Fantom’s sell-off escalates with 52% losses – Are more incoming?

- Fantom appeared to have a strongly bearish construction on the every day chart

- OBV slipped under November lows whereas the subsequent downward value goal was at $0.5

On the time of writing, Fantom [FTM], quickly to be rebranded to Sonic, had a bearish outlook on the technical evaluation entrance. Its value motion has been intensely bearish over the previous month. Actually, it has famous 52.6% losses in simply 26 days.

FTM will see a 1:1 token swap on Binance to the brand new Sonic token S. The strategic plan to introduce Sonic as a brand new layer-1 blockchain, promising 10,000 transactions a second, may bolster demand for the token within the coming weeks.

Fantom costs preserve tumbling decrease

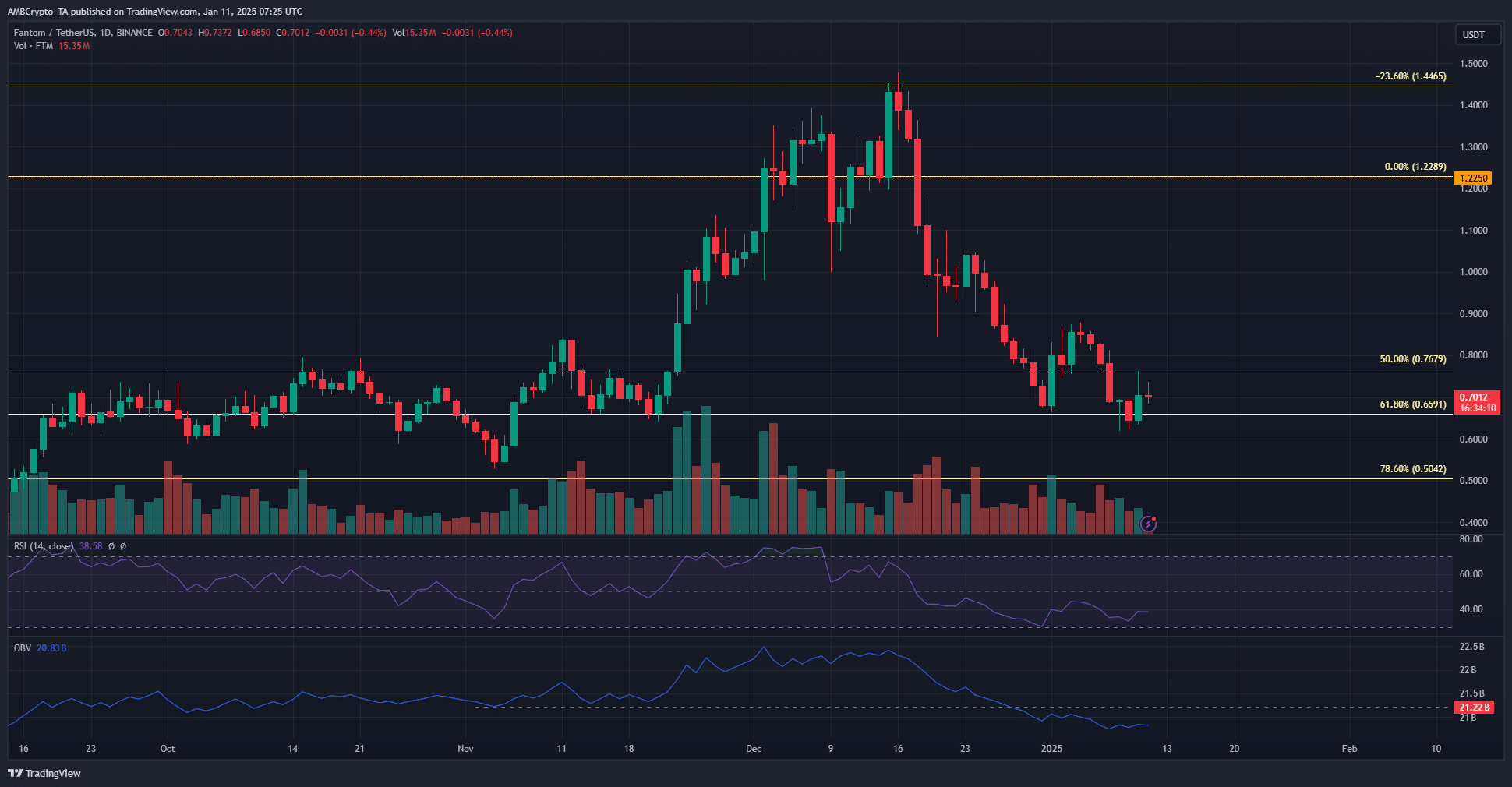

Supply: FTM/USDT on TradingView

The preliminary FTM rejection from the $1.44-level occurred on 16 December. Two days later, Bitcoin [BTC] shed 5.6% on the again of bearish information from the U.S FOMC assembly. This accelerated FTM bulls’ woes.

