Ethereum’s new roadmap: Will Vitalik’s latest plan boost scalability?

Buterin has proposed a brand new roadmap geared toward enhancing the scalability, finality, and safety of Ethereum’s Layer 2 options.

Vitalik Buterin’s new roadmap for Ethereum introduces a “2-of-3” mannequin, combining optimistic proofs, zero-knowledge (ZK) proofs, and trusted execution atmosphere (TEE) provers.

Transactions are finalized when two of those proofs agree, decreasing reliance on one methodology and addressing safety and fraud considerations.

The proposal targets long-standing Layer 2 scaling points whereas preserving Ethereum’s decentralization.

A key characteristic is the event of “Stage 2 rollups,” which promise sooner confirmations, higher finality, and elevated resilience in semi-trusted environments.

Ethereum’s liquidation considerations

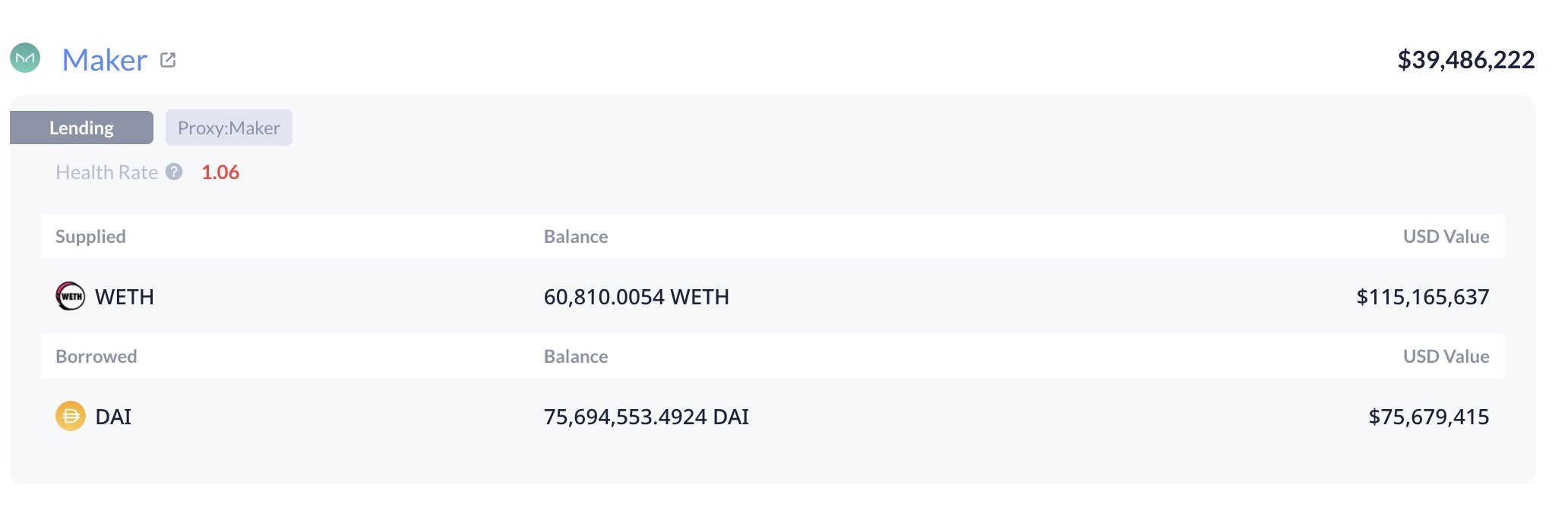

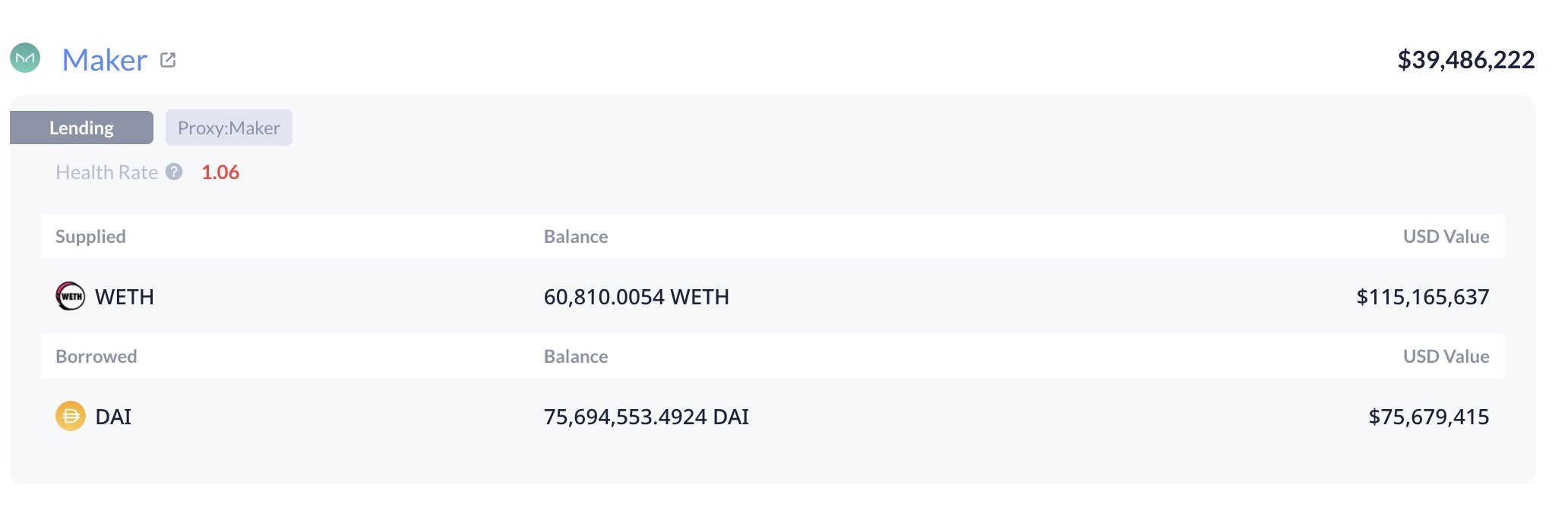

Whereas Ethereum’s Layer 2 improvements give attention to bettering scalability and safety, the broader ecosystem nonetheless faces vital monetary dangers. One such concern is the liquidation threat tied to large ETH holdings on MakerDAO.

Supply: X

As the worth of ETH fluctuates, the 125,603 ETH (roughly $238M) held by two main whales on Maker is prone to liquidation.

With the well being price dropping to 1.07 and significant liquidation costs at $1,805 and $1,787, an extra decline in ETH’s worth may set off compelled liquidations, doubtlessly impacting market stability.

