ATOM crypto up 6% in a day – THIS is why price needs to stay above $5

- ATOM crypto was up 6% in a day, with the worth chart exhibiting a break of the descending trendline.

- Its response on the $5 zone may decide its potential to proceed trending increased.

Cosmos [ATOM] achieved a 6% enhance in a day because it efficiently breached the declining trendline that appeared on its each day chart.

If bullish momentum maintains its tempo, ATOM may proceed trending increased because it did the final two days.

ATOM got here dangerously near the $5 resistance, which was important to be damaged for a bullish affirmation.

ATOM’s value exceeding $5 and establishing long-term place above present ranges may present potential for a rally, which may attain new resistance obstacles.

A failure to interrupt and maintain costs above $5 may make the bullish setup pointless and end in value rejection that might set off market decline.

A value motion to $4.30 stage could sign ATOM’s weak spot, which may set off decrease assist areas close to $4.

Supply: Buying and selling View

The MACD indicator displayed a weak bullish orientation from its histogram that was barely bearish from bullish.

The proximity of MACD to its sign strains indicated a risk of market stabilization earlier than rising with a definite pattern sample.

When ATOM exceeded the descending trendline it confirmed an evolving market momentum.

Value motion after the present juncture may most likely rely on the conduct of Cosmos, because it trades between important ranges at $4.30 and $5.

ATOM’s liquidation ranges

Extra evaluation confirmed the heatmap from Binance revealed excessive focus on the $4.87 stage, accompanied by a liquidation leverage of $233.23K.

These zones of excessive focus of liquidation actions signified an necessary space of curiosity.

The each day features created bigger liquidations within the areas round $4.87 and $5 thus suggesting value resistance potentialities.

Subsequently, lengthy liquidations zones shaped at $4.68 and $4.57 prompting key assist ranges.

Lengthy liquidations would possible happen if ATOM failed to take care of positions above these resistance ranges, which may end in heightened market fluctuations.

Alternatively, increased costs would see extra quick positions flushed.

Supply: Coinglass

ATOM wants to determine itself at $4.87 and $5 to find out whether or not it may have an uptrend.

A value rejection close to $5 may produce a correction, but a profitable break via this stage may sign additional upward value motion.

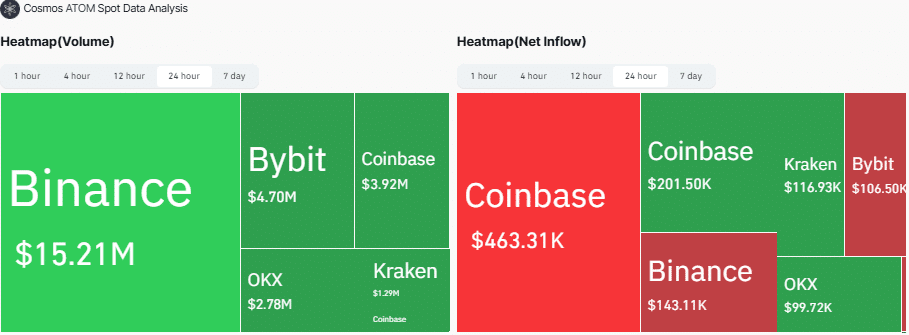

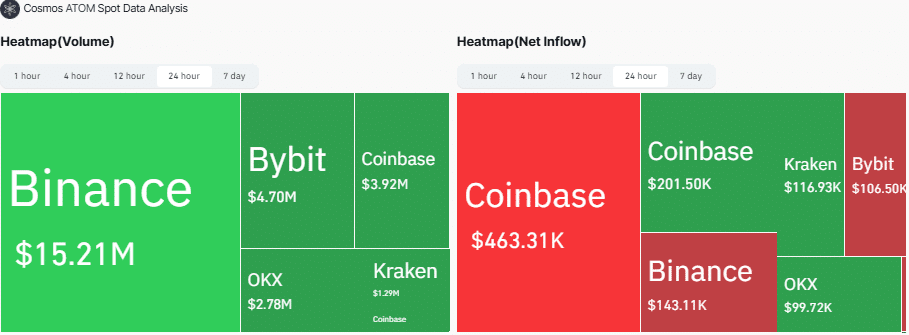

Quantity and netflow of spot trades

In the meantime, Binance maintained the very best ATOM spot quantity place at $15.21M, Bybit at $4.70M whereas Coinbase obtained $3.92M. The trade pairs of OKX and Kraken yielded $2.78M and $1.29M respectively.

Coinbase’s first account noticed a $463.31K outflow whereas Coinbase, Kraken and OKX maintained constructive inflows totaling $201.50K, $116.93K and $99.72K correspondingly.

Binance and Bybit noticed withdrawals price $143.11K and $106.50K into their platforms respectively.

Supply: Coinglass

The withdrawals may point out buyers taking earnings or redistributing funds, whereas the inflows prompt the exchanges nonetheless remained ready of gaining extra funds.

The surge in among the trade’s asset consumption confirmed indicators that ATOM may proceed rising in worth. If the platforms stored draining property, it may set off momentary downward stress on ATOM and different tokens.