Examining Ethereum’s role in Solana’s booming liquidity

- $600M bridged to Solana in October, with over 90% being from Ethereum

- Inflow extra proof of Solana’s position in DeFi, NFTs, and cross-chain innovation

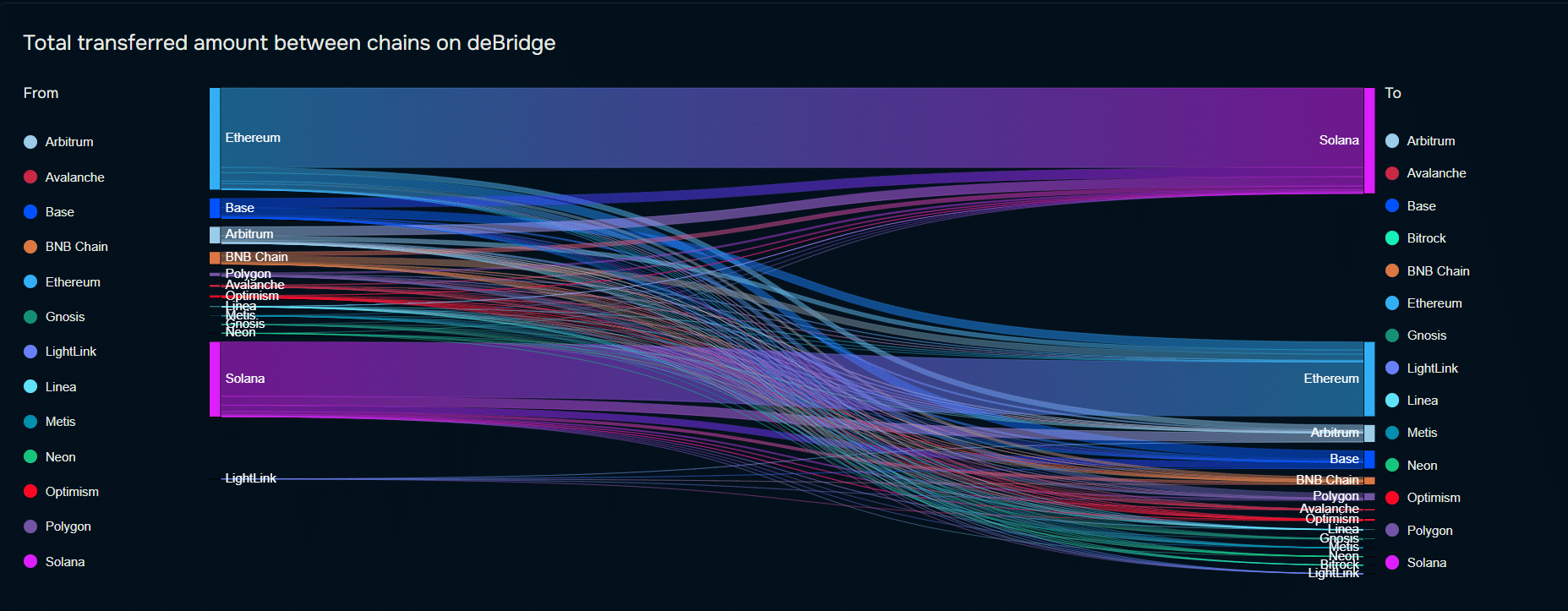

In an period marked by fast developments in blockchain know-how, October noticed over $600 million in digital belongings stream into Solana [SOL] from different blockchain networks, with Ethereum [ETH] contributing over 90% of this switch. This vital motion underscores Solana’s rising enchantment as a scalable, low-cost various for decentralized finance (DeFi), NFTs, and different blockchain-based functions.

As cross-chain interoperability turns into a precedence for customers searching for entry to various ecosystems, Solana’s rising liquidity and mission improvement sign its more and more aggressive place. The query now could be how this inflow will form Solana’s position within the cryptocurrency panorama.

Bridging and its influence on Solana’s market place

Blockchain bridging refers back to the switch of digital belongings throughout completely different blockchain networks, permitting tokens from one ecosystem – akin to Ethereum – to function on one other, like Solana. This course of allows customers to entry providers or advantages that could be higher suited to their particular wants or yield prospects on various chains.

Supply: deBridge

In October alone, over $600 million was bridged to Solana, with Ethereum representing over 90% of this stream. That is extra proof of Solana’s place as an more and more viable ecosystem for decentralized finance and different blockchain-powered functions.

This inflow of capital bolsters Solana’s aggressive edge. It establishes it as a formidable alternative for tasks searching for pace, scalability, and low-cost transactions. Solana’s efficiency effectivity has been more and more engaging in a market the place Ethereum’s charges and transaction occasions can current obstacles.

This capital influx not solely raises liquidity throughout the ecosystem, but in addition helps the rising maturity of its infrastructure. It additionally incentivizes each current tasks and new developments to contemplate Solana as their most well-liked platform.

Advantages for Solana’s DeFi and NFT tasks

The influx of liquidity straight enhances the event and attractiveness of DeFi and NFT tasks, areas that proceed to display sturdy development. Fairly a number of tasks are set to achieve profit – Marinade Finance, a liquid staking protocol, and Orca, a user-friendly decentralized change, to call a number of. These tasks achieve rapid entry to larger liquidity.

New tasks are additionally positioning themselves on Solana, profiting from the chain’s interoperability and improved liquidity. As an example, Solend, a decentralized lending protocol, reported larger participation charges with new collateral choices that enchantment to customers from different chains.

Latest partnerships and platform expansions by protocols like Jupiter Aggregator, which mixture liquidity throughout decentralized exchanges, have additional capitalized on the latest inflow to enhance person expertise and transaction effectivity.

On the NFT aspect, Solana’s phantom pockets and marketplaces like Magic Eden have welcomed contemporary capital to assist creators and collectors. The ecosystem’s momentum additionally attracts consideration to area of interest NFT tasks, akin to Tensor and Formfunction. These supply distinctive NFT buying and selling functionalities, catering to a rising demand for various digital belongings.

Moreover, cross-chain capabilities are a boon for NFT creators on Ethereum. They will now can entry Solana’s viewers with out leaving their Ethereum-originated tasks behind.

Tendencies in cross-chain interoperability and future development potential

The numerous motion of belongings highlights a broader development – Cross-chain interoperability. As blockchain networks search to handle scalability challenges and person demand for cost-effective options, cross-chain mechanisms are essential for development and resilience within the ecosystem.

Protocols like Wormhole and Allbridge, which facilitate asset transfers throughout chains, have seen better use as customers look to leverage alternatives in Solana’s low-fee and high-speed atmosphere.

Is Your Portfolio Inexperienced? Try the Solana Revenue Calculator

Going ahead, Solana’s rising integration with different blockchains, alongside its enchantment for high-throughput functions, would imply a powerful development trajectory.