Ethereum’s breakout odds – Here’s what traders can look out for!

- Mixed books for ETH confirmed an total optimistic development in worth motion

- Whale exercise on Ethereum community has grown recently too

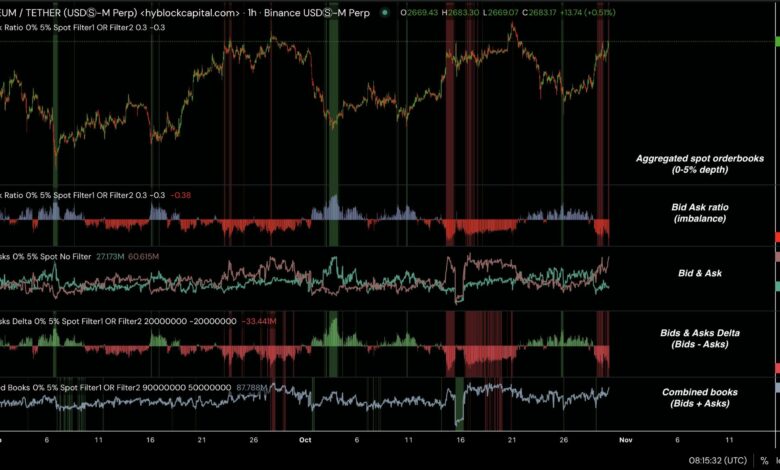

Ethereum (ETH), on the time of writing, appeared to point out some optimistic momentum out there, backed by sturdy bid volumes and indicators of rising shopping for curiosity.

In actual fact, latest information revealed mixed bid volumes of $27.173 million and ask volumes of $60.615 million, indicating an upward development in demand.

With ETH’s worth at $2,683 at press time, constant shopping for stress within the coming periods may push it in direction of the next resistance stage. Any main sell-off would possibly lead ETH nearer to its help at round $2,300.

Supply: Hyblock Capital

ETH worth motion and prediction

ETH’s worth hasn’t proven vital power in latest months, but it surely appeared near a breakthrough.

ETH sat near a essential resistance stage close to $2,800, which, if breached, may sign a parabolic transfer in direction of the $4,000-mark.

This market basis, coupled with a gradual however regular worth uptick, prompt that ETH could possibly be primed for an upward transfer quickly.

Nonetheless, ETH’s market stays unpredictable. In actual fact, some analysts are speculating {that a} pullback may happen earlier than a extra sustained rally.

Supply: Buying and selling View

Value predictions stay cautious although, as Ethereum may dip to retest the $2500 space, forming a stronger basis for a subsequent rally.

For buyers using a dollar-cost averaging (DCA) technique, these worth ranges would possibly supply favorable entry factors for long-term positions.

Whale exercise and crypto breadth

Along with the market sentiment, Ethereum’s whale exercise not too long ago spiked, marking a six-week excessive as ETH dipped to $2,380.

Traditionally, whale exercise of this scale usually means accumulation by main buyers. This sample may encourage a worth restoration if whales proceed to build up ETH in anticipation of additional positive aspects.

Nonetheless, any worth affect from whale exercise would rely on whether or not Ethereum sustains this shopping for curiosity over the long run.

Supply: Santiment

A profitable break would doubtless ignite broader curiosity throughout the crypto market, probably boosting altcoin costs as nicely.

