Ethereum’s challenge – Record low fees and a 6% price decline mean…

- Ethereum’s community exercise dropped over the previous few months

- Value fell by 6%, however there could also be possibilities of a pattern reversal on the charts

With the broader crypto-market persevering with to stay bearish, Ethereum [ETH] witnessed yet one more setback. The most recent improvement got here from the blockchain’s community exercise, as a key metric hit a report low. Let’s take a look at what’s occurring with the king of altcoins.

A have a look at Ethereum’s community exercise

IntoTheBlock just lately shared a tweet highlighting this significant replace. As per the tweet, Ethereum’s charges hit a 9-month low of $18.2 million. Moreover, the blockchain’s gasoline charges additionally dropped to as little as 1 gwei. Even so, it’s attention-grabbing to notice that regardless of the drop in charges, the blockchain’s income remained excessive.

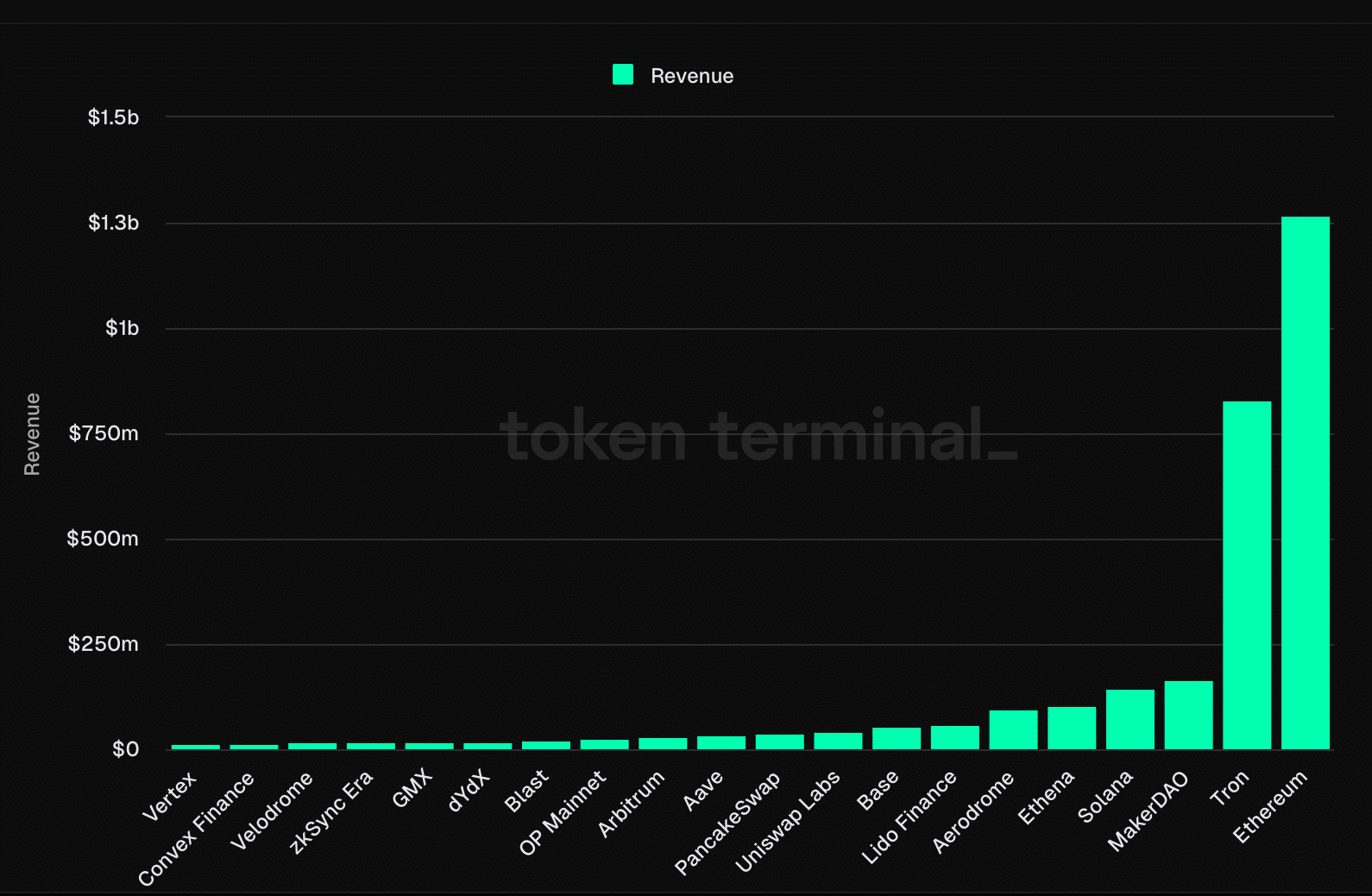

AMBCrypto’s commentary of Token Terminal’s knowledge revealed that ETH topped the record of cryptos when it comes to income over the past six months. Other than ETH, Tron and MakerDAO made it to the highest three on the identical record.

