Ethereum’s next price target – ETH can climb to $3,300 ONLY if…

- Ethereum’s worth appreciated by greater than 2.5% within the final 24 hours

- Most metrics and market indicators seemed bullish on ETH’s charts

As market sentiment modified over the previous few hours, Ethereum [ETH] benefited from the identical as its each day chart turned inexperienced. Nevertheless, the most recent uptick may simply be the start of a large rally, particularly because the king of altcoins’ worth is now transferring inside a bullish sample.

Ethereum’s bullish transfer

The final 7 days weren’t within the traders’ greatest pursuits as ETH’s worth dropped by over 5%. Nevertheless, because the market pattern modified, ETH additionally managed to push its worth up by greater than 2.5% in 24 hours. In line with CoinMarketCap, on the time of writing, ETH was buying and selling at $2,988.30 with a market capitalization of over $358 billion.

Apparently, issues may get even higher for ETH within the coming days. World of Charts, a well-liked crypto-analyst, not too long ago shared a tweet highlighting that the ETH/BTC pair was transferring inside a falling edge sample. A profitable breakout from the sample might end in ETH hitting new highs within the coming months.

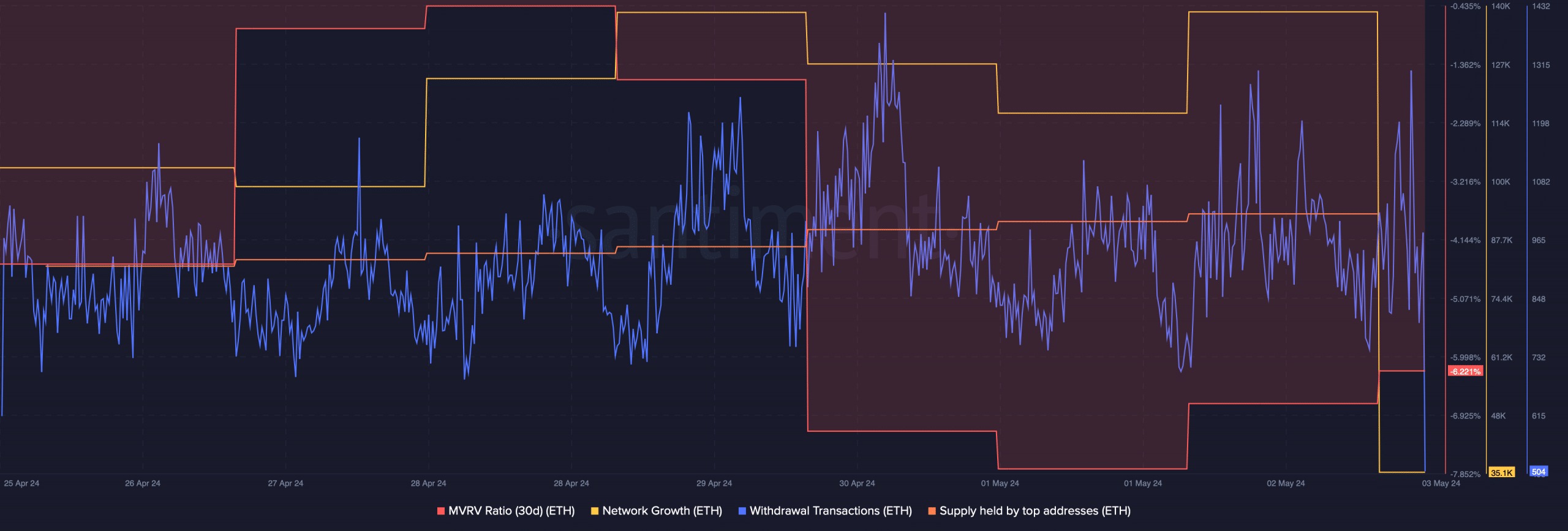

Due to this fact, AMBCrypto checked ETH’s metrics to see whether or not it could handle a breakout. Our evaluation of Santiment’s information revealed that ETH’s community progress hiked over the previous few days. Merely put, extra addresses have been created to switch the token as its energetic withdrawal fee climbed final week.

Moreover, Ethereum’s provide held by high addresses additionally rose barely, suggesting that purchasing strain on the token was excessive.

Quite the opposite, its MVRV ratio remained low. At press time, ETH’s MVRV ratio had a worth of -6.22%.

