Ethereum’s demand rises positioning the ETH for sustained gains

- ETH has gained 2.39% over the previous 24 hours.

- Ethereum’s demand facet is strengthening, positioning the altcoin for sustained positive aspects.

For the reason that market recovered from the tariffs crash, Ethereum [ETH] has traded in an ascending sample. In reality, as of this writing, Ethereum was buying and selling at $1610.

This marked a 2.36% enhance on day by day charts.

Earlier than these positive aspects, the altcoin had been on a downward trajectory, dropping on weekly and month-to-month charts by 10.99% and 14.79%, respectively.

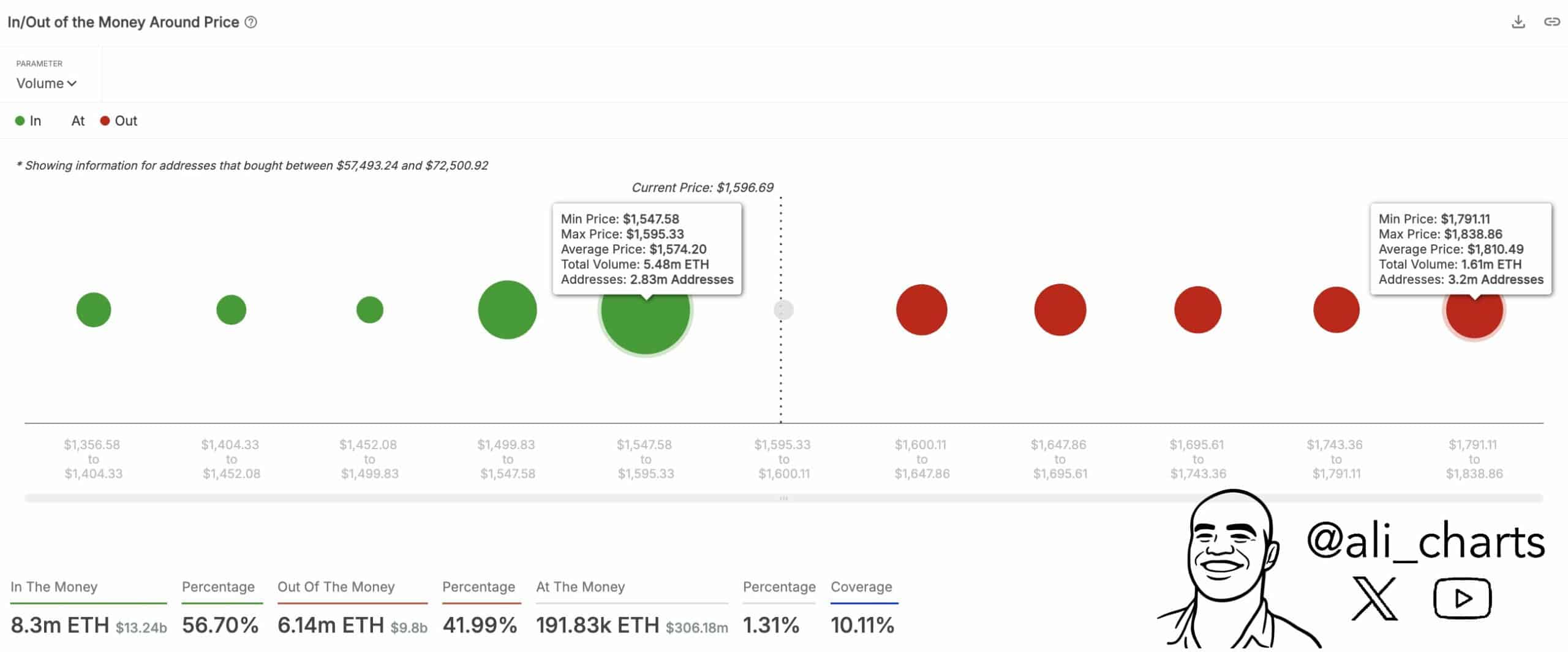

With the latest positive aspects, stakeholders are eyeing a extra sustained uptrend. Common crypto analyst, Ali Martinez, has instructed a possible rally to $1,810.

