Ethereum’s bull run: Traders show confidence as ETH’s price climbs

- ETH remains to be caught under its short-moving common.

- The worth development, nonetheless, confirmed that bulls had been lively out there.

In current days, Ethereum [ETH] has been experiencing a sequence of uptrends, with any declines famous being too delicate to impression its general upward trajectory considerably.

As ETH’s worth continues to climb, merchants have gotten more and more bullish, exhibiting better aggression of their market positions.

Ethereum sends sturdy alerts

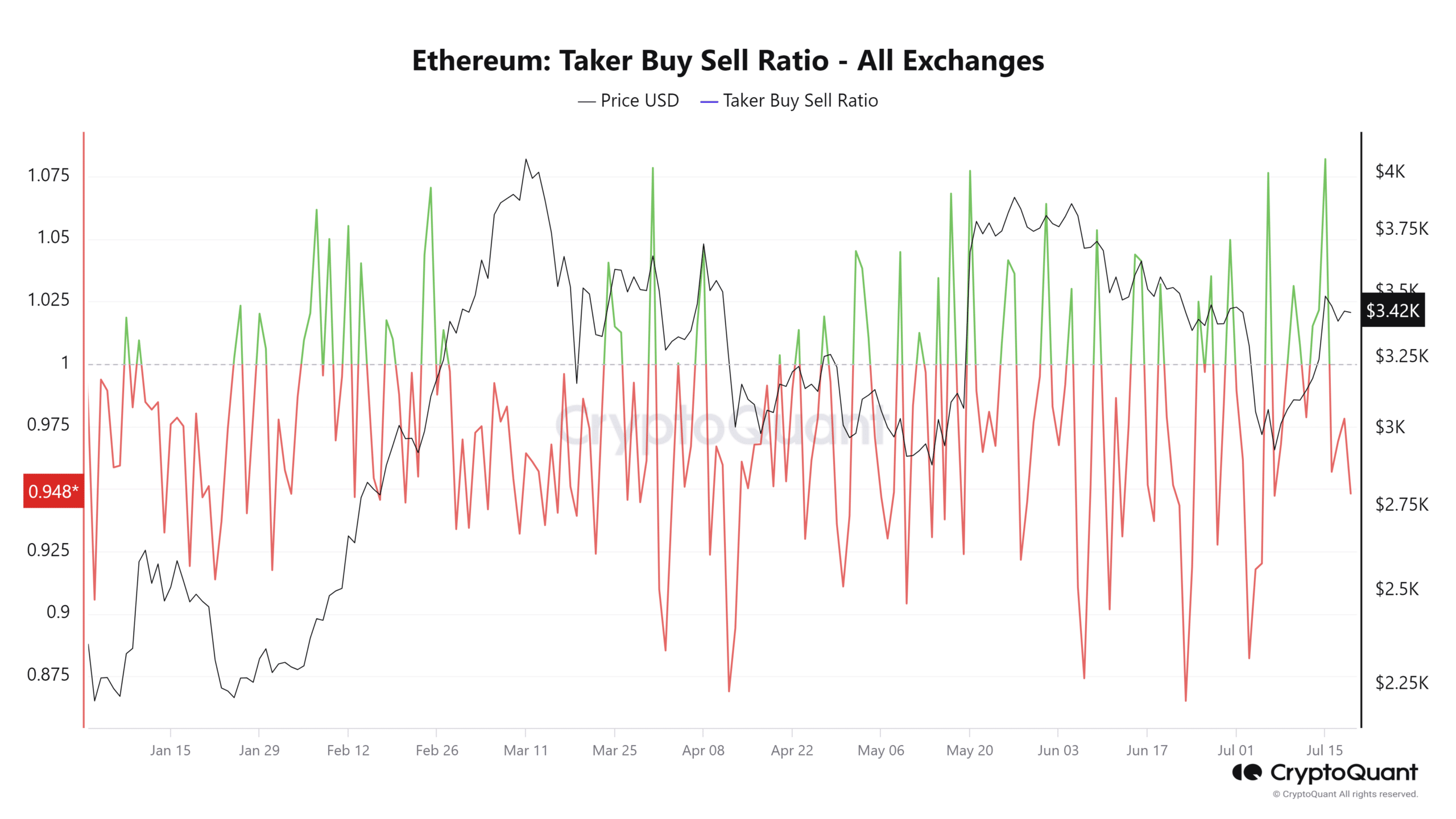

A current evaluation of the Taker Purchase Promote Ratio for Ethereum on CryptoQuant revealed important exercise. This ratio has skilled notable spikes above the worth of 1 in current weeks, indicating shifts in market dynamics.

A Taker Purchase Promote Ratio above 1 is a robust indicator of aggressive buying by bulls. It means that patrons are taking the initiative in executing market orders, which tends to drive costs upward.

The current spikes on this ratio corresponded with the intervals when the ETH worth started to rise, exhibiting elevated shopping for stress.

Supply: CryptoQuant

As of this writing, the Taker Purchase Promote Ratio has barely dipped under 1. This discount could indicate a short lived easing of shopping for stress or a rise in promoting exercise.

Nevertheless, ought to the upward development within the Taker Purchase Promote Ratio resume, CryptoQuant suggests it may verify a possible mid-term bullish development for Ethereum.

