GBTC’s discount to its Bitcoin funds narrows in October. What’s next?

- The low cost shrunk considerably on a year-to-date foundation.

- Authorized victories within the Grayscale vs. SEC episode introduced constructive sentiment.

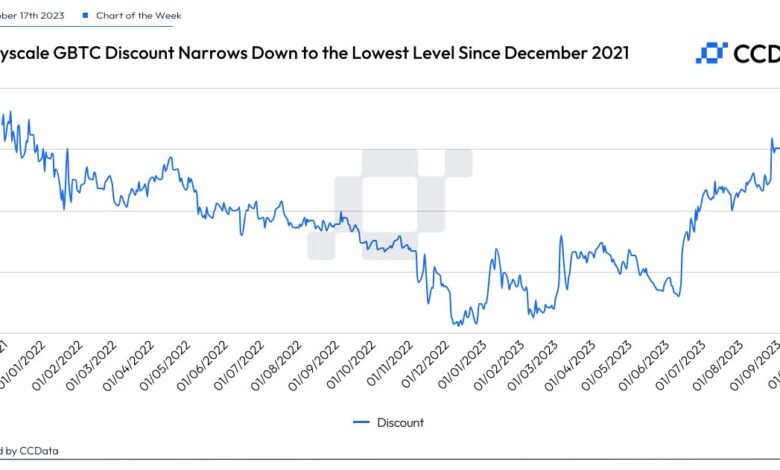

The world’s largest Bitcoin [BTC] fund, Grayscale Bitcoin Belief (GBTC), narrowed the low cost to its underlying holdings to its lowest degree in practically two years, in line with digital belongings information supplier CCData.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

GBTC will get nearer to underlying Bitcoin

Knowledge confirmed that the $15 billion market cap product’s low cost in opposition to its internet asset worth (NAV) dropped to 14.8% in October, the bottom since December 2021. This was a big enchancment on a year-to-date (YTD) foundation.

Supply: CCData

A fund’s low cost to NAV basically implies that the market worth of the fund’s shares have been buying and selling at a lower cost than the precise worth of the belongings held by the fund. Put merely, buyers have been shopping for one thing for lower than its value.

Sometimes, when the low cost narrows, it implies that buyers have been having a extra bullish view on GBTC.

As indicated above, low cost to the NAV had surged to about 50% late final yr and spent a lot of H1 2023 in a spread round 40%. Nevertheless, the final quarter marked a noticeable shift in sentiment.

A collection of constructive developments surrounding Grayscale Investments’ bid to rework the belief right into a spot Bitcoin ETF might clarify the reversal.

GBTC rides on authorized victories

Not like belief merchandise, which often deviate from the worth of their underlying belongings, a spot ETF maintains the fund’s worth in step with the asset worth.

Recall that the U.S. Securities and Trade Fee (SEC) rejected the applying final yr, citing non-compliance to investor safety requirements. Following this, Grayscale filed an enchantment asking for a evaluation of the regulator’s choice.

A court docket ruling earlier in August agreed with Grayscale’s arguments and directed the SEC to evaluation its choice. The decision spurred hopes of a conversion within the close to future, whereas additionally decreasing the low cost between GBTC and NVA.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

The constructive sentiment peaked after SEC determined to not enchantment in opposition to the decision.

Observing the developments, CCData mentioned,

“The low cost is more likely to proceed diminishing with the continued anticipation surrounding Grayscale’s case for the conversion of GBTC Belief into an ETF product.”