Supply: Token Terminal

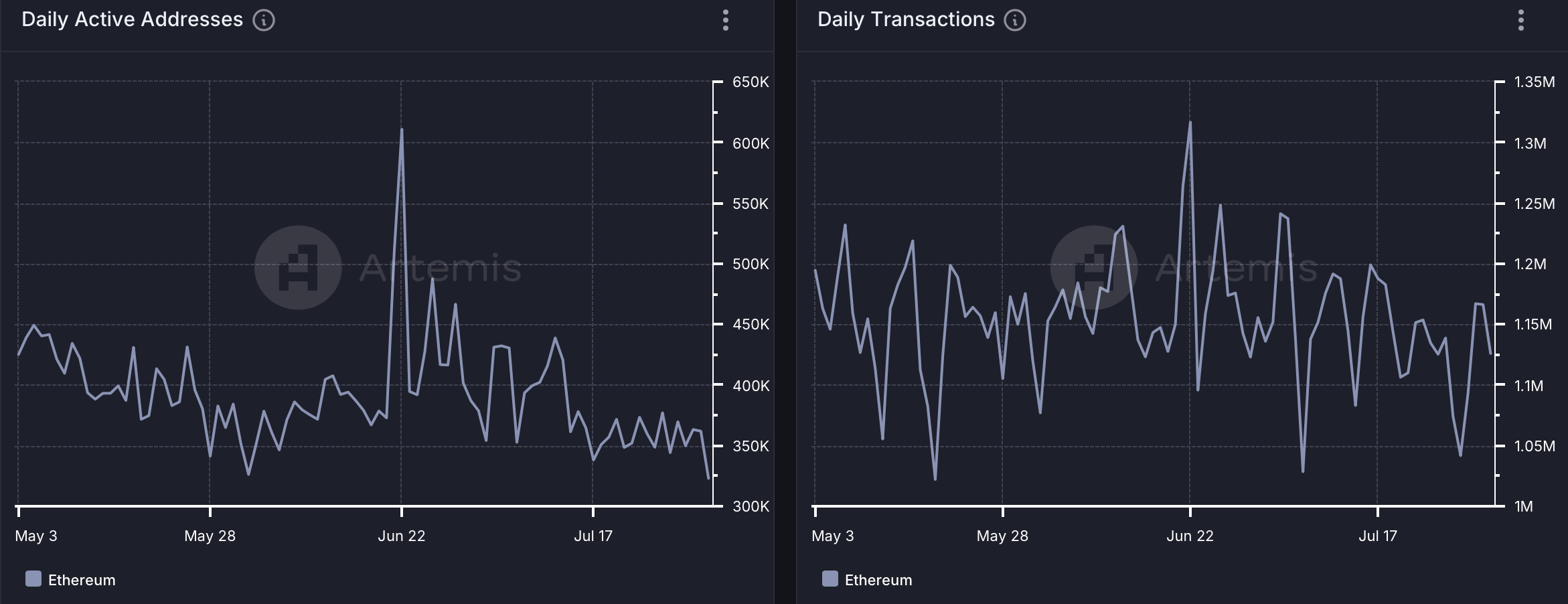

We then checked Artemis’ knowledge to higher perceive Ethereum’s community exercise.

We discovered that ETH’s each day lively addresses dropped considerably over the past three months. Due to the identical, the blockchain’s each day transactions additionally witnessed a slight drop over the identical interval. Thus far, ETH has processed greater than 2.44 billion transactions with a mean TPS of 14.

Supply: Artemis

ETH bears are right here

Within the meantime, the market’s bears equipped and pushed the token’s value down on the charts. In keeping with CoinMarketCap, ETH’s value misplaced greater than 9% of its worth within the final seven days. Within the final 24 hours alone, the altcoin dropped by 6%.

