Fidelity’s 64.9K ETH dump worth $213 million – Assessing its impact

- Constancy contributed to the weekly promote strain by offloading $213 million value of ETH

- A brief time period bullish aid might already be enjoying out

Ethereum [ETH] is perhaps about to get well after its newest rally, however a significant sale has solid some doubt on that risk. The truth is, an deal with belonging to Constancy has reportedly offloaded a big quantity of ETH.

A latest Lookonchain evaluation revealed that Constancy transferred 64,997 ETH to Coinbase. This occurred on Friday and the transferred ETH was reportedly value over $213 million. This switch occurred after a bearish week and after the cryptocurrency had already gone by a significant pullback through the week.

The switch from a personal pockets on to an change means that Constancy is offloading ETH. This occurred on the identical day as when Ethereum ETFs registered a complete of $159.4 million in web outflows. Unsurprisingly, Constancy’s FETH ETF had the very best quantity of outflows out of all Ethereum ETFs on Thursday at $147.7 million.

Is Constancy’s ETH sale a mirrored image of market sentiment?

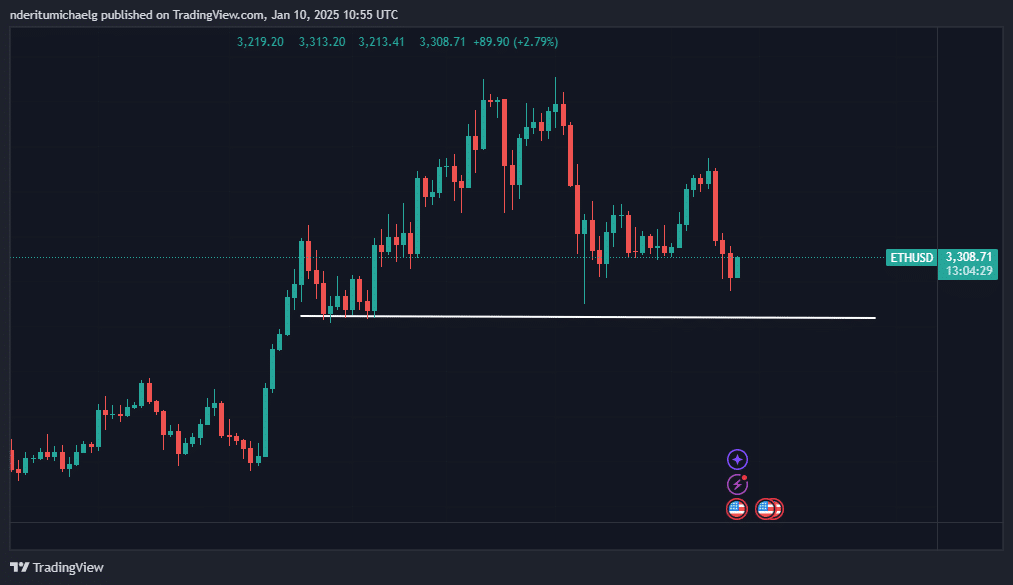

ETH has maintained web promote strain since Tuesday, and it maintained this development on Friday – Identical day as when Constancy transferred the aforementioned cash. This resulted in a 15.54% dip from its weekly excessive to a weekly low.

supply: TradingView

ETH was valued at $3,308 at press time, courtesy of a 2.89% uptick within the final 16 hours. This slight restoration prompt that demand made a comeback after Friday’s shut. Therefore, there was some accumulation after the weekly dip.

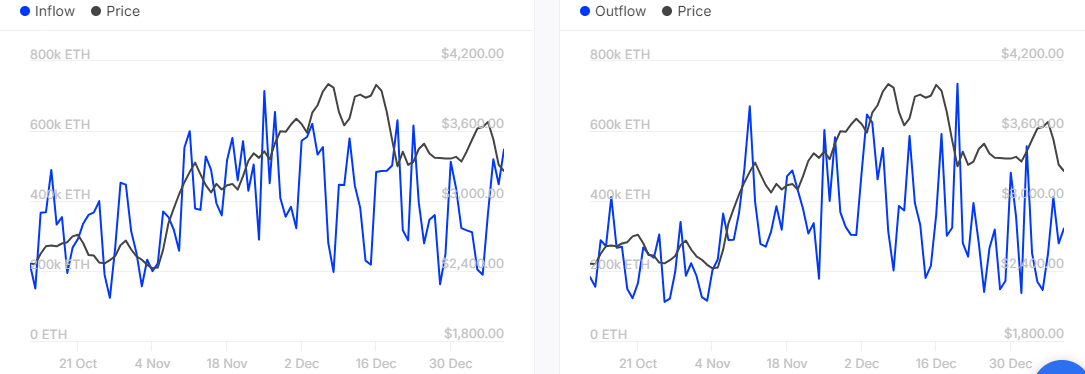

Nevertheless, can the cryptocurrency maintain this hike? That might rely upon the extent of demand and who’s shopping for. Onchain information confirmed that whales have been shopping for the newest dip. For instance, giant holder inflows clocked in at 547,230 ETH whereas giant holder outflows amounted to 321,650 ETH on 9 January.