The 61.8% Fibonacci retracement degree at $0.659 provided some respite in the direction of the tip of December, however the sellers had been too robust. Over the past two weeks, they’ve pressured one other new decrease low, persevering with the downward pattern for Fantom.

The RSI has been under impartial 50 for practically a month now, showcasing agency bearish momentum. Extra worryingly, the OBV slipped under November’s lows. This mirrored monumental promoting stress available in the market.

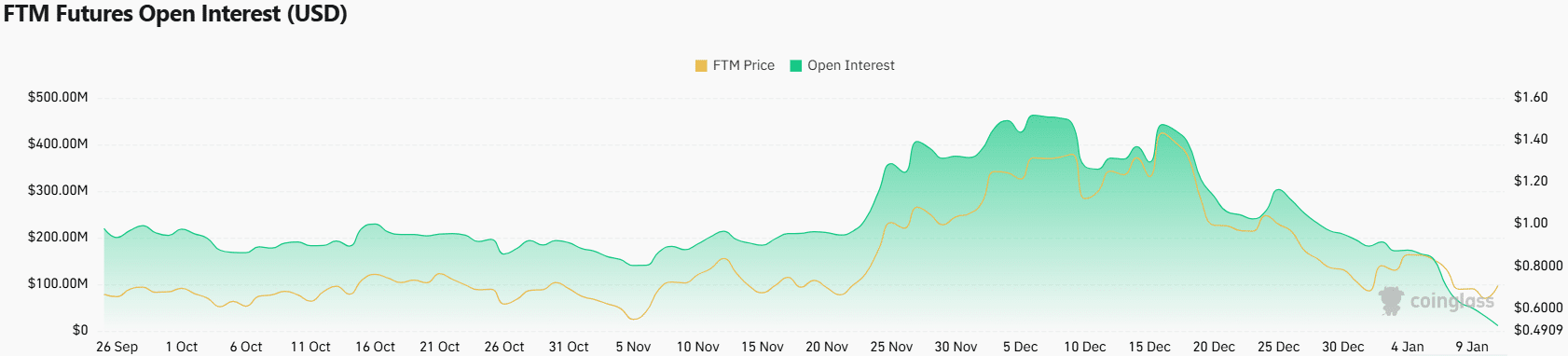

Open Curiosity slides to new lows

Supply: Coinglass

It was not solely the OBV that made new lows. The Open Curiosity additionally hit ranges not seen in two years. Collectively, they underlined excessive promoting stress on the token. Nevertheless, the token swap from FTM to S may clarify a few of these losses.

Learn Fantom’s [FTM] Value Prediction 2025-26

Because of the swap, merchants could be opting to exit their positions. Exchanges have additionally introduced plans to delist FTM and open Sonic buying and selling pairs. This, mixed with the general bearish market sentiment, may clarify the drop in OI and demand.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion