Ethereum’s breakout odds – Is $3200 a viable price target?

- Ethereum, at press time, was buying and selling at a key stage on the day by day timeframe

- Establishments and whales resumed exercise as optimism returned to the market

Ethereum (ETH), the market’s second-largest cryptocurrency, is buying and selling at important ranges once more. These ranges are particularly important for long-term buyers. On the time of writing, ETH was hovering across the $2,700 vary – An necessary resistance stage on the day by day timeframe.

The earlier month’s value ranges are actually appearing as key assist and resistance zones. ETH is respecting the earlier month’s low as assist, whereas the midpoint between the earlier month’s excessive and low is appearing as resistance.

Market sentiment stays optimistic, suggesting a possible break above the $2,700 resistance. This might push ETH to focus on the $3,200-level. Nevertheless, market dynamics stay unpredictable, and any abrupt change might alter this outlook.

Supply: Hyblock Capital, TradingView

Elevated whale and establishment exercise

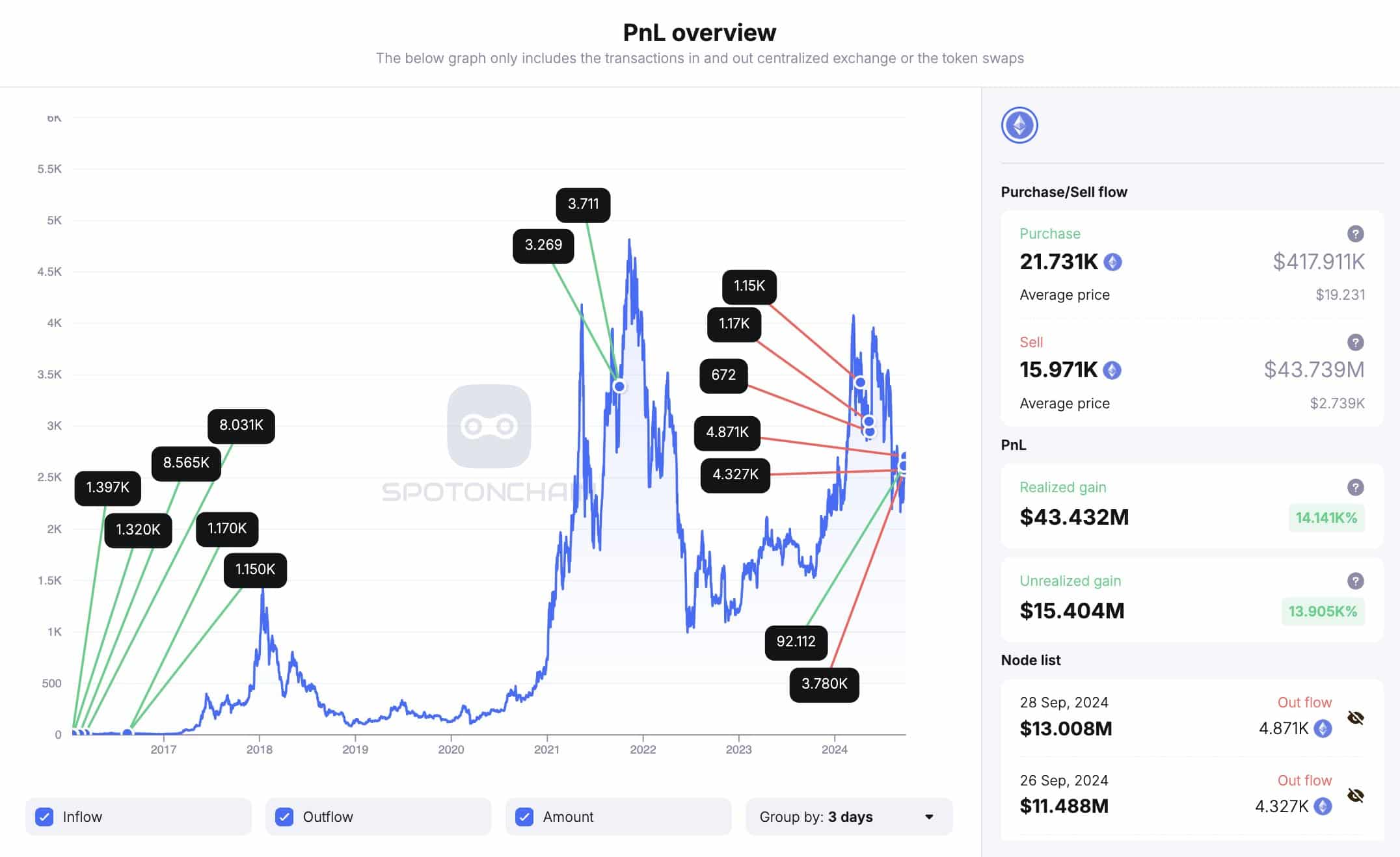

Higher institutional and whale exercise additional supported the case for the next ETH value. Just lately, an Ethereum whale who has been silent for 4 months, cashed in 12,979 ETH, making a revenue of $34.3 million.

