Bitcoin – Miner balances see steepest decline of the year, should you worry?

- Regardless of latest bouts of decline, Bitcoin stays near the $10,000-level

- Miners dumped their largest batch of holdings in months as its value hit a significant milestone

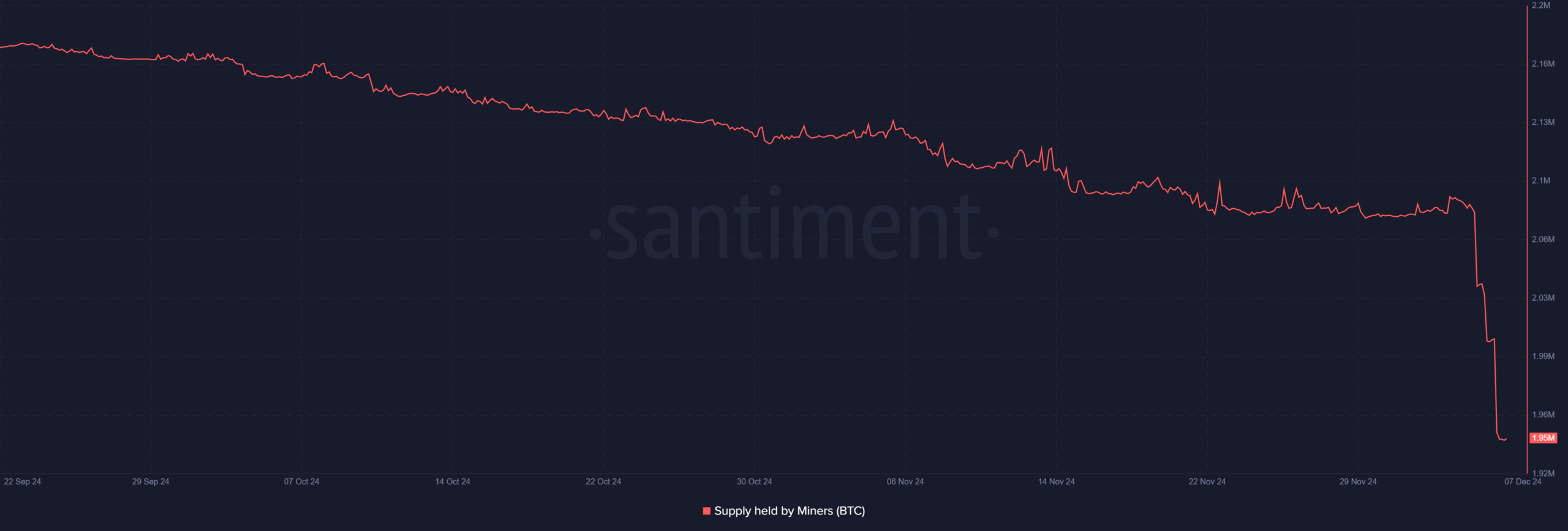

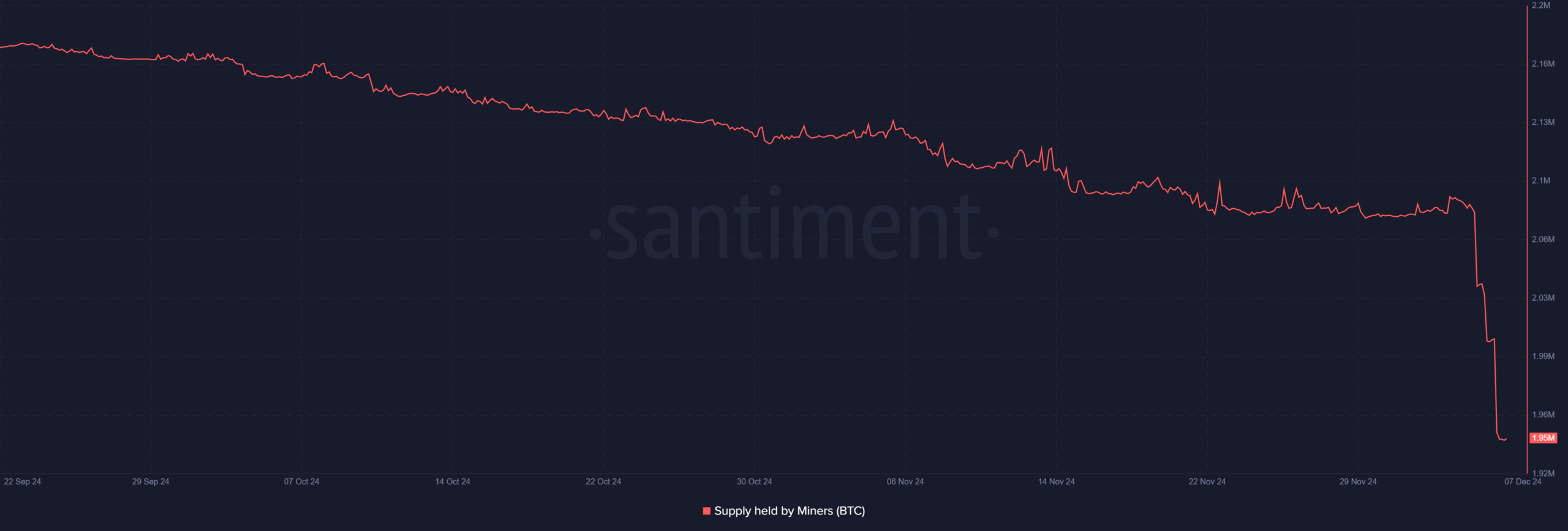

Bitcoin miners have offloaded a staggering 85,503 BTC over the past 48 hours, inflicting miner balances to drop to roughly 1.95 million BTC – Their lowest stage in latest months. In actual fact, this marks the sharpest fall in miner holdings in 2024.

As anticipated, this raises questions on its impression on Bitcoin’s value too.

Bitcoin miners’ promoting and value developments

The latest dip in miner balances is essentially the most vital since February, nevertheless it has not but instantly affected Bitcoin’s value momentum. An evaluation of the miner provide on Santiment revealed that on 5 December, it had a studying of over 2 million.

Nonetheless, it had dropped to round 1.95 million, on the time of writing.

Supply: Santiment

Traditionally, vital miner sell-offs typically align with market corrections, however 2024 has seen a divergence between miner exercise and value developments. Regardless of these sell-offs, nevertheless, non-mining whales and sharks have continued to build up – Highlighting the complexity of market dynamics.