This could possible result in additional worth will increase as bullish sentiment sustains and intensifies out there.

Ethereum’s Open Curiosity shaping up

AMBCrypto’s evaluation of Ethereum’s Open Curiosity on Coinglass indicated a big uptick in the previous couple of days. Beginning across the ninth of July, the Open Curiosity elevated from roughly $12 billion to over $14.2 billion.

Moreover, there was a pointy rise in Ethereum’s Funding Fee.

An increase within the Funding Fee sometimes signifies that lengthy positions are paying premiums to brief positions, suggesting bullish sentiment amongst merchants holding lengthy positions.

These developments — the rise in Open Curiosity and the upper Funding Fee — recommend elevated market exercise and money influx from patrons.

This aligned with different bullish indicators just like the Taker Purchase Promote Ratio, portray an image of a robust bullish development for Ethereum.

ETH’s rising bull development

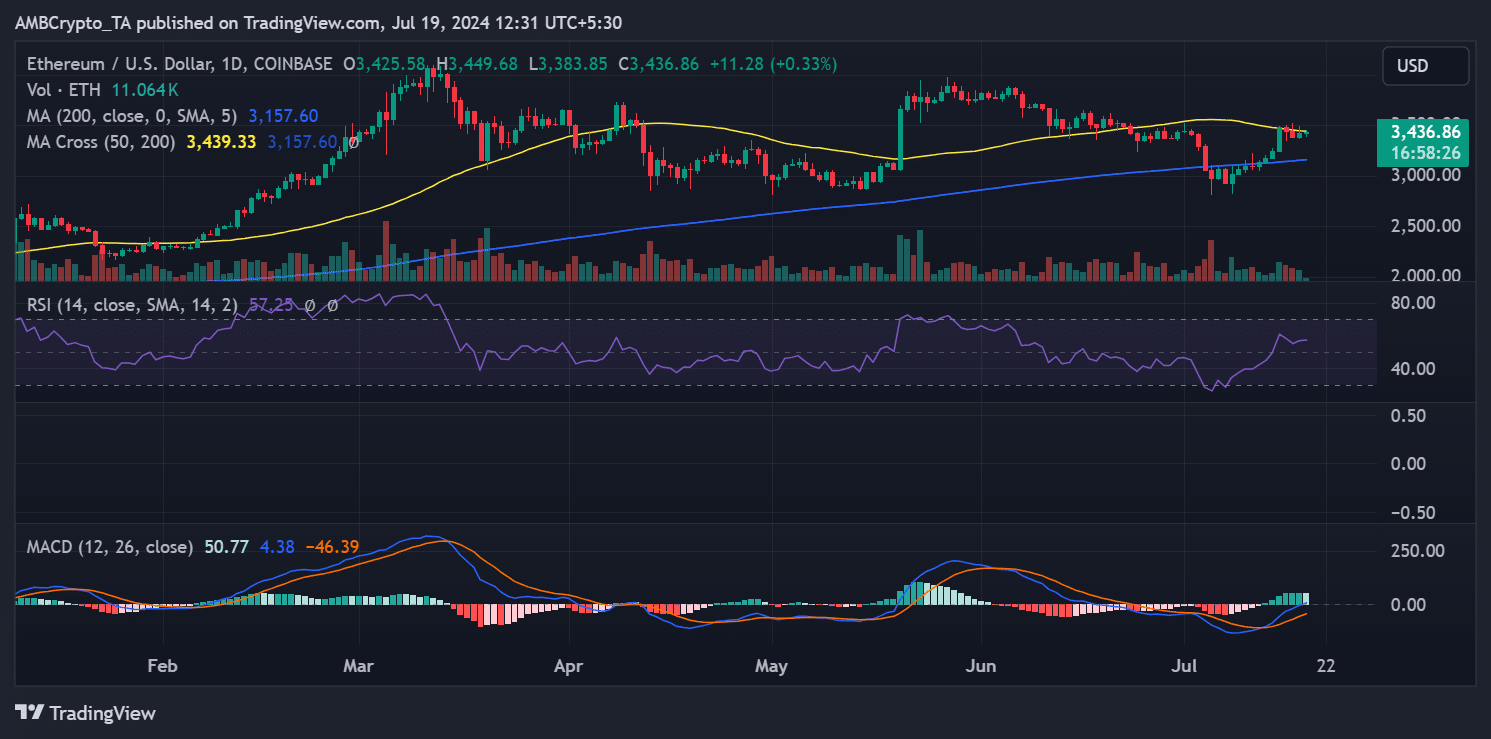

As of press time, Ethereum was buying and selling at roughly $3,436, marking a lower than 1% enhance.

This delicate rise adopted a extra important enhance of over 1% within the earlier buying and selling session, which pushed its worth to round $3,425.

Supply: TradingView

Learn Ethereum’s [ETH] Worth Prediction 2024-25

AMBCrypto’s take a look at Ethereum’s Shifting Common Convergence Divergence (MACD) supplied additional perception into its market conduct. As of this writing, the ETH MACD was trending above zero, which generally alerts a bullish development.

Nevertheless, the indicator strains are positioned barely under zero, suggesting that whereas there’s certainly a bullish development, it has not but gained sturdy momentum.