Ethereum’s [ETH] short-term price targets – Is the $2,300 resistance too strong?

- Ethereum’s MVRV and realized worth hinted at early restoration, however $2,300 stays a robust resistance stage

- Whale curiosity has grown and but, rising reserves and falling gasoline alluded to short-term warning

Ethereum [ETH] lately reclaimed its realized worth at $2,040 on the charts, signaling renewed optimism throughout the market. This transfer indicated that Ethereum might be getting into a restoration part after its extended bear market.

At press time, Ethereum was buying and selling at $2,064.80, following a slight 0.10% lower during the last 24 hours.

Traditionally, when Ethereum crosses its realized worth, it marks the start of a bullish pattern. Due to this fact, this might be an important turning level for ETH. Nonetheless, it nonetheless faces a number of hurdles that would decelerate its momentum.

What does MVRV evaluation say about Ethereum’s worth?

On the time of writing, Ethereum’s MVRV ratio stood at roughly 1.02. MVRV ratios beneath 1 traditionally imply {that a} market backside is close to, whereas ratios above 2.4 point out overvaluation. Ethereum’s press time place, due to this fact, signaled that whereas in a restoration part, the altcoin was not but overvalued.

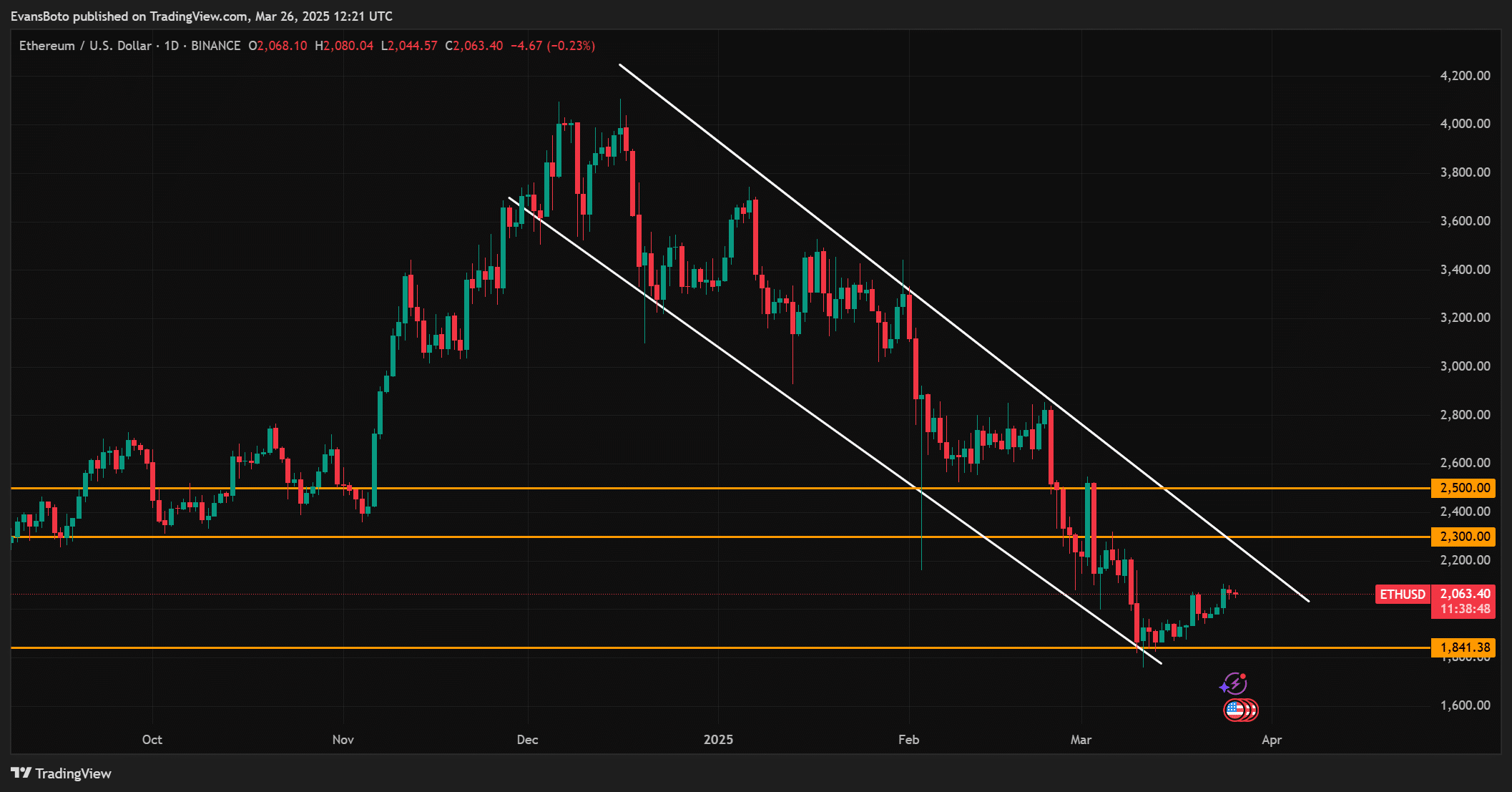

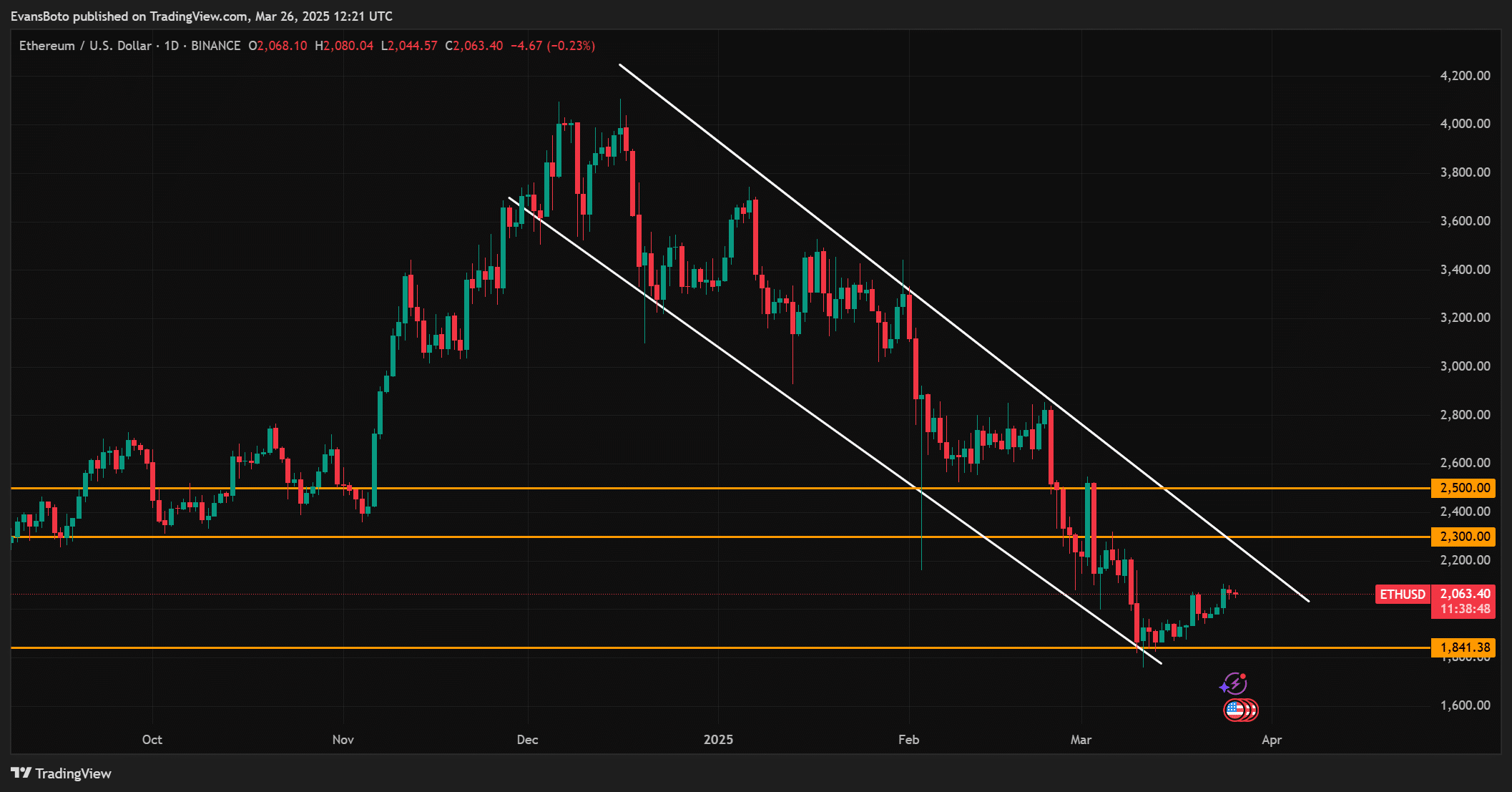

On the charts, Ethereum faces substantial resistance forward on the $2,300-level. In response to the MVRV Excessive Deviation Pricing Bands, this stage marks a vital barrier that ETH should clear for a sustained bullish pattern. ETH can be buying and selling inside a falling wedge channel close to the higher boundary. Due to this fact, the value motion round $2,300 shall be pivotal in figuring out whether or not Ethereum’s restoration continues or stalls.

Supply: TradingView

Whale exercise and consumer exercise – What do they imply for Ethereum?

Whale exercise continues to help the mid-term bullish case for ETH. Notably, BlackRock lately gathered 1.25 million ETH price round $2.5 billion – An indication of heightened institutional curiosity.

Nonetheless, on-chain metrics pointed to some blended alerts. Ethereum’s trade reserves elevated to 18.375 million ETH, up +0.18% within the final 24 hours. Relatively than indicating demand, this uptick might counsel rising sell-side strain as extra ETH is being deposited into exchanges – Typically a precursor to potential profit-taking.

In the meantime, consumer exercise has remained sturdy, with 20,913 energetic addresses recorded – A +0.99% hike over the identical interval. This uptick in energetic wallets hinted at sustained community engagement, a constructive signal for ETH’s elementary well being.

