Fantom network grows: A sign of FTM’s incoming price rally?

- Fantom’s worth examined key ranges, with elevated community exercise signaling potential restoration.

- Market sentiment confirmed optimism as bullish liquidations and technical indicators hinted at a reversal.

Fantom [FTM], buying and selling at $0.7934 at press time with a 2.16% drop previously 24 hours, continued to spark curiosity regardless of its present downtrend.

Latest community knowledge confirmed elevated exercise, elevating the query: May this mark the start of a worth reversal?

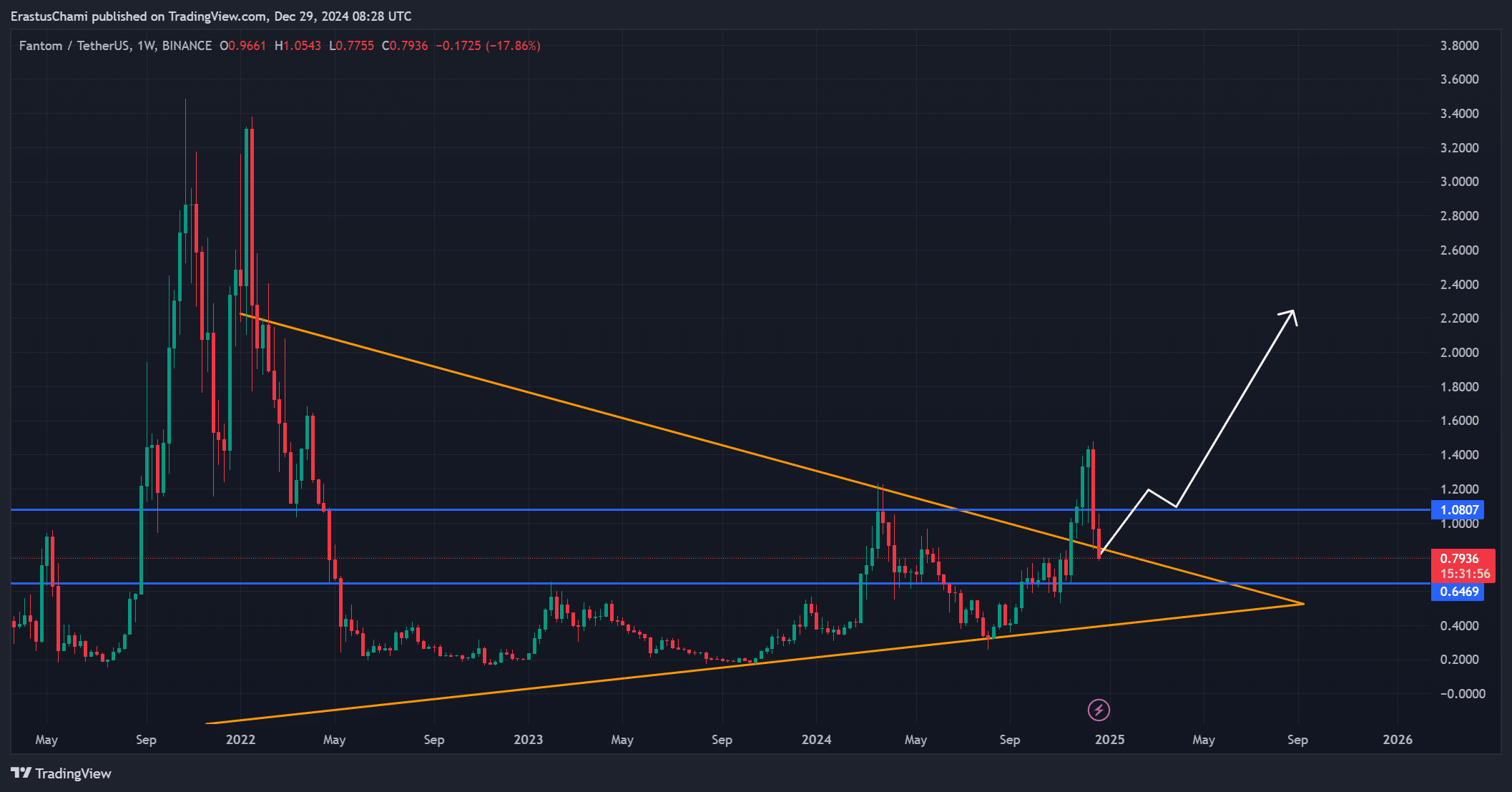

Can FTM break away from its present vary?