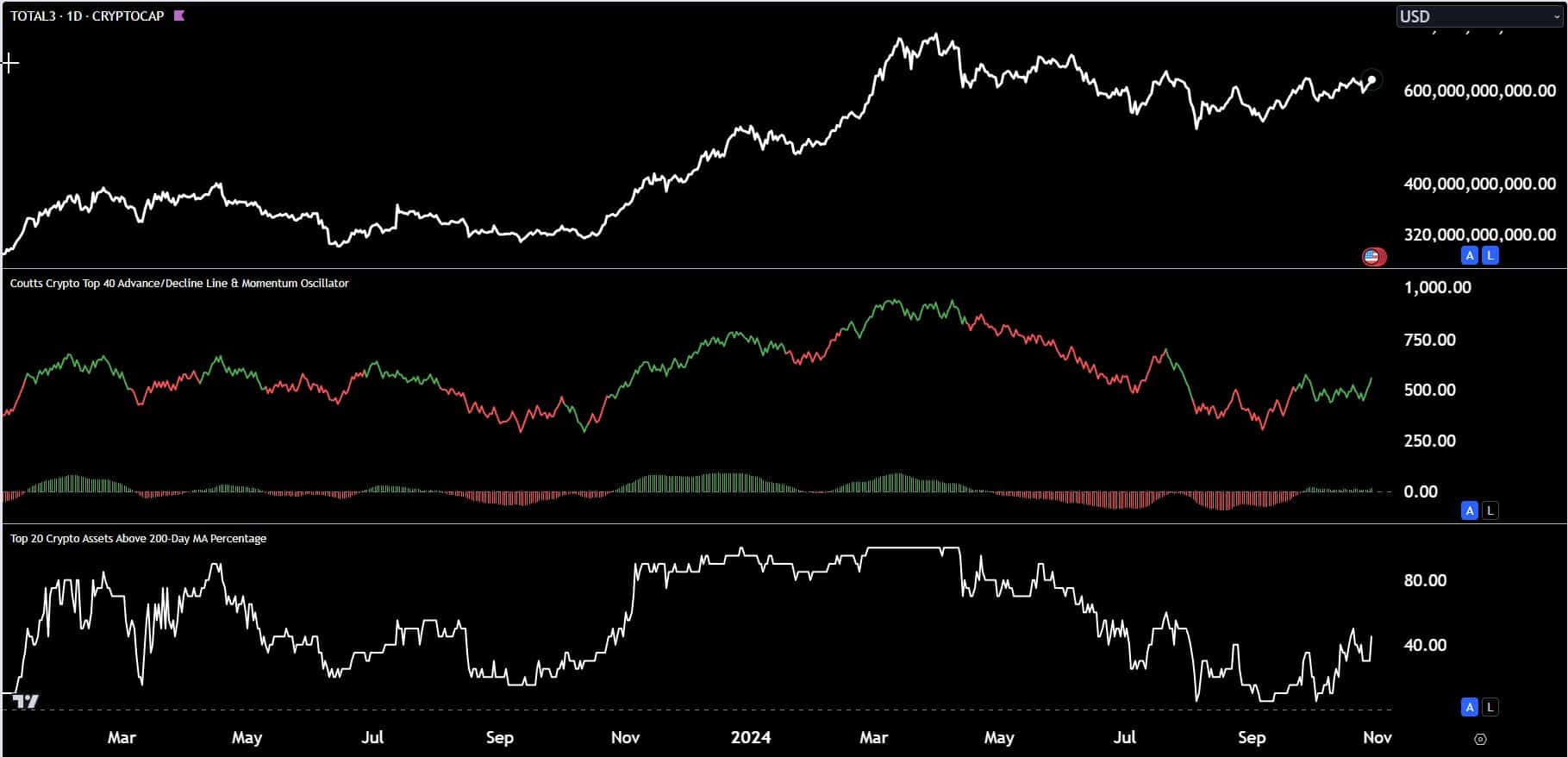

The rising technical breadth measures confirmed the underside within the crypto market in early September for the highest 200 property. The customized advance or decline line and different crypto breadth measures elevated whereas the costs oscillated over the previous 2 months.

Supply: Jamie Coutts, CMT/ X

Analysts watching ETH’s worth motion count on it to carry out nicely, in comparison with Bitcoin (BTC), which has outperformed ETH in latest weeks.

ETH’s potential breakout would possibly slender the efficiency hole between the 2 main cryptocurrencies. Nonetheless, market members ought to control help and resistance ranges, because the market’s subsequent strikes will rely on whether or not Ethereum sustains its present shopping for stress or not.