Ethereum’s slow Q2: Will ETF approval and low supply drive prices up?

- Ethereum’s efficiency in Q2 was unprofitable, indicating a tough quarter.

- Whales and retail buyers took some earnings as costs surged.

Ethereum [ETH] witnessed a surge in worth and recognition over the previous couple of days following the announcement of Ethereum ETFs.

A disappointing quarter

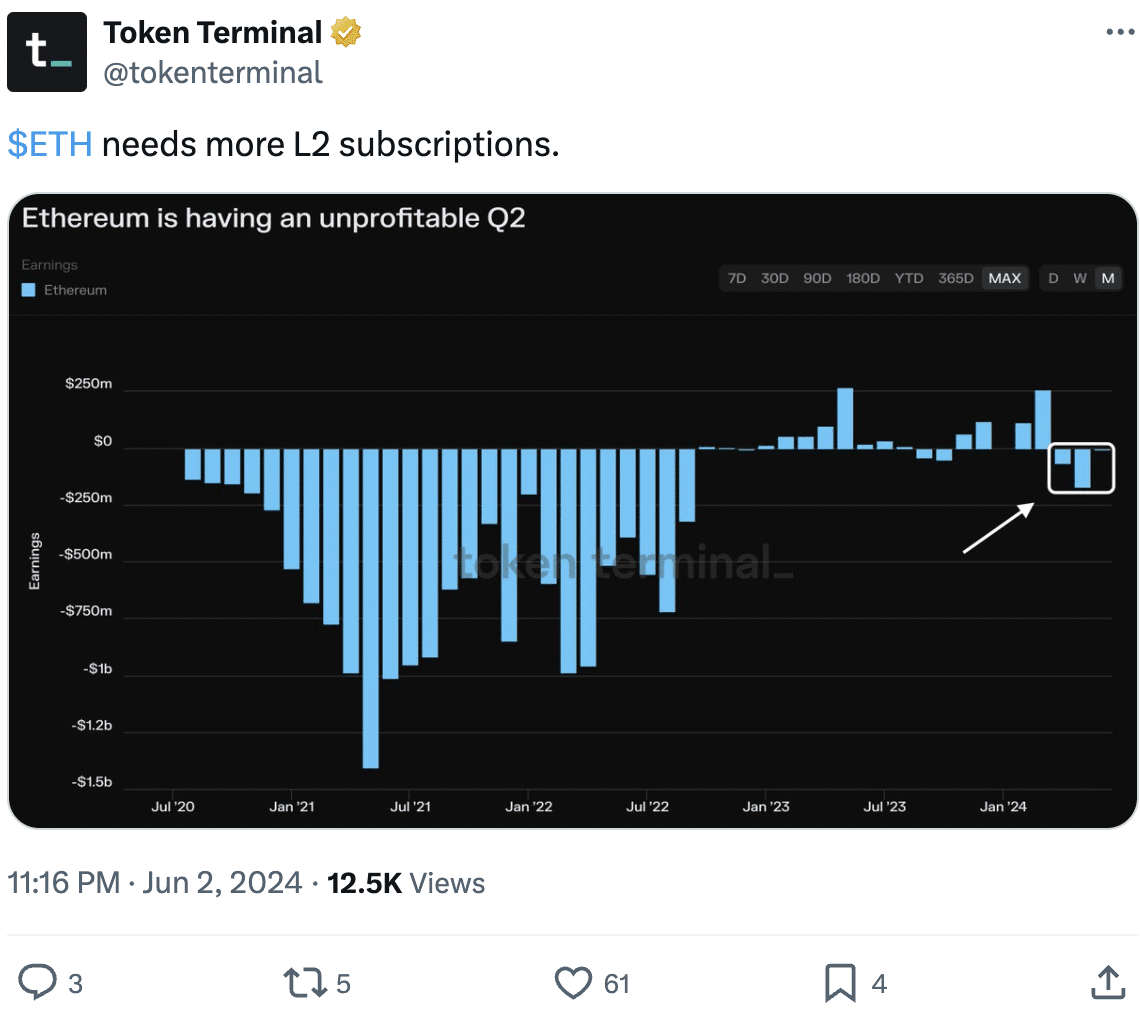

Regardless of this, the ecosystem was not doing too nicely. Token Terminal’s information indicated that Ethereum was having an unprofitable Q2.

If Ethereum continues to have issues producing income, it will make it a lot tougher for the community to promote its holdings.

Supply: X

Nonetheless, curiosity in ETH remained had remained comparatively excessive.