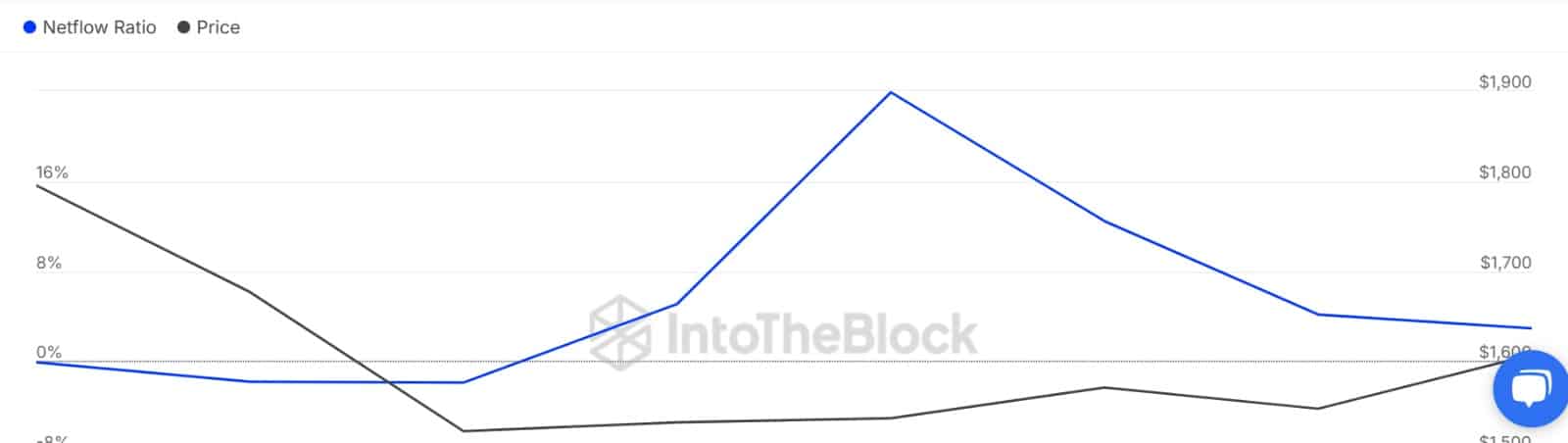

Supply: IntoTheBlock

In his evaluation, Martinez posited that since ETH has reclaimed its key help degree of $1574, the altcoin may rally if the demand zone holds. Thus, a maintain above this rally will see the altcoin reclaim the $1,810 resistance degree.

The query is, can Ethereum make sustained positive aspects to reclaim a better resistance degree?

Can Ethereum see a sustained uptrend?

In line with AMBCrypto’s evaluation, Ethereum is seeing a restoration on its demand facet.