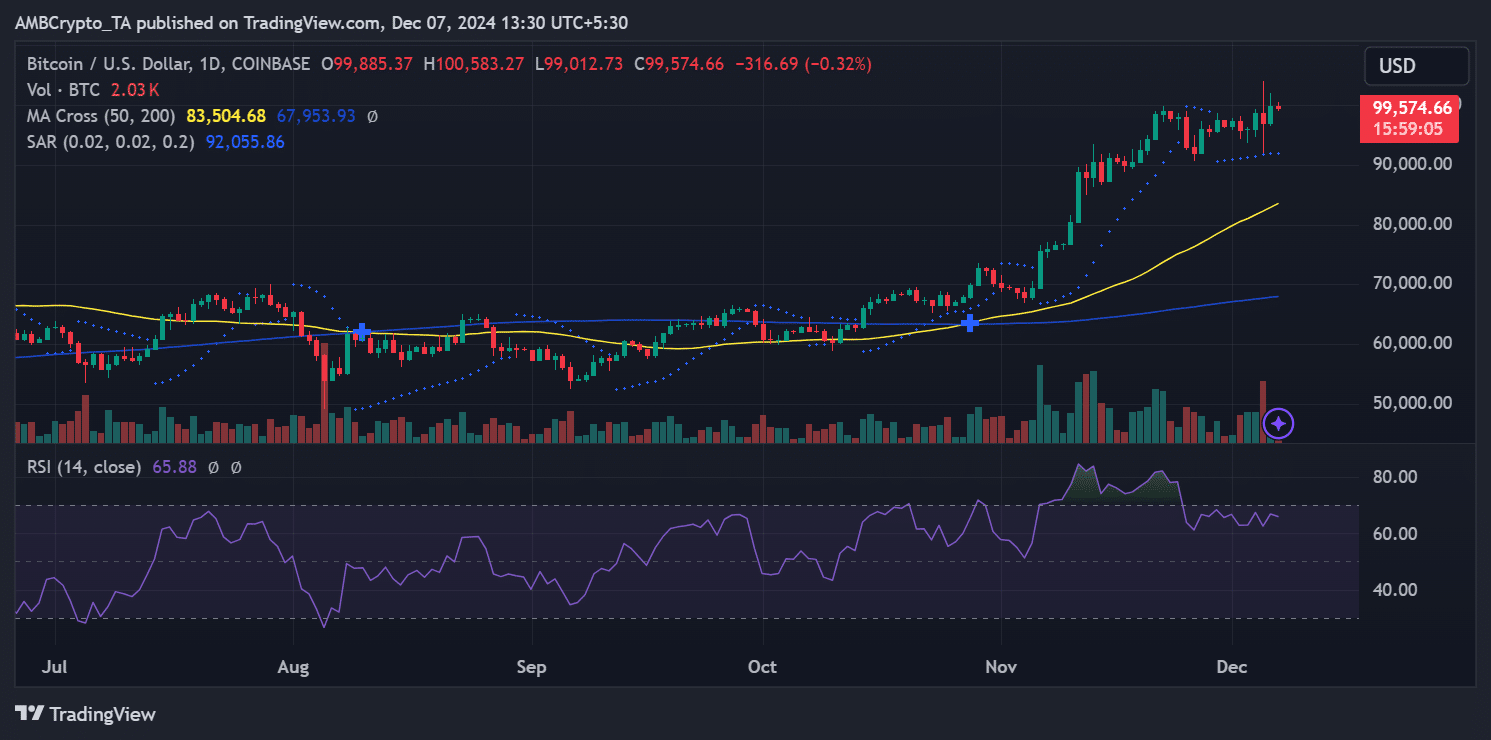

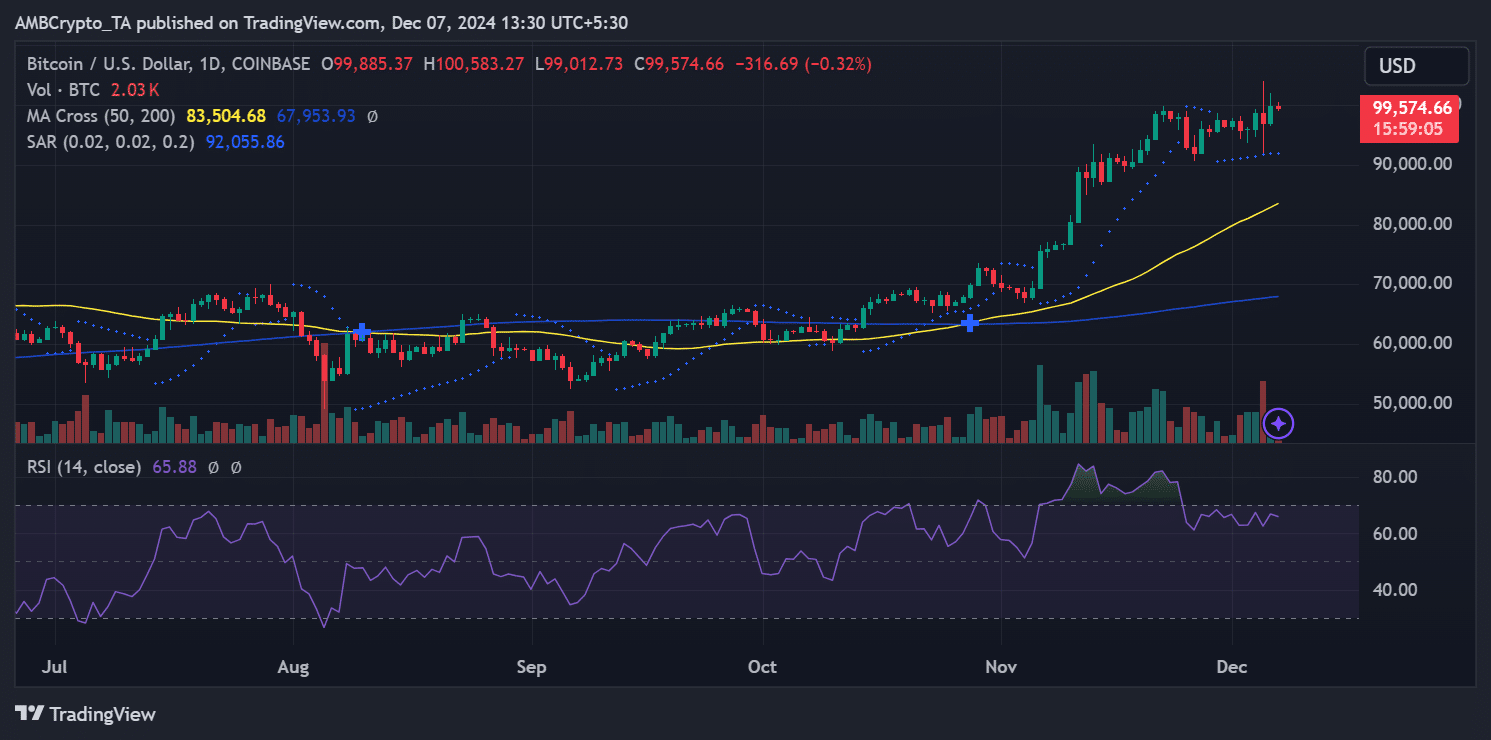

At press time, Bitcoin appeared to be consolidating close to its psychological resistance at $100,000. The Relative Power Index (RSI) highlighted a price of 65.88 – An indication that the asset stays in bullish territory, though overbought situations weren’t but evident.

The Parabolic SAR and shifting averages additional supported a bullish bias, with the value buying and selling properly above the 50-day and 200-day shifting averages at $83,504 and $67,953, respectively.