Supply: Santiment

Ethereum’s weekly goal

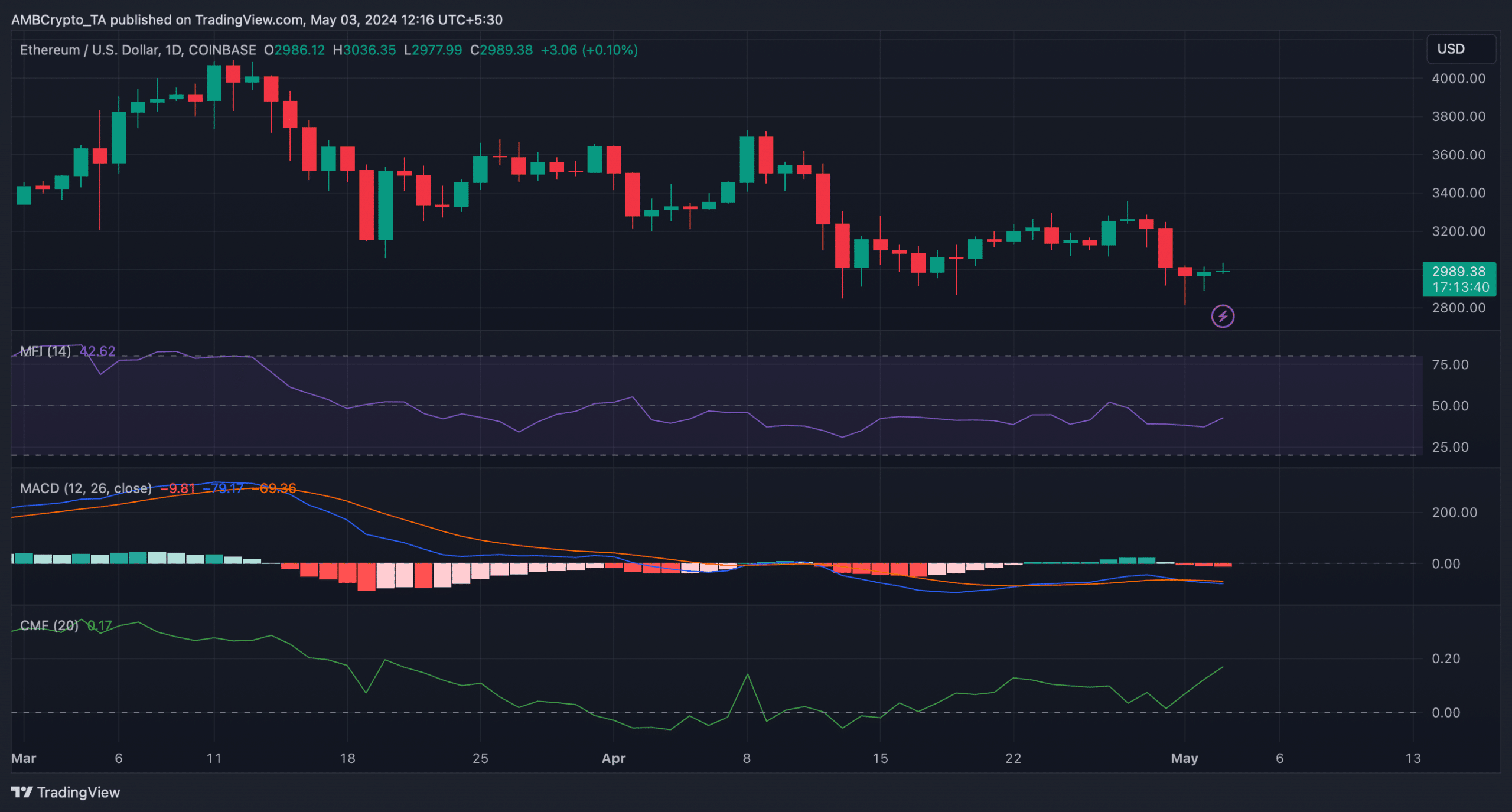

Since most metrics appeared bullish, AMBCrypto then checked ETH’s each day chart to see whether or not an additional uptrend was inevitable.

We discovered that ETH’s Chaikin Cash Movement (CMF) registered a pointy uptick from the impartial degree. The Cash Movement Index (MFI) additionally went north. Each of those indicators counsel that the probabilities of a sustained bull rally are excessive.

Alternatively, the MACD supported the sellers because it flashed a bearish crossover on the charts.

