Is Bitcoin approaching a local top? – Traders, here’s what to expect

- Lengthy-term holders are trimming BTC positions, whereas short-term merchants journey momentum.

- Regardless of consolidation close to $102K, bullish sentiment holds.

After months of quiet perception, long-term holders are lastly beginning to trim their positions – simply as short-term merchants journey a wave of earnings sparked by Bitcoin’s [BTC] surge.

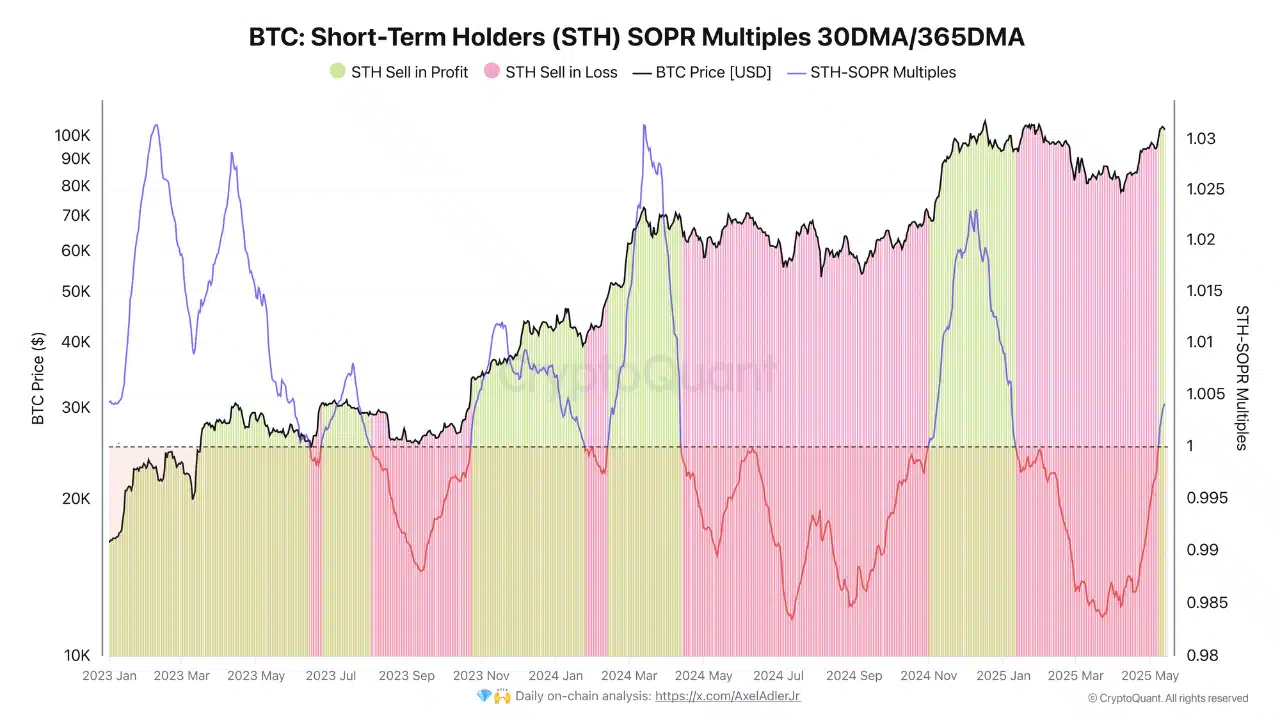

With BTC now effectively over the $100K mark, market momentum is simple. LTH spending is rising, STH SOPR stays above 1, and the broader temper feels bullish. However rising profit-taking may quickly check the market’s resilience.

Early indicators of distribution

After a steady accumulation phase that noticed LTH provide climb from 13.66 million BTC in mid-March to a peak of 14.29 million BTC, the pattern has quietly reversed.

Supply: Glassnode

Could has recorded two consecutive declines in long-term holder (LTH) provide, alongside an increase in LTH spending to 0.43—a major enhance.

These delicate shifts usually sign approaching native tops, as seasoned holders begin taking earnings earlier than broader market actions.

With Bitcoin now buying and selling above $100K, these inflection factors warrant shut monitoring.