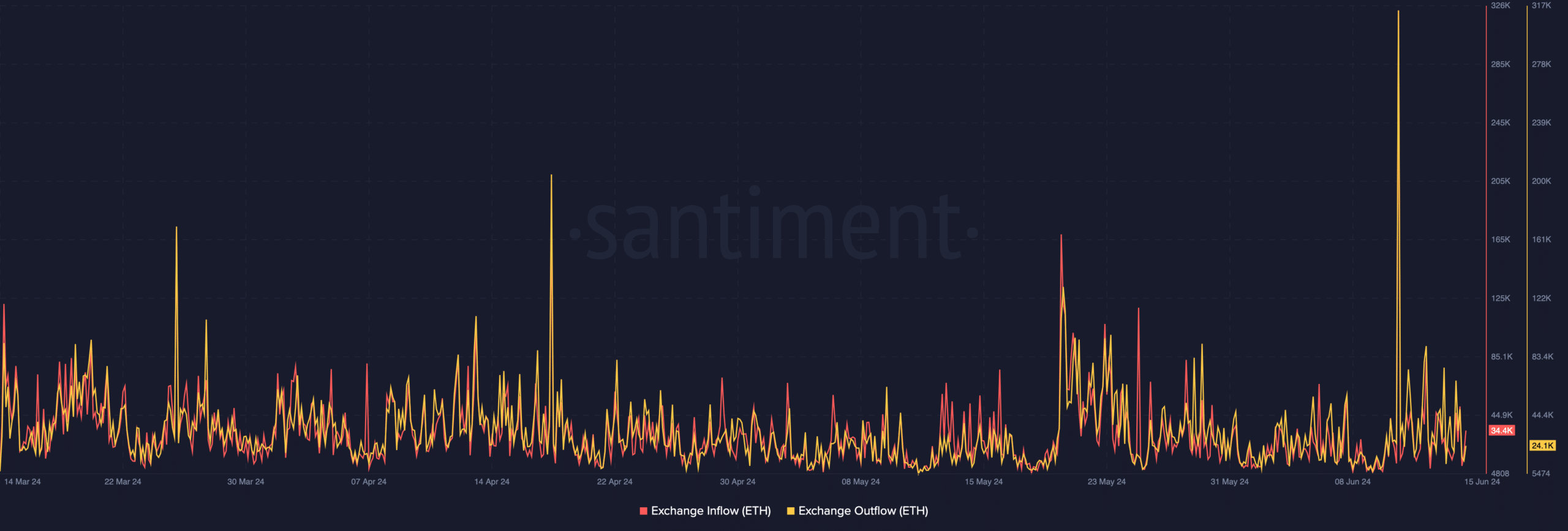

AMBCrypto additionally analyzed Alternate inflows and outflows to evaluate ETH’s subsequent motion. Alternate inflows observe the variety of cash despatched into exchanges.

If this will increase, it signifies that holders are planning to promote. When this occurs, the worth of a cryptocurrency normally decreases. Alternate outflows, then again, measures the variety of cash despatched out of exchanges.

At press time, ETH’s Alternate inflows have been $34,400 whereas the altcoin’s outflows have been 24,100. The distinction within the flows implied that there have been extra ETH up on the market, than these retired to chilly wallets.

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

If this continues, the worth of the cryptocurrency may drop under $3,400 prefer it did on 14 June. Then again, a fall in promoting stress may halt this decline and ETH may preserve consolidating on the charts.