Supply: IntoTheBlock

The surge in whale demand might set ETH up for a little bit of a weekend restoration. Even the change flows prompt that the cryptocurrency could also be ready the place demand possible makes a comeback.

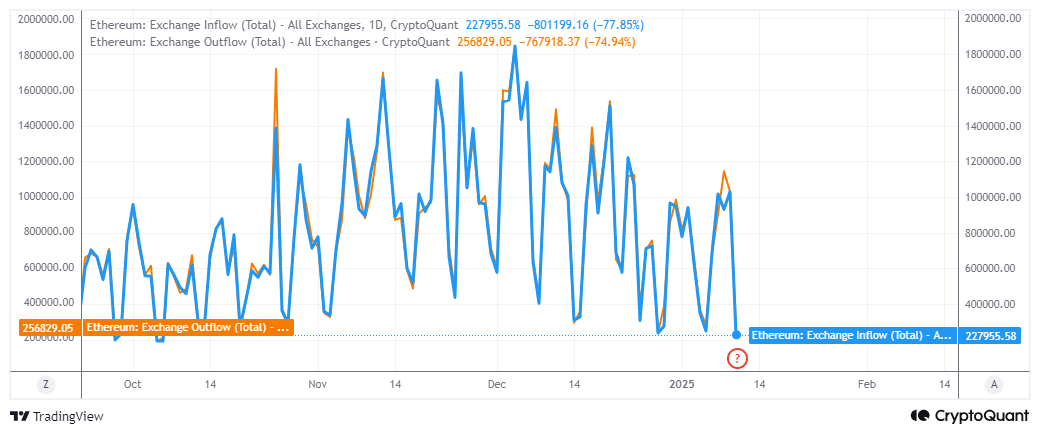

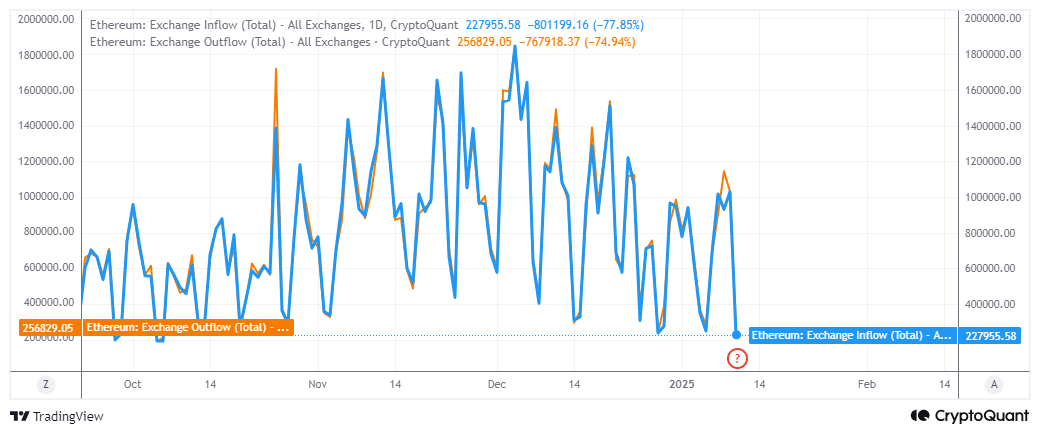

Change flows just lately dipped to ranges final seen in early November. Based on CryptoQuant, change outflows have been barely greater at 256,829.05 ETH, in comparison with 227,955.58 ETH, on the time of writing.

supply: CryptoQuant

Change movement information gave the impression to be consistent with the latest uptick and pointed in direction of the opportunity of a restoration rally. Nevertheless, traders ought to be weary of the opportunity of extra draw back.

The truth is, ETH’s day by day chart positioned the following main assist stage on the $3,033-price stage. Failure to safe sufficient demand at its press time stage would imply that ETH might probably capitulate to the aforementioned assist stage.