Nevertheless, the pattern may change quickly. Lookonchain just lately revealed {that a} good cash with a 100% optimistic monitor report purchased ETH, hinting that there could also be possibilities of a value hike quickly.

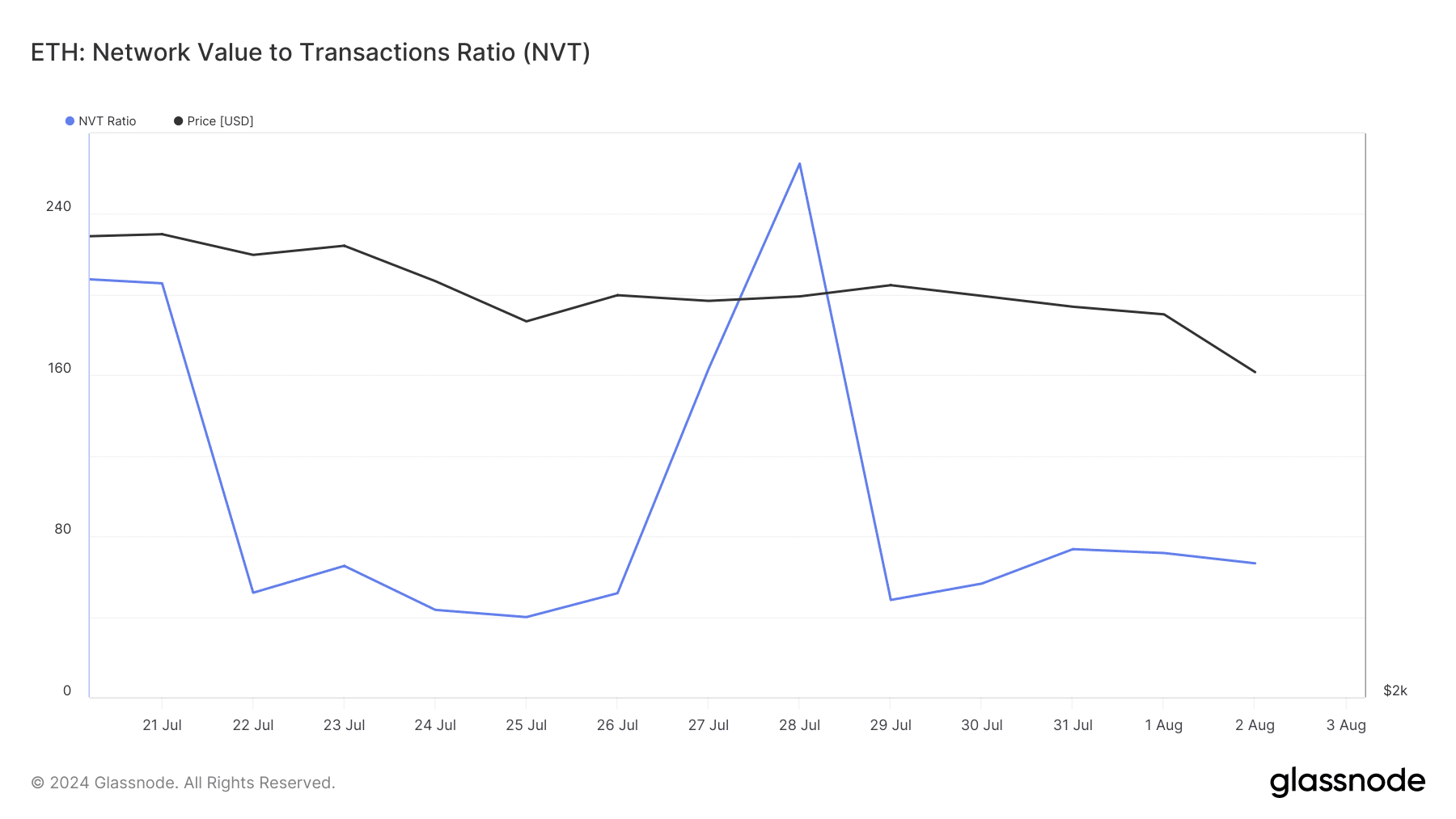

AMBCrypto’s evaluation of Glassnode’s knowledge urged that Ethereum’s NVT ratio dropped too. A decline on this metric implies that an asset is undervalued – An indication that the possibilities of a value hike may be excessive.

