$50B and counting: Why Strategy’s Bitcoin buying suddenly looks urgent

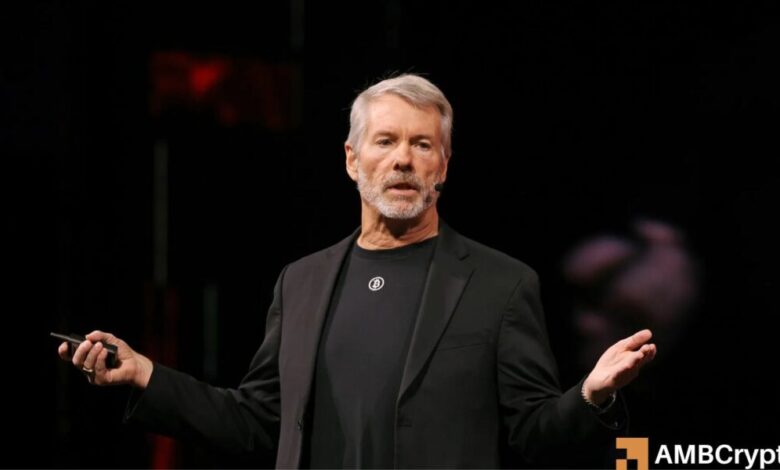

Michael Saylor’s newest aggressive Bitcoin purchases have left analysts with extra hypothesis than stable solutions.

On the fifteenth of December, the agency bought 10.6K BTC, price over $980 million. Final week, it acquired $962 million in Bitcoin.

This translated to roughly $2 billion in Bitcoin [BTC] scoops in simply two weeks, and Technique’s cumulative funding within the crypto formally crossed $50 billion.

Supply: X

So, why go all in regardless of the pending menace of MSCI index exclusion and potential outflows? Why scale BTC buys should you might be compelled to liquidate them if mNAV slips under 1x?

In response to analysts, Saylor was positioning for one thing greater.

Michael Saylor’s new Bitcoin guess

In actual fact, the tempo of accumulation of about 10K BTC per week signalled a “sense of urgency,” famous one analyst, Peter Duan. He posed,

“MSTR slamming the ATM with $2B of frequent shares in two weeks feels much less like routine funding and extra like a way of urgency. One thing mega bullish is likely to be coming.”

The daring guess? A Bitcoin financial institution or structured BTC-backed lending applications with established banks like JPMorgan, in response to analyst Hermes Lux.

Lux added,

That is the principle cause Saylor is so closely shopping for these previous two weeks, which is able to seemingly proceed by way of the rest of the 12 months at >10k BTC per week for so long as potential.”

He concluded,

“The extra BTC $MSTR owns, the higher this works for the banks, and the extra income can be generated by Technique.”

Lux famous that banks are already getting ready for this forward of the passage of the crypto market construction invoice by early 2026. In response to him, the MSTR inventory would be the internet beneficiary.

Supply: X

Effectively, this was not far-fetched. Saylor just lately said that loaning BTC to banks can be the ‘endgame’ and the ‘largest alternative.’

“I feel the massive concept, massive alternative and end-game is that we are going to attain some extent the place main banks will mean you can deposit the BTC they usually’ll provide you with 500-700 foundation factors of yield towards it.”

He floated the same concept in the course of the Bitcoin MENA convention.

Critics warn of MSTR dilution

The current BTC purchases have been largely funded by the sale of MSTR inventory. In actual fact, for the newest bid, Technique bought $888 million price of MSTR shares and $82 million of STRD most popular shares to purchase BTC.

Some supported the agency’s aggressive transfer to accumulate as a lot BTC as potential in the course of the present correction. Nevertheless, critics slammed the agency for the MSTR inventory dilution.

Bart Mol, an analyst, posed,

“What’s the purpose of issuing frequent inventory when mNAV is at greatest at 1.14? Hoping we’ve seen the underside and Bitcoin rises within the coming months? In the meantime, regular shareholders are getting diluted into oblivion.”

Supply: Technique

That mentioned, MSTR inventory dropped 8.14% after the replace at closed at $162 on Monday. The decline additionally adopted BTC’s weakening by 2% to $85k.

Closing Ideas

- Saylor’s shopping for spree highlighted how conviction-driven methods can reshape each steadiness sheets and market expectations.

- Whether or not this tempo alerts preparation for a brand new institutional use case, or just amplifies threat, stays unsure.