Exec – Bitcoin’s post halving prediction could see BTC’s price hit $200K

- Bitcoin’s 2024 halving is fueling divided sentiment proper now

- Anthony Scaramucci believes in BTC’s adoption curve and potential as a mainstream asset

The D-day is lastly right here – Bitcoin’s [BTC] 2024 halving. Regardless of the joy, nevertheless, the eagerly anticipated occasion has left its viewers divided into two camps – Those that count on main corrections and those that count on BTC to hike by +10x.

Sentiment round Bitcoin has been particularly divided over the previous week or two on the again of the crypto’s topsy-turvy motion on the charts. On the time of writing, as an example, it was valued at simply over $62,000. This, inside 6 hours of Bitcoin falling beneath $60,000 on the again of geopolitical tensions between Israel and Iran.

Exterior of its worth motion although, the query stays – Is Bitcoin a secure haven?

Anthony Scaramucci’s bullish viewpoint

Shedding gentle on BTC’s atypical worth actions, Anthony Scaramucci, Founding father of SkyBridge Capital, in a latest interview with CNBC mentioned,

“Bitcoin is on an adoption curve.”

He added,

“You gained’t see this inflation hedge, or a retailer of worth as different pundits are saying till you recover from a billion customers. So, proper now it’s gonna be far more unstable than the individuals like.”

With this angle, Scaramucci then tried to counsel that folks will understand Bitcoin as a risk-on or a risk-off asset till it reaches a sure stage of adoption.

Bitcoin’s provide and demand expectations

As anticipated, Bitcoin’s halving has sparked contrasting expectations of a supply-demand shift, which clashes with latest tendencies. Relatively than a surge in promoting stress, miners are reportedly easing outflows. This sudden growth suggests a possible short-term market enhance, difficult typical predictions and introducing a singular angle to the halving narrative.

