Examining if Ethereum can rally past $3K as investor confidence rises

- ETH is repeating a well-known value motion sample, with a possible distribution section forward.

- Rising ETF holdings and realized cap trace at a shift in market dynamics.

Ethereum [ETH] seems to be repeating a well-known sample. Often, from earlier observations, altcoins’ value motion observe an accumulation-manipulation- distribution phases.

In the course of the earlier bullish run in November, ETH witnessed a 42% surge, adopted a brief time period of value consolidation.

Put up this, there was a last distribution section that noticed a consecutive 21% value rally, making an all-time excessive of $4.1K. The value degree holds because the all-time as much as day.

Zooming all the way down to the day by day chart, historical past seems to be repeating itself.

For the reason that latest breakout from the bullish flag again on the eighth of Might, costs surged by the same proportion (42%) and gave the impression to be at a consolidation section throughout press time.

Might the same distribution section observe for a possible 21% rally-most probably previous the $3K milestone value?

Supply: TradingView

Notably, the stochastic RSI, a momentum indicator that follows value motion primarily based on latest highs and lows, was approaching the oversold zone at press time — a area that might flash breakout indicators.

No assure, however this setup extends a hand to credibility of a possible rally in ETH’s value.

ETH capital inflow suggests mounting confidence

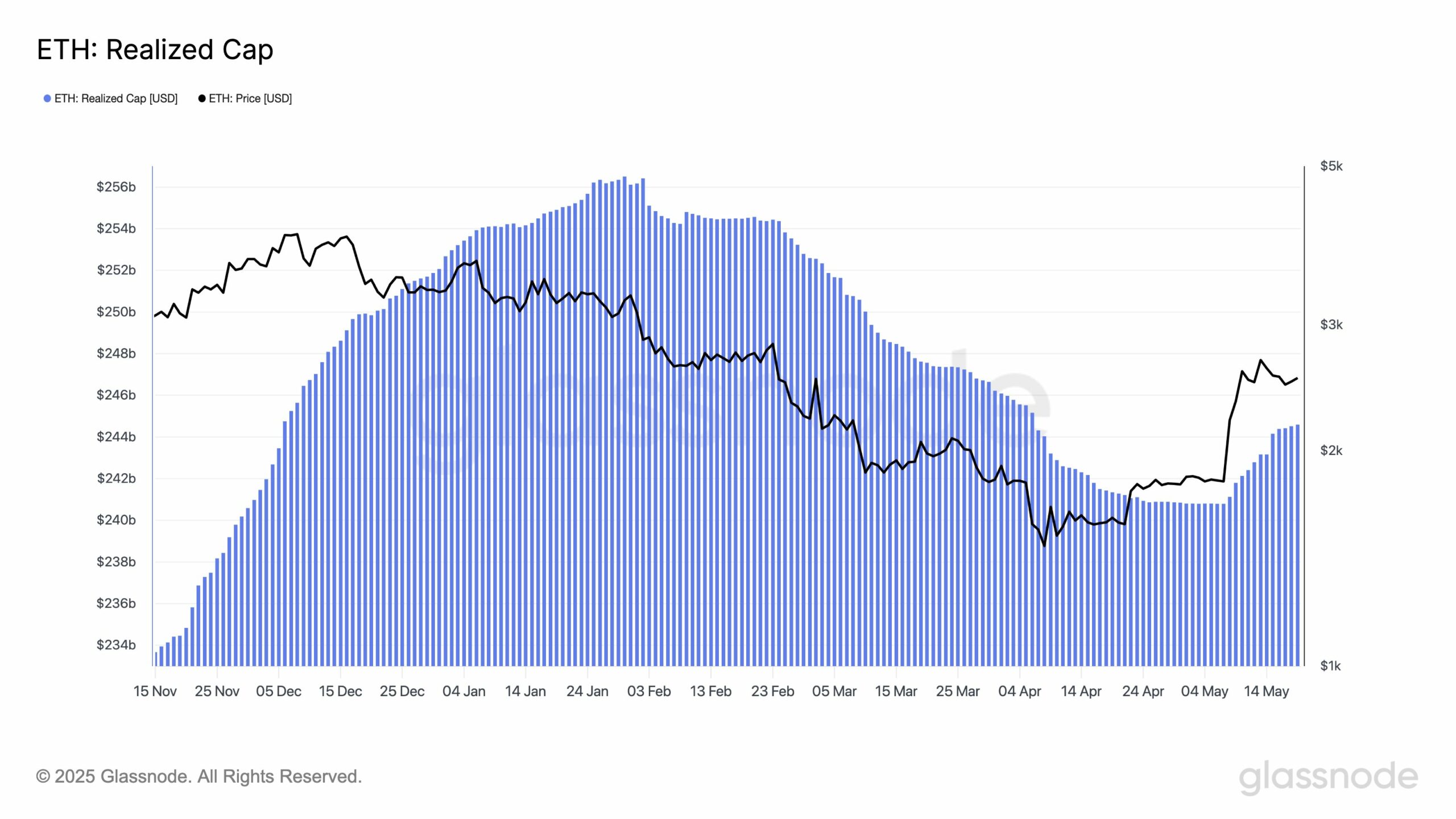