This whale initially purchased ETH at simply $7.07 per token. This whale has since offered a complete of 15,879 ETH, netting $43.5 million in revenue.

With this whale nonetheless holding 5,760 ETH price roughly $15.5 million, it signifies that bigger buyers are betting on ETH hitting the $3200 goal. This renewed whale exercise is a robust indicator of ETH’s bullish potential, additional supporting $3200 goal.

Supply: SpotOnChain

In the meantime, institutional actions are additionally influencing the market.

Two main establishments have been offloading ETH not too long ago. Cumberland, a buying and selling agency, deposited 11,800 ETH, valued at $31.88 million, into Coinbase. Quite the opposite, ParaFi Capital withdrew 5,134 ETH from Lido and transferred it to Coinbase Prime.

Regardless of this promoting exercise, the hike in whale participation is an indication that many are nonetheless optimistic about Ethereum’s future value motion.

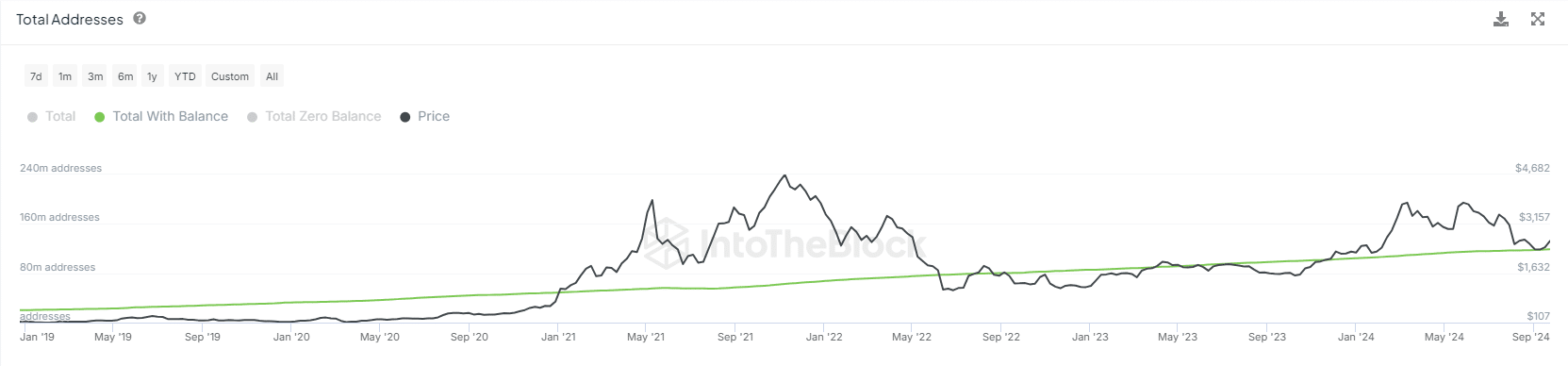

Hike in ETH whole addresses with steadiness

One other constructive sign for ETH is the uptick within the whole variety of addresses holding a steadiness. The rising variety of pockets addresses is a robust indicator that extra buyers are coming into the Ethereum ecosystem.

This pattern is usually seen as a bullish sign, one suggesting that Ethereum’s adoption is growing resulting from its utility in decentralized finance (DeFi) and scalability options.

Supply: IntoTheBlock

The uptick in pockets addresses may be interpreted as one other bullish sign alluding to ETH’s $3,200 value goal within the ultimate quarter of the 12 months. This era is traditionally identified for bullish crypto market exercise.

