Fidelity seeks SEC nod to unlock staking on its Ethereum ETF – Could this boost crypto yields?

- Constancy is looking for the SEC’s permission for staking on its ETF ETFs

- ETF staking may supply an additional 3% yield to traders.

Constancy, by means of the CBOE alternate, has filed an software with the SEC, looking for permission on staking provision for its Ethereum [ETH] ETF product. This, after the same software by 21Shares and Grayscale in February, marking rising optimism round potential staking options in U.S spot ETH ETFs.

The merchandise launched final summer time now have about $7 billion in complete internet property simply locked in custody accounts.

These property may generate additional yield if staked – Delegating a part of ETH to validators to safe the blockchain community and reward them with further tokens.

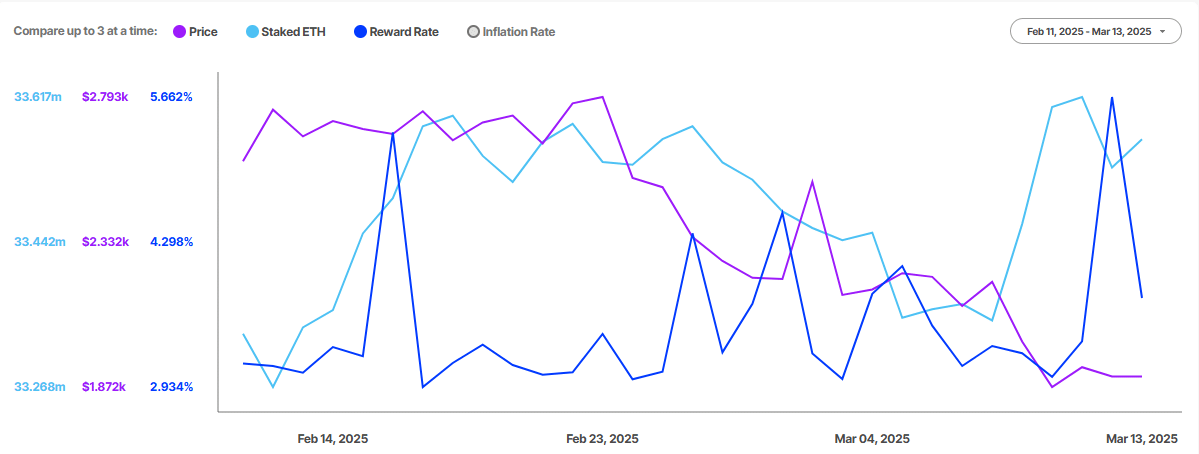

ETH staking rewards

Even Bitwise is mulling the same submitting within the U.S., stating that it could enhance investor returns. In a current Bloomberg interview, Matt Hougan, Bitwise CEO, stated,

“ETPs ought to stake. We’ve seen in Europe that staking ETPs work and assist enhance investor returns and enhance community safety.”

For his half, Etherealize founder Vivek Raman claimed that lack of staking “dampened” ETH ETF adoption. In line with the exec, ETH ETF staking,

“Can open up extra money, it could possibly open up a differentiated narrative round Ethereum.”

In line with Staking Rewards, staked ETH was attracting about 3.7% annualized returns as of press time. These additional rewards might be loved by traders and drive demand for the ETH ETF.

