Ethereum’s next move remains uncertain amid whale sell-offs – What next?

- In a key growth, one whale moved $19.54 million value of ETH to Kraken.

- Market sentiment remained divided, with conflicting indicators from key indicators.

Regardless of a quick interval of turbulence on the twenty fifth of November, Ethereum [ETH] has demonstrated resilience, posting a day by day achieve of 1.38%.

This restoration contributes to a powerful weekly improve of 9.85%, underscoring the market’s present bullish momentum.

But, regardless of these features, warning persevered. Delicate bearish indicators remained in play, with the potential to drive ETH decrease if broader market situations deteriorate.

Whale transfers ETH, probably triggering a value drop

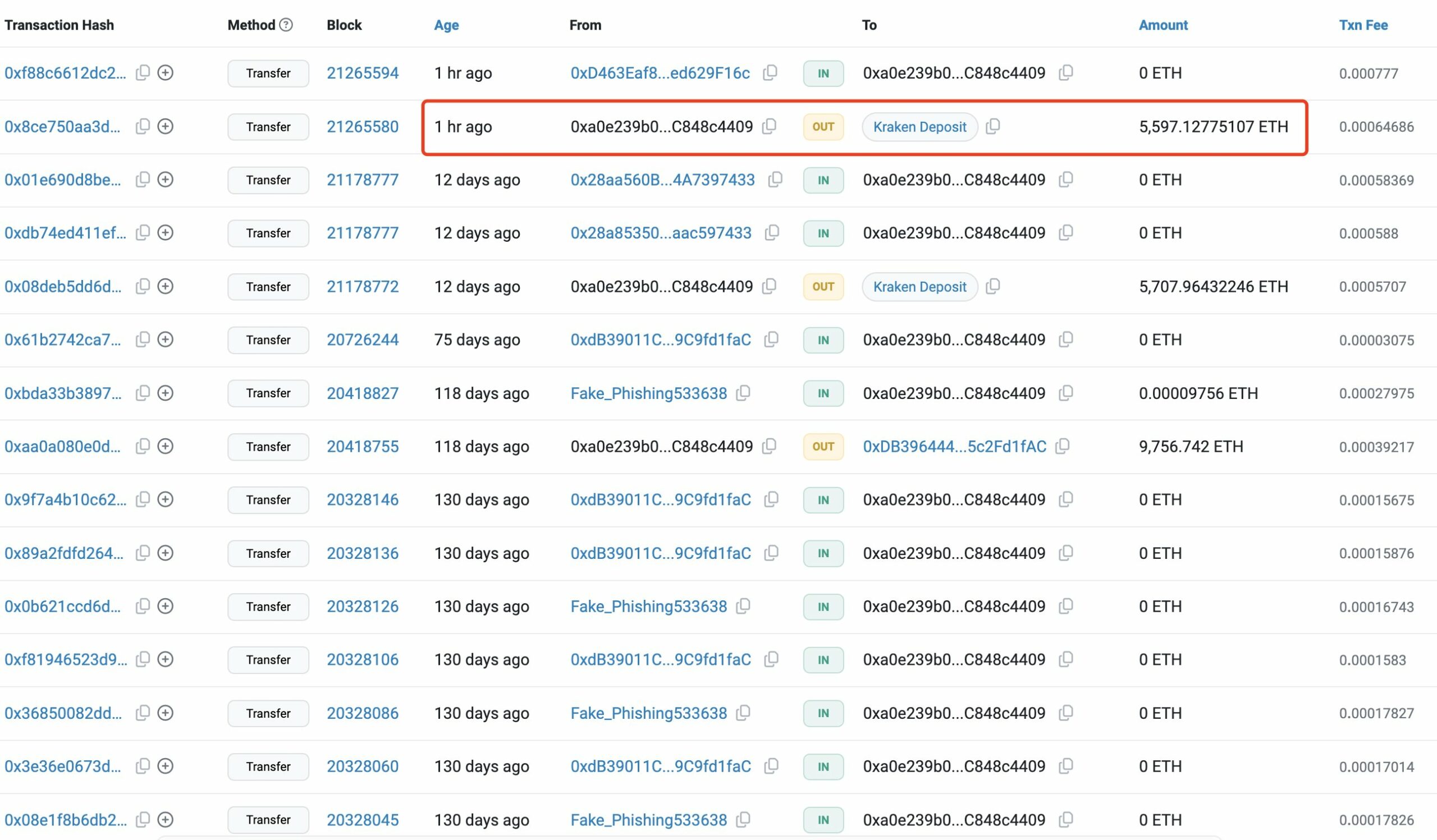

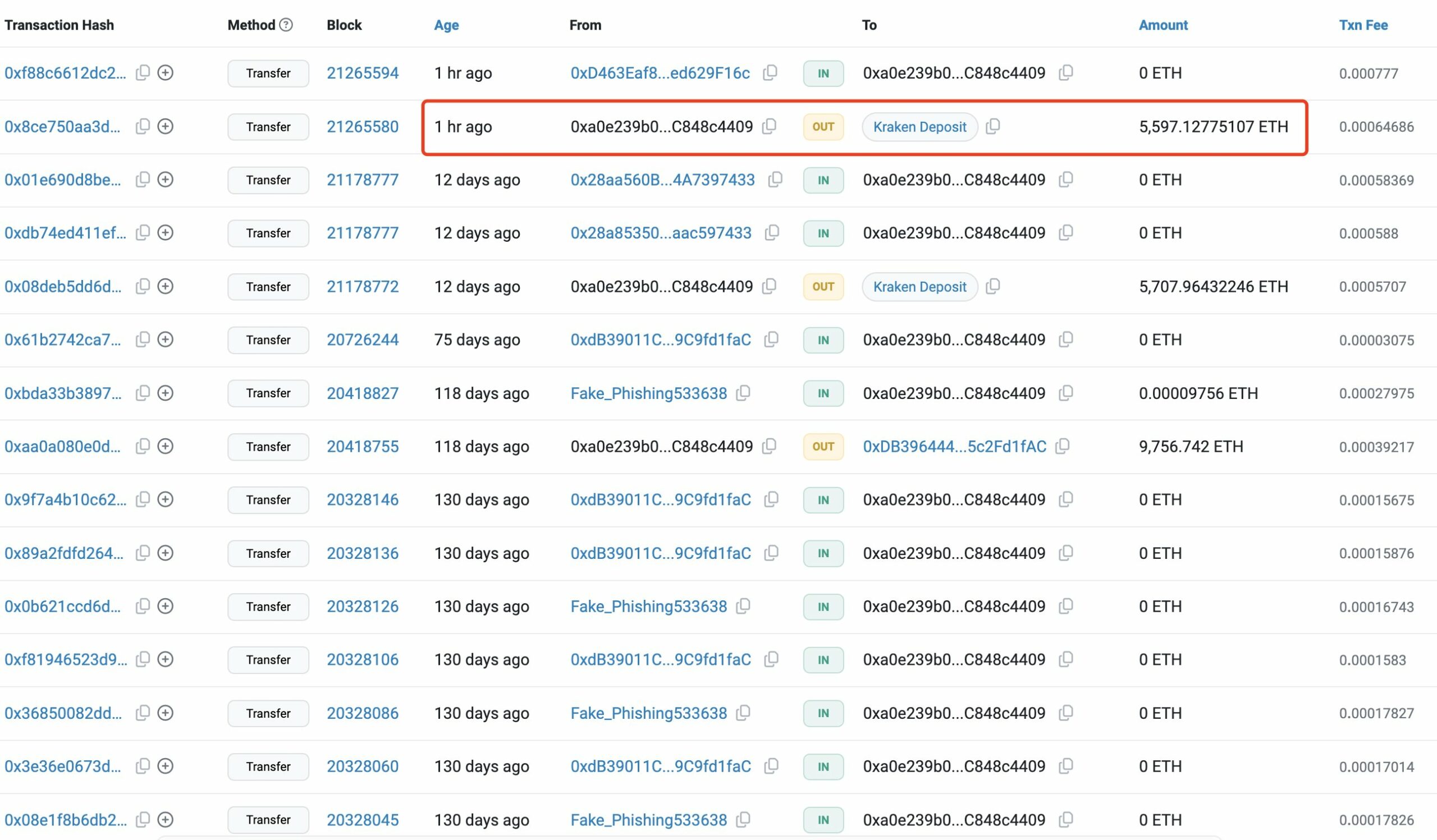

In line with knowledge from Lookonchain, a whale pockets related to ETH Devcon just lately moved 5,597 ETH—value $19.45 million—into the cryptocurrency change Kraken.

Supply: X

The transaction got here shortly after ETH briefly reclaimed the $3,500 stage. Such actions are sometimes seen as bearish, as massive inflows to exchanges typically sign intentions to promote, whether or not for profit-taking or as a result of declining market confidence.