FTM’s worth remained inside a decent vary, with vital assist at $0.7316 and resistance at $0.9671. A breakout above this resistance might push the value towards $1.08, a stage with important psychological significance.

Nonetheless, failure to carry the present assist might result in additional losses. The descending triangle sample seen on the charts suggests a significant worth transfer could also be imminent.

Due to this fact, the subsequent few buying and selling classes might decide FTM’s short-term trajectory.

Supply: TradingView

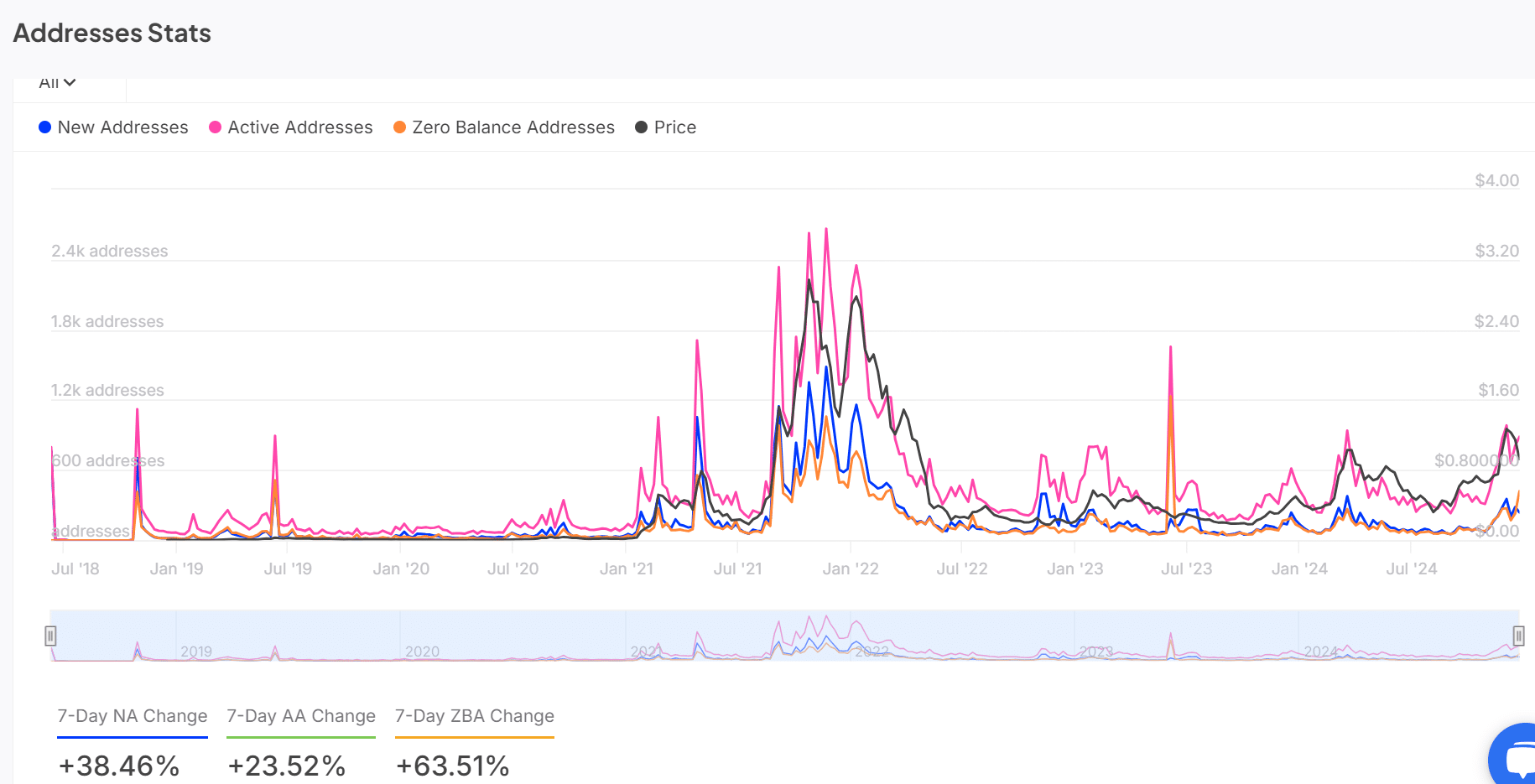

Is community exercise hinting at a bullish future?

