Ethereum’s Buterin has confidence in Aave, but should you share it too?

- Vitalik Buterin’s deposit of two.27M USDC and a couple of,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish massive transactions, community development, and impartial momentum for the token

Ethereum Co-founder Vitalik Buterin has made waves within the DeFi house with a latest deposit of two.27 million USDC and a couple of,851 ETH (roughly $6.73 million) into the Aave [AAVE] protocol. This vital transaction has raised questions on its influence on Aave’s liquidity and the token’s worth efficiency.

Ergo, the query – Is that this a bullish sign for Aave’s future?

How did Buterin’s deposit have an effect on Aave’s liquidity?

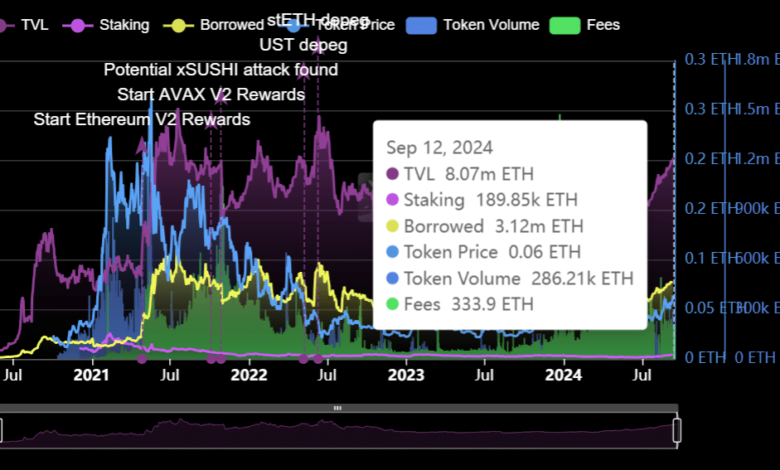

Buterin’s deposit has considerably contributed to Aave’s general Complete Worth Locked (TVL), which stood at 8.07 million ETH at press time. Of this, 3.12 million ETH was borrowed, reflecting robust demand for loans on the platform. Aave’s TVL in USD phrases sat at $11.08 billion, giving it a commanding 25.4% market share within the DeFi ecosystem, second solely to Uniswap.

This increase in liquidity strengthens Aave’s capability to problem massive loans and makes the platform much more interesting for each lenders and debtors. AAVE’s token was buying and selling at $147.86 at press time, with good points of 1.48% during the last 24 hours.

Supply: DeFiLlama

What are Aave’s on-chain indicators saying?

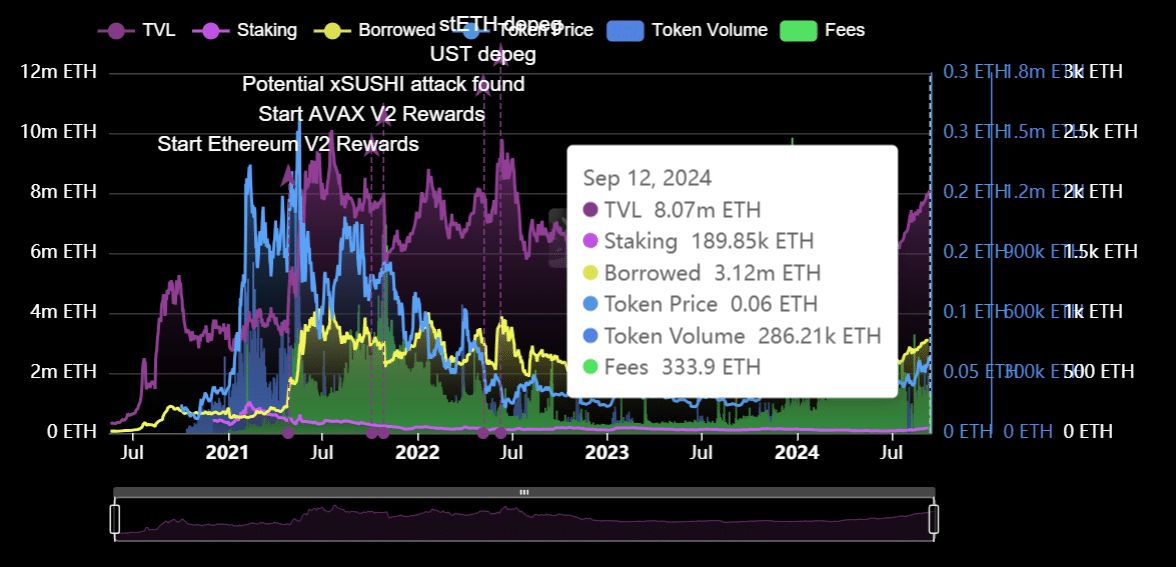

Current on-chain indicators indicated a largely bullish outlook for Aave. The Web Community Development underlined a 0.35% bullish sign, reflecting the platform’s regular growth in consumer exercise.

Massive transactions gave the impression to be notably noteworthy, exhibiting a 3.24% bullish sign. This recommended that whales and huge traders are shifting vital quantities on Aave—Buterin’s deposit being one clear instance.

Moreover, the focus metric highlighted a 0.56% bullish sign – An indication of the arrogance of huge holders in sustaining or growing their positions.

