From Banks To Hedge Funds

With anticipation round Bitcoin ETFs from giants like BlackRock, Constancy, and Invesco, and an anticipated halving in April 2024, forecasts for Bitcoin’s value subsequent yr present a major vary. From JPMorgan to Commonplace Chartered Financial institution, listed here are probably the most notable estimates for 2024:

Pantera Capital: $150,000

Of their August “Blockchain Letter”, Pantera Capital, led by Dan Morehead, predicts a potential rise to $147,843 publish the 2024 halving. Using the stock-to-flow (S2F) ratio, they consider the value mannequin suggests the valuation of Bitcoin towards its shortage will grow to be extra pronounced.

Particularly, Pantera Capital said, “The 2020 halving lowered the provision of latest bitcoins by 43% relative to the earlier halving. It had a 23% as huge an impression on value.” With historical past as a reference, this might point out a hike from $35k earlier than the halving to $148k after. Nevertheless, not all Bitcoin supporters are on board, having witnessed failed predictions based mostly on this mannequin within the current previous.

Commonplace Chartered Financial institution: $120,000

In a current analysis report from July, Commonplace Chartered Financial institution provided a bullish outlook on Bitcoin’s potential trajectory. The British multinational financial institution now expects Bitcoin’s worth to ascend to $50,000 by the tip of the present yr, with the potential to soar as excessive as $120,000 by the shut of 2024. This revised forecast from Commonplace Chartered marks a rise from their earlier April prediction, the place they projected a prime of $100,000 for Bitcoin.

The upward revision within the financial institution’s forecast is underpinned by a number of figuring out elements. Notably, one major purpose cited for the potential value escalation is the continued banking-sector disaster. Moreover, the report sheds gentle on the rising profitability for Bitcoin miners as a pivotal issue influencing the value trajectory. Geoff Kendrick, the pinnacle of FX and digital property analysis, emphasizes the instrumental function of miners. He notes, “The rationale right here is that, along with sustaining the Bitcoin ledger, miners play a key function in figuring out the web provide of newly mined BTC.”

JPMorgan: $45,000 Per Bitcoin

JPMorgan, one of many world’s main funding banks, anticipates a extra restrained development for Bitcoin, predicting an increase to $45,000. This forecast is influenced by the surging gold costs. Traditionally, Bitcoin and gold have proven correlation of their value actions, and with the gold value not too long ago surpassing the $2,000 mark per ounce, it has bolstered JPMorgan’s conservative outlook on Bitcoin.

In an in depth be aware from Could, JPMorgan strategists defined, “With the gold value rising above $2,000, the worth of gold held for funding functions outdoors central banks stands at about [$3 trillion]. Consequently, this means a Bitcoin value of $45,000, based mostly on the premise that BTC will obtain a standing akin to gold amongst non-public traders.”

Matrixport: $125,000 By Finish-2024

In July, Matrixport, a distinguished crypto companies supplier, predicted that Bitcoin’s value may surge to as excessive as $125,000 by the shut of 2024. This optimistic outlook was based mostly on historic value patterns and a major sign: Bitcoin’s current breach of $31,000 in mid-July, marking its highest stage in over a yr. Traditionally, such milestones have signaled the tip of bear markets and the start of strong bull markets.

By evaluating these patterns with historic knowledge from 2015, 2019, and 2020, Matrixport estimated potential positive aspects of as much as 123% inside twelve months and 310% inside eighteen months. This interprets to potential Bitcoin costs of $65,539 and $125,731 inside these respective timeframes.

Tim Draper: $250,000

Tim Draper, a distinguished enterprise capitalist, maintains a extremely bullish outlook on Bitcoin. Whereas his earlier prediction for Bitcoin to achieve $250,000 by June 2023 didn’t materialize, he stays optimistic concerning the cryptocurrency’s long-term potential. In a July interview on Bloomberg TV, Draper attributed current regulatory actions in the US, resembling these towards Coinbase and Binance, to BTC’s short-term downtrend.

Regardless of these challenges, Draper continues to consider in Bitcoin’s transformative energy and sees it probably reaching $250,000, albeit now probably by 2024 or 2025. His confidence in Bitcoin’s skill to revolutionize finance and retain its long-term worth stays unwavering.

Berenberg: $56,630 At Bitcoin Halving

The German funding financial institution Berenberg revised its prediction in July, pointing towards $56,630 by April 2024. This upward adjustment was supported by improved market sentiment attributed to the anticipation of the Bitcoin halving occasion anticipated in April 2024 and the rising curiosity exhibited by distinguished institutional gamers.

Berenberg’s group of analysts, led by the insightful Mark Palmer, emphasizes their expectation of serious appreciation in Bitcoin’s worth within the coming months. This projection is pushed by two key elements: the extremely anticipated Bitcoin halving occasion and the rising enthusiasm displayed by important establishments.

Highlighting their confidence out there, Berenberg additionally reaffirmed its purchase ranking on the inventory of Microstrategy. The financial institution has revised its share value goal for Microstrategy from $430 to $510, pushed by the next valuation of the corporate’s BTC holdings and an improved outlook for its software program enterprise.

