Ethereum’s big hint: Last chance to buy ETH at $3,500?

- Ethereum’s value declined by greater than 3% within the final 24 hours.

- A key indicator advised that ETH was close to its market backside.

Ethereum [ETH] bears continued to dominate the market because the token’s weekly chart remained purple.

Nonetheless, all the scenario can change, as the most recent information revealed that this may be the final stage of the buildup section for altcoins.

Since Ethereum is the world’s largest altcoin, the probabilities of ETH gaining bullish momentum appeared doubtless.

Final likelihood to purchase ETH

CoinMarketCap’s data revealed that ETH’s value dropped by greater than 3% within the final seven days. On the time of writing, the king of altcoins was buying and selling at $3,553.33 with a market capitalization of over $426 billion.

In the meantime, Milkybull, a preferred crypto analyst, posted a tweet highlighting how altcoins have been following its 2020 pattern, which resulted in a large altcoin season then.

In 2020, the altcoin market cap broke out of a pennant sample, initiating a bull rally. The same sample has as soon as once more emerged, hinting that this may be the final alternative to purchase alts, together with Ethereum, at a cheaper price.

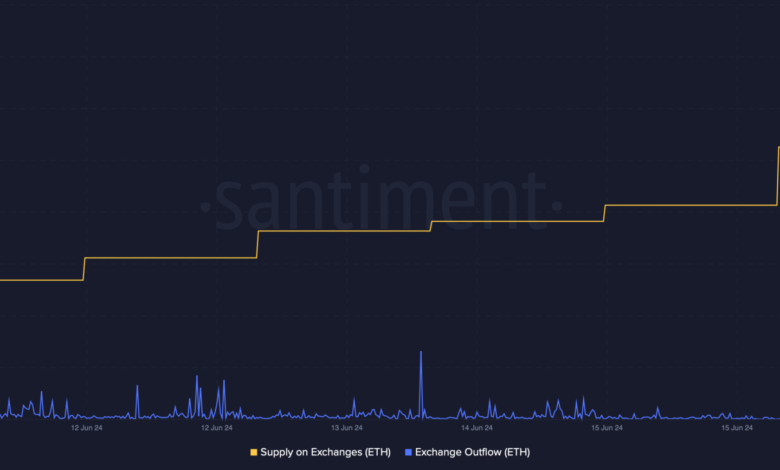

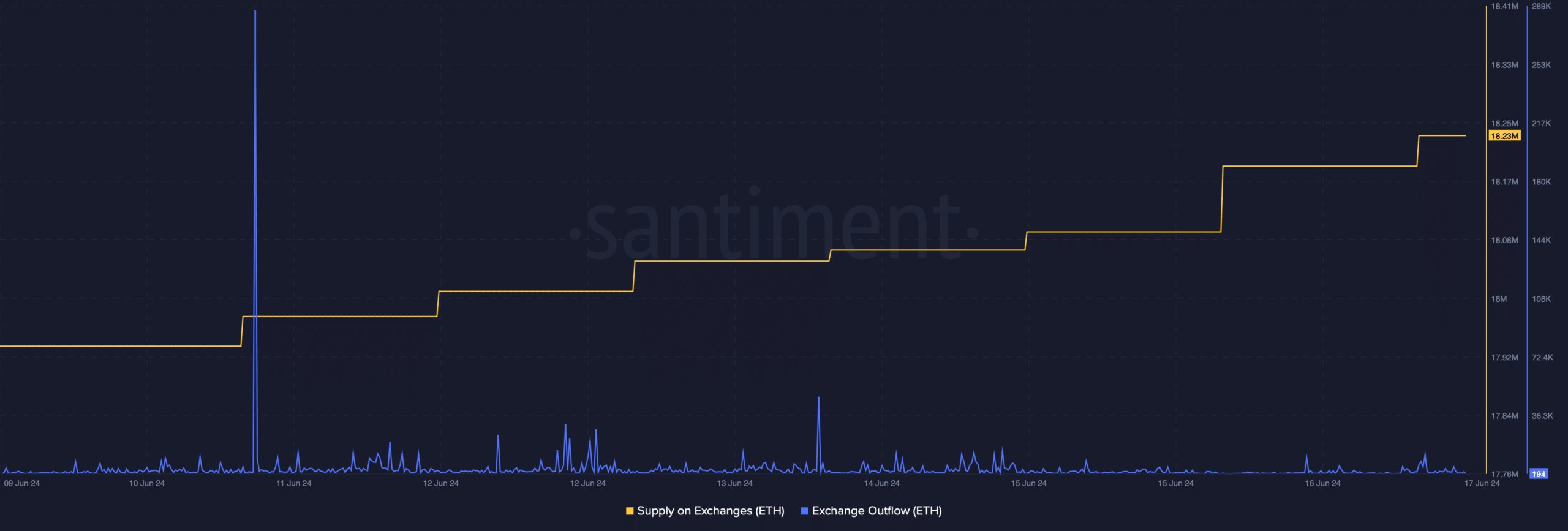

Nonetheless, AMBCrypto’s evaluation of Santiment’s information revealed that traders weren’t capitalizing on this chance.

