Ethereum’s volume surges in November: Mapping ETH’s road ahead

- Ethereum noticed constructive on-chain exercise in November.

- ETH additionally ended the month positively.

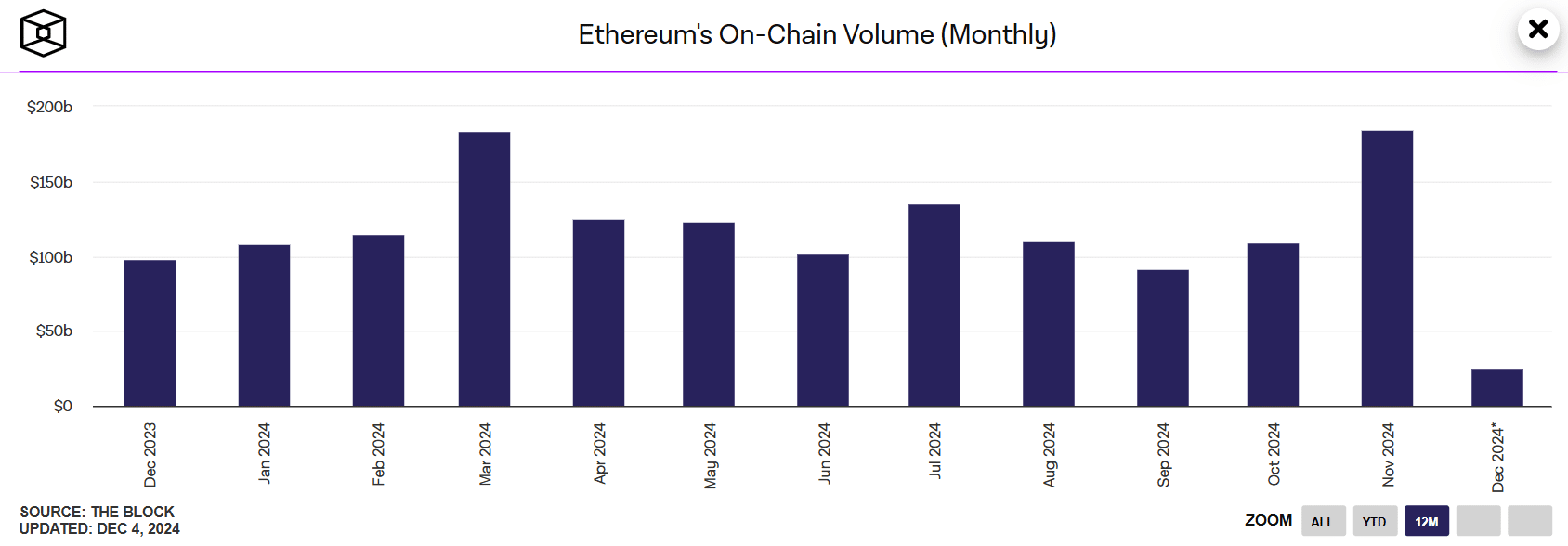

Ethereum’s on-chain exercise soared to outstanding ranges in November, with its month-to-month transaction quantity hitting over $180 billion.

This milestone additionally marked the community’s most important month-to-month quantity in practically three years, surpassing current months’ efficiency and highlighting Ethereum’s pivotal function within the blockchain ecosystem.

Ethereum quantity reaches a brand new excessive

In accordance with evaluation of information from IntoTheBlock, Ethereum has hit its highest on-chain quantity in 2024.

A have a look at the chart confirmed that its quantity in November was $183.74 billion, surpassing the document quantity of $183.94 billion set in March.

Supply: IntoTheBlock

Additional evaluation confirmed that its NFT quantity additionally noticed a big improve within the final 30 days.

Knowledge from CryptoSlam exhibits that the platform’s NFT gross sales quantity exceeded $253 million within the final 30 days, indicating an over 32% improve. With this determine, Ethereum outperformed all different blockchains in NFT gross sales.

TVL and ecosystem development

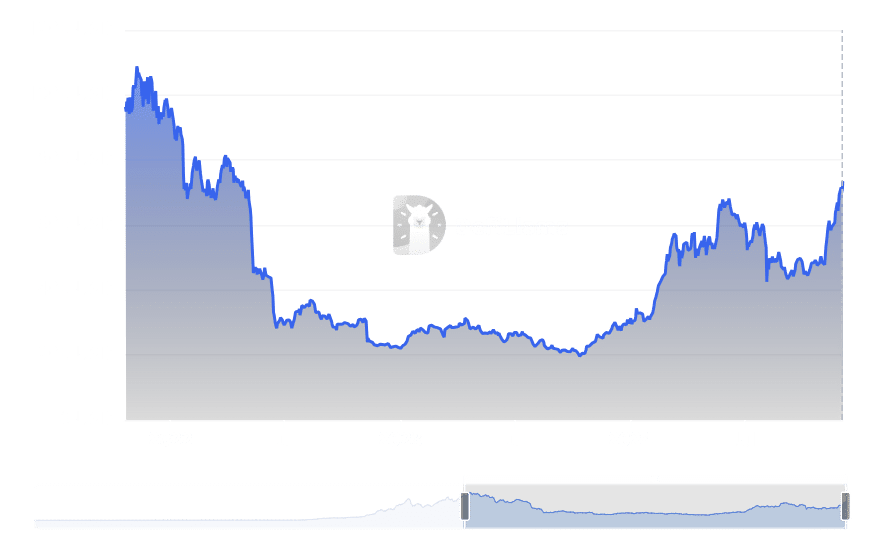

The community’s Complete Worth Locked (TVL) has additionally seen a gradual climb, reflecting renewed investor curiosity in decentralized finance (DeFi).

Supply: DefiLlama

In accordance with the evaluation of the TVL chart from DeFiLlama, Ethereum’s TVL has rebounded from mid-year lows, with billions of {dollars} locked throughout its various vary of protocols.

As of this writing, the TVL is round $73.48 billion, whereas the general TVL is round $135 billion. The development of the Ethereum quantity and TVL is a constructive sign for the community.

Analyzing Ethereum’s value momentum

From a value perspective, Ethereum has maintained a bullish trajectory. The every day chart signifies that ETH/USD has constantly traded above its 50-day and 200-day transferring averages, signaling a robust uptrend.

The Relative Power Index (RSI) was hovering at 67.7, suggesting the asset is nearing overbought territory however nonetheless has room for additional upside.

Supply: TradingView

Ethereum’s value closed in November at practically $3,700, solidifying positive aspects from earlier months.

Parabolic SAR factors under the worth motion additional reinforce the bullish sentiment, suggesting that upward momentum is unbroken.

As Ethereum approaches essential resistance ranges, market individuals stay optimistic about its means to maintain its rally and capitalize on the community’s rising quantity.

Practical or not, right here’s ETH market cap in BTC’s phrases

Ethereum’s record-breaking on-chain quantity, coupled with its management in NFT gross sales and TVL, paints a constructive image for the community.

With the community attaining its highest exercise ranges since 2021, Ethereum is well-positioned to construct on its momentum heading into 2025.