eToro trading: U.S. clients restricted to BTC, ETH, BCH post SEC deal

- eToro buying and selling platform will limit U.S. crypto trades to Bitcoin, Ethereum, and Bitcoin Money following a settlement with the SEC.

- The SEC has fined eToro $1.5 million for working as an unregistered crypto dealer and clearing company.

eToro trading platform has reached a settlement with the U.S. Securities and Change Fee (SEC), agreeing to halt most cryptocurrency choices to its U.S. prospects.

For context, the SEC accused eToro of offering entry to crypto property deemed as securities since 2020 with out adhering to federal securities registration necessities.

As a part of the settlement, eToro can pay a $1.5 million penalty for working as an unregistered dealer and clearing company in reference to its crypto providers.

Execs weigh in

Remarking on the identical, eToro’s co-founder and CEO, Yoni Assia, expressed his ideas, in a press release and stated, the settlement permits the corporate to,

“Give attention to offering modern and related merchandise throughout our diversified U.S. enterprise. As an early adopter and world pioneer of cryptoassets in addition to a big participant in regulated securities, it will be significant for us to be compliant and to work intently with regulators world wide.”

For sure, Assia wasn’t the one one to reply to the scenario. A number of business specialists additionally weighed in.

As an illustration, Lowell Ness, a associate at Perkins Coie, added his perspective, stating,

“It’s fascinating to see events agreeing to this type of drastic settlement when considered in opposition to federal courtroom rulings holding that programmatic trades should not securities transactions. This settlement highlights the massive hole which may be creating between regulators and a number of the early courtroom selections.”

What’s extra to it?

That being stated, eToro will restrict its U.S. prospects to buying and selling solely Bitcoin [BTC], Bitcoin Money [BCH], and Ethereum [ETH] on its platform.

For all different cryptocurrencies, customers can have a 180-day window to promote their holdings, after which these tokens will not be out there for commerce.

This choice marks a big shift within the platform’s crypto choices in response to regulatory challenges. Nonetheless, this transfer confronted important criticism, with many viewing it as an overreach by the SEC.

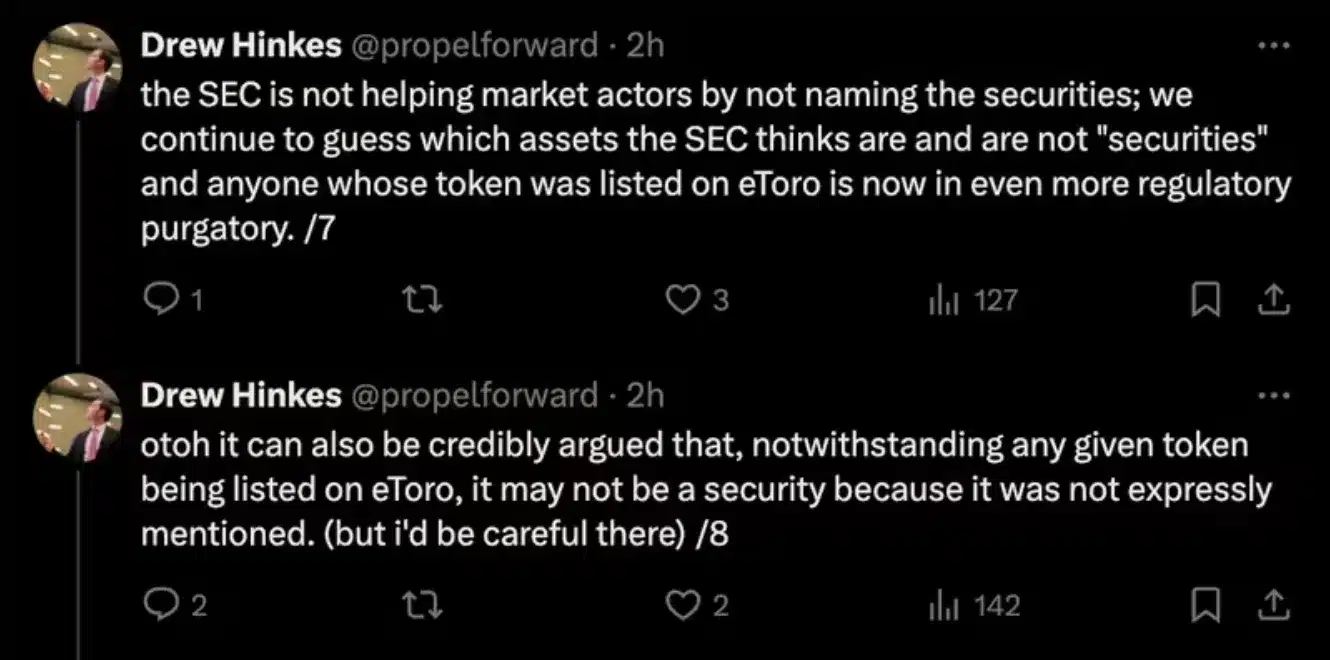

Commenting on the problem, Drew Hinkes, Associate at Okay&L Gates, shared his ideas on X, noticing,

Supply: Drew Hinkes/X

This case with eToro will not be an remoted incident, as quite a few main crypto platforms like Coinbase, Kraken, Binance, and Uniswap [UNI] have additionally confronted authorized challenges with the SEC.

Whereas a few of these battles are nonetheless ongoing, others have concluded with the SEC rising victorious.

SEC fines report unveiled

Actually, a latest report revealed that the SEC imposed important penalties on distinguished crypto corporations between 2013 and 2024, highlighting key instances and the character of the regulatory violations dedicated by these corporations.

In keeping with the report,

“Since 2013, the SEC has levied over $7.42 billion in fines in opposition to crypto corporations and people, of which 63% of the high-quality quantity, i.e., $4.68 billion, got here in 2024 alone.”

Since 2022, the SEC has ramped up its efforts to manage the cryptocurrency area, imposing penalties on corporations and holding executives accountable to emphasise stricter oversight.