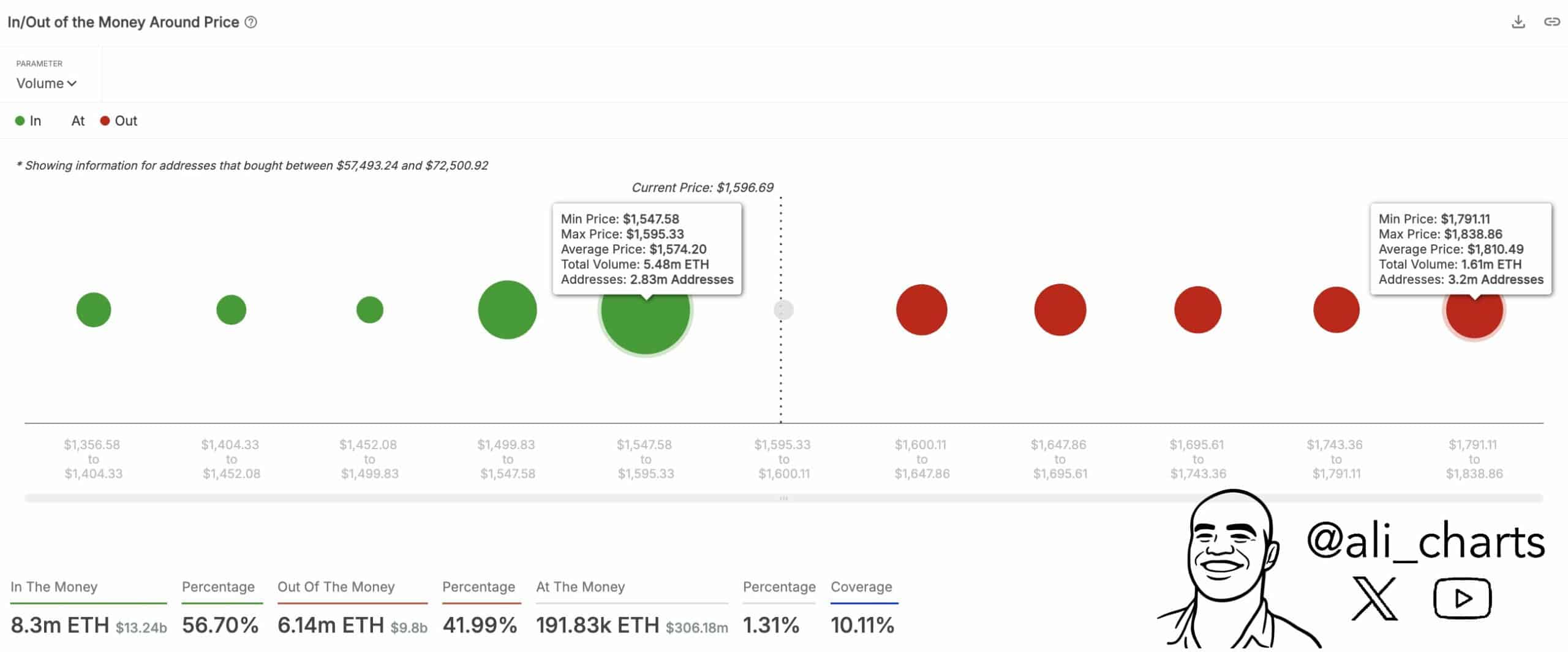

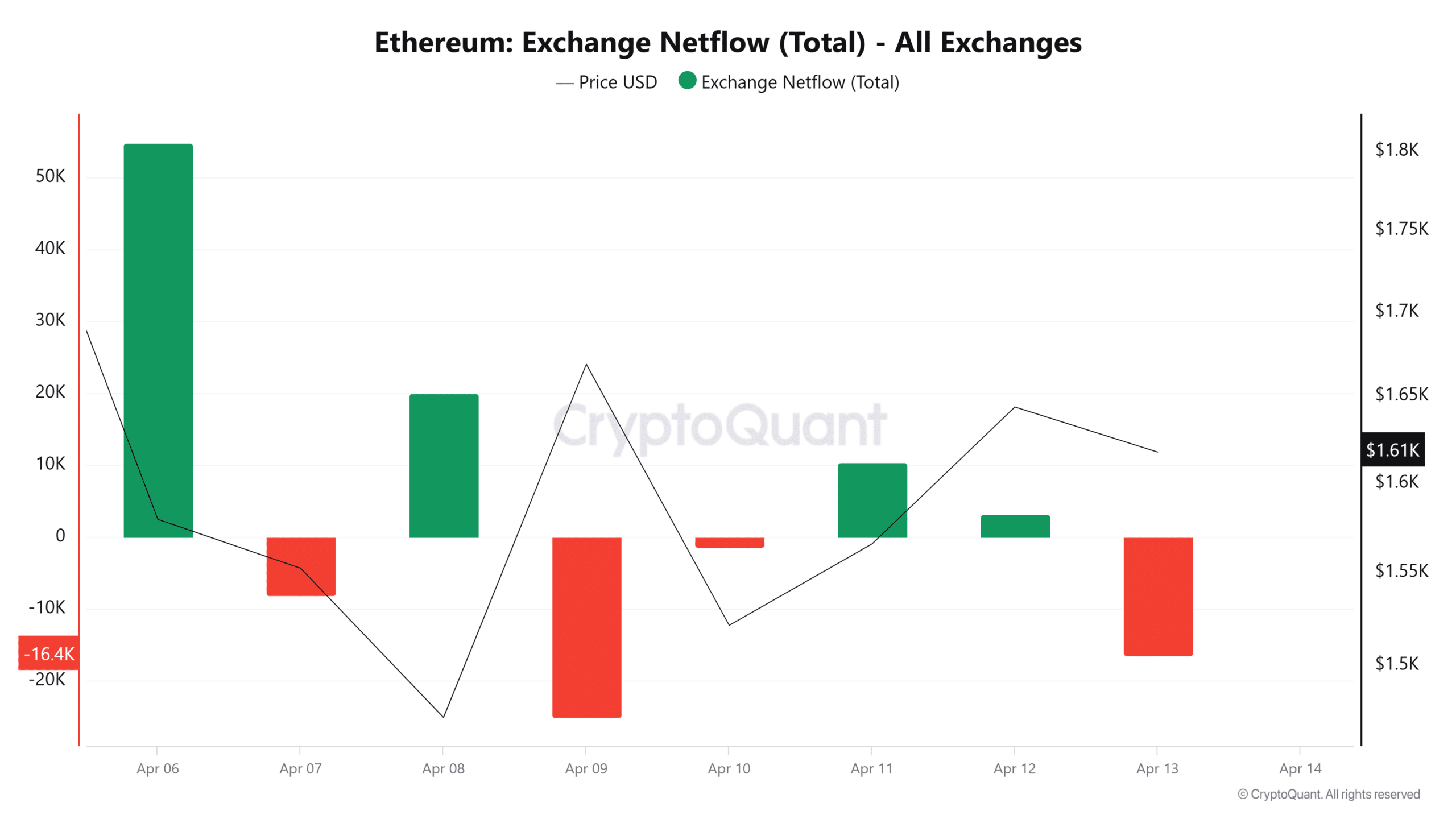

For starters, Ethereum’s Change Netflow has turned unfavourable after two consecutive days of constructive flows. A shift into unfavourable means that buyers have turned to accumulating Ethereum.

As such, there are extra change outflows than inflows, reflecting a rising demand.

Supply: CryptoQuant

Optimistic order imbalance additional validates this side. With a constructive order imbalance, it reveals that there are extra purchase orders executed than promote ones.

This means that patrons are lively out there, leading to extra change outflows.

Supply: MobChat

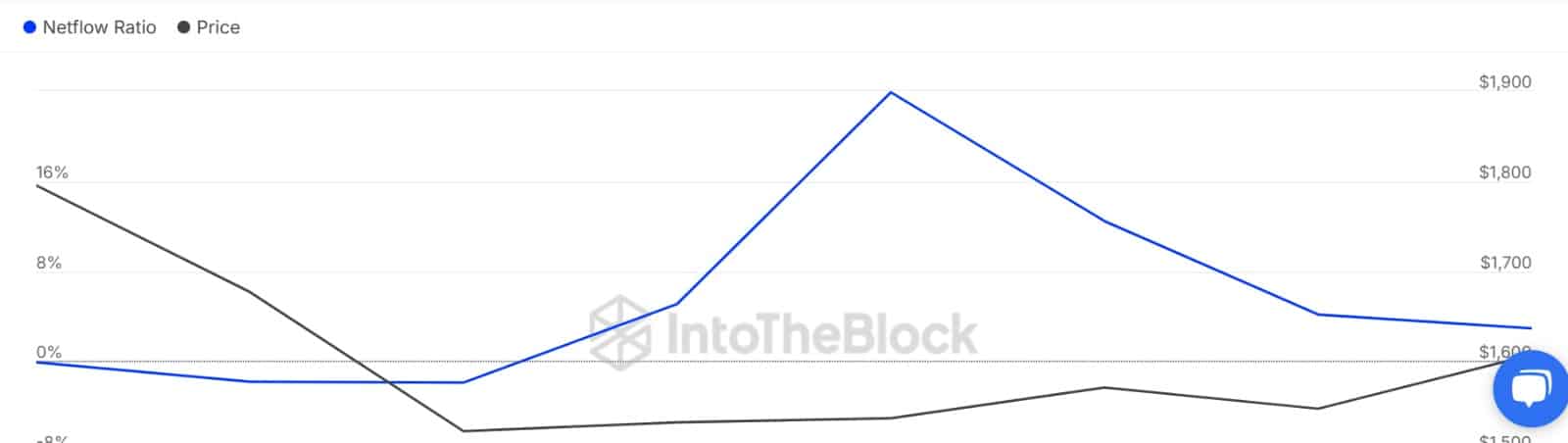

The rising demand is much more prevalent amongst whales. As such, Ethereum massive holders are making fewer transfers into exchanges.

massive holders’ netflow to change netflow ratio, whales’ circulation to change ratio has dropped from 23.9% to 2.92%.

This drop means that whales are shopping for greater than they’re promoting.

Supply: IntoTheBlock

With whales and retailers shopping for, it appears they’re shopping for the altcoin and taking lengthy positions. We are able to see this as Ethereum’s Aggregated Funding Fee has turned constructive, reflecting a better demand for lengthy positions.

Thus, most buyers expect costs to rise even additional.

Supply: Coinalyze

Merely put, Ethereum is seeing a surge in demand. Traditionally, a better demand leads to greater costs. With ETH getting extra patrons than sellers, we may see the altcoin reclaim $1758.

If it rises to this degree, we may see a transfer in direction of $1800. Conversely, if the try by bulls fails, we may see a correction with ETH retracing to $1465.