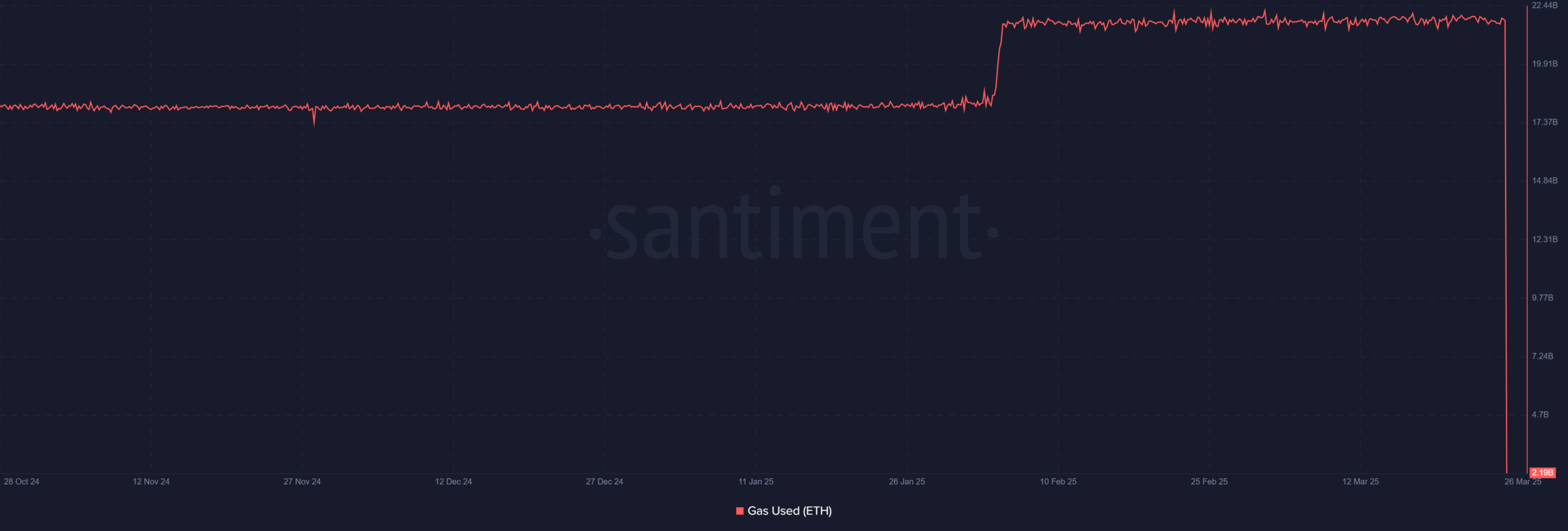

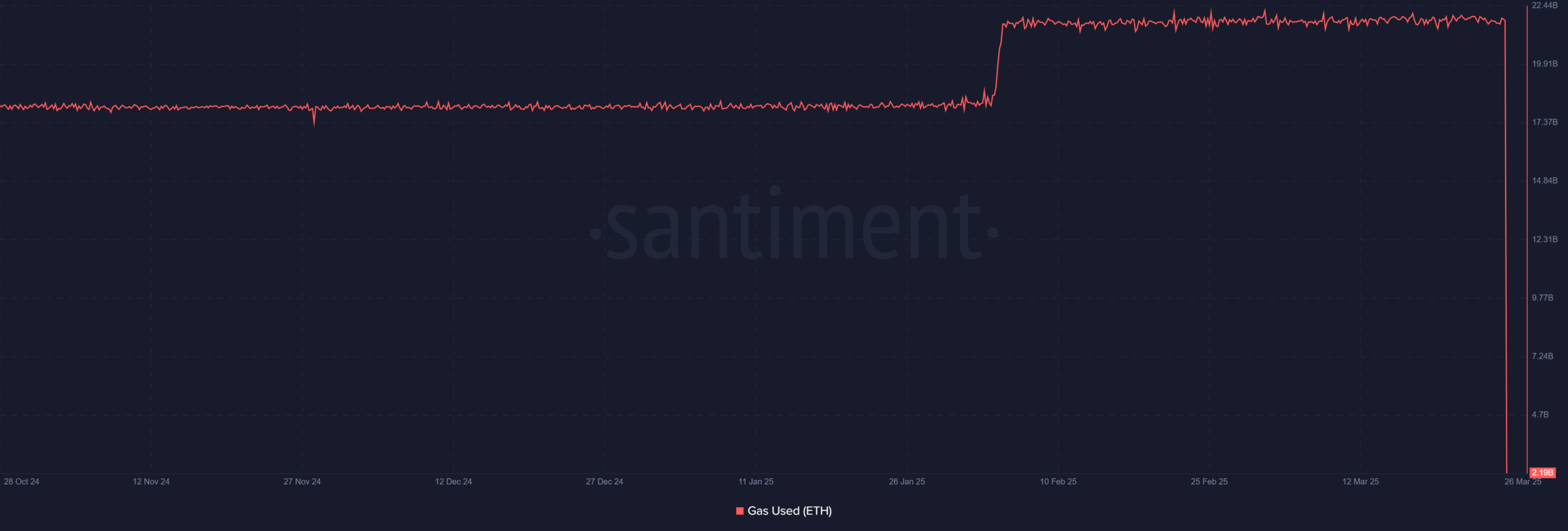

Quite the opposite, Ethereum’s gasoline utilization dropped sharply to 2.19 billion ETH – A steep decline from current highs close to 22 billion. This might replicate decrease transaction volumes or fall in good contract execution – Probably signaling a short-term cooldown in community exercise.

Supply: Santiment

Ethereum faces sturdy resistance – What’s the subsequent step?

As predicted beforehand by AMBCrypto, Ethereum now faces a vital resistance zone between $2,200 and $2,250. Breaking above this zone may pave the best way for a retest of the $2,400-level.

Nonetheless, if ETH struggles to take care of its momentum, it may face a pullback to the $2,000-support stage. Due to this fact, market individuals might want to look ahead to indicators of both a breakthrough or a possible reversal.

Conclusion

Ethereum has seen some sturdy indicators of restoration, with constructive MVRV ratios and rising institutional curiosity. Nonetheless, the $2,300-resistance stays a major hurdle.

Whereas ETH has the potential to interrupt by way of this stage, overcoming it’s going to require sustained shopping for momentum and the clearing of key obstacles. Given the prevailing market circumstances, Ethereum is more likely to face challenges in breaking this resistance within the brief time period.