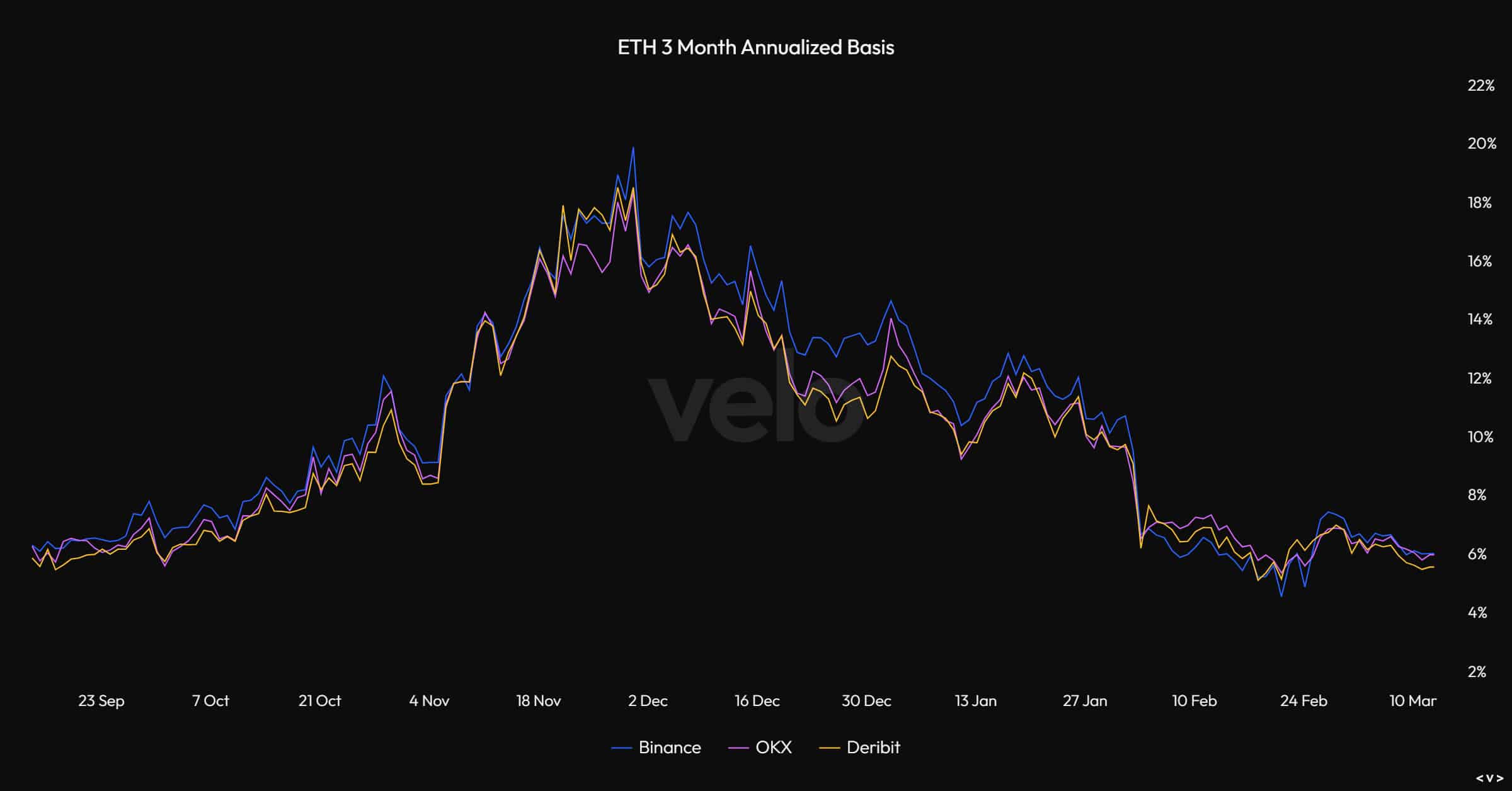

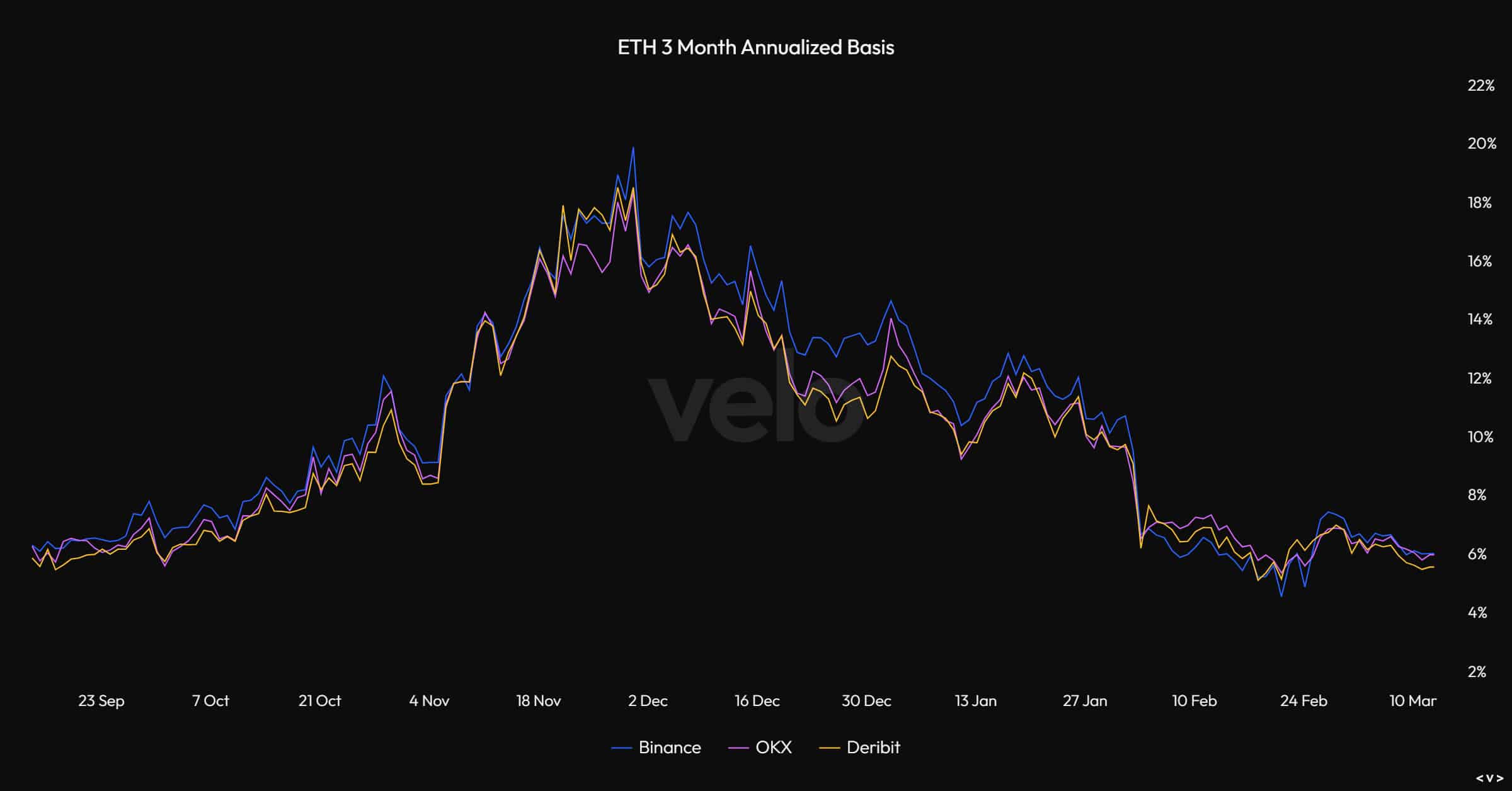

Proper now, the one yield that asset managers can capitalize on by means of the ETH ETFs is the CME Ethereum foundation commerce. It entails shopping for spot ETH ETF and opening a brief on the CME Futures to pocket the value distinction (yield or foundation).

Throughout final November’s uptrend, the CME ETH foundation commerce yielded almost 20%. That might be a whopping 23% yield if staking rewards had been included.

Supply: Velo

Nonetheless, resulting from broader weak sentiment, the CME foundation commerce had dropped to about 6% at press time. And but, this might collectively supply a couple of 9% yield for ETH ETF traders if staking returns are factored in.

In the meantime, ETH was valued at $1.88k on the time of writing, down 54% from its document highs of $4k. It stays to be seen whether or not ETF staking will enhance the altcoin’s worth or not.