FDUSD goes up, TUSD goes down: Unraveling Binance’s moves

- FDUSD’s rise got here at the price of TUSD after the latter’s zero-fee buying and selling program was eliminated.

- TUSD was nonetheless the fourth-largest stablecoin by market cap.

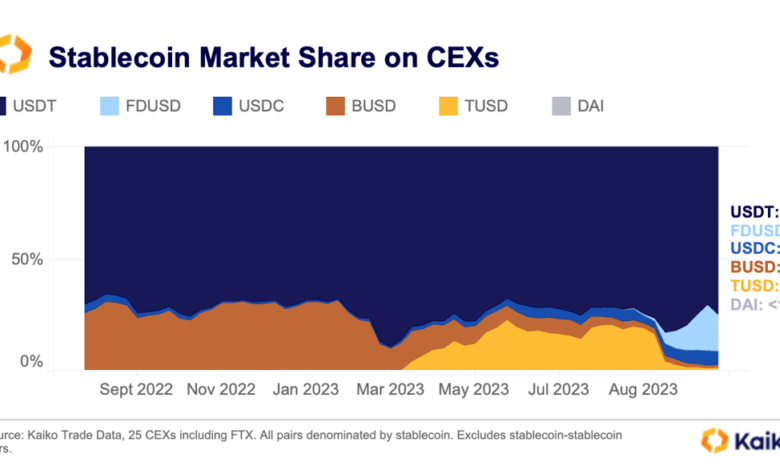

In a dramatic flip of occasions, three-month outdated First Digital USD [FDUSD] leapfrogged main gamers to grow to be the second-most traded stablecoin throughout centralized crypto exchanges (CEXes).

Based on crypto market knowledge supplier Kaiko, FDUSD’s market share spectacularly lifted to 16%, trailing market chief and largest stablecoin by market cap, Tether [USDT].

Supply: Kaiko

TUSD’s loss is FDUSD’s acquire

FDUSD is a 1:1 USD-backed stablecoin issued by Hong Kong-based First Digital Labs that debuted on Binance [BNB] in July. As fairly evident from the graph above, FDUSD’s rise coincided with the sharp fall in market share of one other stablecoin TrueUSD [TUSD].

TUSD was propped up by Binance in March following the downfall of Binance USD [BUSD] attributable to regulatory oversights. Binance started aggressively advertising and marketing TUSD, aided by its profitable zero-fee buying and selling program.

The promotional technique goals at boosting buying and selling exercise by waiving off maker and taker charges for particular buying and selling pairs. The gimmick paid off and TUSD’s market share expanded from 1% to 23% in a brief span of time.

Curiously, the vast majority of the quantity was generated from the BTC-TUSD pair.

Nonetheless, as issues turned out, Binance removed the zero-fee promotion for the aforementioned pair in early September.

Whereas a believable motive behind the transfer was not but clear, rumors of publicity to the bankrupt crypto custodian Prime Belief did the rounds for some time. TUSD’s stablecoin quantity share on CEXs has since plummeted to 1% as of this writing.

Across the similar time, FDUSD witnessed a pointy spike in buying and selling exercise. By the way, FDUSD was additionally promoted by Binance by way of its zero-fee program.

TUSD nonetheless had one thing to cheer about

Regardless of the stoop in buying and selling exercise, there wasn’t any noticeable fall in TUSD’s market cap. On the contrary, it noticed a marginal enhance of two.7% till press time, knowledge from Glassnode confirmed.

Furthermore, TUSD continued to carry on to its place because the fourth-largest stablecoin, with a market cap of $3.36 billion as of this writing.

Supply: Glassnode

It stays to be seen which approach the ever-evolving stablecoin panorama pivots from the present situation. Binance’s backing of FDUSD may go a great distance in cementing its place available in the market.

On the similar time, the hole in market capitalization between FDUSD and TUSD was big, and it might be unfair to model the previous because the latter’s alternative.