Supply: IntoTheBlock

What does Technical Evaluation say about AAVE?

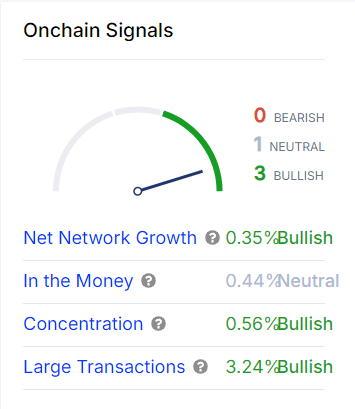

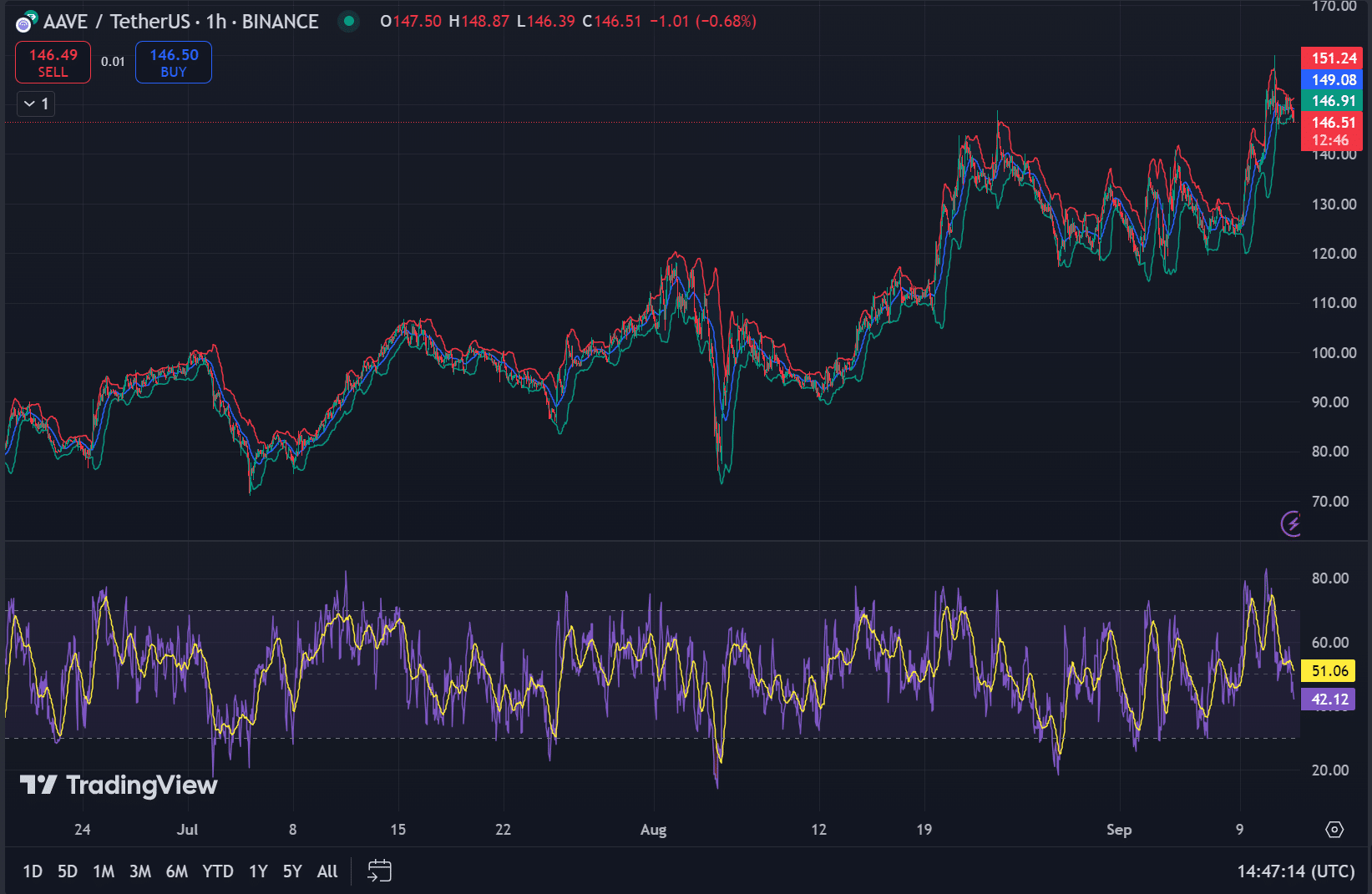

From a technical standpoint, AAVE’s token was buying and selling at $147.86, with 1.48% good points over 24 hours at press time. The Relative Energy Index (RSI) was at 51.06, indicating impartial momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealED that AAVE gave the impression to be buying and selling close to the higher band, with the worth at $147.86 and the higher band at roughly $151.24.

Each metrics indicated that the token could have room for upward motion. Particularly if shopping for stress will increase.

Supply: TradingView

Is Buterin’s deposit a bullish sign for Aave?

Sure, Vitalik Buterin’s deposit into Aave is certainly a bullish sign. The addition of $6.73 million value of property into the protocol boosts liquidity and market confidence.

Mixed with constructive on-chain indicators, equivalent to robust whale exercise and internet community development, and technical evaluation, Aave could also be well-positioned for future development.