Fantom’s blockchain exercise surged at press time, with new addresses rising by 38.46%, lively addresses rising by 23.52%, and nil stability addresses rising by 63.51% previously week.

This enhance mirrored rising curiosity and participation within the ecosystem, which might bolster FTM’s long-term worth.

Nonetheless, whereas these numbers seemed promising, constant progress might be important to sustaining bullish momentum. Due to this fact, community exercise stays a key indicator to look at.

Supply: IntoTheBlock

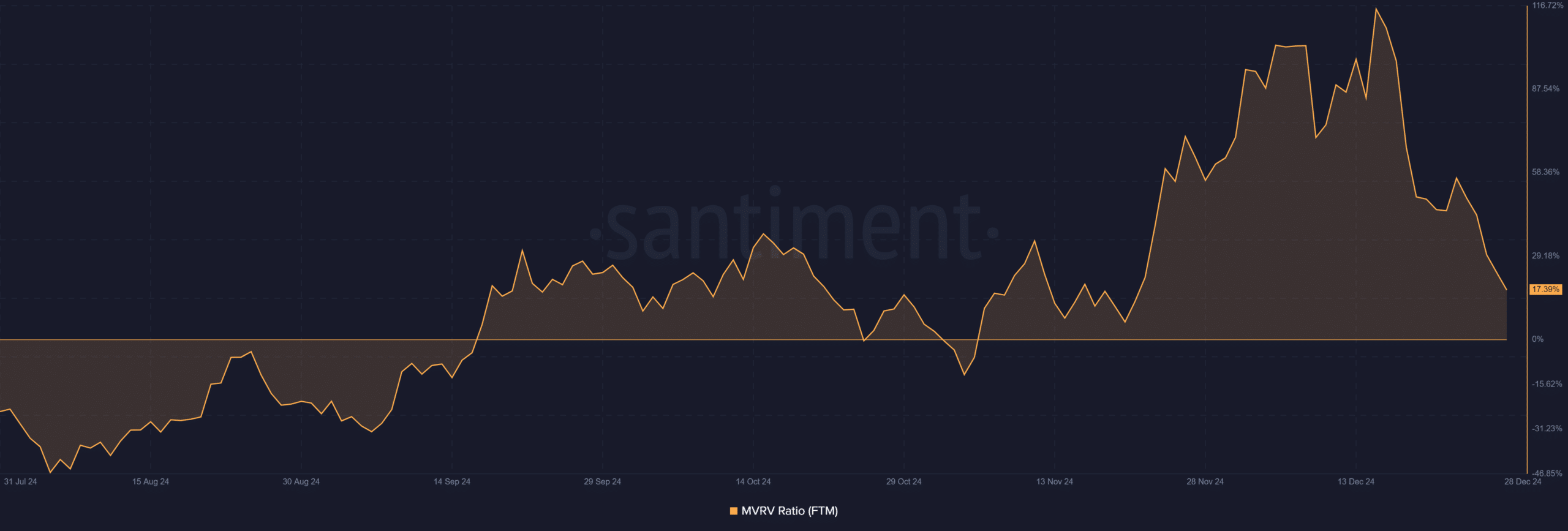

MVRV ratio alerts potential undervaluation

The Market Worth to Realized Worth (MVRV) ratio has dropped to 17.39%, highlighting diminished profitability for FTM holders.

