FTX sells Solana – should investors be worried?

- SOL was down marginally over the past 24 hours.

- Solana’s quantity additionally dropped, whereas its RSI and MFI entered overbought zones.

Solana [SOL] has managed to take care of its place on the highest 10 listing for fairly a while. The token additionally capitalized on the latest bull rally, as its worth rallied in double digits over the past week.

Is your portfolio inexperienced? Take a look at the SOL Revenue Calculator

Nonetheless, FTX, the notorious crypto alternate that brought about huge havoc a number of months in the past, has transferred a considerable quantity of SOL within the latest previous.

FTX is promoting Solana

Solana has been forming very properly within the latest previous, due to the bullish market situation. Due to that, the token has carried out rather well and has managed to raise its worth by double digits within the final seven days.

In line with CoinMarketCap, SOL’s worth surged by greater than 12% over the past seven days.

On the time of writing, the token was buying and selling at $32.20 with a market capitalization of over $13.49 billion, making it the seventh-largest crypto. Whilst SOL’s weekly chat was inexperienced, the token’s latest developments advised a distinct story.

As per CoinMarketCap, SOL was down by over 0.2% over the past 24 hours. A doable cause behind this present worth drop may very well be resulting from an act from FTX. As per the most recent information, FTX transferred greater than 300,000 SOL tokens, which had been price over $10 million.

UPDATE:

FTX/Alameda transferred $19.4M property once more as we speak, together with:

309,185 $SOL($10M)

2.03M $BAND($3.15M)

3.82M $PERP($2.3M)

46.67M $TRU($1.78M)

4.39M $BICO($1M)

915,048 $KNC($686K)

5.47M $CVC($479K)

7,275 $BOND($30K)https://t.co/Pn82059rin pic.twitter.com/yukVPUEJt4— Lookonchain (@lookonchain) October 28, 2023

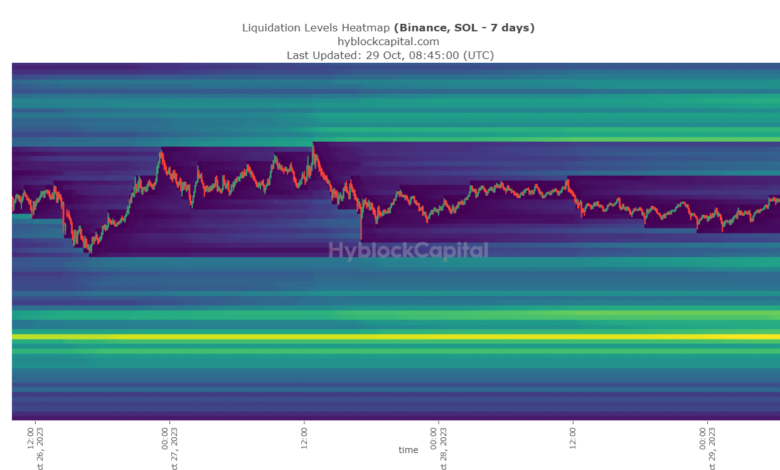

Although FTX transferred SOL, a take a look at Solana’s liquidity heatmap revealed that traders weren’t truly promoting the token. This was evident from SOL’s liquidation heatmap, offered by Hyblock Capital.

The final main liquidation occurred on 27 October, when SOL’s worth went over the $33 mark.

Supply: Hyblock Capital

Whereas Solana’s liquidation degree appeared secure, the identical can’t be stated for its efficiency on different fronts. SOL’s buying and selling quantity dropped considerably over the past week, that means that traders had been reluctant to commerce the token.

Due to the latest worth downtrend, Solana’s Worth Volatility 1w additionally plummeted over the previous few weeks. Nonetheless, SOL remained in demand within the futures market, which was evident from its inexperienced Binance Funding Price.

Supply: Santiment

Learn Solana’s [SOL] Worth Prediction 2023-24

Traders should follow warning

Like a lot of the aforementioned metrics, market indicators additionally remained bearish. For instance, SOL’s Relative Energy Index (RSI) was in overbought zones. This could enhance promoting strain and, in flip, drop the token’s worth additional.

Nonetheless, its Chaikin Cash Circulation (CMF) remained bullish because it registered an uptick within the latest previous.

Supply: TradingView