We discovered that ETH’s alternate outflow declined during the last week. Moreover, its provide on alternate additionally elevated, that means that promoting stress on the token was excessive.

Supply: Santiment

Is Ethereum awaiting a rally?

Since Milklybull’s evaluation hinted at a bull rally, AMBCrypto then analyzed ETH’s on-chain information to see whether or not it supported the potential for a value enhance.

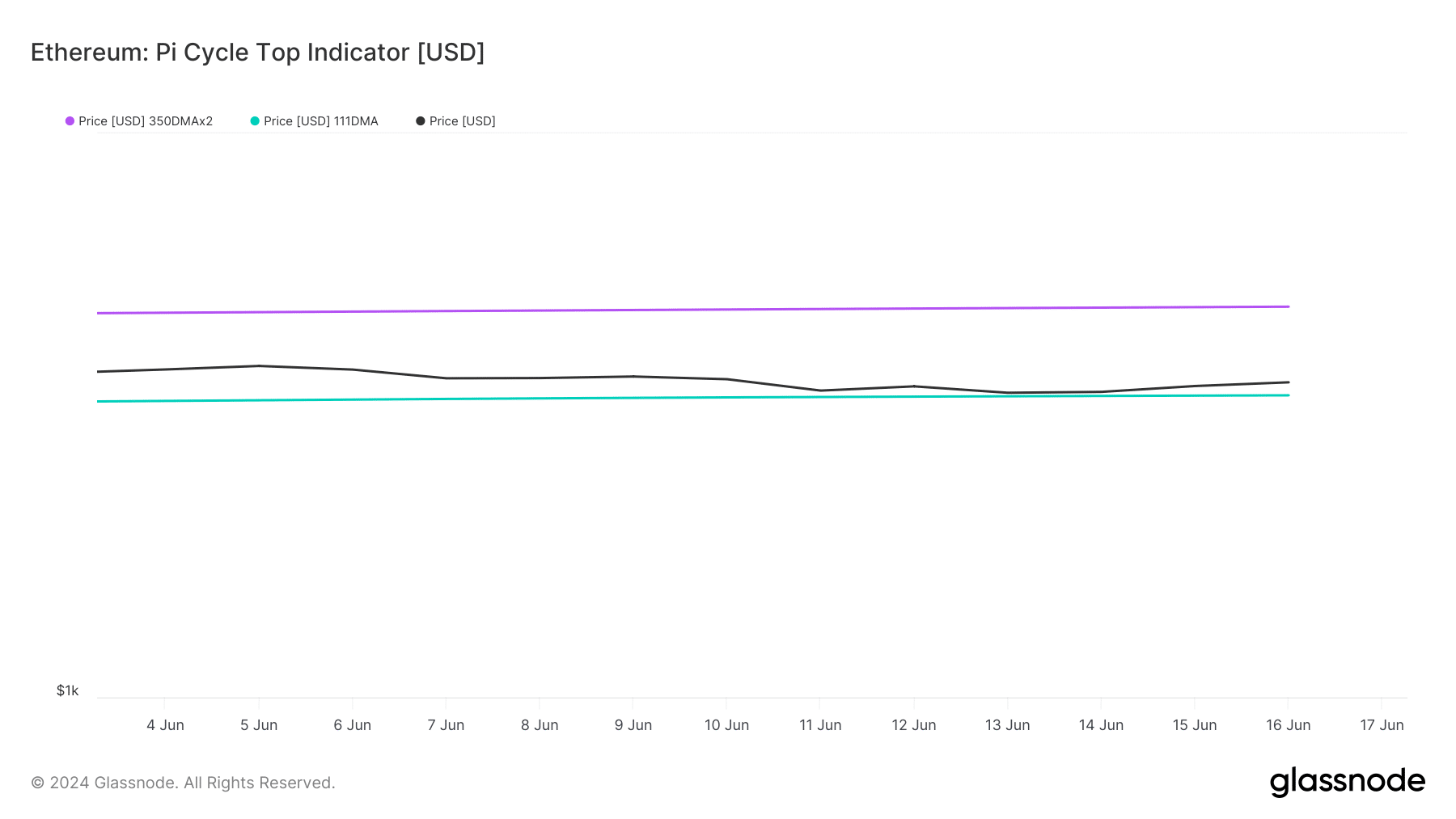

Ethereum’s Pi Cycle High indicator revealed that ETH was resting close to a market backside, hinting at a value uptick.