Blockware Options: $400,000

Blockware Intelligence, in an analysis from August titled “2024 Halving Evaluation: Understanding Market Cycles and Alternatives Created by the Halving,” delved into the intriguing chance of Bitcoin’s value reaching $400,000 through the subsequent halving epoch, anticipated in 2024/25.

A central issue recognized within the analysis is the function of the halving in shaping Bitcoin’s market cycles. The report asserts that miners, accountable for a good portion of promote stress, obtain newly minted BTC, a lot of which they have to promote to cowl operational prices. Nevertheless, the halving occasions serve to weed out inefficient miners, resulting in lowered promote stress.

With provide diminishing because of halvings, the analysis emphasizes that demand turns into the first determinant of BTC’s market value. Historic knowledge signifies {that a} surge in demand usually follows halving occasions. Market members, outfitted with an understanding of the supply-side dynamics launched by halvings, put together to deploy capital on the first indicators of upward momentum, probably resulting in substantial value appreciation. This surge in demand is especially evident in present on-chain knowledge, validating the constructive sentiment surrounding halving occasions.

Past these notable forecasts, there are a plethora of different value predictions for BTC, starting from Cathie Wooden’s (ARK Make investments) formidable $1 million projection to Mike Novogratz’s (Galaxy Digital) $500,000, Tom Lee’s (Fundstrat International) $180,000, Robert Kiyosaki’s (Wealthy Dad Firm) $100,000, Adam Again’s $100,000, and Arthur Hayes’ $70,000 prediction, underscoring the various views on Bitcoin’s future worth.

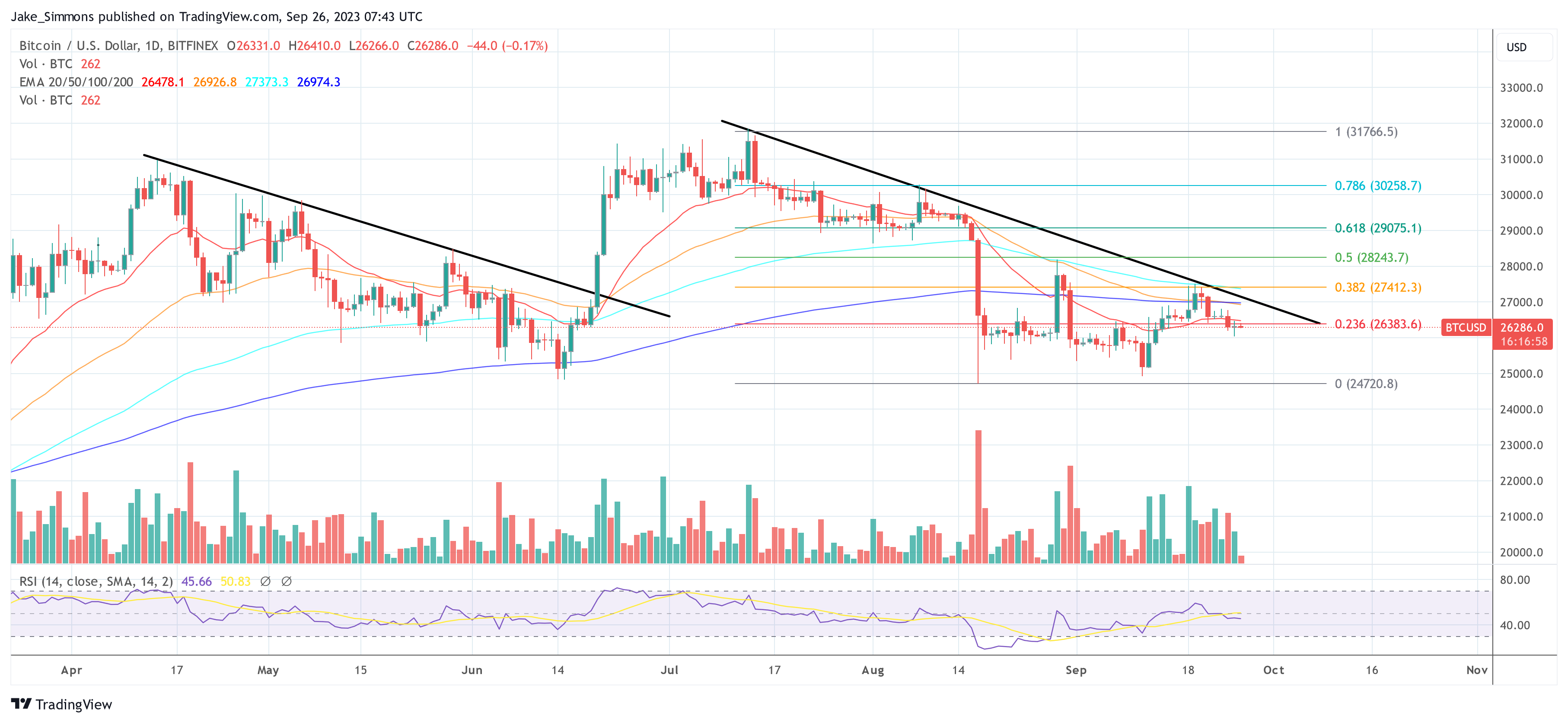

At press time, Bitcoin traded at $26,286.

Featured picture from Shutterstock, chart from TradingView.com