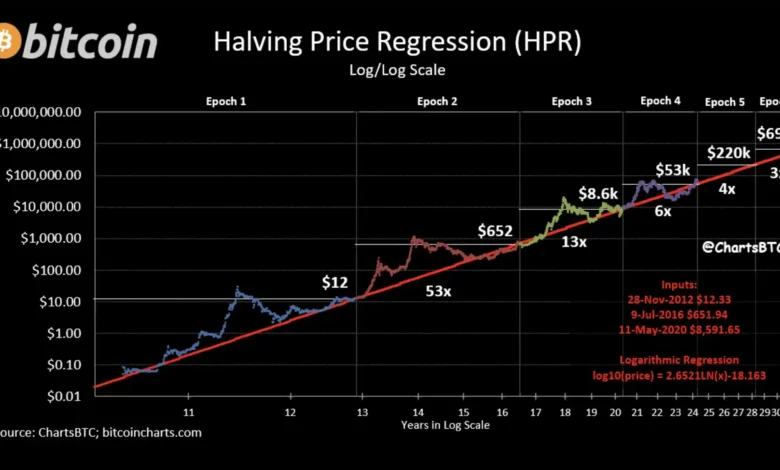

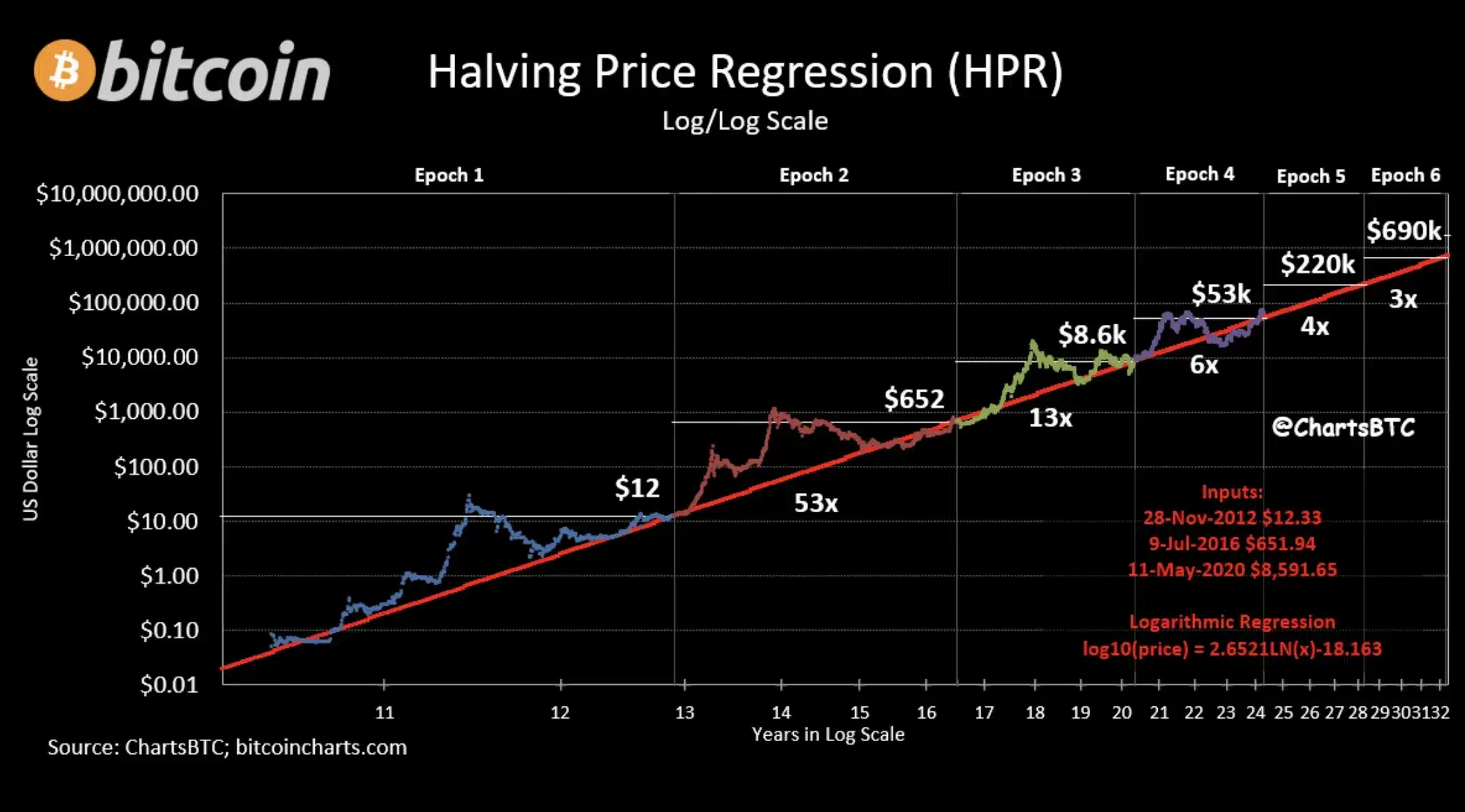

Historic knowledge, as highlighted by @ChartBTC, can be utilized to display Bitcoin’s worth surges following previous halving occasions.

Supply: Twitter/ChartsBTC

Remarking on the identical, Anthony Pompliano, Pomp Investments founder and associate, in a latest conversation with CNBC, claimed,

“Ignore the noise of short-term worth actions.”

That being mentioned, Bitcoin can by no means go too far-off with constructive sentiments, with critics like Peter Schiff believing,

“All week Bitcoin pumpers made excuses for Bitcoin’s selloff on Sat. They claimed that since all different markets had been closed, Bitcoin was the one asset anybody may promote. Effectively, all of the markets are buying and selling now and Bitcoin is getting killed once more. Bitcoin pumpers are out of excuses.”

Bitcoin’s future outlook

In conclusion, regardless of issues about Bitcoin, Scaramucci foresees BTC turning into a mainstream portfolio asset, probably rivalling gold’s market capitalization.

Ergo, whereas acknowledging short-term worth fluctuations because of exterior elements like wars, he maintained a long-term bullish perspective on BTC.

“Bitcoin worth may hit round $200k.”