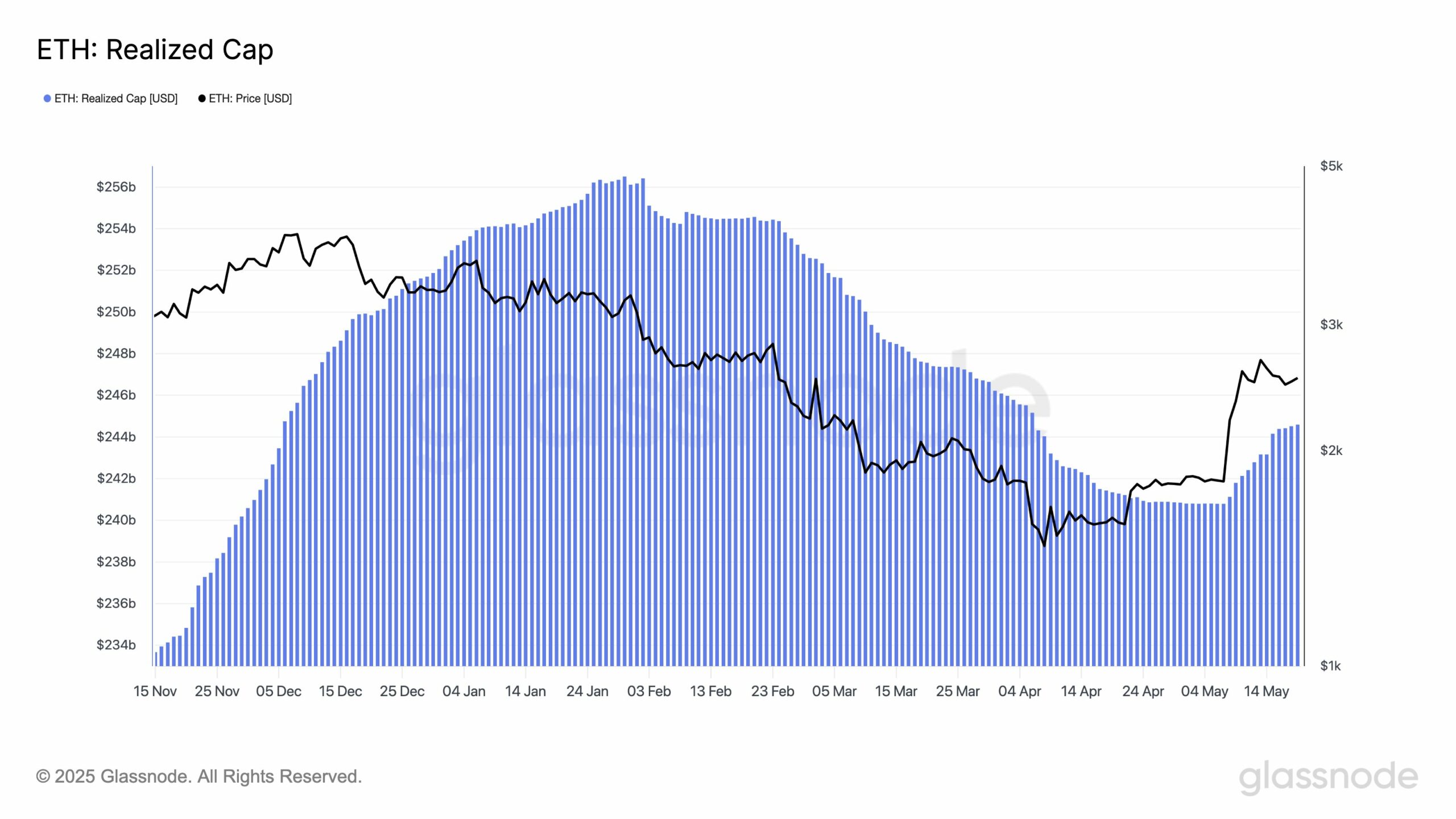

Focusing our analytical lens on on-chain metrics, Ethereum’s realized capital, which mirrors the whole worth of all ETH on the value they have been final transferred — has elevated considerably in Might.

It moved from $240.8 billion on the seventh of Might to $244.6 billion on the nineteenth of Might.

The $3.8 billion increase is an indication of elevated conviction amongst holders and suggests an inflow of latest capital.

Supply: Glassnode

This sort of fast surge sometimes signifies much less promoting strain, as extra traders are holding ETH at increased values. It implies that Ethereum is just not solely being traded, however held for the long run.

The surge tends to solidify the bottom for a possible bullish rally as implied by the technical indicators bullish bias.

ETF holdings are gaining momentum

Institutional gamers are making strikes as nicely. Based on AMBCrypto’s evaluation of CryptoQuant information, ETH ETF holdings are growing quickly, pointing to a renewed investor curiosity.

With spot ETH ETFs gaining momentum after Bitcoin ETF approvals, bigger capital inflow could quickly observe.

These holdings sometimes mirror institutional sentiment and the rising pattern means that establishments are regularly warming as much as ETH’s long-term prospects.

Supply: CryptoQuant

With restored technical momentum, extra realized capital inflow and a rising ETF publicity, Ethereum’s foundations look higher. If present traits persist, the trail to $3,000 is just not distant.

The projected goal at $3.3K is inside ETH radars.