Ethereum’s Vitalik is ‘really impressed’ – Is Optimism warranted?

- Optimism allotted a large quantity of tokens for incentivizing progress locally.

- Regardless of constructive developments, OP confronted challenges with declining value and rising quick positions.

In a current transfer showcasing dedication to neighborhood help, Optimism [OP] distributed 30 million OP tokens to contributors constructing public items for the Optimism Collective.

This strategic initiative goals to incentivize tasks driving curiosity and utility throughout the Optimism protocol.

RetroPGF Spherical 3 outcomes are right here!

30M OP was granted to contributors constructing the general public items that energy the Optimism Collective. pic.twitter.com/f4KicSz99t

— Optimism (@Optimism) January 11, 2024

Some reward

Vitalik Buterin, Ethereum’s [ETH] co-founder, publicly praised this resolution on Twitter.

He particularly counseled Optimism’s ongoing dedication to funding public items, offering a pathway for builders and contributors to have interaction with Ethereum, even within the absence of a traditional enterprise mannequin.

Buterin’s endorsement emphasised the importance of adopting related funding methods for tasks sooner or later.

Over $100m distributed in @Optimism RetroPGF spherical 3.

Actually impressed to see their ongoing dedication to funding public items, serving to devs and others contribute to Ethereum even when they lack a enterprise mannequin.

Hope to see extra tasks doing QF and RPGF rounds sooner or later! https://t.co/igZCTsnNLt pic.twitter.com/JFGB1MNDDS

— vitalik.eth (@VitalikButerin) January 11, 2024

By way of the general state of the protocol, Optimism was doing comparatively nicely.

Every day energetic customers maintained consistency, signaling regular engagement. There was a large surge on the transaction entrance, indicating rising exercise and interplay throughout the Optimism ecosystem.

Furthermore, Optimism’s Decentralized Trade (DEX) volumes and Whole Worth Locked (TVL) each skilled appreciable progress. This constructive pattern not solely signified elevated curiosity but in addition pointed towards the increasing utility and adoption of the community.

Supply: Artemis

Challenges forward

Regardless of these constructive developments, OP’s market efficiency wasn’t as cheerful. The token’s current value motion noticed a decline of 0.97%, with OP buying and selling at $3.85 on the time of reporting.

The Market-Worth-to-Realized-Worth (MVRV) ratio, nonetheless, remained excessive, indicating that present token holders have been nonetheless in a worthwhile place.

Whereas this means a constructive outlook for present holders, it additionally raises issues about potential sell-offs.

Supply: Santiment

How a lot are 1,10,100 OPs price in the present day?

Merchants’ habits additional sophisticated the image as quick positions round OP elevated, constituting 52.14% of general positions.

This prevalence of quick positions signifies a good portion of the market anticipating a lower within the token’s worth, including a layer of uncertainty to OP’s market dynamics.

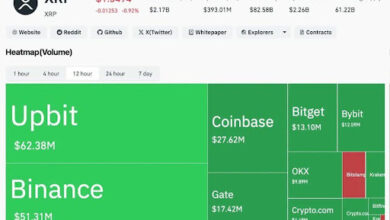

Supply: coinglass