Traditionally, such declines have preceded important worth strikes, as they typically sign undervaluation.

This might appeal to consumers trying to capitalize on discounted costs. Nonetheless, persistent promoting strain might additionally push costs decrease. Merchants ought to monitor sentiment intently to gauge the market’s subsequent transfer.

Supply: Santiment

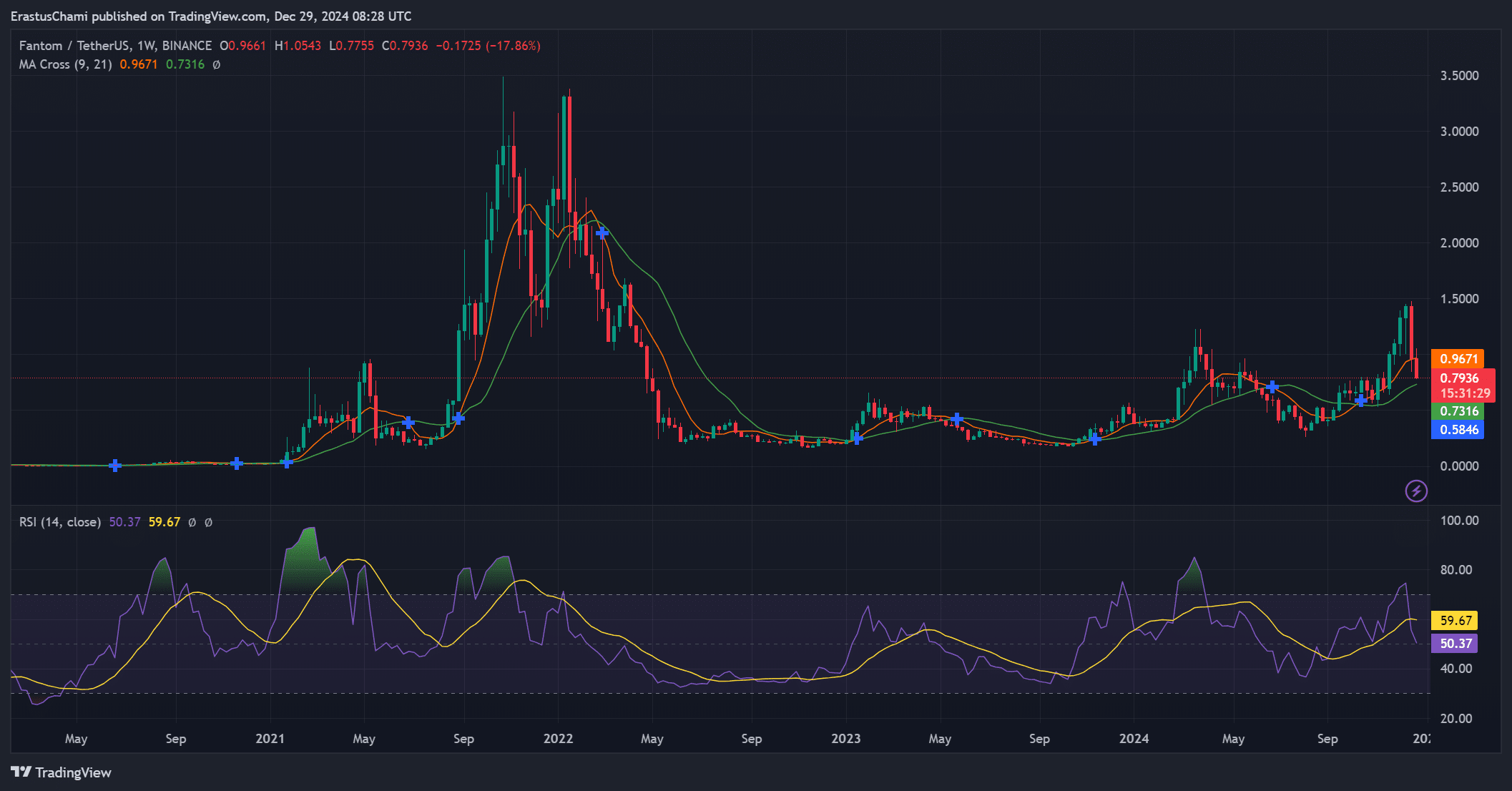

Are technical indicators flashing a reversal sign?

