Bitcoin’s new rally in waiting? Unraveling 3 key signals

- Bitcoin’s 1M 25 Delta Skew fell to -6.1%, displaying increased demand for calls over places within the choices market.

- Whale Trade Stability Change dropped to -49.7K BTC over 30 days, confirming decrease sell-side strain.

Though Bitcoin [BTC] has struggled to maintain an upward momentum and continued to commerce beneath a straight consolidation channel, sentiment stays bullish.

The king coin continues to see robust demand from all market individuals.

Name choices surge

In accordance with Glassnode, Bitcoin’s 1M 25 Delta Skew has dropped to -6.1%, displaying name choices now carry increased implied volatility than places.

Supply: Glassnode

At current, 205,447.56 BTC are allotted to name choices—round 60% of the overall. Places account for simply 131,697 BTC, or 39%.

That imbalance exhibits a transparent directional bias.

When calls dominate like this, it usually displays robust upward conviction amongst market individuals.

CoinGlass information confirms this pattern. Merchants seem keen to pay a premium for upside publicity, positioning for a rally somewhat than hedging danger.

This construction sends a risk-on sign, supporting bullish continuation.

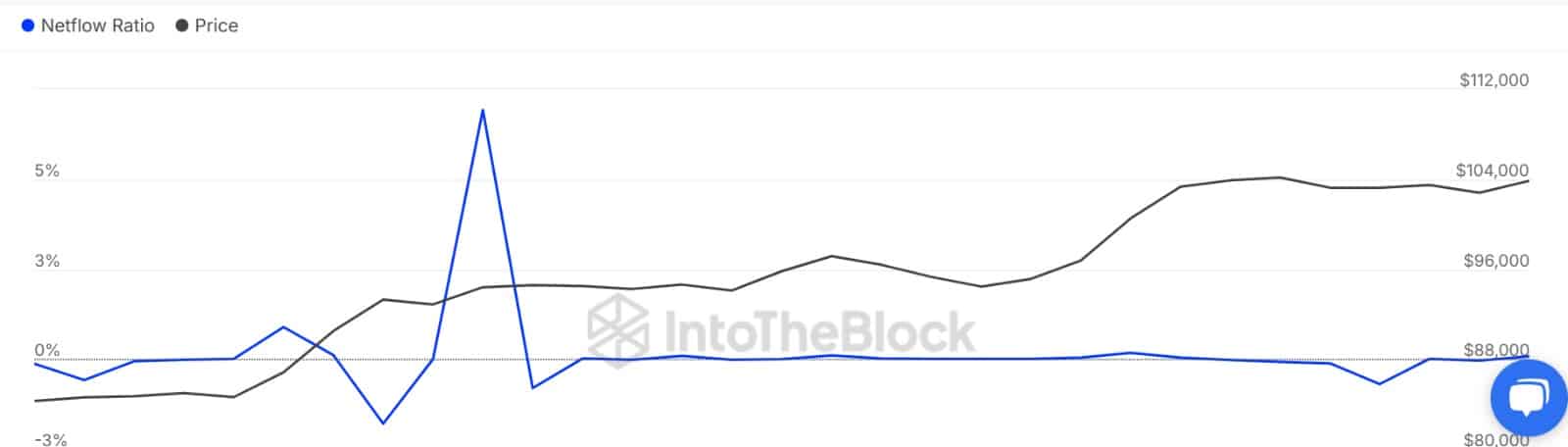

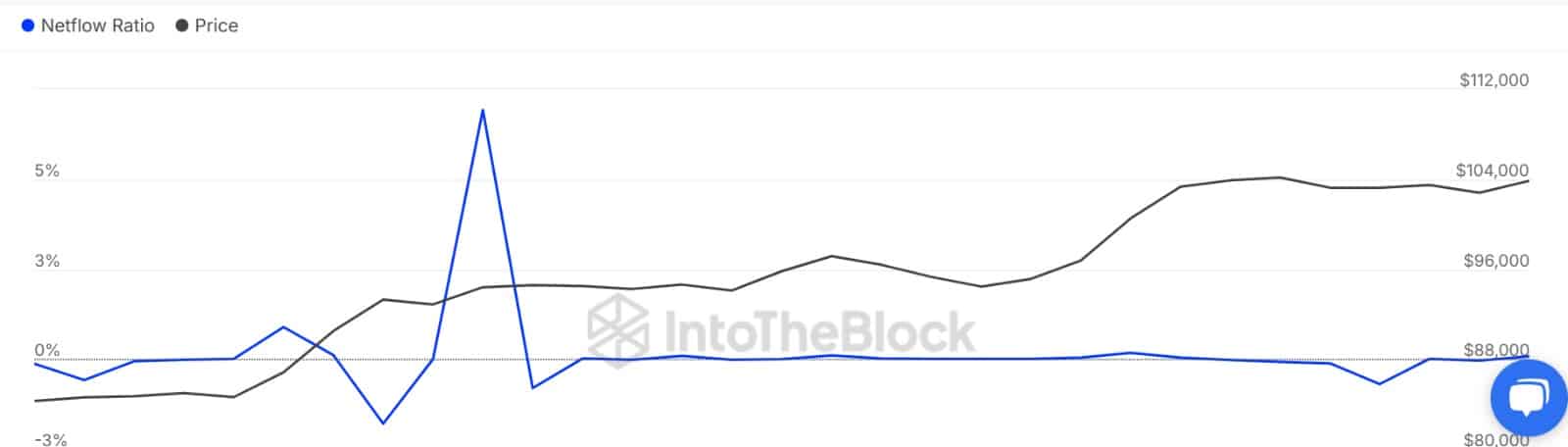

Whales accumulate as netflows keep destructive

Supply: CoinGlass

We are able to see this demand throughout market individuals from each retail merchants and whales.

For starters, Bitcoin’s spot Netflow has held inside the destructive territory over the past 5 days. It sat at -$48.9 million at press time, reflecting a powerful accumulation pattern.

Trying additional, this demand for Bitcoin is much more aggressive amongst giant holders. Whales have been accumulating BTC over the past 30 days.

Thus, Whale Trade Inflows have considerably declined over the past months. As an illustration, on Binance, whale influx has declined to hit a 6-month low.

Supply: Checkonchain

On high of that, Whale Trade Stability Change hit -49.7K BTC over the past 30 days, whereas giant whales (1K–10K BTC) confirmed a -26K steadiness shift.

Merely put, whales aren’t sending cash to exchanges—they’re holding tight.

Moreover, Bitcoin’s Giant Holders Netflow to Trade Netflow Ratio has dropped from 6.93% to 0.08% over the past 30 days.

This additional confirms diminished trade influx from whales, as they’re promoting much less whereas they’re accumulating extra.

Supply: IntoTheBlock

What’s subsequent: Breakout or rejection?

With name choices dominating the Futures market, it means that buyers are bullish and anticipate costs to rise even additional. Thus, merchants aren’t solely assured in BTC, however speculators are aggressively betting on it.

Demand for Bitcoin stays robust amongst whales and retail buyers, positioning it for potential positive factors. If developments maintain, BTC may escape of consolidation and attain $107,225.

Nonetheless, if short-term holders take earnings, it might retrace to round $101,530.