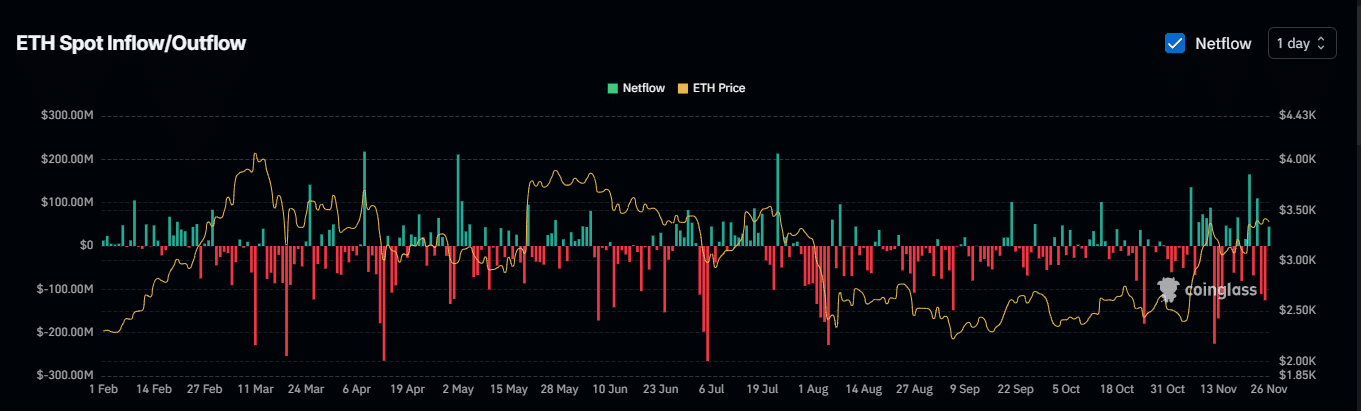

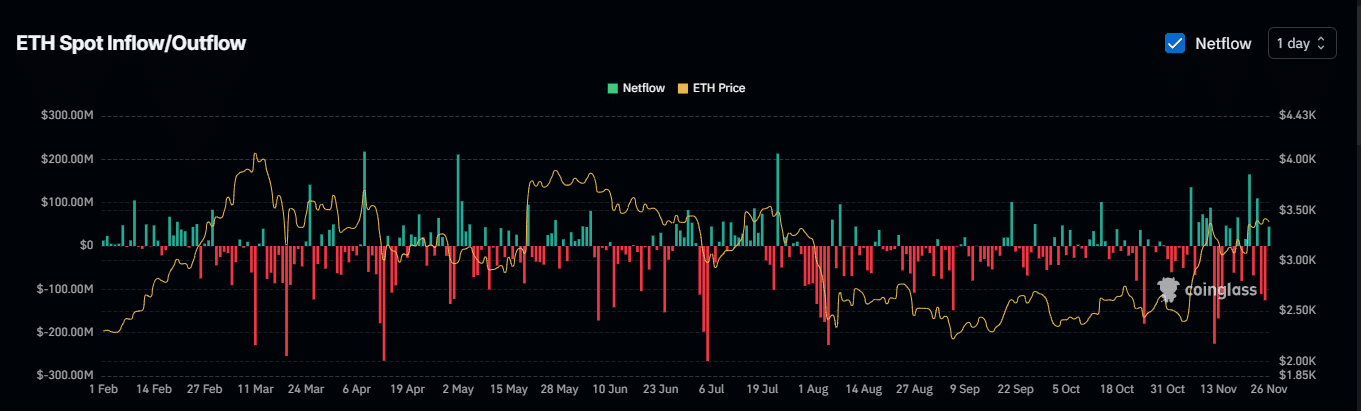

AMBCrypto discovered the general Change Netflow gives a unique perspective on ETH’s potential transfer.

Market contributors align with whales

Change Netflow, which measures the movement of belongings out and in of exchanges, is a key indicator of market sentiment.

Constructive Netflow sometimes indicators bearish sentiment as belongings transfer into exchanges for potential promoting, whereas unfavorable Netflow displays bullish sentiment, indicating withdrawals for holding.

On the twenty fifth of November, Netflow was unfavorable, with $125.17 million withdrawn from exchanges—a bullish sign that outweighed whale exercise.

Nevertheless, the Netflow has since turned optimistic, with $53.96 million moved again to exchanges.