Ethereum worth outlook

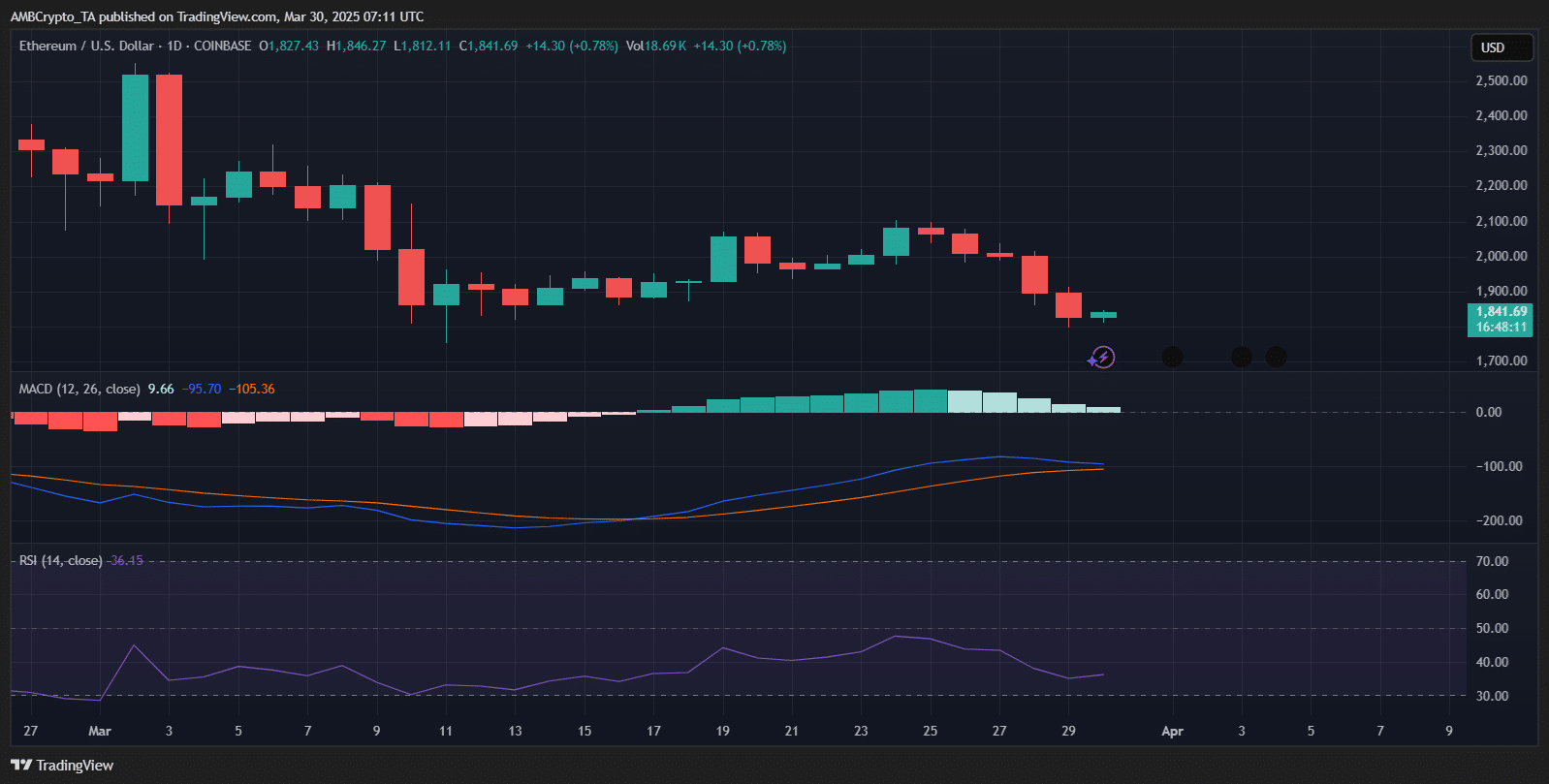

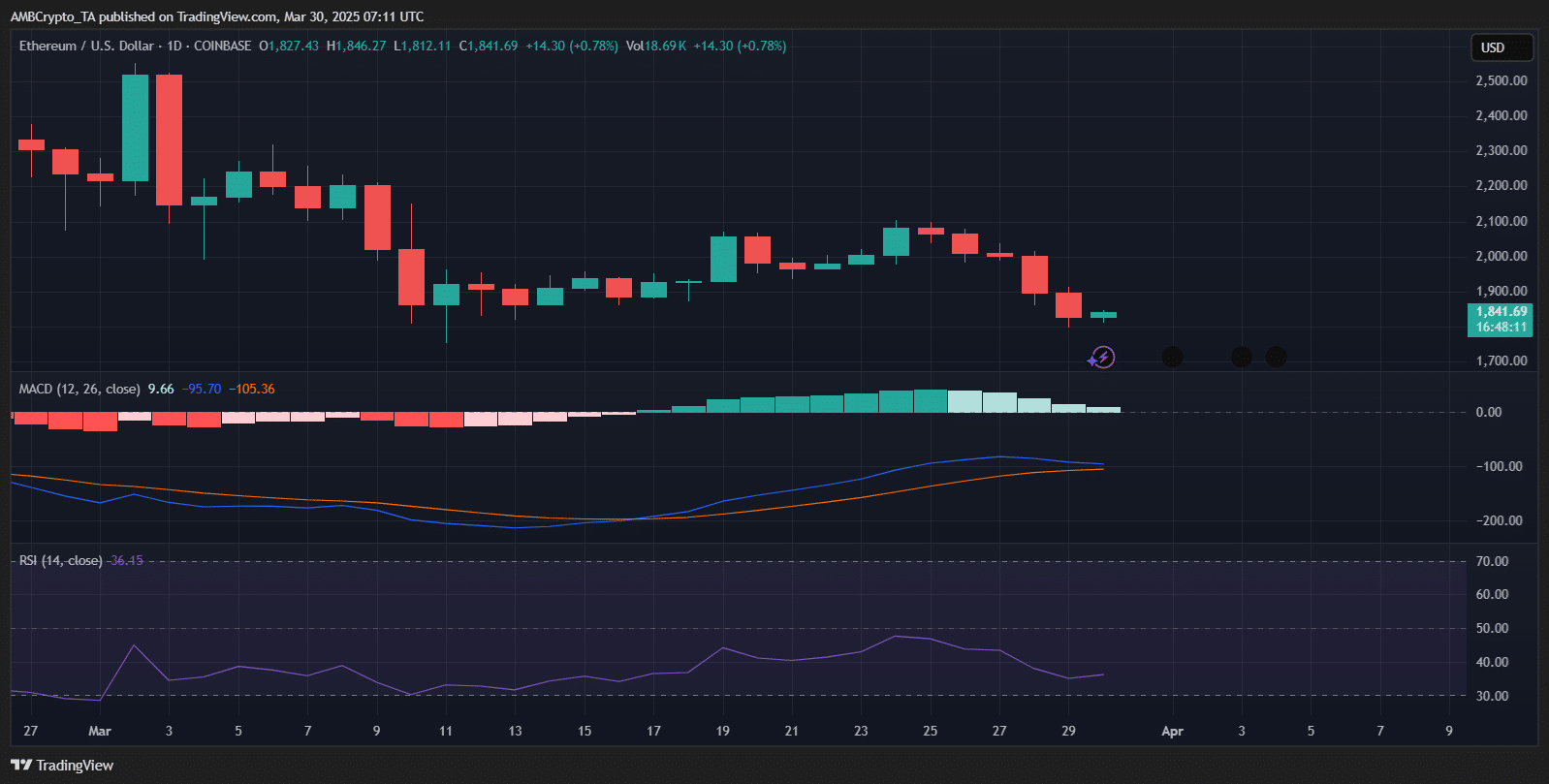

The Ethereum every day chart reveals a slight restoration after an 8% drop within the final week, buying and selling at $1,841.69 at press time.

The MACD indicator stays bearish, with the road under the sign line, suggesting ongoing promoting stress. The RSI at 36.45 indicated oversold circumstances, hinting at a possible reversal if shopping for quantity will increase.

Supply: TradingView

The current worth motion reveals a consolidation part after a pointy decline, with help doubtless round $1,750-$1,700. If bullish momentum builds, resistance is predicted close to $1,900-$2,000.

The general development stays unsure, with additional draw back attainable except a powerful shopping for push materializes.