Ethereum’s latest downtrend – Examining how weak ETH really is against BTC

- Ethereum’s bullish divergence has been invalidated

- Establishments at the moment are promoting ETH, with buying and selling quantity reducing too

Ethereum (ETH), at press time, gave the impression to be exhibiting some weak spot towards Bitcoin (BTC), with the ETH/BTC value motion chart deep within the crimson. Actually, the bullish divergence for ETH seemed invalidated because it approached the 0.04 BTC stage.

If Bitcoin continues to achieve momentum in direction of the $61k-$62k vary after reclaiming $57k, ETH might be anticipated to drop additional.

At the moment, ETH lacks a stable help stage, and merchants might want to look forward to higher market circumstances earlier than any important rebound. Now, the continued inflows may assist ETH regain stability. Nonetheless, for now, it stays weaker than Bitcoin.

The ETH/BTC Relative Power Index (RSI) highlighted this divergence, with the value motion declining whereas the RSI fashioned increased lows – An indication of a possible reversal.

Supply: TradingView

The reducing quantity additionally indicators that ETH might quickly dip beneath the 0.04 BTC stage. If Bitcoin weakens, this might current an opportunity for ETH to reverse. Till confirmed in any other case although, the bearish development for ETH will stay the more than likely situation.

World establishments are promoting ETH

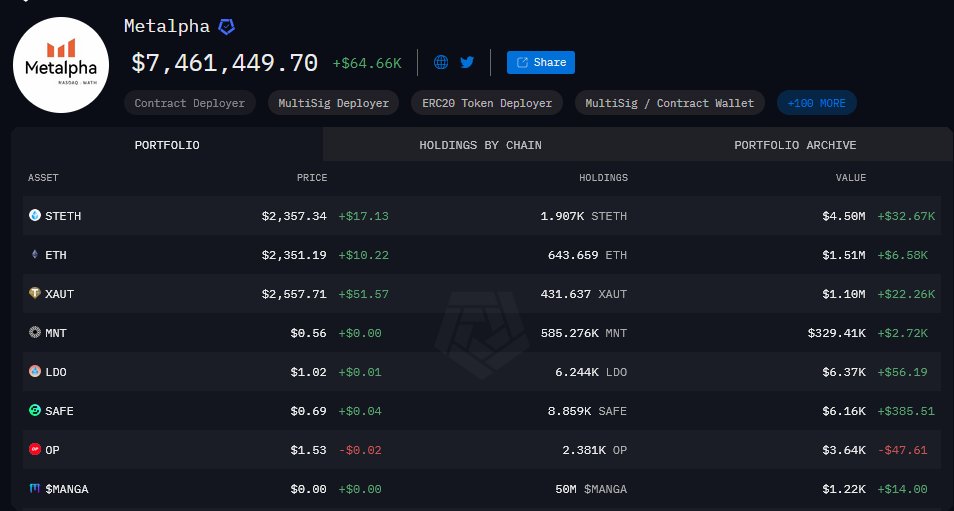

That’s not all although, with main international establishments now promoting off their Ethereum holdings, as per Lookonchain on X.

As an example, Metalpha just lately deposited 6,999 ETH, valued at $16.4 million, into Binance, contributing to their complete deposits of 62,588 ETH value $145.1 million during the last six days.

Their remaining ETH holdings now stand at simply 23.5k ETH, value $55 million. Metalpha has additionally liquidated its Layer 2 tokens similar to Optimism (OP), whereas additionally decreasing its staked ETH (stETH) holdings to 1,907 stETH.

Supply: Arkham

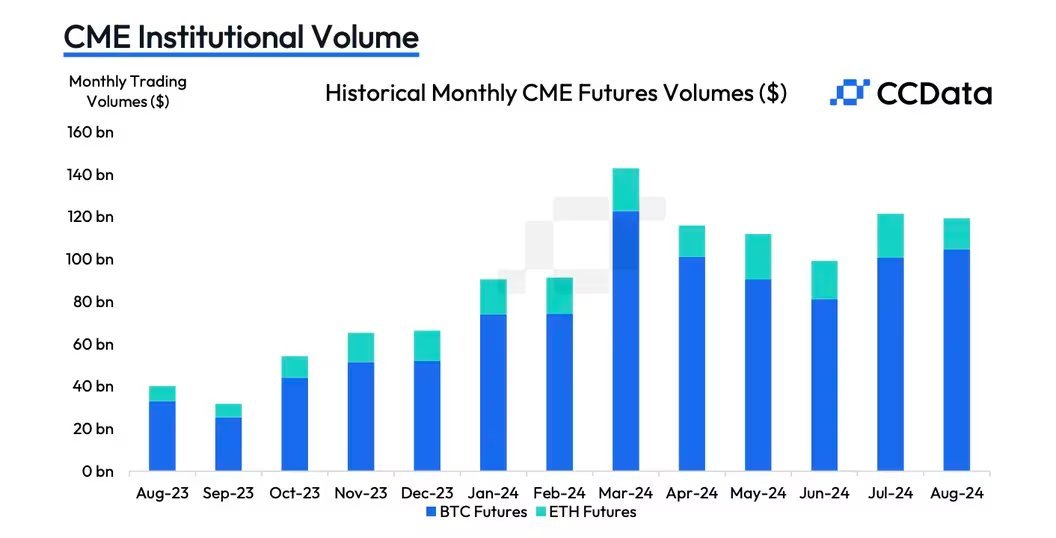

Ethereum CME buying and selling quantity

Moreover, ETH is more likely to stay weak towards BTC attributable to declining Futures buying and selling quantity on the Chicago Mercantile Trade (CME). Actually, it fell by 28.7% to $14.8 billion in August, marking its lowest stage since 2023.

12 months-to-date, ETH’s value can also be destructive, with its exchange-traded funds (ETFs) having recorded destructive internet cumulative flows. The Ethereum Basis can also be promoting ETH, including additional strain on the value.

Supply: X

Because of this ETH might proceed to say no earlier than probably rebounding, probably in This autumn 2024.

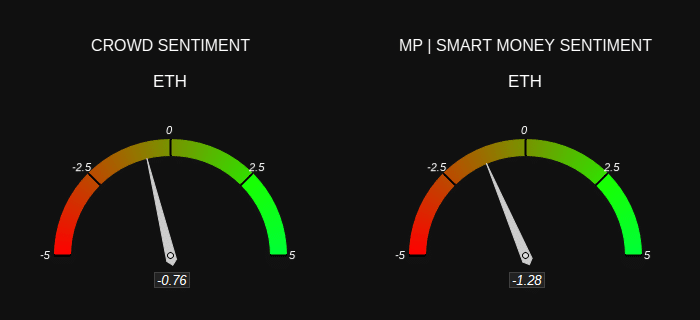

Crowd and sensible cash sentiment

Lastly, crowd and sensible cash sentiment additionally indicated bearishness for ETH. Each retail merchants and institutional buyers agree that ETH stays bearish within the present market atmosphere.

This alignment between small and huge gamers means that Ethereum’s downtrend might persist till market dynamics shift or a major catalyst emerges to help a value restoration.

Therefore, ETH is anticipated to stay weak towards Bitcoin. Particularly till broader crypto market circumstances enhance.

Supply: Market Prophit