If this development continues, it may improve promoting stress on ETH, suggesting that market contributors had been now leaning towards promoting reasonably than holding.

Supply: Coinglass

ETH’s subsequent transfer is unclear

At press time, market sentiment remained divided. On the bearish facet, $52 million in lengthy positions had been liquidated, reflecting vital losses because the market moved in opposition to bullish merchants—a transparent signal of promoting stress.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

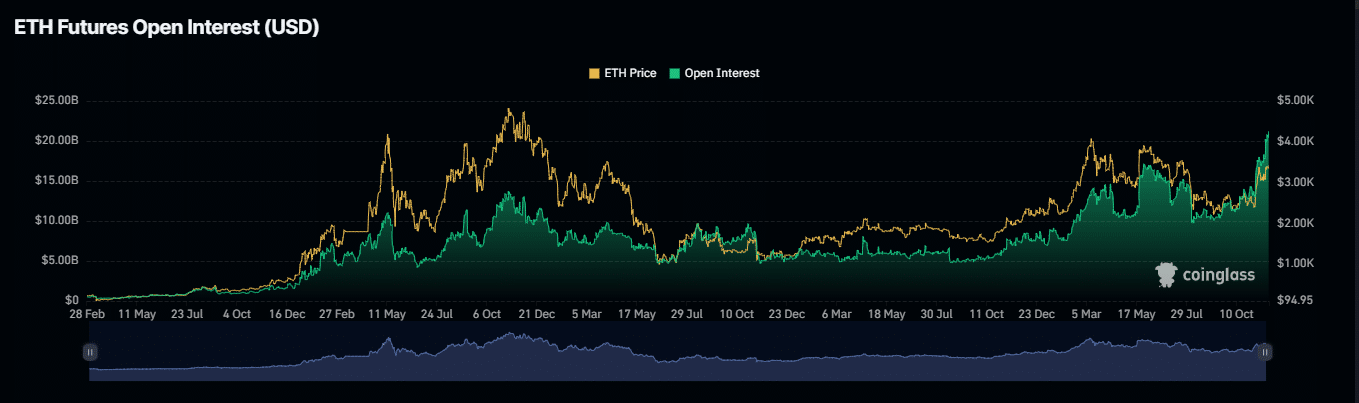

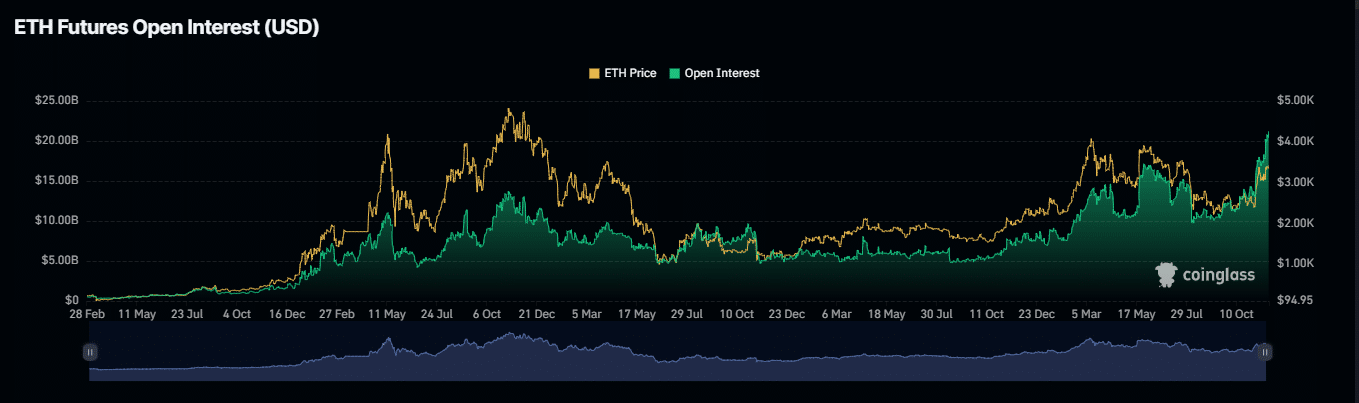

In the meantime, Open Curiosity hit a bullish peak, reaching $21.44 billion—the very best in two years. This surge steered a rising variety of lengthy spinoff contracts, signaling optimism for a possible value improve.

Supply: Coinglass

Till these opposing indicators converge, ETH’s value route will stay unsure.