Supply: TradingView

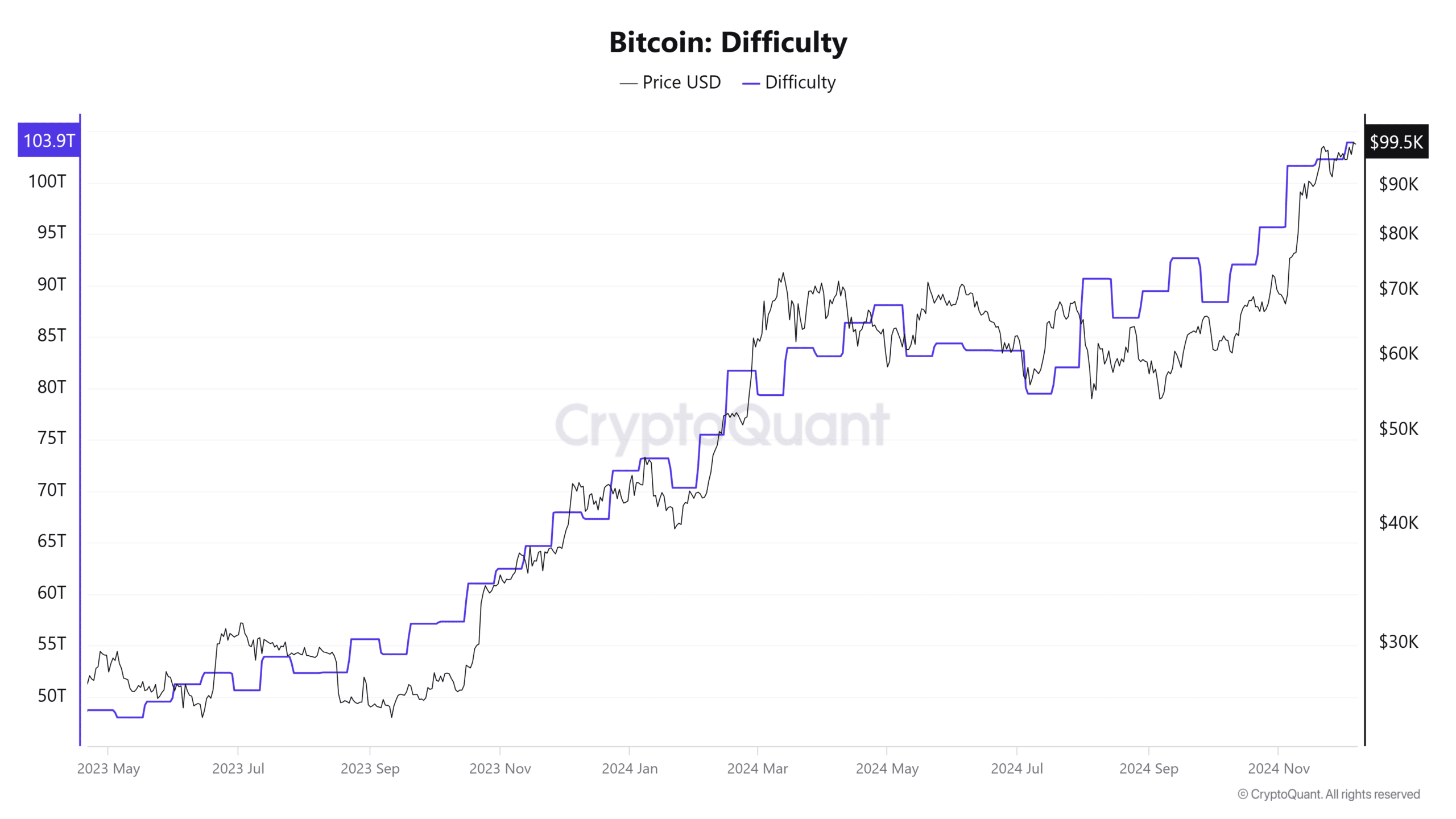

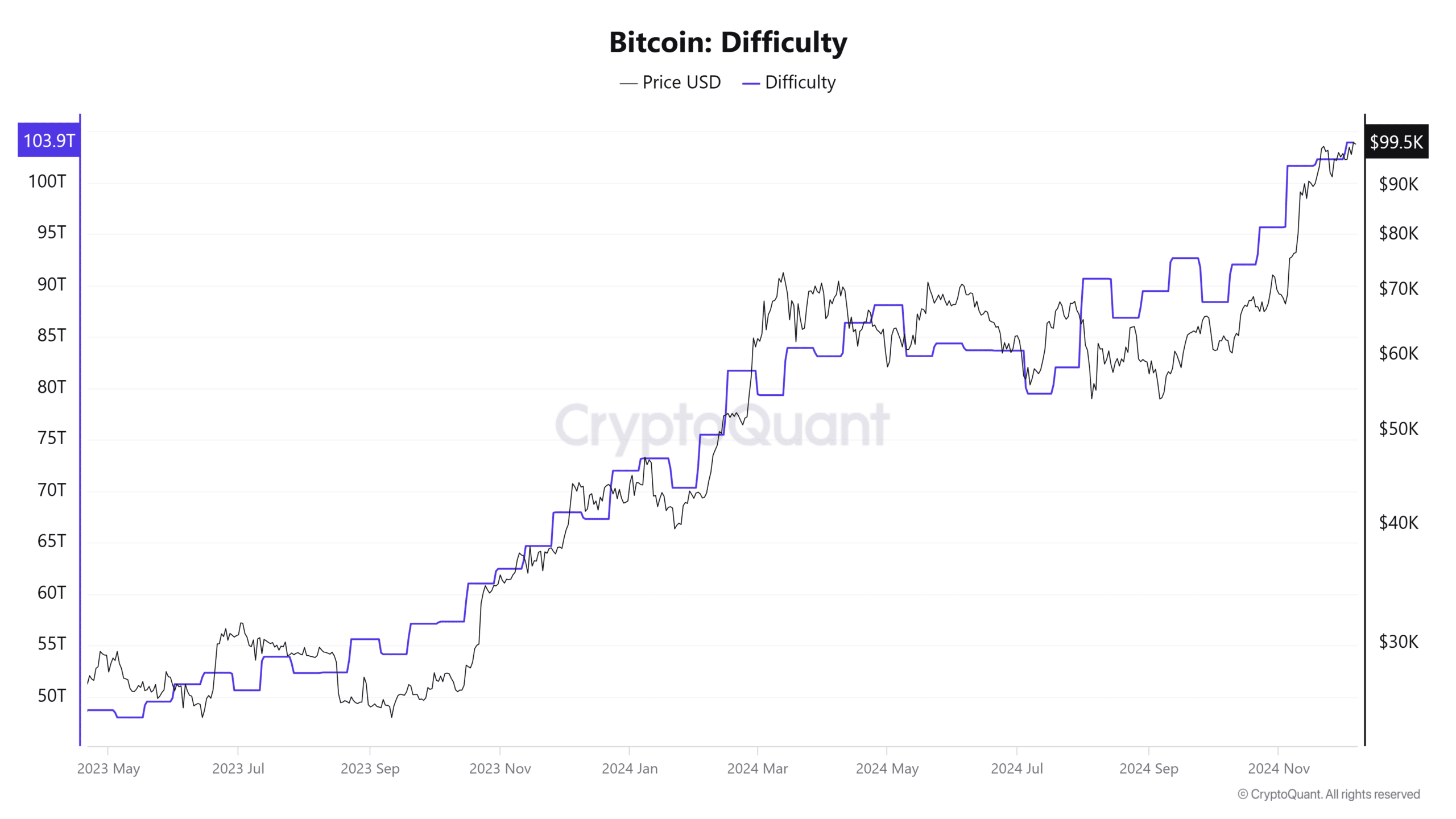

Community metrics – Hashrate, issue, and income

An evaluation of Bitcoin’s hashrate revealed that it hit an all-time excessive of over 900 EH/s. The sustained hike indicated sturdy competitors amongst miners.

Coupled with a report community issue of 103.9T, excessive mining exercise has continued regardless of the autumn in miner balances.