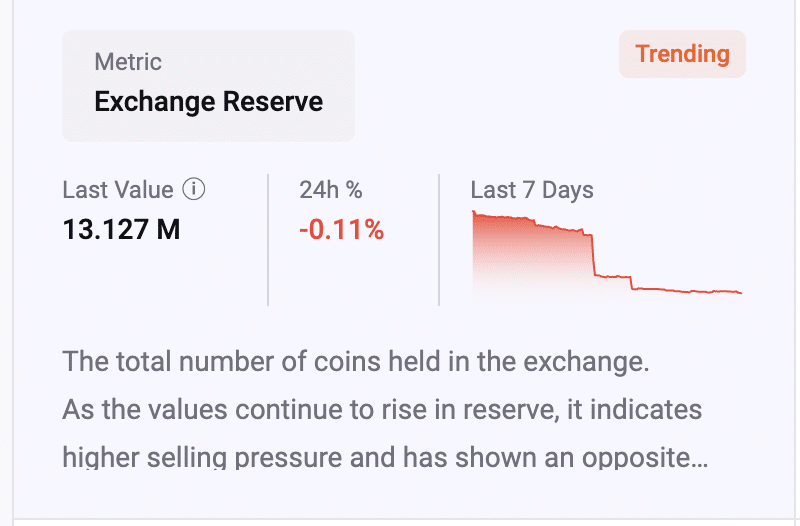

Following the twenty third Could approval of spot Ethereum exchange-traded funds ETFs in america, greater than $3 billion value of Ethereum was withdrawn from centralized crypto exchanges, indicating a possible provide squeeze.

Information confirmed that the quantity of Ethereum on exchanges decreased by round 797,000, or $3.02 billion, between twenty third Could and 2nd June.

Supply: CryptoQuant

This discount in change reserves implies fewer ETH is obtainable on the market as buyers transfer their property to self-custody for functions aside from quick promoting.

Ethereum’s provide on exchanges was now at its lowest stage in years, simply 10.6%. This discount in provide, coupled with a surge in demand from buyers submit quite a few ETF approvals might additional enhance the value of ETH and nuge it in the direction of its all time excessive (ATH).

However, considerations linger that Grayscale’s Ethereum Belief (ETHE), which manages $11 billion in funds, might influence Ethereum’s worth motion. That is primarily based on the instance of the Grayscale Bitcoin Belief (GBTC), which noticed $6.5 billion in outflows inside the first month of its approval.

How is ETH doing?

At press time, ETH was buying and selling at $3,833.59 and its worth had grown by 1.19% within the final 24 hours. Surprisingly, each whale curiosity and retail curiosity dipped barely over the previous couple of days.

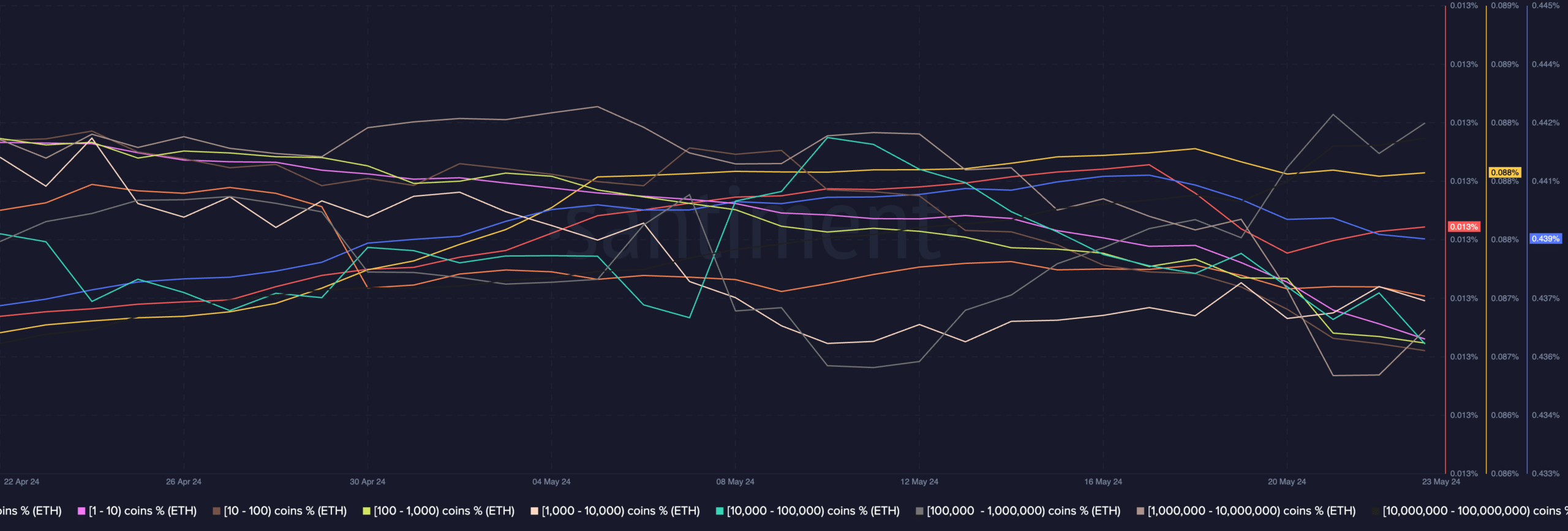

AMBCrypto’s examination of Santiment’s information revealed that cohorts holding wherever between 0.01 ETH to 10 ETH had witnessed a decline in general ETH held by them.

Furthermore, the addresses holding extra that quantity additionally let go of a few of their ETH.

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

This habits exhibited by each whales and retail buyers indicated that a variety of holders have been indulging in some stage of revenue taking as costs soared.

Nonetheless, the promote offs haven’t been important sufficient to influence costs negatively.

Supply: Santiment