Fartcoin sees 8.5M token sell-off, yet $1 may be closer than you think

- FARTCOIN has defied broader market promoting with triple-digit month-to-month positive factors.

- As deep pockets understand earnings, is the $1 mark in peril?

Fartcoin [FARTCOIN] continues to dominate the weekly top-performers chart. Nevertheless, its momentum has cooled from triple-digit to double-digit positive factors. This deceleration suggests that giant holders could also be realizing earnings, particularly after the memecoin reclaimed the $0.98 stage on the eleventh of April.

On-chain data from Lookonchain helps this commentary. Over the previous two days, whale wallets have offloaded roughly 8.5 million FARTCOIN tokens. At this key provide zone, this is able to roughly account for $8.33 million in sell-off worth.

As Fartcoin approaches the psychologically vital $1 stage, these sizable sell-offs may restrict the rally, probably creating robust overhead resistance within the $0.80 — $0.98 vary.

However can the memecoin defy broader market odds as soon as once more?

A technical and on-chain breakdown

On the month-to-month timeframe, FARTCOIN has posted a staggering 239.14% acquire, positioning it as the highest performer.

Consequently, the memecoin has managed to sidestep main drawdowns, suggesting that capital rotation in periods of high-FUD might have funneled liquidity into speculative high-beta performs like FARTCOIN. Therefore, giving it a definite relative energy benefit.

Past pure value motion, the basics are displaying momentum as properly. Adoption metrics have exploded, with the variety of complete addresses rising by 146.20% year-to-date, now totaling 408,377.

Supply: Glassnode

Out of those, addresses holding over 10,000 tokens have rebounded to late-March ranges, with 5,125 wallets presently on this bracket. Mathematically, this cohort holds a minimal of 51.25 million FARTCOIN tokens.

Nevertheless, regardless of the sturdy metrics, warning is warranted. Whale offloads, coupled with an RSI sitting deep in overbought territory, recommend that the memecoin could also be approaching a technical overextension. An excessive amount of, too quickly, maybe?

Is FARTCOIN overbought or overvalued? – The important thing differentiator is…

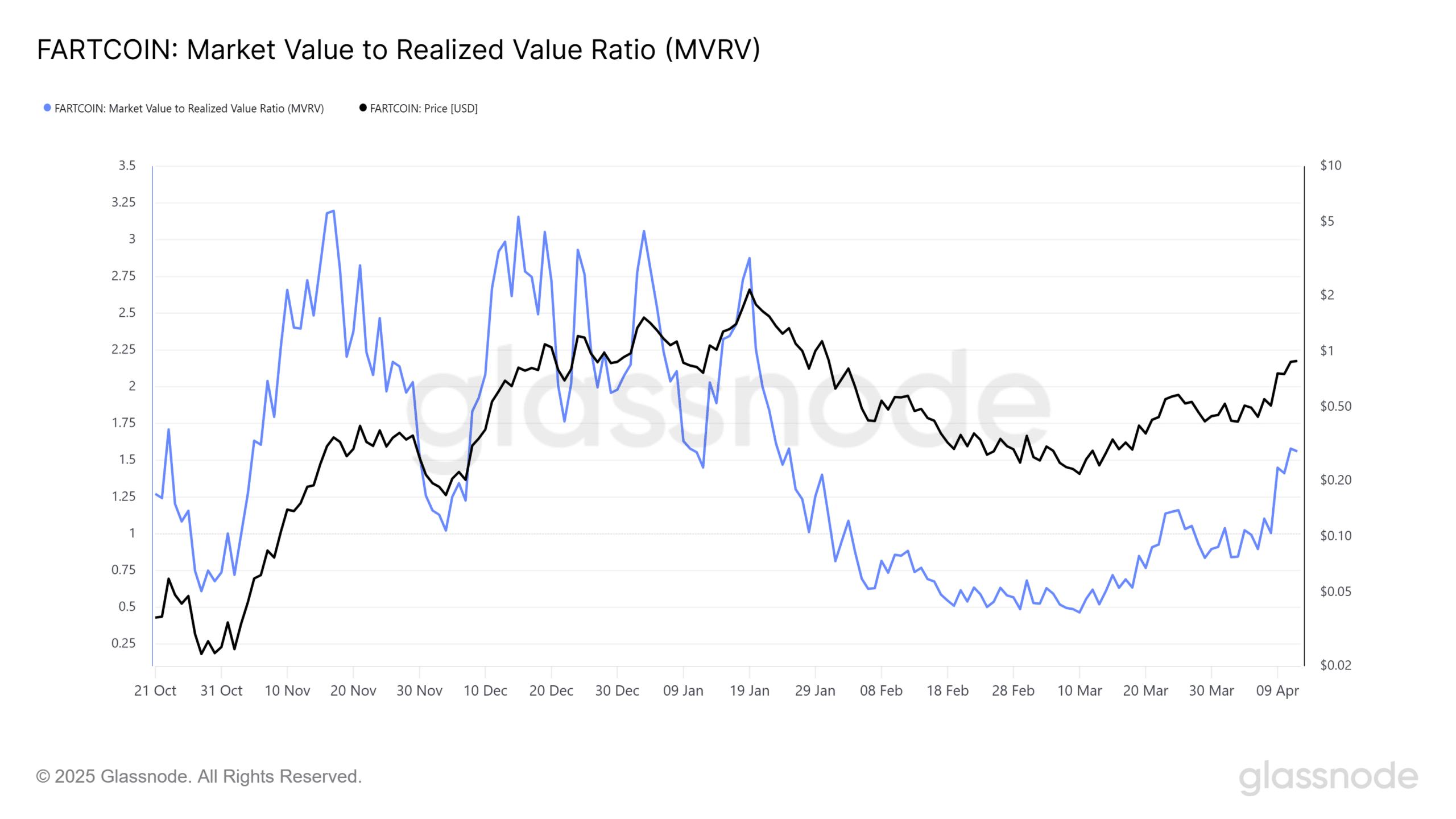

The Market Worth to Realized Worth ratio (MVRV) compares the present value of a coin to the common value at which it final moved. A ratio above 3.0 typically indicators overvaluation.

At press time, FARTCOIN’s MVRV ratio stood at 1.50, displaying a bullish divergence. In contrast to previous market tops the place the ratio spiked above 3 close to $1, this means the coin isn’t overvalued but.

Supply: Glassnode

Nevertheless, whereas not overvalued, FARTCOIN might face a technical pullback.

The share of provide in revenue has soared previous 85%, a stage final seen throughout the mid-January rally. Coupled with a persistently elevated LTH NUPL within the euphoria phase, the stage is ready for potential profit-taking by long-term holders.

But, the shortage of overvaluation indicators that market confidence in FARTCOIN stays sturdy. This implies that any pullback would doubtless be short-lived, with broader upside potential nonetheless in play.

Given FARTCOIN’s strong fundamentals, liquidity grabs in periods of excessive FUD, and an MVRV ratio that doesn’t sign overvaluation, this presents a novel alternative.

Because of this, the $1 mark could be nearer than many anticipate.