Supply: Glassnode

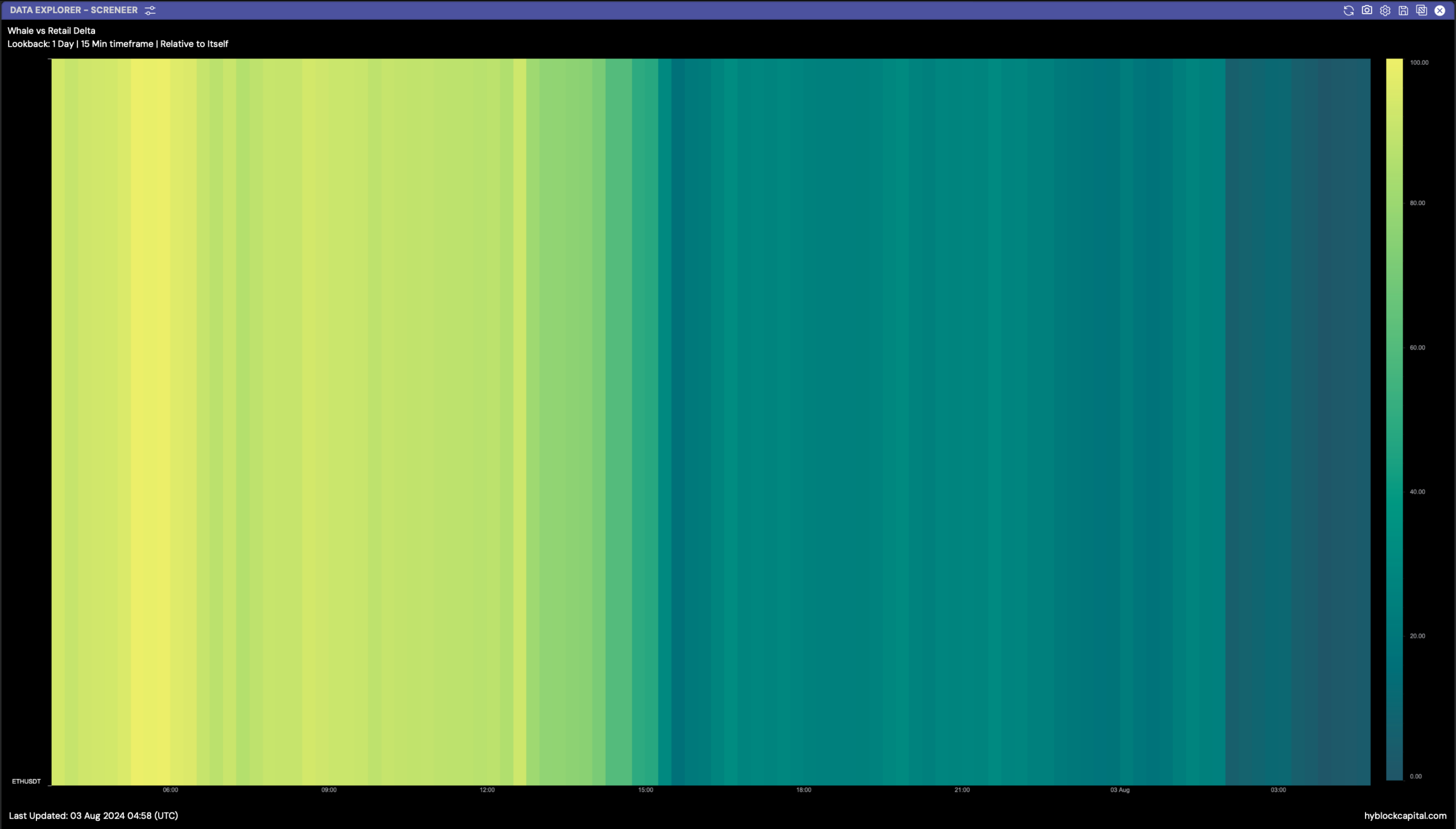

Lastly, Ethereum’s whale vs retail delta had a price of three, on the time of writing. For starters, this metric is used to establish massive gaps between retail lengthy share and whale lengthy share. This indicator ranges from -100 to 100, with 0 representing whales and retail positioned precisely the identical.

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Since at press time it had a price of three, it meant that whale positions had been extra – An indication that big-pocketed gamers out there have been fairly assured within the token.

Supply: Hyblock Capital