Ethereum’s big gamble – Whales bet on the dip, but will it pay off?

- Ethereum whales seem like executing a “buy-the-fear” technique as ETH breaks by means of help ranges

- Is a rebound imminent on the charts?

When huge cash pours into the market throughout a dip, it’s referred to as a “buy-the-fear” technique. On this case, Ethereum [ETH] whales appear to be doing simply that, making the most of the panic to scoop up discounted belongings in anticipation of a market restoration.

The thriller group “7 Siblings” made a bold move, investing $42.66 million to amass 25,100 ETH at round $1,700, In an analogous transfer, one other whale borrowed 8.25 million DAI to buy 5,227.3 ETH at round $1,578.

Therefore, should you observe swimsuit and purchase into the concern?

Ethereum on whale alert

At press time, Ethereum appeared to be breaking by means of multi-year lows, with the altcoin buying and selling 16.8% decrease at $1,490 – Ranges not seen in two years. The outlook regarded murky, and anticipating a direct rebound can be untimely.

Why? The “7 Siblings” group is at present dealing with a $5.27 million loss, equating to a $120 loss per ETH. Likewise, the opposite whale has been sitting on a $460k loss.

This highlighted that regardless of the aggressive accumulation, these whales are nonetheless below significant pressure. Particularly because the market stays in a fragile state. Until these huge palms enter revenue positions, the market can be vulnerable to extra sell-offs if these whales resolve to interrupt even.

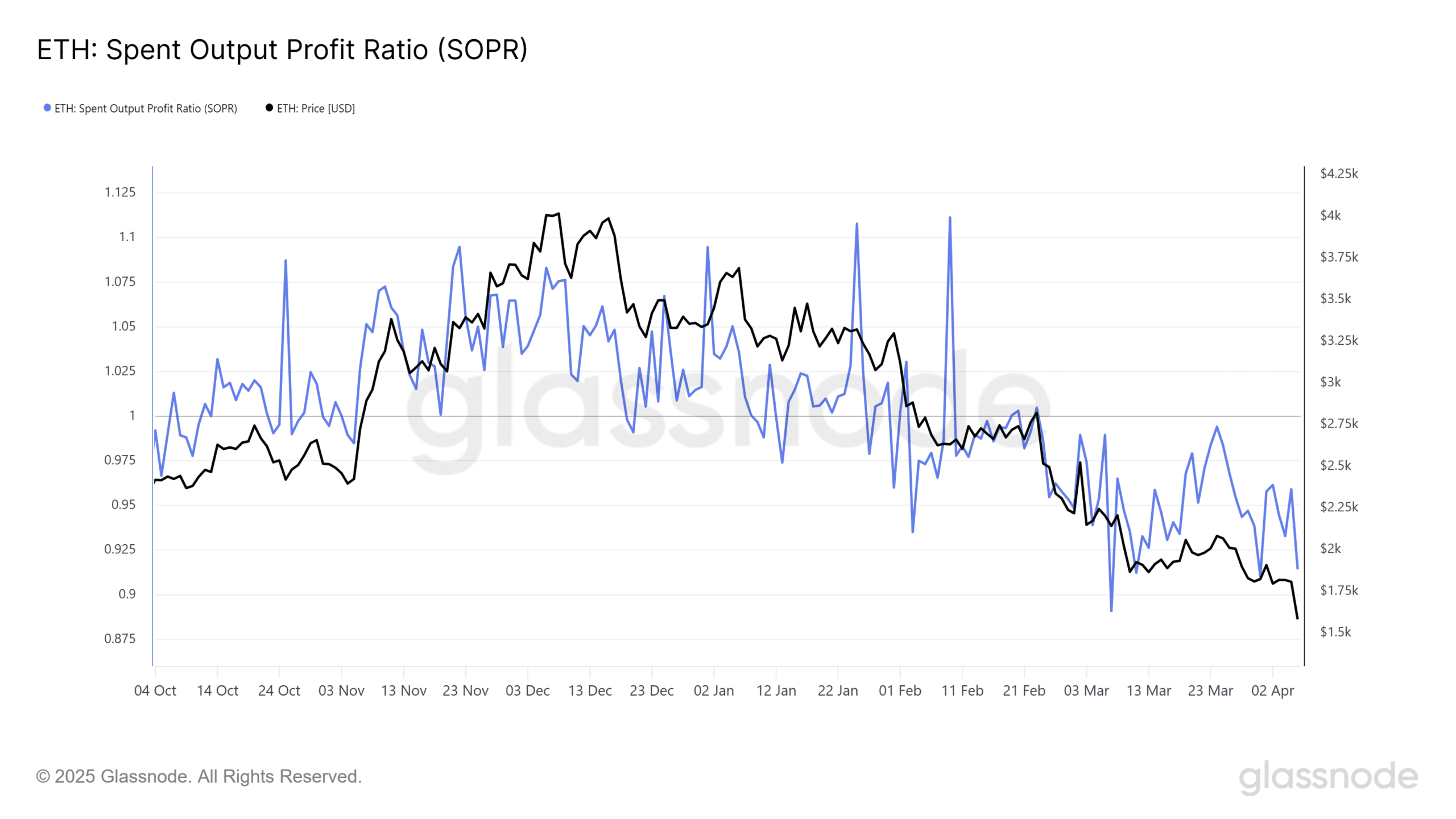

Wanting on the SOPR (Spent Output Revenue Ratio) chart underlined the probability of sustained sell-offs. Particularly because the identical fell to a six-month low.