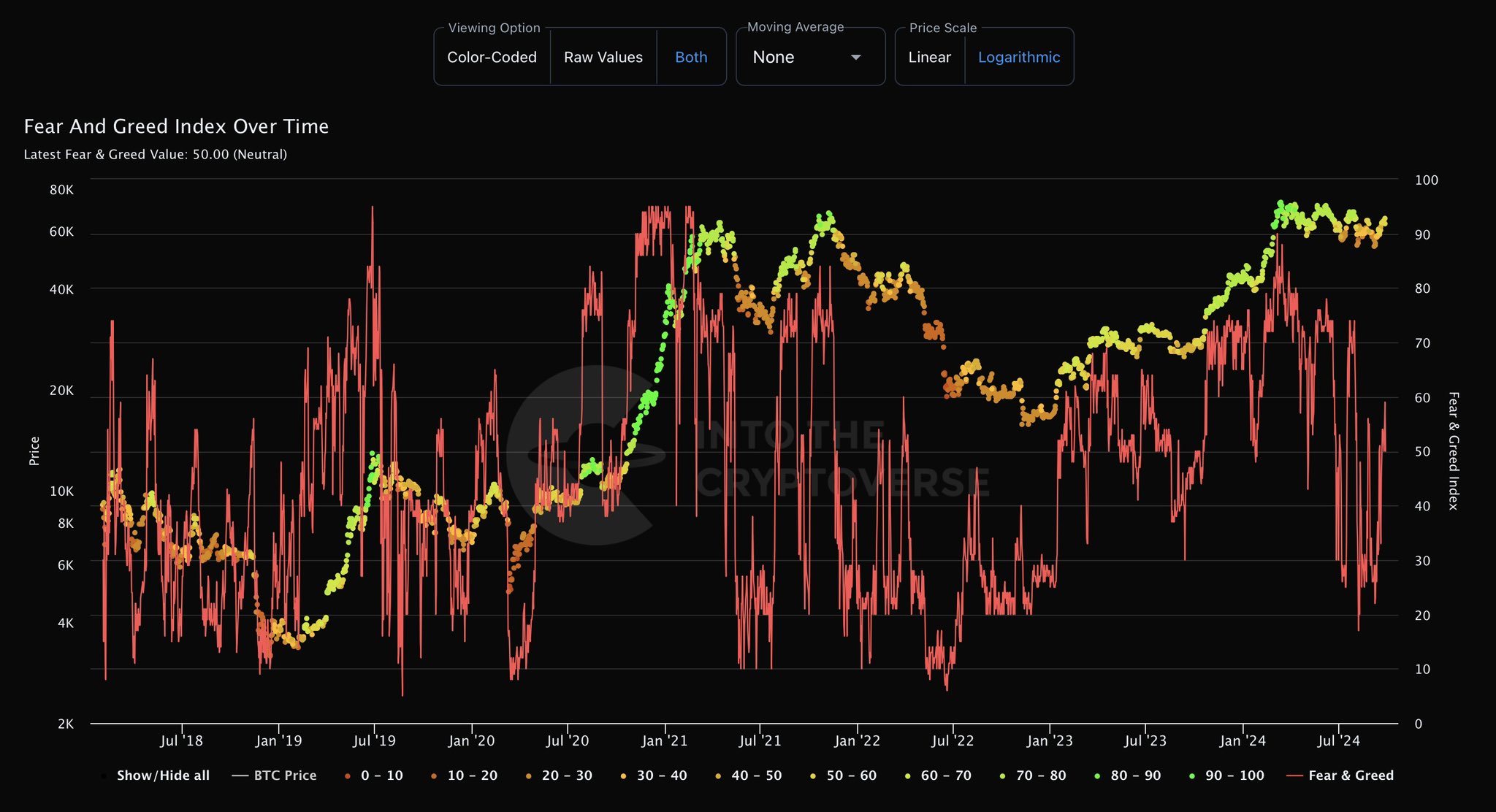

Concern and Greed Index now at impartial

The market’s optimism can be mirrored within the Concern and Greed Index, which moved to a impartial studying of fifty at press time. This can be a constructive shift after a protracted interval of maximum concern, significantly following the 5 August market crash.

Because the market begins to get well, extra merchants are more likely to be interested in ETH, making it a great time to build up extra ETH forward of the anticipated bullish transfer.

Traditionally, coming into the market when it’s flashing impartial sentiment provides higher alternatives than ready for excessive greed. This usually indicators market tops.

Supply: IntoTheCryptoverse

Proper now, Ethereum is positioned to maneuver larger, pushed by whale exercise, elevated adoption, and enhancing market sentiment.

If ETH can break by way of the $2,700 resistance, the subsequent goal of $3,200 could possibly be inside attain.