Ethereum’s crisis: How leadership’s mixed messages affect ETH

- Ethereum group members had divergent views on ETH’s worth and highway map.

- The combined indicators from Ethereum management may dent ETH’s sentiment.

The Ethereum [ETH] management has hit the headlines following its long-term roadmap and ETH’s worth accrual views. One of many Ethereum group members, Justin Drake, advised that ETH was like Nvidia and Apple and will entice multi-trillion valuations primarily based on its charges.

Drake stated,

“Ethereum is sort of a very giant enterprise like Nvidia, Apple..we will muster multitrillion valuations purely primarily based on the flows [fees]. After which you recognize there’s an entire totally different matter on high of this base valuation of trillions of {dollars} for ETH to be cash, collateral..for decentralized stablecoins.”

Blended views on ETH’s worth

Nonetheless, some builders and founders within the Ethereum eco-system disagreed with these perceived management views. Sam Kazemian, Founding father of DeFi protocol Frax Finance, was one of many critics.

Kazemian felt that evaluating ETH to Nvidia or Apple would restrict the altcoin’s development potential in comparison with Bitcoin. He claimed that this valuation wouldn’t be a win for the altcoin asset.

‘ETH presently has $1B annual income. If we 385x this income to match Apple’s which means ETH would 11x to match Apple’s valuation. Does this appear to be a successful roadmap for ETH?”

He believed this was a flawed approach for the management to gauge ETH’s worth and may not compete with BTC.

“Ethereum as an enormous enterprise the place its ‘base valuation’ is measured as money flows from charges give it a combating likelihood to catch up or ever overtake BTC?”

He added,

“Apple has $385B annual income, it’s value $3.3T. BTC has 0 annual income & by no means may have a single greenback of income. It’s value $1.1T already.”

Kazemian, like most protocol founders, championed that ETH’s main worth needs to be primarily based on its ‘retailer of worth’ (SoV) and DeFi ecosystem.

ETH management says…

Not like BTC’s “digital gold” tagline, ETH has struggled to have an impactful and unified pitch deck for potential traders. The leaders’ push for “programmable cash” and “digital oil” hasn’t grabbed the anticipated enchantment.

Ethereum’s DeFi imaginative and prescient has additionally seen divergent visions from leaders. For instance, Vitalik Buterin has been skeptical of pure DeFi as the one crypto development catalyst.

This was against different group members like Kazemian and Uniswap’s Hayden Adams, who believed DeFi was crucial to the expansion of ETH’s worth.

In accordance with Coinbase analysts, this divergent imaginative and prescient for Ethereum’s DeFi has made it onerous for brand spanking new traders to know the asset and dented its market sentiment.

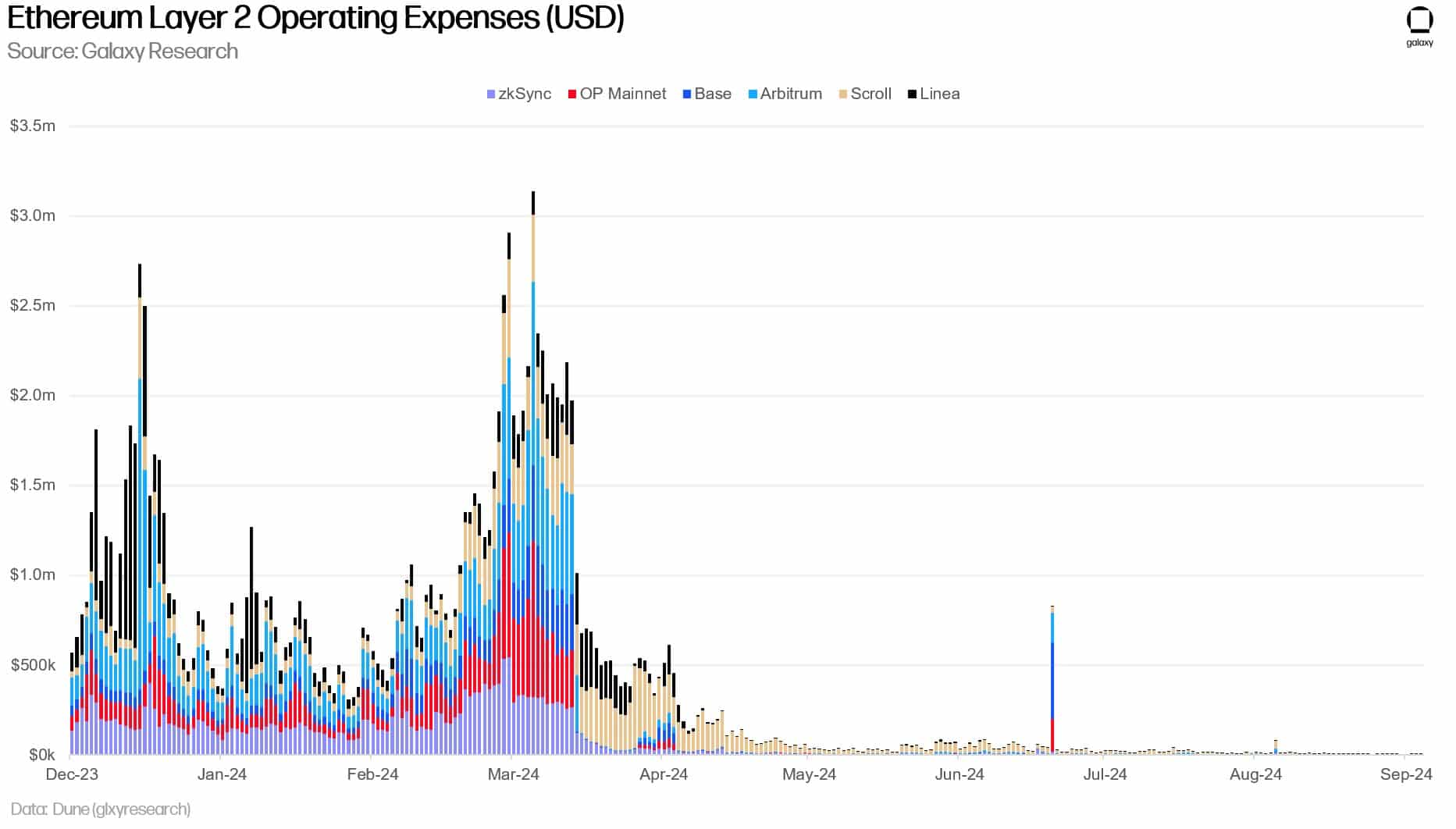

Apart from, ETH’s charges have declined significantly for the reason that Dencun improve in March, as low-cost blobs prompted customers emigrate to L2s.

Supply: Galaxy Analysis

This has additionally divided the group on whether or not to tweak blob charges to assist ETH L1 achieve worth from L2s as ETH’s inflation downside compounds post-Dencun improve.

The above group points have shattered investor sentiment round ETH even additional.

That mentioned, ETH has misplaced floor to BTC. The underperformance was illustrated by a yearly low on the ETH/BTC ratio, which tracks the altcoin’s worth efficiency relative to BTC. ETH’s worth has dropped 44% in comparison with BTC up to now two years.