The SOPR metric confirmed {that a} majority of market members are dealing with losses, heightening the chance of additional liquidations.

Supply: Glassnode

To soak up the sell-side strain, extra huge cash must step in.

Small palms are both panic promoting or ready for Bitcoin to get better. Till bigger gamers take management, the market can be susceptible to additional draw back.

What’s subsequent – A brief squeeze or a speculative loop?

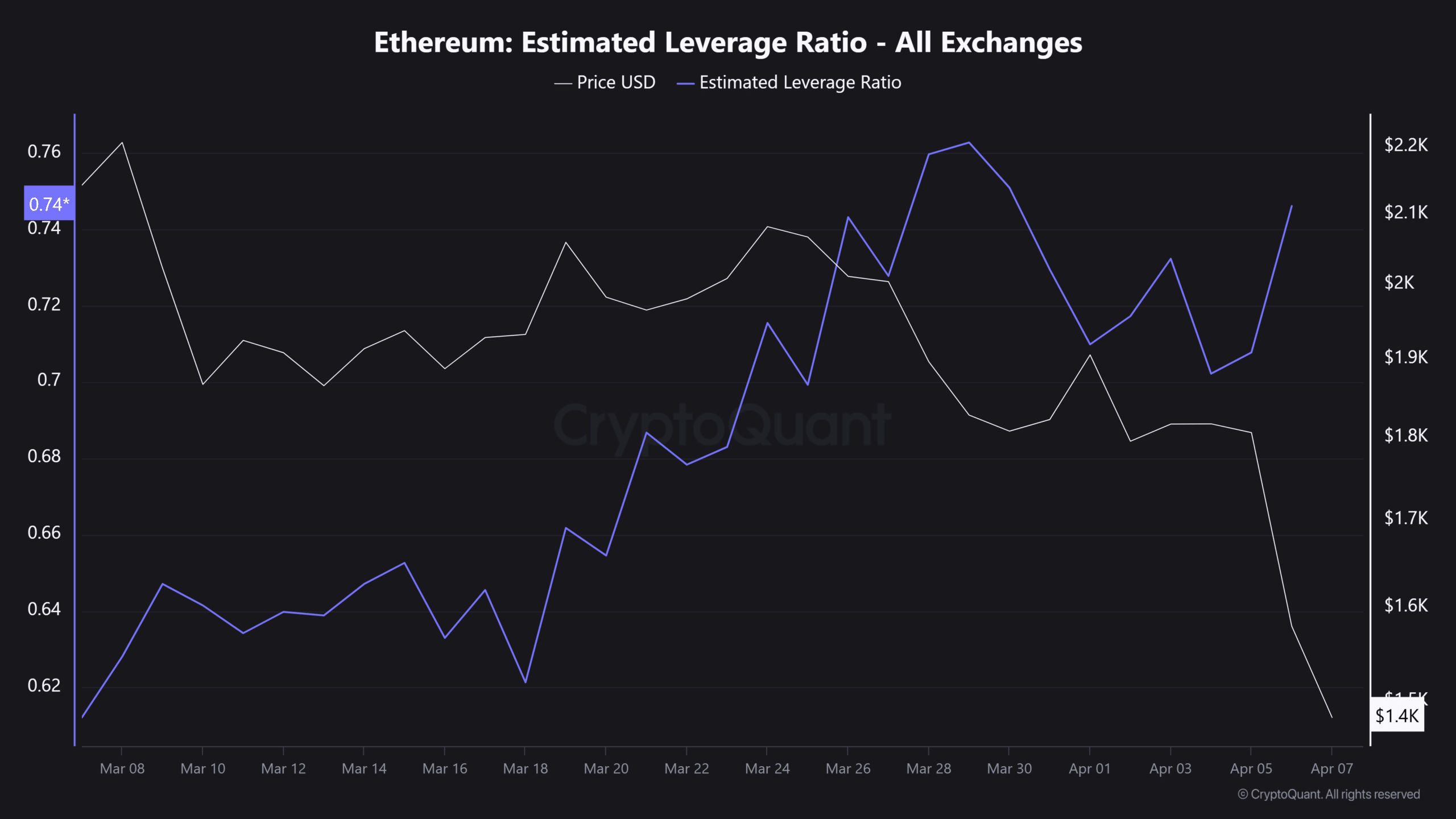

The surprising crash caught Futures merchants off guard, triggering a wave of de-risking with $349.59 million in long liquidations. Regardless of this, nevertheless, Ethereum’s Estimated Leverage Ratio (ELR) spiked – An indication that merchants are nonetheless leaping into high-risk leveraged bets.

Supply: CryptoQuant

This speculative surge, coupled with huge cash inflows, might arrange a brief squeeze if the market reverses.

Nonetheless, within the context of a bearish pattern, this might shortly flip. Why? As a result of Ethereum’s sell-side strain continues to be vital, with ETH reserves climbing from 18.21 million on 1 April to 18.50 million, signaling elevated liquidity out there.

Until robust demand kinds, Ethereum will keep caught in a speculative loop, with whales “shopping for the concern and promoting the greed.” It will preserve the ELR excessive, whereas growing the chance of extra liquidations.