The Relative Power Index (RSI), at 50.37 indicated impartial momentum at press time, with a slight tilt towards bullish restoration.

In the meantime, the shifting common cross recommended potential volatility, because the short-term common approached the long-term common.

Due to this fact, these indicators level to a possible turning level for FTM’s worth, making the upcoming days essential for merchants.

Supply: TradingView

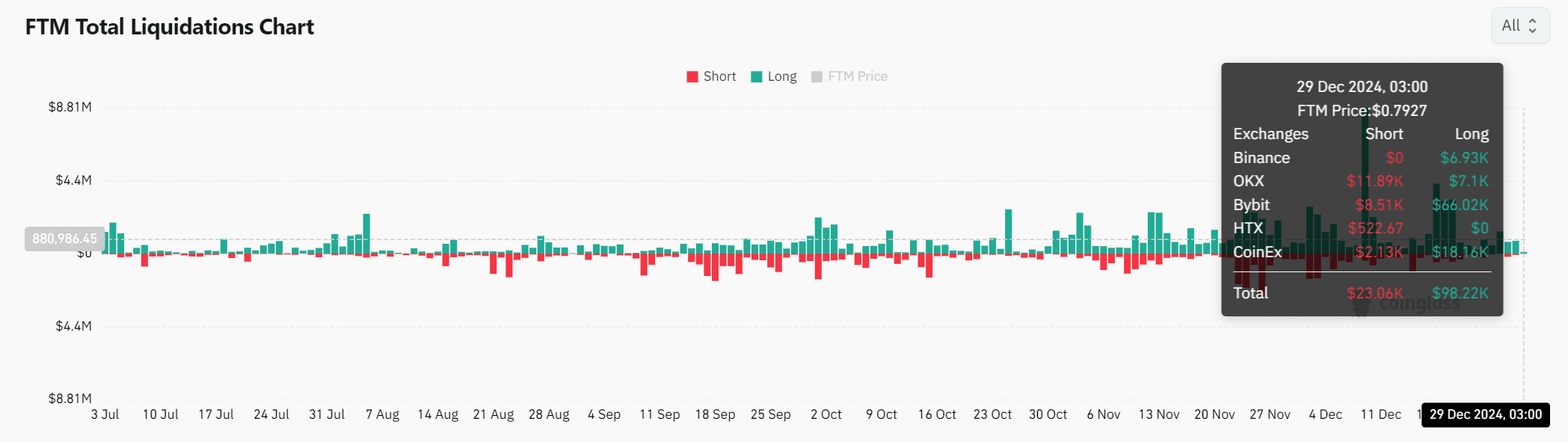

Liquidations counsel merchants stay optimistic

Liquidation traits present $23.06K in shorts towards $98.22K in longs, revealing bullish sentiment regardless of latest declines. This imbalance means that many merchants are positioning for an upward worth motion.

Nonetheless, exterior market forces might nonetheless weigh on FTM’s efficiency. Due to this fact, liquidation knowledge needs to be analyzed alongside different metrics for a extra complete view.

Supply: Coinglass

Learn Fantom’s [FTM] Worth Prediction 2024-25

Fantom’s rising community exercise, alongside bullish liquidation traits and technical alerts, suggests the potential for a worth restoration.

Nonetheless, the declining MVRV ratio and resistance ranges should be fastidiously monitored. If FTM sustains its community progress and breaks key ranges, a rally might materialize within the coming weeks.