FARTCOIN’s rally sees warning signs! – Why are traders pulling back?

- Fartcoin dropped 6.93% after a 550% rally, triggering warning amongst merchants.

- Social mentions and dominance plummeted, weakening the memecoin’s viral momentum.

Fartcoin [FARTCOIN] has recorded a powerful 550% rally over the previous two months, capturing consideration throughout the crypto market. Nevertheless, current knowledge developments now invite nearer scrutiny.

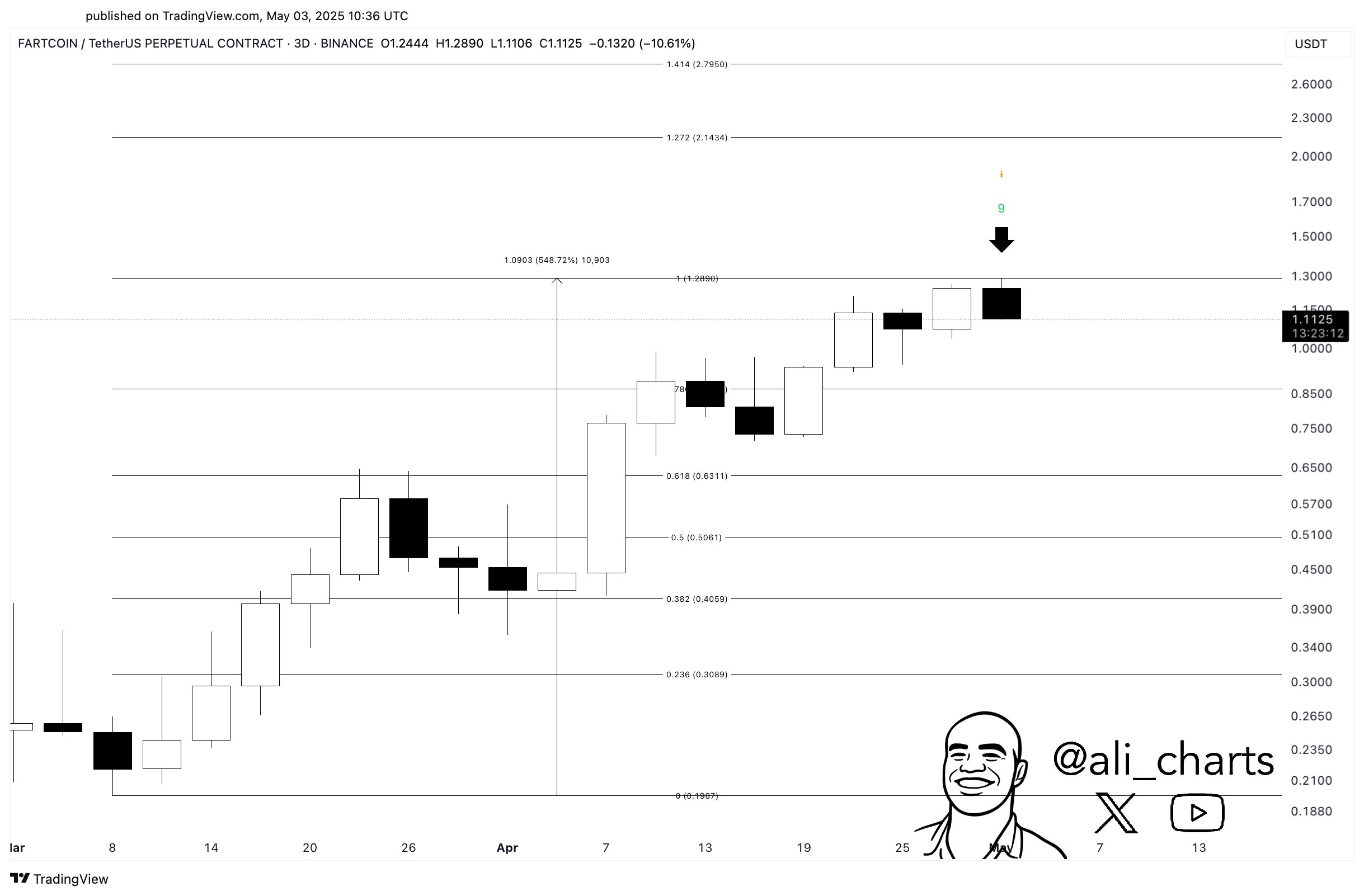

The TD Sequential indicator has printed a 9-count promote sign on the 3-day chart, a sample that usually precedes native tops and short-term corrections.

Supply: X/Ali Charts

At press time, Fartcoin traded at $1.11, down 6.93% up to now 24 hours.

As merchants reassess their positions, a number of market alerts might form the coin’s subsequent directional transfer.

Is fading hype killing Fartcoin’s momentum?

The emotional temperature surrounding Fartcoin is cooling quickly.

In response to Santiment knowledge, Weighted Sentiment dropped into adverse territory at -0.126 on the time of writing. This drop pointed to rising concern overtaking earlier greed — a basic signal of waning confidence.

After all, such sentiment shifts usually foreshadow corrections.

As bullish urge for food cools, many members start pulling again. Actually, Fartcoin’s social traction mirrored this drop in confidence.

Supply: Santiment

Social engagement round Fartcoin has additionally taken a notable hit, suggesting that retail pleasure is fading.

On the time of writing, Social Quantity dropped to simply 13 mentions whereas Social Dominance fell to 0.186%, marking one of many lowest engagement factors for the reason that uptrend started.

This decline in visibility and dialog highlights a discount in speculative consideration, which had beforehand fueled a lot of the token’s momentum.

As memecoins rely closely on viral buzz and herd psychology, fading social metrics weaken the rally’s basis.

Are bulls shedding management of the market?

On the derivatives entrance, cracks widened.

The Lengthy Liquidations spiked to $619.16K, whereas shorts totaled solely $30.6K—indicating a large imbalance in dealer positioning.

This implies that overly leveraged bulls had been caught off guard by the current worth drop and had been pressured to exit positions quickly.

Liquidation cascades of this nature usually intensify volatility and create additional draw back danger.

Supply: CoinGlass

Spot market exercise reinforces the rising warning amongst Fartcoin members.

On the third of Might, web Change Outflows totaled practically half 1,000,000 {dollars}, with $955.70K leaving exchanges in opposition to $496.59K in inflows.

This motion signifies that holders could also be pulling funds to personal wallets, probably locking in income or bracing for market instability.

Giant outflows throughout downturns usually sign waning belief in short-term worth stability..

Can Fartcoin keep away from a deeper correction?

Contemplating the confluence of bearish sentiment, declining social engagement, web Change Outflows, and aggressive Lengthy Liquidations, Fartcoin seems more and more susceptible.

The current TD Sequential promote sign provides technical weight to the argument for a possible short-term correction. Though the broader development stays spectacular, these metrics recommend that momentum is weakening.

Except sentiment and exercise reverse sharply, Fartcoin may battle to keep up present ranges within the coming days. Subsequently, the chance of a deeper pullback now outweighs the possibility of speedy restoration.