From Euphoria to Fear, Bitcoin is now a shadow of its former self

- Tightening liquidity and the fear about FTX’s liquidation precipitated Bitcoin fanatics to be cautious.

- A widespread sell-off may result in a worth enhance over time, evidenced by historic information.

For the primary time in nearly three months, Bitcoin [BTC] dropped beneath $25,000 as panic and uncertainty unfold all through the market.

How a lot are 1,10,100 BTCs value in the present day?

The coin, which initially proved to be one of many best-performing belongings of the 12 months, has now discovered itself struggling to meet up with the momentum of different digital currencies exterior the crypto market.

To be candid, the explanations usually are not far-fetched, and the analysis arm of Deutsche Digital Property did effectively to explain the grounds. Prime of the record was the anticipated liquidation of the remaining belongings of FTX.

Bitcoin strikes into bearish territory

Based on Deutsche, bearish sentiment has been solid throughout Bitcoin and the crypto market. The agency, in its report, additionally talked about that the press time sentiment was rather more beneath the optimism the market had throughout the constructive improvement of the ETF functions.

In its 11 September perception, Deutsche talked about,

“Final week, crypto belongings posted one other weak efficiency amid the anticipated liquidation of FTX’s crypto asset holdings.”

Recall that BlackRock’s progress on the Bitcoin ETF triggered the coin’s rise past $30,000. Though the BTC worth decreased considerably a number of weeks later, the Grayscale partial win over the U.S. SEC additionally pushed BTC above $28,000.

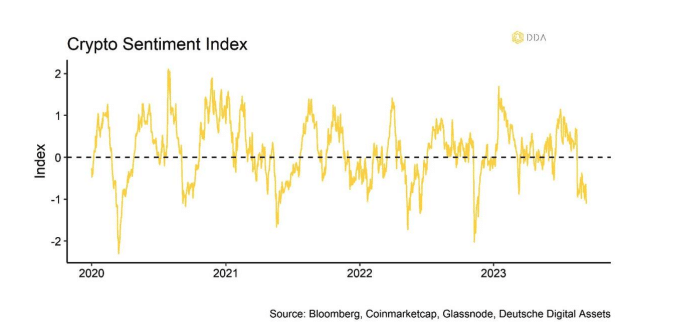

To defend its opinion of bearish dominance, the crypto belongings publicity supplier employed the crypto sentiment index. Much like the Bitcoin worry and greed index, the metric identifies the notion available in the market by contemplating asset flows, volatility, and actions taken by contributors.

On the time of writing, the index was within the worry area. Because of this a big a part of the market is pessimistic in regards to the short-term efficiency of BTC. Therefore, there’s a widespread restrain from shopping for BTC on the press time worth.

Supply: Deutsche Digital Property

Moreover, Deutsche defined that the drop in world Change Traded Merchandise (ETPs) flows. As one other signal of a transfer into bearish territory, the report famous that,

“The majority of the online outflows occurred inside Bitcoin and Ethereum funds (-72.5 mn USD and -12.8 mn USD, respectively).”

Not each enhance deserves applause

On the constructive aspect, Deutsche famous that the surge in Bitcoin energetic addresses was a welcome improvement. It additionally highlighted that many hedge funds had elevated their publicity to Bitcoin and different crypto belongings.

Nonetheless, BTC on-chain transfers had been at a really low level, which means macroliquidity was tightening. Subsequently, it’s doable for Bitcoin’s market cap to lower within the coming days. On the by-product aspect, Open curiosity appears to be choosing up once more.

Open curiosity is the entire variety of open futures contracts on the finish of a buying and selling day. When Open Curiosity will increase, it means liquidity within the derivatives market can also be rising. Conversely, a lower within the metric signifies a surge in contract closure.

Nonetheless, dealer Daan Crypto stated that the open curiosity after a squeeze might not be a very good signal for Bitcoin. Whereas referring to earlier comparable situations, Daan famous that BTC may go on a full retrace.

#Bitcoin Open Curiosity rising quickly once more after the squeeze.

This occurred as effectively throughout all of the earlier strikes up the place loads of positions got here in later, worth refused to maneuver, began turning and we went for a full retrace.

Not once more pls sirs. pic.twitter.com/PhI9ZapnrO

— Daan Crypto Trades (@DaanCrypto) September 12, 2023

Hope for BTC ultimately

However he additionally opined that the retracement might be prevented. Daan posted on X (previously Twitter) that BTC’s capacity to rise above $26,100 might be the catalyst the coin wants to flee retracement. His publish learn,

“My hope is that the truth that the transfer began throughout the Asia session, causes for a uncommon full trending day. Above 26.1 or so I feel we’d be protected from a full retrace for some time. Bulls received to maintain the momentum going whereas they received it on the decrease timeframes.”

Within the interim, CryptoQuant writer BaroVirtual elucidated that Bitcoin may return to its bull section quickly. Based on him, BTC was in an intense accumulation section, as indicated by the short-term holders (Spent Output Revenue Ratio) SOPR.

The SOPR indicator offers perception into macro market sentiment, profitability, and losses taken over a specific timeframe. It additionally displays the diploma of realized revenue or loss for all cash moved on-chain.

Usually, values of the SOPR higher than 1 indicate that holders are promoting at a revenue. However when the metric is destructive, it’s a signal of amassed losses by short-term holders.

Supply: CryptoQuant

Sensible or not, right here’s BTC’s market cap in ETH phrases

With the metric hovering across the destructive zone, BaroVirtual defined that it was much like the situation round Could to September 2021, March 2020, and October to December 2019.

He concluded that,

“The indicated intervals of the 155-day RoC destructive histogram coincide with bursts of brief liquidations (USD) of 1 pressure or one other, suggesting some sell-off at or close to the underside. After that, Bitcoin tends to extend in worth over time.”