Supply: CryptoQuant

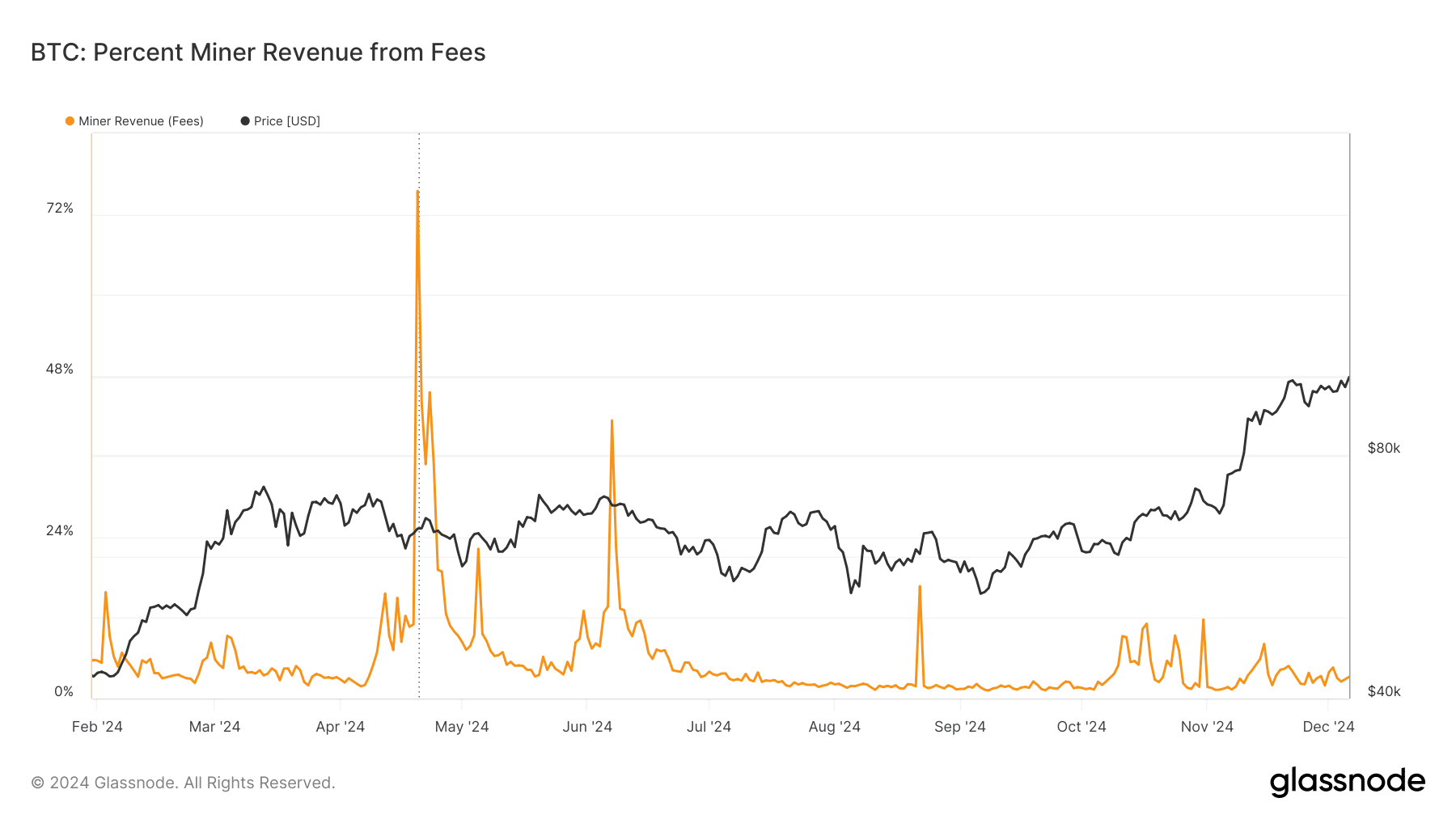

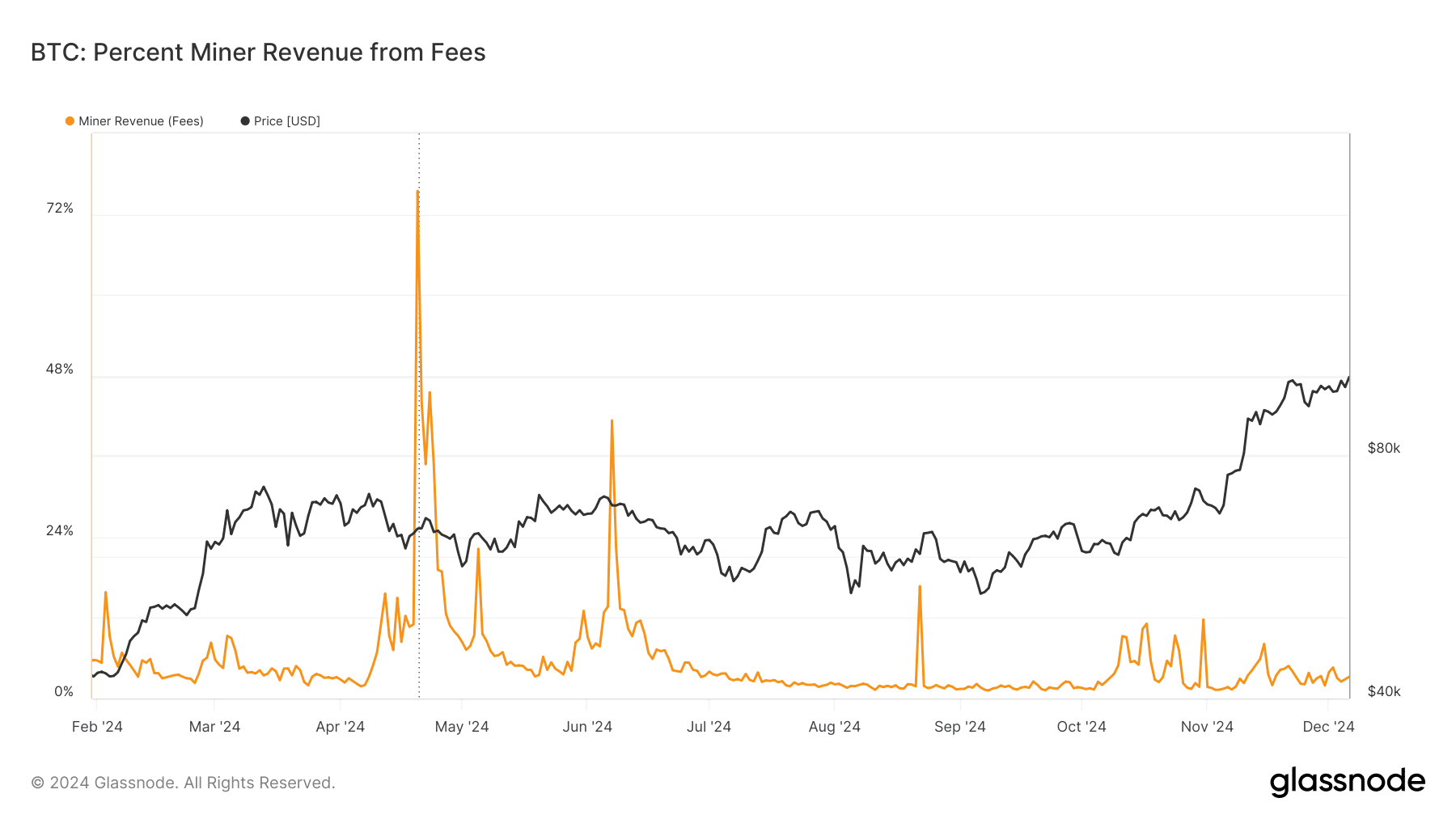

Moreover, miner income from charges stays subdued, with transaction charges contributing to solely about 10% of whole miner earnings.

That is considerably decrease than the peaks seen earlier in 2024, emphasizing miners’ dependence on block rewards.

Supply: Glassnode

Implications for Bitcoin’s value

The divergence between miner exercise and value developments underscored Bitcoin’s market maturity. Regardless of main sell-offs, Bitcoin’s value has remained resilient, consolidating close to its all-time excessive as consumers stepped in to soak up the promoting stress. Nonetheless, sustained promoting from miners may result in heightened volatility, particularly if compounded by macroeconomic or liquidity considerations.

Bitcoin’s means to keep up its value close to $100,000 amid vital miner promoting displays the rising affect of non-mining market individuals and the asset’s broader adoption.

Learn Bitcoin (BTC) Worth Prediction 2024-25

As miners modify their holdings, market individuals will intently watch Bitcoin’s means to interrupt previous its psychological resistance and maintain its rally. The approaching weeks shall be vital for figuring out whether or not the latest miner sell-off means a possible turning level or merely displays short-term market changes.