If that occurs, then ETH may quickly attain $4.92k. For starters, the Pi Cycle indicators are composed of the 111-day shifting common and a 2x a number of of the 350-day shifting common of Ethereum’s value.

Supply: Glassnode

The potential of ETH gaining bullish momentum appeared excessive, as at press time the token’s fear and greed index had a price of 38%, that means that the market was in a “concern” section.

At any time when the metric reaches that stage, it signifies that the probabilities of a bull rally are excessive. We then took a take a look at ETH’s 12-hour chart to raised perceive what to anticipate from the king of altcoins.

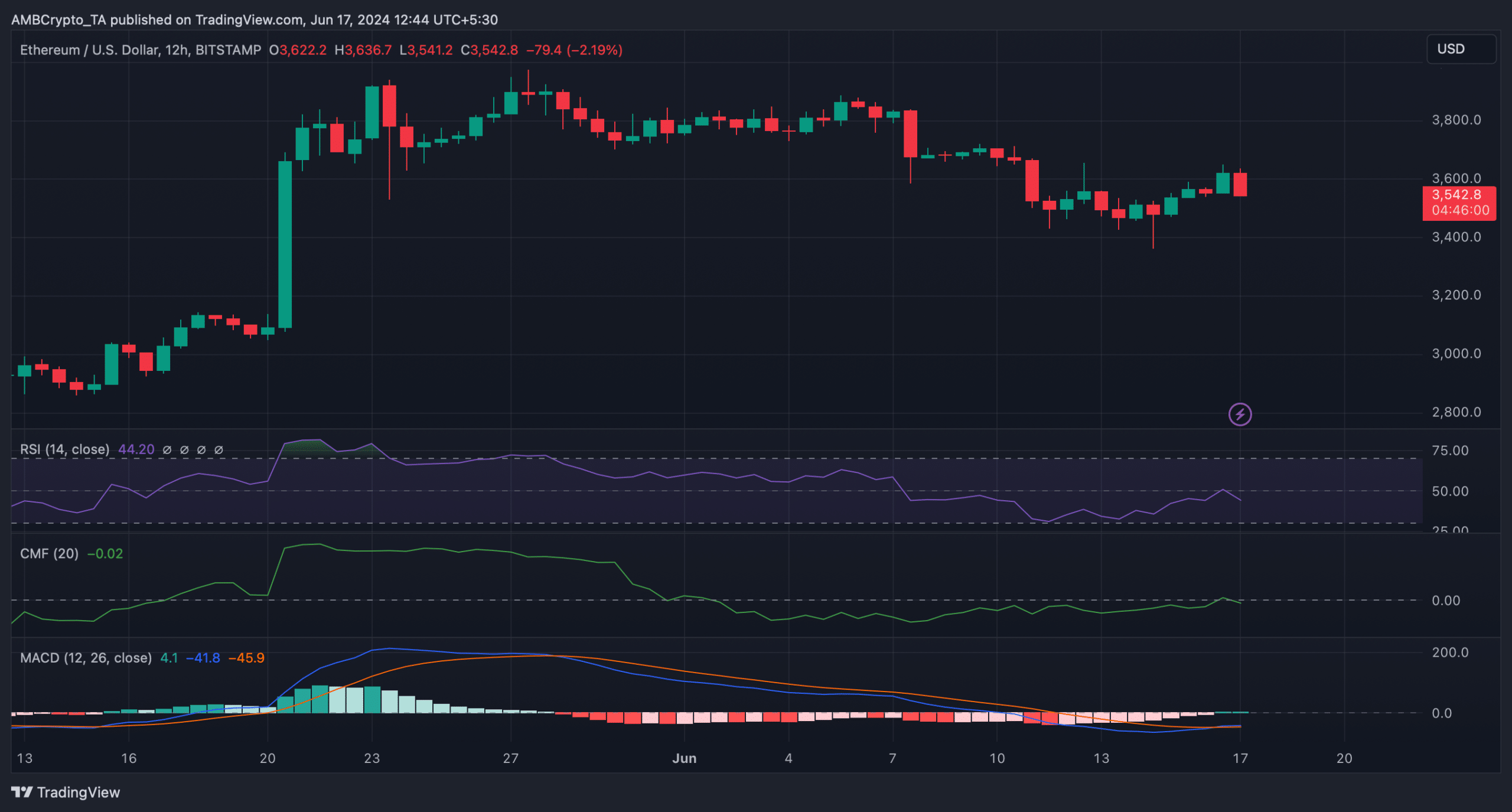

The technical indicator MACD displayed a bullish crossover.

Learn Ethereum’s [ETH] Value Prediction 2024-2025

Nonetheless, the remainder of the symptoms seemed bearish. As an example, the Relative Power Index (RSI) registered a downtick.

The Chaikin Cash Circulation (CMF) additionally adopted an identical declining pattern, suggesting that it would take a bit longer for ETH to start a bull rally.

Supply: TradingView