Every Bitcoin supply bracket has this common theme

- The one to five-year energetic age bands resolved to HODLing Bitcoin.

- Cash in revenue exceed these in loss regardless of BTC’s lower.

Bitcoin’s [BTC] provide distribution has been a subject of curiosity lengthy earlier than the king coin reached the $69,000 All-Time Excessive (ATH), up until this era when it has been pegged again. Remarkably, every provide class, represented by the energetic age bands, shares a standard attribute that would affect BTC.

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

By analyzing the one to five-year energetic age bands, Glassnode confirmed that they’ve been sure collectively since hitting their respective ATHs.

All of the classes are in unison

On the time the on-chain analytic platform printed its tweet, the one-year age band had the best improve. This implies that various buyers have collected BTC and caught with it since final 12 months’s capitulation.

The #Bitcoin Provide Final Energetic Age Bands are all at the moment at ATHs. This implies that HODLing is the first dynamic throughout all subsections of the Lengthy-Time period Holder cohort.

🔴 Provide Final Energetic 1+ Yrs In the past: 69.2%

🟠 Provide Final Energetic 2+ Yrs In the past: 55.7%

🟢 Provide Final Energetic 3+… pic.twitter.com/FYdWi1tVq2— glassnode (@glassnode) July 26, 2023

For context, the energetic age bands measure the motion of cash collected or saved for lengthy durations of time.

When the metric rises, it implies that long-term accumulation is growing. However when the metric falls, it implies that long-term holders are spending and distributing their cash. And most instances, this falls into the fingers of the youthful cohort.

Subsequently, the one to five-year age bands rising concurrently implies that the first resolve of long-term holders is to HODL.

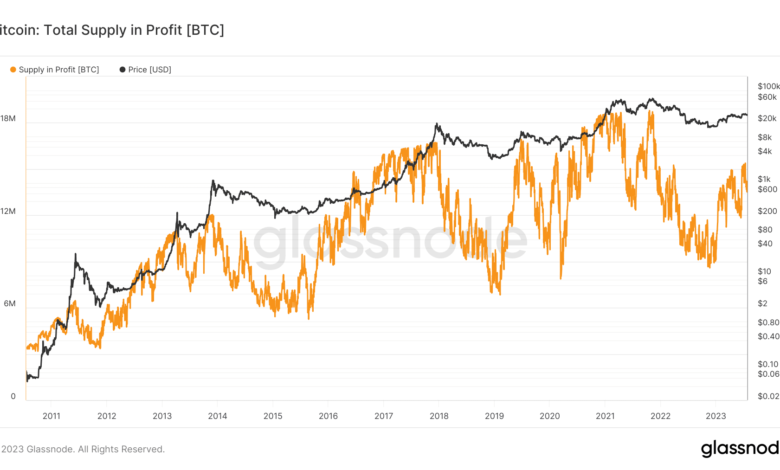

Concerning the overall Bitcoin supply in profit, Glassnode confirmed that it had decreased to 14.19 million as of 26 July. The Bitcoin provide in revenue reveals the quantity of cash whose worth on the final transfer was decrease than the present worth.

Supply: Glassnode

BTC stays tempting regardless of this fall

Though the metric was nonetheless increased than it was in December 2022, the decline may very well be linked to BTC’s current dip. Based on CoinMarketCap, BTC’s 365-day 28.49% hike has become a 2.86% lower within the final 30 days.

As anticipated, the autumn in revenue provide resulted in a rise in Bitcoin’s supply in loss. However at 5.21 million, the variety of holders in revenue nonetheless exceeded these dealing with a downturn on the worth collected.

Supply: Glassnode

In the meantime, the realized market cap HODL waves have been right down to 1.691. As a substitute for the circulation HODL waves, the realized market cap HODL waves weigh the realized worth of cash in every provide bracket.

How a lot are 1,10,100 BTCs price in the present day?

The lower implies that youthful unspent cash have been categorized into older cash. Usually, this proves accumulation with rising market assist from the older cash.

Supply: Santiment

As an combination overview of HODLing habits, the metric confirmed that Bitcoin remains to be interesting to the common investor. Additionally, the conviction to not distribute cash was nonetheless excessive.