Supply: TradingView

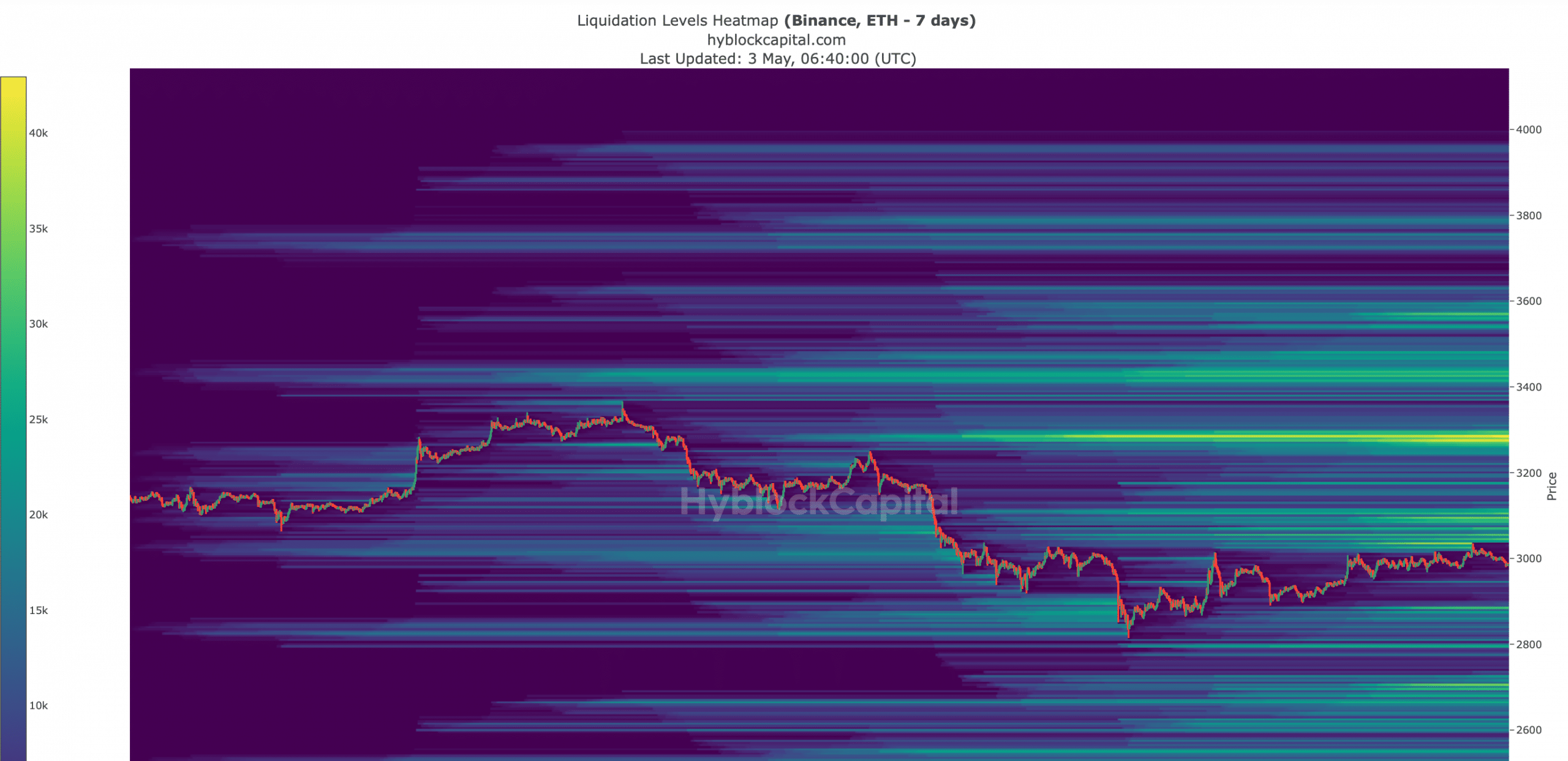

We then analyzed Hyblock Capital’s information to search out out the attainable targets ETH may hit this week if the bull rally lasts. To ensure that ETH to maintain the rally, will probably be essential for the token to go above $3,100, as liquidations would rise sharply.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

A hike in liquidations might end in a worth correction. A profitable breakout above that degree might permit ETH to climb to $3,300 by the top of this week if every little thing falls into place.

Supply: Hyblock Capital